The Affordable Care Act and the Labor Market

15 Feb 2015 Leave a comment

in fiscal policy, great recession, labour economics, labour supply, macroeconomics Tags: Casey Mulligan, Obamacare, taxation and the labour supply

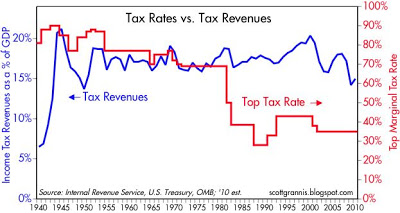

Explicit and implicit marginal tax rate increases in the past seventy years in the USA

03 Dec 2014 Leave a comment

in business cycles, great recession, job search and matching, labour supply, macroeconomics Tags: Casey Mulligan, great recession, taxation and the labour supply

More on More Efficient Tax Systems Leading to Bigger Government

02 Dec 2014 Leave a comment

in comparative institutional analysis, constitutional political economy, liberalism, Public Choice Tags: Casey Mulligan, Gary Becker, growth in government, public choice

…in Deadweight Costs and the Size of Government (NBER Working Paper Number No. 6789) , [Gary Becker and Casey Mulligan] conclude that flatter and broader taxes also tend to encourage bigger government because taxpayers offer less resistance to increases in flat tax rates than in rates of more onerous and less efficient forms of taxation.

Any decline in the resistance of taxpayers leads to larger government budgets since an endless number of groups agitate for greater government support.

Flat tax rates, such as the VAT and Social Security taxes on earnings, usually start at very low levels but invariably increase over time.

The VAT is now 20 percent and higher in some countries. And payroll taxes began at a modest 2 percent in the 1930s in the United States, but have been increased 21 times to the present 15 percent combined rate on employees and employers.

More Efficient Tax Systems Lead to Bigger Government

26 Nov 2014 Leave a comment

in comparative institutional analysis, constitutional political economy, politics - USA, Public Choice Tags: Casey Mulligan, Gary Becker, growth in government, public choice

Tax reforms lead to higher taxes

22 Mar 2014 3 Comments

in constitutional political economy, James Buchanan, Public Choice, public economics, taxation Tags: Casey Mulligan, efficient taxes, Gary Becker, growth of government, James M. Buchanan, tax reform, taxation in Nordic countries

After the 1970s tax revolts and California’s Proposition 13, Buchanan and Brennan wrote The Power to Tax. Their message was that if you don’t always trust governments, beware of efficient taxes.

More efficient taxes make it easier for government to extract more tax revenue from the population with less resistance. Taxes can be made more efficient by broadening tax bases and removing loopholes while lowering marginal rates. A GST that replaces a web of sales taxes is a common example. The GST always goes up over time, never down over time. Most tax reforms are revenue neutral.

When Brennan said at a tax reform conference in Australia 20 years or so ago that efficient taxes and tax reforms are both bad because they lead to higher taxes and a larger government, no one understood him.

Idealists all, the audience including me assumed they were advising a benevolent government, not a revenue-maximising leviathan government – a beast that needed to be staved with constitutional constraints on the number and size of tax bases and tax instruments.

Fiscal arrangements were analysed by Buchanan and Brennan in The Power to Tax in terms of the preferences of citizen-taxpayers who are permitted at some constitutional level of choice to select the fiscal institutions they are to be subject to over an uncertain future.

Those in elected office are assumed to exploit the power assigned to them to the maximum possible extent: government is a revenue-maximising leviathan.

Buchanan and Brennan were all for inefficient tax systems because they do not raise as much revenue. A government that cannot raise much revenue cannot grow very large.

Gary Becker and Casey Mulligan attributed the growth in the size of governments in the 20th century to demographic shifts, more efficient taxes, more efficient spending, a shift in the political power from the taxed to the subsidised, shifts in political power among taxed groups, and shifts in political power among the subsidised groups:

An improvement in the efficiency of either taxes or spending would reduce political pressure for suppressing the growth of government and thereby increase total tax revenue and spending.

Tax reform saved the late 20th century welfare state by raising the same or more revenue with less taxpayer resistance. Taxes are very efficient in the Nordic countries – high tax rates on labour income and consumption but lower on capital income. And light regulation too.

Recent Comments