The Brexit vote is about the supremacy of Parliament

30 Jun 2016 Leave a comment

in economics, international economic law, international economics, International law Tags: British economy, British politics, Common market, European Union

Why did voters vote to Leave or Remain? @JulieAnneGenter @Income_Equality

28 Jun 2016 Leave a comment

in constitutional political economy, international economic law, international economics, International law, Public Choice Tags: British economy, British politics, Common market, European Union, pessimism bias, single market, Twitter left, voter demographics

There were few difference across the political spectrum as to why voters voted to Remain or Leave. This is according to Lord Ashcroft’s survey on referendum day of over 12,000 voters.

Source: How the United Kingdom voted on Thursday… and why – Lord Ashcroft Polls

Labour and Tory voters voted to leave to regain control over immigration and sovereignty.

Labour and Tory voters who wanted to remain thought the EU and its single market was a good deal not worth putting at risk. It is all about identity politics, not inequality.

Vote Leave voters are a grumpy lot who think things have been getting worse for 30 years:

Leavers see more threats than opportunities to their standard of living from the way the economy and society are changing, by 71% to 29% – more than twice the margin among remainers…

By large majorities, voters who saw multiculturalism, feminism, the Green movement, globalisation and immigration as forces for good voted to remain in the EU; those who saw them as a force for ill voted by even larger majorities to leave.

% difference between UK’s GDP per capita and EU founding members since 1950

25 Jun 2016 Leave a comment

in economic growth, economic history, international economics, International law

Eurosclerosis started in the 1970s while the British disease came to an end with the election of the Thatcher government so the chart paper is misleading.

Source: Britain’s EU membership: New insight from economic history | VOX, CEPR’s Policy Portal.

The ever astute @JohnCassidy nails why #Brexit occurred

25 Jun 2016 Leave a comment

in constitutional political economy, international economic law, international economics, International law

@JulieAnneGenter @NZGreens @LewisHoldenNZ @DanHannanMEP’s best single case for #Brexit

24 Jun 2016 Leave a comment

in constitutional political economy, economics, industrial organisation, international economic law, International law, liberalism Tags: Brexit, British economy, British politics, Common market, customs unions

Patrick Minford explains #Brexit

22 Jun 2016 Leave a comment

in applied welfare economics, comparative institutional analysis, economics, international economic law, international economics, International law, Public Choice Tags: Brexit, British economy, British politics, Common market, European Union

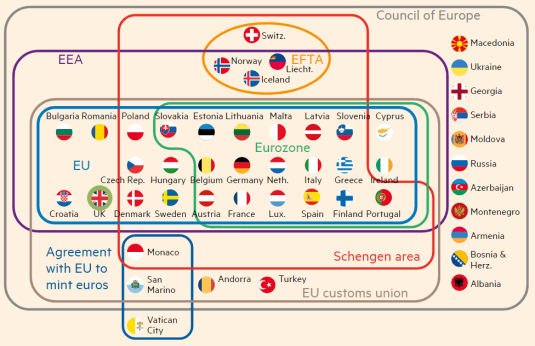

The UK in Europe

18 Jun 2016 Leave a comment

Source: The UK in Europe: a visual guide to Brexit | FT.co. Will

Winkel tripel projection

06 Jun 2016 Leave a comment

in international economics, International law Tags: maps

.

No @sarahinthesen8 this is not acceptable. Stopping the boats saved hundreds of lives

30 May 2016 Leave a comment

in Economics of international refugee law, international economic law, International law, labour economics, politics - Australia Tags: Australian Greens, avoiding difficult choices, economics of immigration, Leftover Left, rational irrationality

People who enter illegally by boat do not increase the number of refugees of Australia admits in any one year. They change who was granted asylum within the same fixed quota. Increasing the quota will not change incentives for illegal entry if illegal entry allows for settlement in Australia.

Top 10 Evil Actions By Usually Nice Countries

29 May 2016 Leave a comment

in economic history, economics, International law, laws of war, war and peace

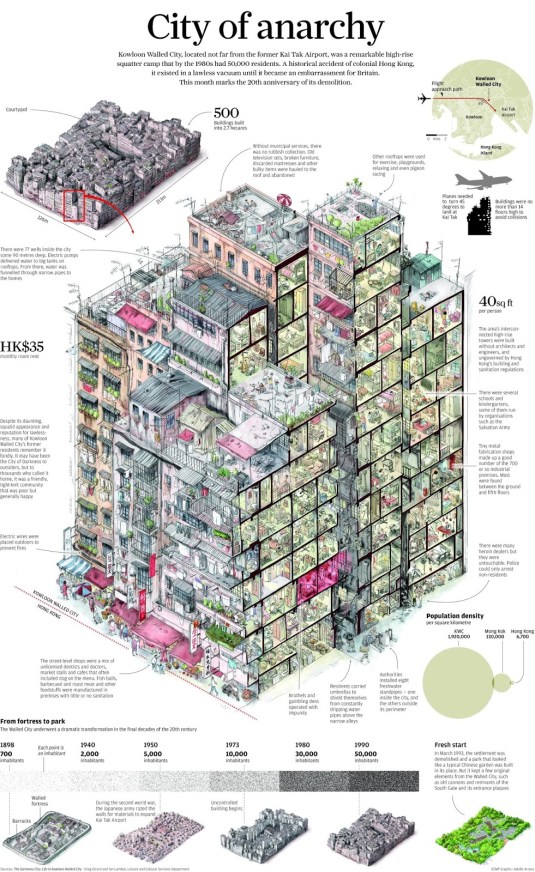

Kowloon: City of anarchy

22 May 2016 Leave a comment

in economics of crime, international economics, International law, law and economics, property rights Tags: Hong Kong

#Morganfoundation discovers that #Ukraine is a dodgy place to buy credence goods

19 Apr 2016 Leave a comment

in economics of climate change, economics of crime, economics of information, environmental economics, global warming, industrial organisation, international economic law, international economics, International law, law and economics, politics - New Zealand, survivor principle Tags: adverse selection, asymmetric information, carbon trading, climate alarmism, climate alarmists, credence goods, experience goods, inspection goods

Morgan Foundation yesterday put out a report pointing out that many of the carbon credits purchased from the Ukraine under the carbon trading scheme are fraudulent.

That comes with no surprise to anyone vaguely familiar with business conditions and the level of official corruption in the former Soviet Union. Russia is a more honest place to do business.

Carbon traders who buy from the Ukraine are not buying an inspection good. An inspection good is a good whose quality you can ascertain before purchase.

They are not buying an experience good. An experience good is a good whose quality is ascertained after purchase in the course of consumption.

Source: Russia, Ukraine dodgy carbon offsets cost the climate – study | Climate Home – climate change news.

What these carbon traders in New Zealand are doing is buying credence goods from the Ukraine. The credence goods are the carbon credits, which the Morgan Foundation and others have found often to be fraudulent.

A credence good is a good whose value is difficult or impossible for the consumer to ascertain. A classic example of a credence good is motor vehicle repairs.

You must trust the seller and their advice as to how much you need to buy of a credence good. Many forms of medical treatment also require you to trust the seller as to how much you need.

Carbon credits are such a credence good. You know there is corruption in the Ukraine and many other countries that supply them. You may never know at any reasonable cost whether the specific carbon credits you buy were legitimate.

The reason why carbon credits are purchased from such an unreliable source is expressive voting. As is common with expressive politics, what matters is whether the voters cheer or boo the policy. The fact whether it works or not does not matter too much.

The Greens are upset about this corruption in carbon trading. They did not mention the corruption in international carbon trading and climate aid when they welcomed the recent Paris treaty on global warming but that is for another day.

https://twitter.com/kadhimshubber/status/721831502372302849

Co-ordinated international action on global warming is rather pointless if some of the key countries with carbon emission caps are corrupt, which they are.

As Geoff Brennan has argued, CO2 reduction actions will be limited to modest unilateral reductions of a largely token character. There are many expressive voting concerns that politicians must balance to stay in office and the environment is but one of these.

Once climate change policies start to actually become costly to swinging voters, expressive voting support for these policies will fall away, and it has.

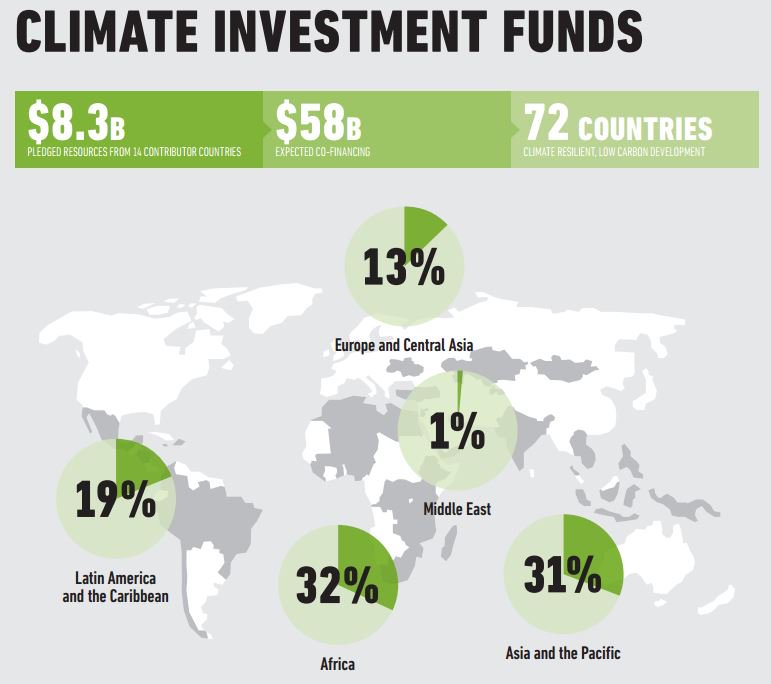

Networked Carbon Markets

Source: World Bank Networked Carbon Markets.

One way to stem that fading support is to buy carbon credits on the cheap and there is plenty of disreputable suppliers of cheap carbon credits. Buying dodgy carbon credits as a way of doing something on global warming without it costing more than expressive voters will pay.

One of the predictions of the adverse selection literature is that if consumers cannot differentiate good and bad goods from each other, such as with used cars, the market will contract sharply or even collapse because buyers cannot trust what is on offer. This risk of adverse selection undermining a market applies with clarity to carbon trading.

Source: How Can Your Vote Shape a Low Carbon Future? It Starts with Carbon Pricing.

@JulieAnneGenter tax havens underwrite The Great Escape from extreme poverty in developing countries

08 Apr 2016 Leave a comment

in applied price theory, constitutional political economy, development economics, economic history, economics of bureaucracy, economics of crime, growth disasters, growth miracles, International law, law and economics, property rights, rentseeking

Tax havens and offshore financial centres are vital to the economic development of poor countries. There are plenty of countries, poor countries, where the ability to move funds offshore is fundamental to successful investment. That is missed in the reporting of the Panama Papers:

Consider the big names that have shown up so far on the list. With the notable exception of Iceland, these are not countries I would describe as “capitalist”: Russia, Pakistan, Iraq, Ukraine, Egypt. They’re countries where kleptocratic government officials amass money not through commerce, but through quasi-legal extortion, or siphoning off the till. This is an activity that has gone on long before capitalism, and probably before there was money.

Tax havens and offshore financial centres offer a way in which entrepreneurs can make an honest investment, secure a return and put it aside safely from the reach of the minister’s cousin who wants to muscle in once the business succeeded.

A major problem in poor countries is short time horizons for investment. Entrepreneurs must make their money quickly.

Many years ago there is a survey of entrepreneurs in Russia and Poland. It was in the early 1990s. Each was asked whether an investment project that doubled their money in two years was worth the risk. The Russian entrepreneurs mostly said no, the Polish entrepreneur said yes.

So insecure are the returns from investment in Russia at that time that the phenomenal returns were required before an investment was made. They would only invest if they could double the money in two years.

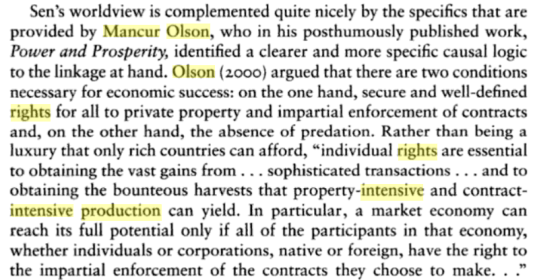

Many years ago, Mancur Olson wrote an insightful book about prosperity and dictatorships. He introduced the concept of rights intensive production.

As countries become more and more developed, investment horizons lengthen and depends more and more upon the enforcement of contract and property rights in a tolerably honest way.

Instead of being the first entrepreneur to introduce the most basic technologies and profit handsomely, entrepreneurs are introducing a product upgrade or new product that is a minor improvement on current offerings. Such investments will take time to pay off.

In many developing countries, China as an example, property rights are insecure. One way to secure your investment is to take the proceeds offshore to a tax haven. If everything goes wrong, at least you got some nest egg overseas.

As many developing countries have corrupt politicians and dishonest courts, the way to secure gains from honest investments is to move some of the profits offshore. That is why tax havens are essential to poor countries growing richer.

One of the sources of Hong Kong prosperity was investors would deal with a Hong Kong-based company with the requisite political and economic links to China. They could enforce their contracts in China against their Hong Kong assets because the contract was based in Hong Kong under British law.

If the local legal system is inadequate, entrepreneurs well look overseas for mechanisms to force contracts and secure their returns on investments against confiscation.

Recent Comments