It’s 700 pages long and goes on about Marx. Some people were watching the other channel when the Berlin Wall fell.

My 1 o’clock lecture at ANU in 1990 was next to a room rented out ironically from 12 to 1 to the Campus Trots and then to the Campus Christians for an hour of prayer to another saviour.

The Twitter summary of Piketty is this:

Karl Marx wasn’t wrong, just early. Pretty much. Sorry, capitalism. #inequalityforevah

The only Marxist I bother with is Jon Elster. He is a leading proponent of Analytical Marxism and one of the last polymaths. Brian Barry once wrote that to review one of Elster’s books one:

would either have to have taken off several years to master the many fields which fall within Elster’s purview or would be a consortium of at least twenty carefully-chosen experts.

All of Elster’s books and writings are worth reading, including

- Ulysses and the Sirens (1979);

- Sour Grapes: Studies in the Subversion of Rationality (1983);

- Making Sense of Marx (1985); and

- An Introduction to Karl Marx (1986).

As Jon Elster noted:

Marxian economics is, with a few exceptions, intellectually dead

and Marx’s labour theory of value is:

useless at best, harmful and misleading at its not infrequent worst.

To go on with my non-review, I will quote Tyler Cowen:

The crude seven-word version of Piketty’s argument is “rates of return on capital won’t diminish.”

Piketty’s reasons why rates of return on capital won’t diminish are fairly specific and restricted to only a small share of capital.

.. In any case this is pure speculation and Piketty’s entire argument depends upon it.

… Piketty converts the entrepreneur into the rentier.

To the extent capital reaps high returns, it is by assuming risk…

Yet the concept of risk hardly plays a role in the major arguments of this book.

Once you introduce risk, the long-run fate of capital returns again becomes far from certain.

In fact the entire book ought to be about risk but instead we get the rentier…

Overall, the main argument is based on two (false) claims.

First, that capital returns will be high and non-diminishing, relative to other factors.

Second, that this can happen without significant increases in real wages.

Piketty’s advocacy of a top marginal income tax rate of 80% and a an international treaty for a wealth tax are wildly impractical and destructive of economic growth and entrepreneurship. His advocacy of 60% marginal tax rates on incomes above $200,000 strike at the heart of the professional and managerial occupations that are the backbone of day-to-day capitalism. Piketty’s wealth tax would tax the homes and the retirement savings of the ordinary middle class:

- wealth below 200,000 euros be taxed at a rate of 0.1 percent,

- wealth between 200,000 and one million euros at 0.5 percent,

- wealth between one million and five million euros at 1.0 percent, and

- wealth above five million euros at 2.0 percent.

Piketty’s reason for these high top tax rates is not to bring in more revenue or to redistribute wealth to poor and the downtrodden but simply “to put an end to such incomes.” Harsanyi argues that:

Like many progressives, Piketty doesn’t really believe that most people deserve their wealth anyway, so confiscating it presents no real moral dilemma.

He also argues that we can measure a person’s productivity and the value of a worker (namely, low-skilled labourers) while arguing that other groups of workers (namely, the kind of people he doesn’t admire) are bequeathed undeserved, “arbitrary” salaries. What tangible benefit does a stockbroker or a kulak or an explanatory journalist offer society, after all?

This takes me back to Jon Elster who had this to say on socialism:

Optimism and wishful thinking have been features of socialist thought from its inception.

In Marx, for instance, two main premises appear to be that whatever is desirable is possible, and that whatever is desirable and possible is inevitable.

…It has become clear that classical socialism massively underestimated the importance of economic incentives.

Greg Mankiw is less harsh, but still to the point:

Like President Obama and others on the left, Piketty wants to spread the wealth around.

Another philosophical viewpoint is that it is the government’s job to enforce rules such as contracts and property rights and promote opportunity rather than to achieve a particular distribution of economic outcomes.

No amount of economic history will tell you that John Rawls (and Thomas Piketty) offers a better political philosophy than Robert Nozick (and Milton Friedman).

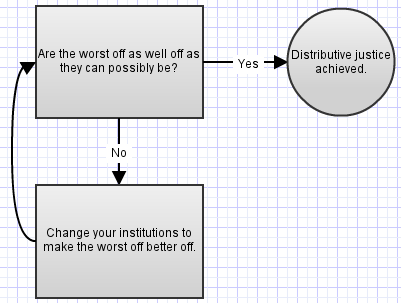

John Rawls was actually very much alive to the importance of incentives in a just and prosperous society.

Unequal incomes might turn out to be to the advantage of everyone. Work effort and entrepreneurial alertness respond to incentives; incentives channel people into the occupations and jobs where they produce more.

Rawls lent qualified support to the idea of a flat-rate consumption tax because these taxes:

impose a levy according to how much a person takes out of the common store of goods and not according to how much he contributes.

A simple way to have a progressive consumption tax is to exempt all savings from taxation.

With his emphasis on fair distributions of income, Rawls’ initial appeal was to the Left. Left-wing thinkers then started to dislike his acceptance of capitalism and his tolerance of large discrepancies in income and wealth.

It’s impossible to make the workers better off by taxing capital. The optimal rate of tax on income from capital is zero. This is why the Mirrlees Review of the UK taxation system argued for zero taxation of the returns to capital.

Robert Lucas estimated in 1990 that eliminating all taxes on income from capital would increase the U.S. capital stock by about 35% and consumption by 7%.

Hans Fehr, Sabine Jokisch, Ashwin Kambhampati, and Laurence J. Kotlikoff (2014) found that eliminating the corporate income tax completely would raise the U.S. capital stock (machines and buildings) by 23%, output by 8% and the real wages of unskilled and skilled workers each by 12%.

Book reviews serve the same purpose as film reviews. They are filters for our time. Do you agree?

I made a time management decision to not read a long book plenty of others reviewed and some even understood.

As for the growing income inequality, there is a long literature dating back 25-years arguing that skill-biased technological change is increasing the returns to investing in education as Gary Becker blogged in 2011:

Earnings inequality in the United States and many other countries has increased greatly since the late 1970s, due in large measure to globalization and technological progress that raised the productivity of more educated and more skilled individuals.

While the average American college graduate earned about a 40% premium over the average high school graduate in 1980, this premium increased to over 70% in 2000.

The good side of this higher education-based earnings inequality is that it induced more young men, and especially more young women, to go to and finish college.

The bad side is that many sufficiently able children could not take advantage of the greater returns from a college education because their parents did not prepare them to perform well in school, or they went to bad schools, or they lacked the financing to attend college.

As a result, the incomes of high school dropouts and of many high school graduates stagnated while incomes boomed for many persons who graduated college, and even more so for those with post graduate education.

There is nothing new under the sun.

Recent Comments