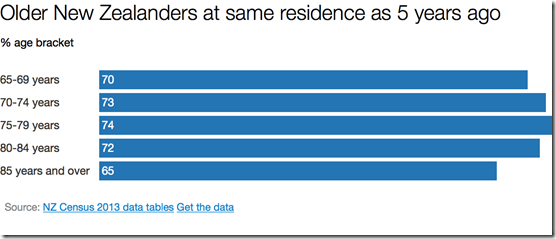

Morgan’s capital tax forgot 30% retirees move every 5 years @TaxpayersUnion

30 Mar 2017 Leave a comment

in politics - New Zealand, population economics, public economics Tags: 2017 New Zealand election, capital taxation, inheritance taxes, Opportunities Party, optimal tax theory

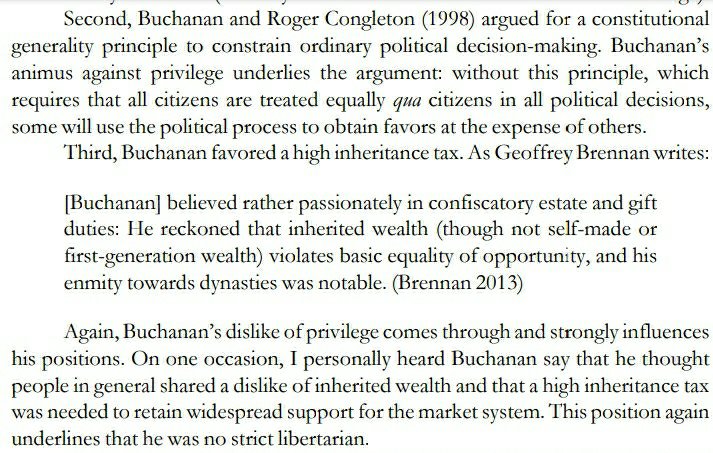

With 30% of retirees changing address every 5 years, they will have to downsize into hovels because they have to pay IRD the great big new tax on their capital championed by Morgan and his Opportunities Party well before they die.

Morgan’s 1.8% tax on equity capital is not an inheritance tax for the majority of retirees. It is a nest egg tax as they downsize after the kids fly the nest, grandchildren appear or they move to a more convenient place as they become frail.

Because they will have to pay back taxes of tens of thousands of dollars to IRD every time they sell their house, retirees either will not be able to move closer to family because of grand-children or health issues or they will have difficulty moving into a retirement home of their choice.

This is the first in a series of blogs showing how the Opportunities Party is too clever by half in its manifesto development. By insisting on having different policies to everybody else by a good country mile, it ends up having to take up the policies others rejected because they do not work.

In the case at hand, they put an inheritance tax on ordinary New Zealanders at the same rate as the rich including the founder of the Opportunities Party. This tax will be the only capital tax anywhere that is not progressive.

Over 70% of the retired own their own house mortgage free. The majority of that equity will now go to IRD plus interest by the time both members of the couple die given the average capital tax will be about $10,000 per year in Wellington and twice that in Auckland. They face up to 20 to 25 years of deferred capital taxation that will take half the value of their house easily. It will be hardest if they must cash-out their house to go into retirement home.

The purpose of buying a house is to have a nest egg for retirement. You may draw down that capital because of health issues or pass it on to children if you are luckier than that.

Morgan wants to radically change the way in which retirees go into the evening of their days. People who just managed to save for a house will have nothing to pass on to their children. No more bank of mum and dad either.

The impact of the top tax rate in the depth and severity of the great depression

24 Apr 2015 Leave a comment

in business cycles, fiscal policy, great depression, macroeconomics, politics - New Zealand, politics - USA, public economics Tags: capital taxation, New Zealand, taxation and the labour supply, top tax rate

Source: Ellen McGrattan.

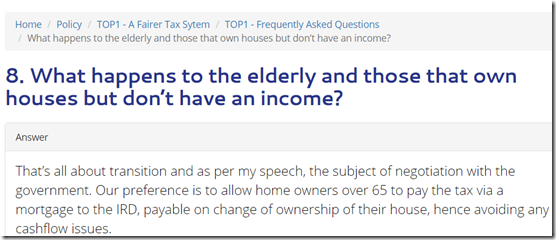

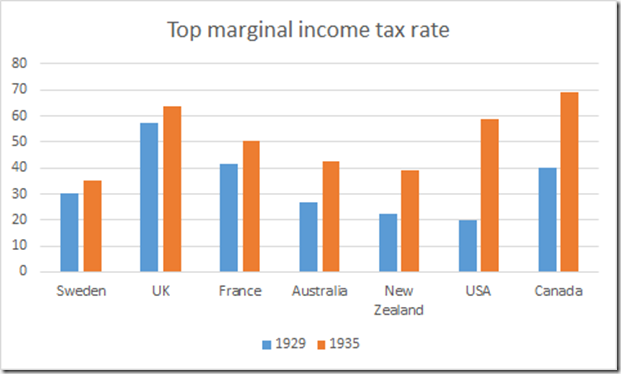

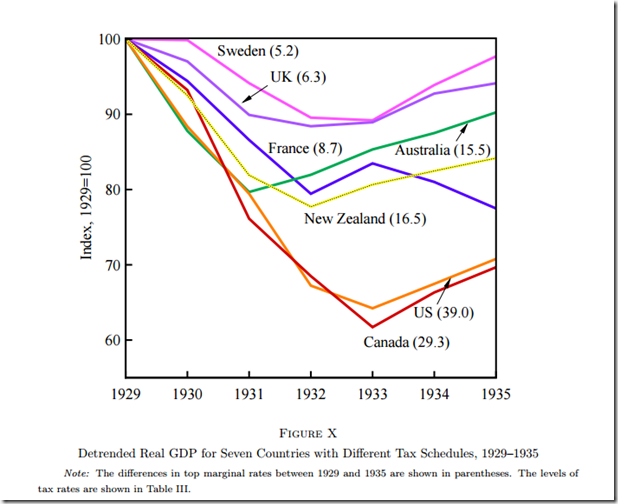

There were large differences in increases in the 1930s in the top marginal income tax rate between Sweden, the UK, France with Australia and New Zealand and between the USA and Canada and the rest as McGrattan explains:

These data show that there is a strong negative correlation, roughly −94%, between the change in the top income tax rates and the deviation in per capita real GDP relative to trend in 1933.

The role of unions in prolonging the Great Depression

20 Apr 2015 1 Comment

in business cycles, fiscal policy, great depression, labour economics, labour supply, macroeconomics, politics - USA, unemployment, unions Tags: capital taxation, FDR, Herbert Hoover, Leftover Left, Leo Ohanian, New Deal, union power, union wage premium, unionisation

Our friends on the left at the Economic Policy Institute were good enough to remind us of the link between rapid unionisation of the US labour market in the early and mid-1930s and the petering out of the recovery from the great depression. That recession within a depression is the Roosevelt recession.

New blog on Mind The Gap: on labour #unions and income #inequality

oxfamblogs.org/mindthegap/201… http://t.co/FyrOboCaRk—

Ricardo FuentesNieva (@rivefuentes) April 17, 2015

Harold Cole and Lee Ohanian analysed in depth this double-dip depression in the USA in a paper in the Journal of Political Economy titled “New Deal Policies and the Persistence of the Great Depression: A General Equilibrium Analysis” about 10 years ago:

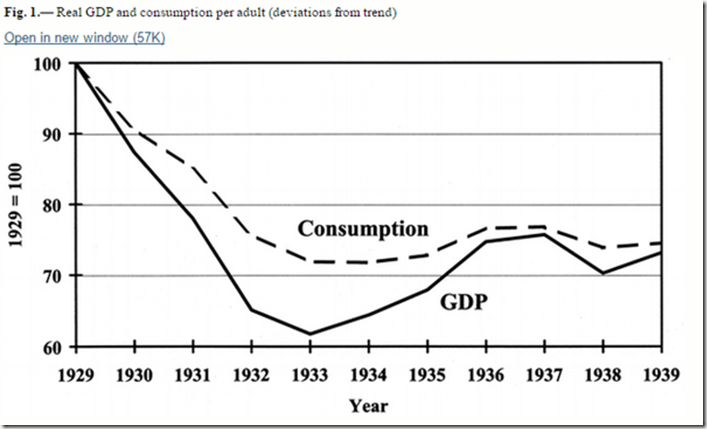

The recovery from the Great Depression was weak… Real gross domestic product per adult, which was 39 percent below trend at the trough of the Depression in 1933, remained 27 percent below trend in 1939. Similarly, private hours worked were 27 percent below trend in 1933 and remained 21 percent below trend in 1939.

The weak recovery is puzzling because the large negative shocks that some economists believe caused the 1929–33 downturn—including monetary shocks, productivity shocks, and banking shocks—become positive after 1933. These positive shocks should have fostered a rapid recovery, with output and employment returning to trend by the late 1930s.

The focus of the paper by Cole and Ohanian in explaining the weak recovery – the double-dip depression in the 1930s – are the New Deal cartelisation policies designed to limit competition and increase labour bargaining power through extensive unionisation of workforce.

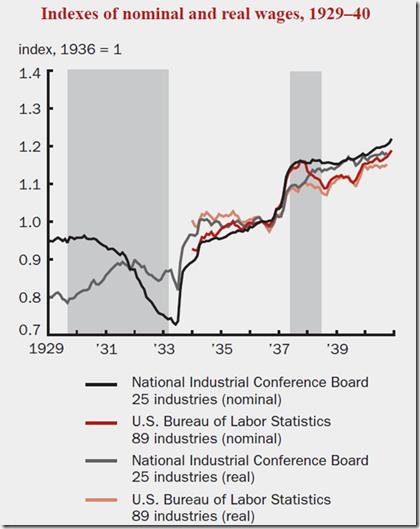

The recovery from the depths of the Great Depression was weak but real wages in several sectors rose significantly above trend despite mass unemployment.

The view that limiting competition in product markets and the labour market was essential for economic prosperity was influential in the 1920s and 1930s. Both FDR and Hoover believed high wages were the key to prosperity.

FDR’s recipe for economic recovery from the great depression when he came to office in 1933 was raising prices and wages and the promotion of unions:

Union membership rose from about 13 percent of employment in 1935 to about 29 percent of employment in 1939, and strike activity doubled from 14 million strike days in 1936 to about 28 million in 1937.

The result of this suppression of market competition and the encouragement of unions was real wages increase despite the weak recovery:

The coincidence of high wages, low consumption, and low hours worked indicates that some factor prevented labour market clearing during the New Deal.

The combination of government interference with competition and strong unions stifled the recovery from the great depression rather than speed it up as was the plan of FDR:

New Deal labour and industrial policies did not lift the economy out of the Depression as President Roosevelt had hoped.

Instead, the joint policies of increasing labour’s bargaining power and linking collusion with paying high wages prevented a normal recovery by creating rents and an inefficient insider-outsider friction that raised wages significantly and restricted employment.

Not only did the adoption of these industrial and trade policies coincide with the persistence of depression through the late 1930s, but the subsequent abandonment of these policies coincided with the strong economic recovery of the 1940s.

U.S. unemployment fell from 22.9% in 1932 to 9.1% in 1937, a reduction of 13.8%, but was back up to 13% by 1938. The Social Security payroll tax debuted in 1937 on top of tax increases in the Revenue Act of 1935. In 1937, the economy fell into recession again. Cooley and Ohanian argue that:

The economy did not tank in 1937 because government spending declined. Increases in tax rates, particularly capital income tax rates, and the expansion of unions, were most likely responsible.

The Great Depression in the USA was unique in the fact that it was so long and the recovery, so weak:

Total hours worked per adult in 1939 remained about 21% below their 1929 level, compared to a decline of 27% in 1933… Per capita consumption did not recover at all, remaining 25% below its trend level throughout the New Deal, and per-capita non-residential investment averaged about 60% below trend.

After 1933, productivity growth was rapid, the banking system was stabilized, deflation was eliminated and there was plenty of demand stimulus as the Fed more than doubled the monetary base between 1933 and 1939. As Lee Ohanian noted:

Depressions are periods of low employment and low living standards. The normal forces of supply and demand should have reduced wages, which would have lowered business costs and increased employment and output. What prevented the normal forces of supply and demand from working?

Central to the faltering of this recovery by 1937 was the regime change when the Supreme Court finally upheld revised laws promoting unionisation:

The downturn of 1937-38 was preceded by large wage hikes that pushed wages well above their NIRA levels, following the Supreme Court’s 1937 decision that upheld the constitutionality of the National Labor Relations Act. These wage hikes led to further job loss, particularly in manufacturing.

The "recession in a depression" thus was not the result of a reversal of New Deal policies, as argued by some, but rather a deepening of New Deal polices that raised wages even further above their competitive levels, and which further prevented the normal forces of supply and demand from restoring full employment.

Lee Ohanian argues that the defining characteristic of the Great Depression was this failure of real wages to fall in the face of mass unemployment:

The defining characteristic of the Great Depression is a substantial and chronic excess supply of labour, with employment well below normal, and real wages in key industrial sectors well above normal.

Policies of Hoover and of FDR of propping up wages and encouraging unions and work sharing were the most important factors in precipitating and prolonging the Great Depression. The Great Depression was the first time U.S. wages did not fall in that you were administered a period of significant deflation.

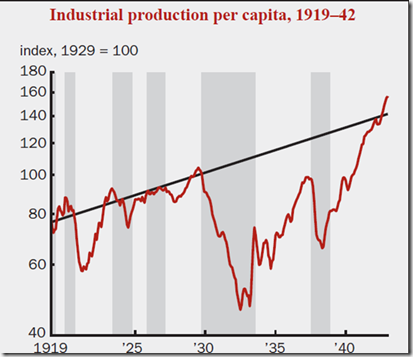

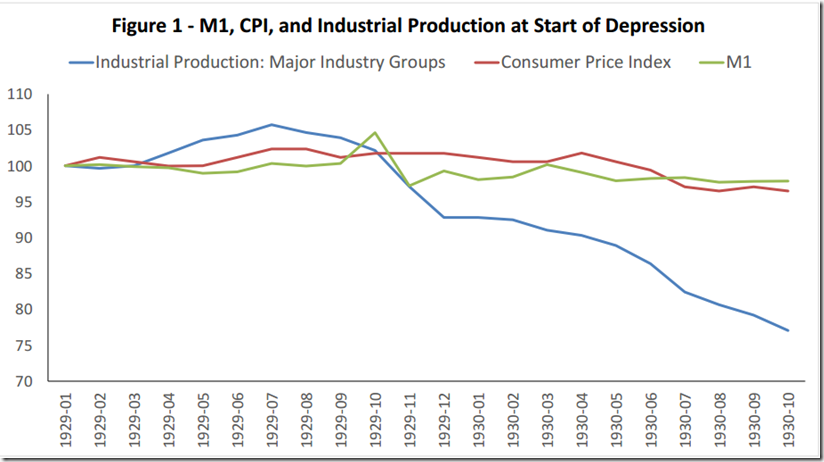

The manufacturing sector, where unions and the threat of unionisation was much stronger which was much harder hit initially than the agricultural sector both in terms of loss of jobs and wages not falling. The Great Depression did not start as an ordinary garden variety recession, as argued by Milton Friedman. It was immediately severe and sector specific with industrial production declining by about 35% between late 1929 and the end of 1930.

This decline in industrial production occurs before any banking crises. Despite this sector specific nature of the onset that Great Depression, monetary policy might have some role in explaining the start of the Great Depression but not in its prolongation:

any monetary explanation of the Depression requires a theory of very large and very protracted monetary non-neutrality. Such a theory has been elusive because the Depression is so much larger than any other downturn, and because explaining the persistence of such a large non-neutrality requires in turn a theory for why the normal economic forces that ultimately undo monetary non-neutrality were grossly absent in this episode.

Source: A different view of the Great Depression’s cause | VOX, CEPR’s Policy Portal.

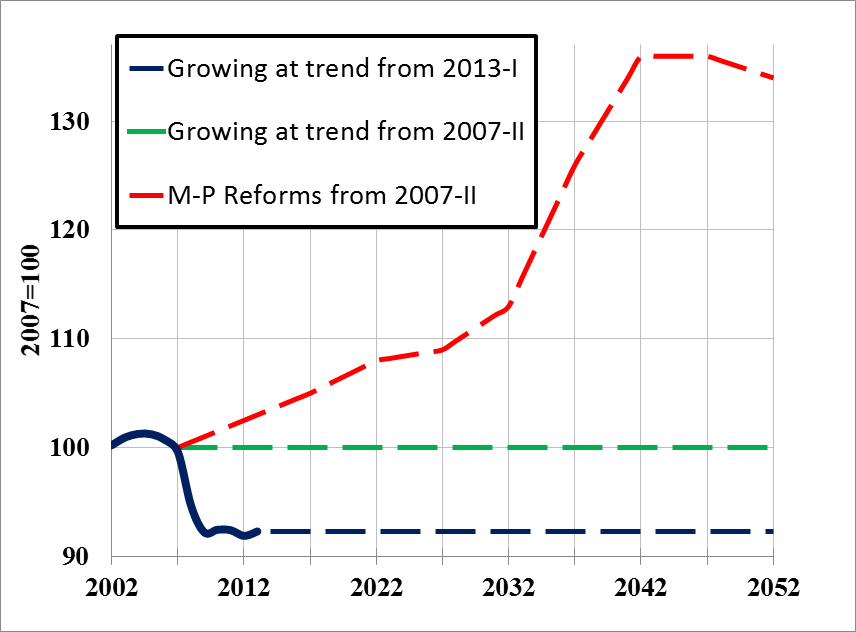

The path to higher U.S. prosperity

12 May 2014 Leave a comment

in applied welfare economics, economic growth, Edward Prescott, great recession, labour economics, macroeconomics Tags: capital taxation, Edward Prescott, retirement savings, tax reform

Suppose the USA:

- Had mandatory savings for retirement

- Eliminated capital income taxes

- Broadened tax base and lowered the marginal tax rate

- Phased in reforms so all birth-year cohorts are made better off

- Left welfare programs and local public good shares the same

- Savings not part of taxable income, saving withdrawals part of taxable income – with these changes U.S. income tax would be a consumption tax

US Detrended GDP per Capita

Source: Edward Prescott and Ellen McGrattan 2013.

Recent Comments