Asymmetric Information and Used Cars

05 May 2016 Leave a comment

in economics of information, industrial organisation Tags: asymmetric information

#Morganfoundation discovers that #Ukraine is a dodgy place to buy credence goods

19 Apr 2016 Leave a comment

in economics of climate change, economics of crime, economics of information, environmental economics, global warming, industrial organisation, international economic law, international economics, International law, law and economics, politics - New Zealand, survivor principle Tags: adverse selection, asymmetric information, carbon trading, climate alarmism, climate alarmists, credence goods, experience goods, inspection goods

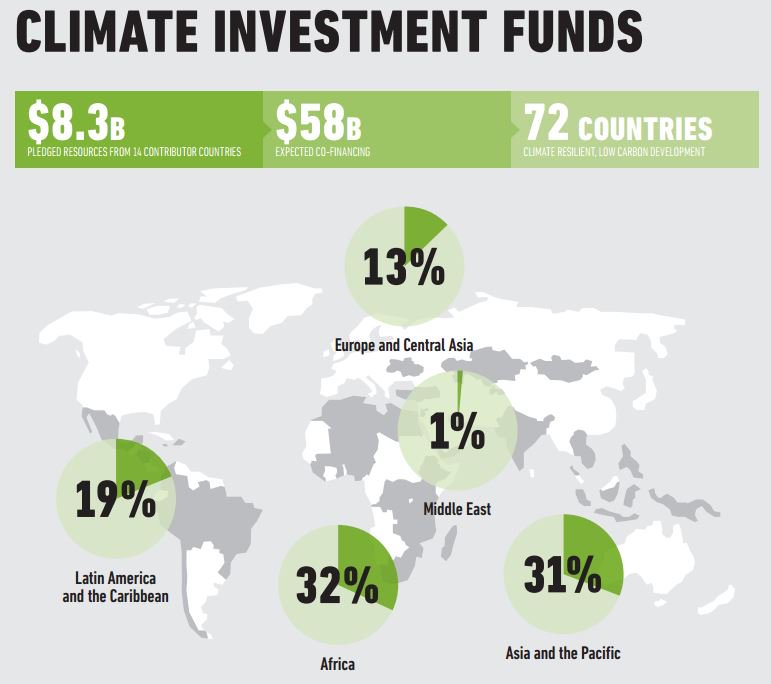

Morgan Foundation yesterday put out a report pointing out that many of the carbon credits purchased from the Ukraine under the carbon trading scheme are fraudulent.

That comes with no surprise to anyone vaguely familiar with business conditions and the level of official corruption in the former Soviet Union. Russia is a more honest place to do business.

Carbon traders who buy from the Ukraine are not buying an inspection good. An inspection good is a good whose quality you can ascertain before purchase.

They are not buying an experience good. An experience good is a good whose quality is ascertained after purchase in the course of consumption.

Source: Russia, Ukraine dodgy carbon offsets cost the climate – study | Climate Home – climate change news.

What these carbon traders in New Zealand are doing is buying credence goods from the Ukraine. The credence goods are the carbon credits, which the Morgan Foundation and others have found often to be fraudulent.

A credence good is a good whose value is difficult or impossible for the consumer to ascertain. A classic example of a credence good is motor vehicle repairs.

You must trust the seller and their advice as to how much you need to buy of a credence good. Many forms of medical treatment also require you to trust the seller as to how much you need.

Carbon credits are such a credence good. You know there is corruption in the Ukraine and many other countries that supply them. You may never know at any reasonable cost whether the specific carbon credits you buy were legitimate.

The reason why carbon credits are purchased from such an unreliable source is expressive voting. As is common with expressive politics, what matters is whether the voters cheer or boo the policy. The fact whether it works or not does not matter too much.

The Greens are upset about this corruption in carbon trading. They did not mention the corruption in international carbon trading and climate aid when they welcomed the recent Paris treaty on global warming but that is for another day.

https://twitter.com/kadhimshubber/status/721831502372302849

Co-ordinated international action on global warming is rather pointless if some of the key countries with carbon emission caps are corrupt, which they are.

As Geoff Brennan has argued, CO2 reduction actions will be limited to modest unilateral reductions of a largely token character. There are many expressive voting concerns that politicians must balance to stay in office and the environment is but one of these.

Once climate change policies start to actually become costly to swinging voters, expressive voting support for these policies will fall away, and it has.

Networked Carbon Markets

Source: World Bank Networked Carbon Markets.

One way to stem that fading support is to buy carbon credits on the cheap and there is plenty of disreputable suppliers of cheap carbon credits. Buying dodgy carbon credits as a way of doing something on global warming without it costing more than expressive voters will pay.

One of the predictions of the adverse selection literature is that if consumers cannot differentiate good and bad goods from each other, such as with used cars, the market will contract sharply or even collapse because buyers cannot trust what is on offer. This risk of adverse selection undermining a market applies with clarity to carbon trading.

Source: How Can Your Vote Shape a Low Carbon Future? It Starts with Carbon Pricing.

Why do companies pay dividends?

27 Mar 2016 1 Comment

in applied price theory, financial economics, industrial organisation, managerial economics, organisational economics, survivor principle Tags: agency costs, agent principal problem, asymmetric information, dividends, entrepreneurial alertness, managerial slack

It is obvious that businesses find dividends sensible to pay because otherwise they will face disquiet from investors. Managers believe that higher dividends mean higher share prices.

Economists finds dividends to be a mysterious (Easterbrook 1984). Miller and Modigliani (1958) declared dividends to be irrelevant because investors can homebrew their own dividends by selling shares or borrowing against their share portfolios.

Modigliani (1980, p. xiii) explains the Miller and Modigliani Theorem as follows:

… with well-functioning markets (and neutral taxes) and rational investors, who can ‘undo’ the corporate financial structure by holding positive or negative amounts of debt, the market value of the firm – debt plus equity – depends only on the income stream generated by its assets.

It follows, in particular, that the value of the firm should not be affected by the share of debt in its financial structure or by what will be done with the returns – paid out as dividends or reinvested (profitably).

Warren Buffett has never paid a dividend. He only agreed to a stock split. Shareholders pressed him to do so. They wanted to bequeath their shares to children without having to sell them.

What is even more mysterious is a simultaneous existence of dividends and the raising of new capital, either through the share market or from borrowing (Easterbrook 1984).

Dividends are costly and ubiquitous so something causes them. Even if investors were irrational, dividends would go away if there cost exceeds their benefits.

If dividends were a bad idea, firms that pay few dividends would prosper relative to others; investors who figure out the truth would also prosper relative to others and before long dividends will be features of failing firms (Easterbrook 1984).

Dividends exist because they influence the firms financing policies. Dividends dissipate free cash and thereby induce the firm to float new shares and borrow. If the firm is constantly in the market for new capital, it must constantly prove the value of the investment to the market (Easterbrook 1984).

The interests and incentives of managers and shareholders frequently conflict over the optimal size of the firm and paying free cash flows as dividends. Jensen (1986) defines free cash flow as follows:

Free cash flow is cash flow in excess of that required to fund all of a firm’s projects that have positive net present values when discounted at the relevant cost of capital. Such free cash flow must be paid out to shareholders if the firm is to be efficient and to maximize value for shareholders (Jensen 1986, p. 323).

The problem is how to motivate managers to pay out this cash rather than invested at below the cost of the capital. By issuing debt, managers bind themselves to pay out future cash flows in a way that a future dividend policy cannot.

Creditors can take the firm into bankruptcy court if they do not repay. Investors and bankers play an important role in monitoring the firm and its proposed projects.

The control function of debt is more important in organisations with large cash flows but low growth prospects. Investors in the share market are alert to the control function of debt. Most leverage increasing transactions result in positive increases in share prices while most transactions that reduce leverage results in share price falls (Jensen 1986).

There is nothing new about using high debt leverage ratios to create greater business value through limiting managerial discretion in focusing entrepreneurial attention on the bottom line.

One of the driving forces behind management leverage buyouts in the 1980s was that they borrowed to take over a company to run it better. The high levels of debt in management buyouts made sure that there was no incentives to tolerate waste or inefficiency or underperforming divisions or product lines of the firm. Any slack with the organisation would very quickly be punished perhaps in bankruptcy. Heavy debt ratios focused the attention of managers and boards of directors.

New debt puts managers under additional scrutiny of a range of bankers and the share market, which is the principal reason for keeping firms constantly in the market for capital. Managers of firms that do not have to go into the market repeatedly and regularly for new capital have more discretion to behave in their own interest rather than those of investors (Easterbrook 1984). The function of dividends is to keep firms in the capital market.

Managers of firms with unused borrowing power and large free cash flows are more like to undertake expansions that are less profitable. The burst of takeovers and leverage buyouts in the 1980s were very much driven by opportunities to profit from reducing corporate slack and downsizing flabby corporate headquarters of large publicly listed companies (Jensen 1986).

Dividends reduce the resources under managers’ control and subjecting them to the monitoring by the capital markets that occurs when a firm must obtain new capital. Financing projects internally avoids this monitoring and the possibility that funds will be unavailable or available only at high explicit prices. Project finance replicates the disciplinary effect of paying regular dividends by borrowing a huge amount at the start of the project. High debt prevents management wasting resources on low return projects.

Dividends are paid by companies to tie the hands of management. Dividends make sure that there is less free cash about for them to spend on projects at their own discretion. When a major expansion must be undertaken, the management of a company must either go to the share market or banks for it to go forward. This means multiple set of decision-makers agree that it is a worthwhile project and provide funding.

The art of business is identifying assets in low-valued uses and devising ways to profitably move them into higher values uses (Froeb and McCann 2008). Wealth is created when entrepreneurs move assets to higher-valued uses.

Froeb and McCann (2008) argued that mistakes are made – business opportunities are missed – for one of two reasons:

1. A lack of information; or

2. Bad incentives.

Rational, self-interested actors err because either they do not have enough information to make better decisions, or they lack incentives to make the best use of information they already have.

Froeb and McCann (2008) argued that three questions arise about all business problems:

1. Who is making the bad decision?

2. Does the decision maker have enough information to make a good decision?

3. Does the decision maker have the incentives to make a good decision?

For Froeb and McCann (2008), the answers to these questions immediately suggest ways to fix them:

1. Let someone else make the decision;

2. Give more information to the decision maker; or

3. Change the decision makers’ incentives.

Dividends follow all three points in this matrix. Dividends include others in investment and expansion decisions of the company. These bankers or new share investors must be given more information on the merits of the new or enlarged project.

The project will not go ahead and any benefits to the careers of the executives championing it will not be forthcoming unless they can persuade these outside parties with plenty of other investment options of the merits of the project.

Dividend show that the market process as well alert to the risks of separating ownership from control. Counter strategies are developed to channel the efforts and align the interests of management teams towards those of investors and owners.

The ownership structure and dividend policies of firms arise out of the search for the capital structure that maximises profits. Different divisions of risk between creditors and shareholders and decision-making rights between owners, boards of directors and managers all affect the value and profitability of a firm. Dividends contribute to that search more profitable forms of organisation by restricting free cash flows in the hands of management.

Drug testing helps minority job applicants @jacindaardern

25 Mar 2016 Leave a comment

in discrimination, economics of information, entrepreneurship, human capital, labour economics, personnel economics Tags: asymmetric information, counter-signalling, employer discrimination, racial discrimination, screening, signalling, statistical discrimination

Statistical discrimination is a harsh mistress. If reliable measures of the quality of job applicants are unavailable for short-listing, such as credit checks, coarser, less reliable screening devices will be employed. That was the case when credit checks were prohibited in employment recruitment:

Looking at 74 million job listings between 2007 and 2013, Clifford and Shoag found that employers started to become pickier, especially in cities where there were a lot of workers with low credit scores. If a credit-check ban went into effect, job postings were more likely to ask for a bachelor’s degree, and to require additional years of experience.

There are other ways that employers could have also become more discerning, Shoag says. They might have started to rely on referrals or recommendations to make sure that applicants were high-quality. In the absence of credit information to establish trustworthiness, they may even have fallen back on racial stereotypes to screen candidates. The researchers couldn’t measure these tactics, but they’re possibilities.

Drug testing allows employers to dispel less accurate stereotypes about drug use among different ethnic and social groups. They increased hiring of minorities because a reliable measure became available of their drug use:

…after a pro-testing law is passed in a state, African-American employment increases in sectors that have high testing rates (mining, manufacturing, transportation, utilities, and government).

These increases are substantial: African-American employment in these industries increases by 7-30%. Because these industries tend to pay wage premia and to have larger firms offering better benefits, African-American wages and benefits coverage also increase. Real wages increase by 1.4-13% relative to whites. The largest shifts in employment and wages occur for low skilled African-American men.

I also find suggestive evidence that employers substitute white women for African-Americans in the absence of testing. Gains in hiring African-Americans in these sectors may have come at the expense of women, particularly in states with large African-American populations.

Employers test for drug use both for health and safety reasons and as a way of screening out less reliable employees. People who break the rules are not reliable employees and that includes taking drugs. In low skill jobs, what employers seek is a recruit who is friendly and reliable.

Testing of the skills of workers also showed similar results. What happened is that the ratio of black to white hirings do not change. The administration of these skills tests allowed the more productive of both white and black job applicants to be identified and hired.

Employers already had an accurate stereotype of the average skills of different ethnic groups. Administration of tests allow them to identify which members of each group were the most productive.

It is a standard result that statistical discrimination improves the chances of below-average applicants subject to the stereotype but harms those of above average quality. For that reason, applicants look for what methods of counter-signalling to show that they are indeed a quality applicant – make themselves stand out from the crowd.

Employers profit from developing screening devices that go beyond stereotypes to identify above-average applicants. They want screening devices that find those who do not otherwise stand out from the crowd because of difficulties in transferring credible information about their quality. This is a special difficulty with low-skilled vacancies because hiring is made based much more than on character than experience.

Why do inmates tattoo their faces?

30 Sep 2015 Leave a comment

There is an economic literature on feuds and duelling

07 Aug 2015 Leave a comment

in applied price theory, comparative institutional analysis, economic history, economics of media and culture Tags: adverse selection, asymmetric information, competition as a discovery procedure, duals, feuds, game theory, moral hazard, screening, signalling

How they resolved spats before Twitter existed

thepoke.co.uk/2015/07/26/res… http://t.co/a04CTYT2aX—

The Poke (@ThePoke) July 27, 2015

Many doubts have been raised about all types of ultrasonic pest repellers

02 Oct 2014 Leave a comment

Managerial Econ: Fee-for-service vs. capitation: 10 fewer amputations per capita

31 Jul 2014 Leave a comment

in health economics Tags: agent principal problems, asymmetric information, moral hazard

- Single-year mortality rates fell from 6.8 per cent in the traditional fee-for-service sample to 1.8 per cent

- Patients in the Medicare Advantage plans had shorter average stays in the hospital (about 19 per cent shorter.)

- Patients in the managed plans were more likely to receive preventive care …For example, diabetic patients in the fee-for-service sample had an average of 11.5 amputations per 1,000 patients; those in HMO plans with global capitation had only 0.3.

via Managerial Econ: Fee-for-service vs. capitation: 10 fewer amputations per capita.

Managerial Econ: Physician Induced Demand

31 Jul 2014 Leave a comment

in applied welfare economics, health economics Tags: agent principal problems, asymmetric information, moral hazard, Physician Induced Demand

Rehavi and Johnson compare obstetricians’ choice of C-section during childbirth when the expectant mother is herself a medical doctor to when she is not. From their abstract:

… Consistent with PID [Physician Induced Demand], physicians are almost 10 per cent less likely to receive a C-section, with only a quarter of this effect attributable to differential sorting of patients to hospitals or obstetricians.

At least 20% of New Zealand workers are subject to occupational regulation

08 Jul 2014 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, David Friedman, economics of information, economics of regulation, entrepreneurship, industrial organisation, labour economics, law and economics, managerial economics, market efficiency, Milton Friedman, personnel economics, politics - New Zealand, Ronald Coase Tags: adverse selection, asymmetric information, blackboard economics, moral hazard, occupational regulation, screening, signalling

There are at least 98 regulated occupations in New Zealand covering about 20% of the workforce. In 2011, this amounts to 440,371 workers. The skills that are regulated range across all skill sets and many occupations:

- 49% of regulation is in the form of a licence;

- 18% of regulated work is in the form of licensing of tasks;

- 31% of regulated workers require a certificate; and

- 4% of regulated workers require registration.

There are 32 different governing Acts that regulated occupations in New Zealand with 55% of the workers subject to occupational regulation are employed in just five occupations:

- 98,000 teachers;

- 48,500 nurses;

- 42,730 bar managers;

- 32,733 chartered accountants; and

- 22,749 electricians.

The Health Practitioners Competency Assurance Act 2003 regulates 22 occupations and a total of 89,807 workers. The next best is the 10 occupations regulated by the Health and Safety in Employment Act 2002 which regulates an unknown number of occupations. The Civil Aviation Act 1990 regulates eight occupations and 19,095 workers, the Building Act 2004 regulates seven occupations and 21,101 workers and the Maritime Transport Act 1994 regulates six occupations and 20,500 workers. 12 of the regulated occupations are regulated under laws passed since 2007.

The purpose of occupational regulation is to protect buyers from quacks and lemons – to overcome asymmetric information about the quality of the provider of the service.

Adverse selection occurs when the seller knows more than the buyer about the true quality of the product or service on offer. This can make it difficult for the two people to do business together. Buyers cannot tell the good from the bad products on offer so many they do not buy to all and withdraw from the market.

Goods and services divide into inspection, experience and credence goods.

- Inspection goods are goods or services was quality can be determined before purchase price inspecting them;

- Experience goods are goods whose quality is determined after purchase in the course of consuming them; and

- Credence goods are goods whose quality may never be known for sure as to whether the good or service actually worked – was that car repair or medical procedure really necessary?

The problem of adverse selection over experience and credence goods present many potentially profitable but as yet unconsummated wealth-creating transactions because of the uncertainty about quality and reliability.

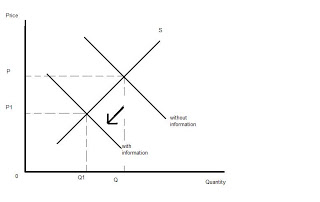

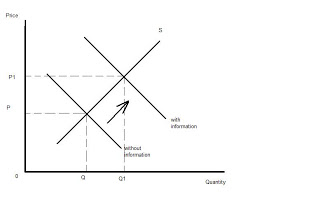

Buyers are reluctant to buy if they are unsure of quality, but if such assurances can be given in a credible manner, a significant increase in demand is possible.

Any entrepreneur who finds ways of providing credible assurances of the quality of this service or work stands to profit handsomely. Brand names and warranties are examples of market generated institutions that overcome these information gaps through screening and signalling.

Screening is the less informed party’s effort, usually the buyer, to learn the information that the more informed party has. Successful screens have the characteristic that it is unprofitable for bad types of sellers to mimic the behaviour of good types.

Signalling is an informed party’s effort, usually the seller, to communicate information to the less informed party.

The main issue with quacks in the labour market is whether there are a large cost of less than average quality service, and is there a sub-market who will buy less than average quality products in the presence of competing sellers competing on the basis of quality assurance. This demand for assurance creates opportunities for entrepreneurs to profit by providing assurance.

David Friedman wrote a paper about contract enforcement in cyberspace where the buyer and seller is in different countries so conventional mechanisms such as the courts are futile in cases where the quality of the good is not as promised or there is a failure to deliver at all:

Public enforcement of contracts between parties in different countries is more costly and uncertain than public enforcement within a single jurisdiction.

Furthermore, in a world where geographical lines are invisible, parties to publicly enforced contracts will frequently not know what law those contracts are likely to fall under. Hence public enforcement, while still possible for future online contracts, will be less workable than for the realspace contracts of the past.

A second and perhaps more serious problem may arise in the future as a result of technological developments that already exist and are now going into common use. These technologies, of which the most fundamental is public key encryption, make possible an online world where many people do business anonymously, with reputations attached to their cyberspace, not their realspace, identities

Online auction and sales sites address adverse selection with authentication and escrow services, insurance, and on-line reputations through the rating of sellers by buyers.

E-commerce is flourishing despite been supposedly plagued by adverse selection and weak contract enforcement against overseas venders.

In the labour market, screening and signalling take the form of probationary periods, promotion ladders, promotion tournaments, incentive pay and the back loading of pay in the form of pension investing and other prizes and bonds for good performance over a long period.

In the case of the labour force, there are good arguments that a major reason for investments in education is as a to signal quality, reliability, diligence as well as investment in a credential that is of no value the case of misconduct or incompetence. Lower quality workers will find it very difficult if not impossible to fake quality and reliability in this way – through investing in higher education.

In the case of teacher registration, for example, does a teacher registration system screen out any more low quality candidates for recruitment than do proper reference checks and a police check for a criminal record.

Mostly disciplinary investigations and deregistrations under the auspices of occupational regulation is for gross misconduct and criminal convictions rather than just shading of quality.

Much of personnel and organisational economics is about the screening and sorting of applicants, recruits and workers by quality and the assurance of performance.

Alert entrepreneurs have every incentive to find more profitable ways to manage the quality of their workforce and sort their recruitment pools.

Baron and Kreps (1999) developed the recruitment taxonomy made up of stars, guardians and foot-soldiers.

Stars hold jobs with limited downside risk but high performance is very good for the firm – the costs of hiring errors for stars such as an R&D worker are small: mostly their salary. Foot-soldiers are employees with narrow ranges of good and bad possible outcomes.

Guardians have jobs where bad performance can be a calamity but good job performance is only slightly better than an average performance.

Airline pilots and safety, compliance, finance and controller jobs are all examples of guardian jobs where risk is all downside. Bad performance of these jobs can bring the company down. Dual control is common in guardian jobs.

The employer’s focus when recruiting and supervising guardians is low job performance and not associating rewards and promotions with risky behaviours. Employers will closely screen applicants for guardian jobs, impose long apprenticeships and may limit recruiting to port-of-entry jobs.

The private sector has ample experience in handling risk in recruitment for guardian jobs. Firms and entrepreneurs are subject to a hard budget constraints that apply immediately if they hire quacks and duds.

Blackboard economics says that governments may be able to improve on market performance but as Coase warned that actually implement regulatory changes in real life is another matter:

The policy under consideration is one which is implemented on the blackboard.

All the information needed is assumed to be available and the teacher plays all the parts. He fixes prices, imposes taxes, and distributes subsidies (on the blackboard) to promote the general welfare.

But there is no counterpart to the teacher within the real economic system

Occupational regulation comes with the real risk of the regulation turning into an anti-competitive barrier to entry as Milton Friedman (1962) warned:

The most obvious social cost is that any one of these measures, whether it be registration, certification, or licensure, almost inevitably becomes a tool in the hands of a special producer group to obtain a monopoly position at the expense of the rest of the public.

There is no way to avoid this result. One can devise one or another set of procedural controls designed to avert this outcome, but none is likely to overcome the problem that arises out of the greater concentration of producer than of consumer interest.

The people who are most concerned with any such arrangement, who will press most for its enforcement and be most concerned with its administration, will be the people in the particular occupation or trade involved.

They will inevitably press for the extension of registration to certification and of certification to licensure. Once licensure is attained, the people who might develop an interest in undermining the regulations are kept from exerting their influence. They don’t get a license, must therefore go into other occupations, and will lose interest.

The result is invariably control over entry by members of the occupation itself and hence the establishment of a monopoly position.

Friedman’s PhD was published in 1945 as Income from Independent Professional Practice. With co-author Simon Kuznets, he argued that licensing procedures limited entry into the medical profession allowing doctors to charge higher fees than if competition were more open.

Data Source: Martin Jenkins 2012, Review of Occupational Regulation, released by the Ministry of Business, Innovation and Employment under the Official Information Act.

Recent Comments