Ht: http://cafehayek.com/2017/11/milton-friedman-absurdity-socialism.html#.WgjbtpzAOTo.facebook

Milton Friedman on the Absurdity of Socialism

13 Dec 2017 Leave a comment

in applied price theory, industrial organisation, Marxist economics, Milton Friedman, Public Choice Tags: fall of communism

Milton Friedman: The Rise of Socialism is Absurd

03 Aug 2017 Leave a comment

in applied price theory, economic history, history of economic thought, industrial organisation, Milton Friedman Tags: collapse of communism

Milton Friedman Speaks – Myths That Conceal Reality

10 May 2017 Leave a comment

in applied price theory, economic history, Milton Friedman Tags: capitalism and freedom

Free To Choose in Under 2 Minutes – Episode 1 The Power of the Market

09 May 2017 Leave a comment

in applied price theory, industrial organisation, international economics, labour economics, labour supply, Milton Friedman, occupational choice, survivor principle Tags: capitalism and freedom

Who Really Pays Business Taxes?

06 May 2017 Leave a comment

in applied price theory, Milton Friedman, Public Choice, public economics Tags: tax incidence

Milton Friedman on Hayek’s ‘Road to Serfdom’ 1994

19 Mar 2017 Leave a comment

in F.A. Hayek, Milton Friedman Tags: Road to Serfdom

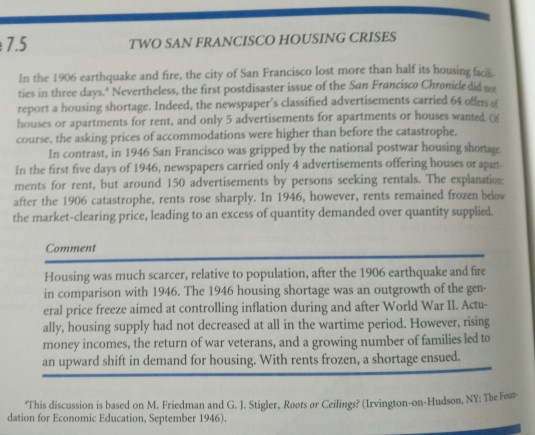

Thinking of rent control?

10 Jan 2017 Leave a comment

in applied price theory, economic history, economics of natural disasters, economics of regulation, Milton Friedman Tags: george stigler, rent control

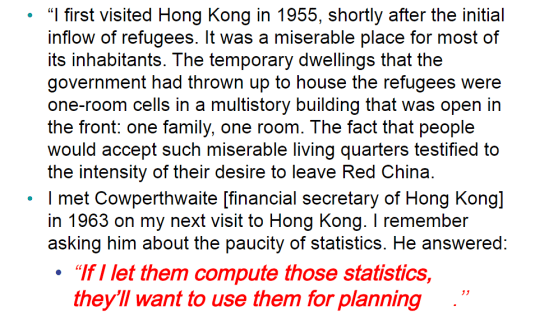

.@BernieSanders should have honeymooned in Hong Kong, not the Soviet Union

18 Dec 2016 Leave a comment

in applied price theory, development economics, economic history, Marxist economics, Milton Friedman

Milton Friedman – Why Economists Disagree

25 Nov 2016 Leave a comment

in history of economic thought, Milton Friedman

Milton Friedman – Congressional House Economic Task Force (1993)

15 Oct 2016 Leave a comment

in economic history, fiscal policy, great depression, history of economic thought, macroeconomics, Milton Friedman, monetarism, monetary economics Tags: fiscal stimulus

Milton Friedman is said to have mesmerised several countries with a flying visit!?

30 Sep 2016 Leave a comment

in business cycles, economic growth, macroeconomics, Milton Friedman, monetarism, monetary economics, politics - Australia Tags: central banks, conspiracy theories, lags on monetary policy, monetary policy, rules versus discretion, The fatal conceit, The pretense to knowledge

Milton Friedman visited Australia in 1975. He spoke with government officials and appeared on the TV show Monday Conference. Apparently, that was enough for him to take over Australian monetary policy setting for the foreseeable future.

When working at the next desk to the monetary policy section in the late 1980s, I heard not a word of Friedman’s Svengali influence:

- The market determined interest rates, not the reserve bank was the mantra for several years. Joan Robinson would be proud that her 1975 visit was still holding the reins.

- Monetary policy was targeting the current account. Read Edwards’ bio of Keating and his extracts from very Keynesian treasury briefings to Keating signed by David Morgan that reminded me of macro101.

See Ed Nelson’s (2005) Monetary Policy Neglect and the Great Inflation in Canada, Australia, and New Zealand who used contemporary news reports from 1970 to the early 1990s to uncover what was and was not ruling monetary policy. For example:

“As late as 1990, the governor of the Reserve Bank rejected central-bank inflation targeting as infeasible in Australia, and cited the need for other tools such as wages policy (AFR, October 18, 1990).”

Bernie Fraser was still sufficiently deprogrammed in 1993 to say that “…I am rather wary of inflation targets.” Easy to then announce one in the same speech when inflation was already 2-3%.

When as a commentator on a Treasury seminar paper in 1986, Peter Boxhall – fresh from the US and 1970s Chicago educated – suggested using monetary policy to reduce the inflation rate quickly to zero, David Morgan and Chris Higgins almost fell off their chairs. They had never heard of such radical ideas.

In their breathless protestations, neither were sufficiently in-tune with their Keynesian educations to remember the role of sticky wages or even the need for the monetary growth reductions to be gradual and, more importantly, credible as per Milton Freidman and as per Tom Sargent’s End of 4 big and two moderate inflations papers.

I was far too junior to point to this gap in their analytical memories about the role of sticky wages, and I was having far too much fun watching the intellectual cream of the Treasury senior management in full flight. At a much later meeting, another high flying deputy secretary was mystified as to why 18% mortgage rates were not reining in the current account in 1989.

Friedman’s Svengali influence did not extend to brainwashing in the monetarist creed that the lags on monetary policy were long and variable. The 1988 or 1989 budget papers put the lag on monetary policy at 1 year, which is short and rapier, if you ask me.

Recent Comments