Ani O’Brien writes – On Friday night, having imbibed a few wines I strayed onto X to unwisely engage in some (slightly drunk) opinion sharing. I tweeted:

Propping up the film sector or stimulating growth?

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

19 May 2025 Leave a comment

in economics of media and culture, entrepreneurship, industrial organisation, movies, politics - New Zealand, Public Choice, rentseeking, survivor principle, television Tags: corporate welfare

Ani O’Brien writes – On Friday night, having imbibed a few wines I strayed onto X to unwisely engage in some (slightly drunk) opinion sharing. I tweeted:

Propping up the film sector or stimulating growth?

01 Mar 2025 Leave a comment

in applied price theory, fiscal policy, industrial organisation, macroeconomics, politics - New Zealand, Public Choice, public economics, rentseeking, survivor principle Tags: corporate welfare

Newsroom has a summary of taxpayer money spent on Mt Ruapehu: How often have we been told this is the final assistance. We are now deep into the sunk cost fallacy.

$50 million of taxpayer money on a ski field

05 Feb 2018 Leave a comment

in applied price theory, industrial organisation, Public Choice, rentseeking, sports economics Tags: corporate welfare

14 Apr 2017 Leave a comment

in applied price theory, economic history, industrial organisation, politics - USA, rentseeking, survivor principle, transport economics Tags: corporate welfare, picking winners

21 Jul 2016 Leave a comment

in comparative institutional analysis, economics, economics of bureaucracy, economics of media and culture, industrial organisation, international economics, politics - New Zealand, Public Choice, rentseeking, survivor principle, television Tags: corporate welfare, industry policy, New Zealand Greens, picking losers, picking winners, Yes Prime Minister

02 Jul 2016 Leave a comment

in applied price theory, economics of bureaucracy, entrepreneurship, industrial organisation, politics - New Zealand, Public Choice, rentseeking, survivor principle Tags: corporate welfare, industry policy, picking losers, picking winners, The pretense to knowledge

My latest corporate welfare report is out at the Taxpayers Union website. The company tax could be 6 percentage points lower but for this generosity of politicians picking winners.

Source: New Zealand Budget Papers, various years.

It is not as bad as you think under the last Labour government budget. $700 million of those hand-outs to business was seed capital for agricultural research institute. That institute to be run out of the investment income on that $700 million one-off injection which the incoming National Party-led government cancelled.

Another $675 million in that last Labour budget was to KiwiRail and OnTrack. Other than that, the Labour Party ran a pretty tight ship on business subsidies. There are no particular record of picking winners. Labour did buy a real loser in KiwiRail. You heard it here first.

13 Apr 2016 Leave a comment

in applied price theory, entrepreneurship, industrial organisation, politics - New Zealand, Public Choice, rentseeking, survivor principle Tags: corporate welfare, creative destruction, entrepreneurial alertness, Hollywood economics, industry policy, picking losers, picking winners

Minister for Science and Innovation Steven Joyce picked a few more winners today. Eleven more start-up technology companies are to be funded $450,000 each in repayable loans to commercialise their technology. The loans are from Callaghan Innovation’s incubator network.

Minister for Science and Innovation Steven Joyce picked a few more winners today. Eleven more start-up technology companies are to be funded $450,000 each in repayable loans to commercialise their technology. The loans are from Callaghan Innovation’s incubator network.

To cut a long diatribe short, I find these sums of money rather piddling. I have encountered this corporate welfare program before at a presentation.

My reaction then as is now: by handing out such small grants, some will succeed, some will fail. Importantly, there will never be one big disaster to bring the whole show down. There is political safety in diversification.

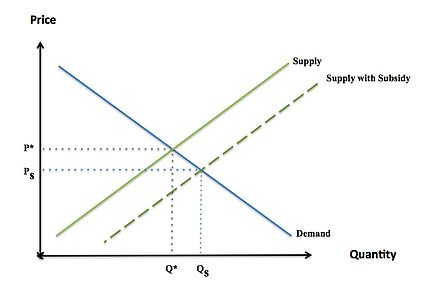

This is not the case with, for example, film subsidies. If Sir Peter Jackson and others finally produce a box office bomb, it will be all too glaring that the taxpayers backed a Hollywood loser with hundreds of millions of dollars. $500 million in subsidies in the case of Avatar.

By peppering small sums of money across the economy, there is no similar risk from this repayable grant scheme for the commercialisation of products.

30 Jul 2015 Leave a comment

in industrial organisation, international economics, politics - New Zealand Tags: bailouts, corporate welfare, KiwRail, New Zealand Greens, TPPA

If a TPPA means no more bailouts for KiwiRail, that is a major benefit from the agreement not previously brought to public attention.

New Zealand shouldn’t be signing an agreement that ties future governments’ hands. #TPPANoWay http://t.co/dawreBzLia—

Green Party NZ (@NZGreens) July 30, 2015The KiwiRail bailouts add 1 to 2 percentage points to the company tax of every New Zealand business. Cutting the company tax by 1-2% by not bailing out KiwiRail would be a major public benefit. I now have one more reason to favour the TPPA.

For all the TPP's flaws, the biggest trade deal in years is good news for the world econ.st/1SjmwS3 http://t.co/UokBxoOXgf—

The Economist (@EconBizFin) July 30, 2015A trade agreement tying the hands of future governments preventing them from bailing out failing state-owned enterprises would be a major gain that could more than offset and indeed pay for the higher drug prices that may result from longer patent lives for new drugs.

Utopia, you are standing in it!

In the finest public service traditions of free and frank advice, the New Zealand Treasury in its budget advice this year advised ministers to contemplate shutting down KiwiRail.

Treasury recommended the Government fund KiwiRail for one more year and undertake a comprehensive public study to look into closing the company. The study is public so that people were informed of the costs of running the rail network compared with any benefits it provided. The Government rejected the idea.

Figure 1: State-owned enterprise welfare, Vote Transport and Vote Finance (KiwiRail), Budgets 08/09 to 15/16

KiwiRail has been a constant thorn in the taxpayers’ side. Since this rail business was acquired in 2008 for $665 million as a commercial investment, Crown investments have totalled $3.4 billion – see Figure 1.

Fortunately in the 2015 budget, the Minister of Finance signalled that the government’s patience with the KiwiRail deficits is not unlimited. KiwiRail…

View original post 204 more words

30 Jul 2015 Leave a comment

in applied price theory, comparative institutional analysis, economics of bureaucracy, entrepreneurship, financial economics, human capital, industrial organisation, labour economics, managerial economics, occupational choice, organisational economics, rentseeking, survivor principle Tags: active investing, corporate welfare, efficient markets hypothesis, entrepreneurial alertness, hedge funds, industry policy, passive investing, picking winners, The fatal conceit, The pretence to knowledge

Page 32 of "An Illustrated Guide to Income" more economic #dataviz at: bit.ly/12SEI9p http://t.co/HYm0II2UNI—

Catherine Mulbrandon (@VisualEcon) May 08, 2013

Page 33 of "An Illustrated Guide to Income" more economic #dataviz at: bit.ly/10M7lqR http://t.co/FcmaqZWB32—

Catherine Mulbrandon (@VisualEcon) May 09, 2013

The hedge fund industry held $2.9 trillion of assets in June. Exchange-traded funds did better econ.st/1DdXgWS http://t.co/CK2foqMOpw—

The Economist (@EconEconomics) August 01, 2015

20 Jul 2015 Leave a comment

in rentseeking, sports economics Tags: corporate welfare, expressive voting, NASA, Pluto, space, sports, sports stadiums, welfare

18 Jul 2015 1 Comment

in economic history, economics of bureaucracy, politics - New Zealand, politics - USA, Public Choice, rentseeking, transport economics Tags: Amtrak, corporate welfare, expressive voting, industry policy, KiwiRail, privatisation, rational ignorance, rational irrationality, state owned enterprises

Figure 1: Amtrak and KiwiRail bailouts, (exchange rate US$1:NZ$1.53), 2008 – 2015

Sources: Federal Funding Received by Amtrak | Mercatus and New report: Corporate welfare in the 2015 budget – Taxpayers’ Union.

New Zealand with its KiwiRail does a good job of keeping up with the Amtrak bailout especially when you look at figure 2, which computes the bailouts on a per capita basis.

Figure 2: Amtrak and KiwiRail bailouts per capita (2014 populations), (exchange rate US$1:NZ$1.53), 2008 – 2015

Sources: Federal Funding Received by Amtrak | Mercatus and New report: Corporate welfare in the 2015 budget – Taxpayers’ Union.

10 Jul 2015 Leave a comment

in applied welfare economics, economics of bureaucracy, economics of media and culture, politics - New Zealand, rentseeking, transport economics Tags: corporate welfare, KiwiRail, media bias, privatisation, public ownership, Radio New Zealand, state owned enterprises

This morning on 9 to noon on Radio New Zealand, Kathryn Ryan, the compere of the program, repeatedly claimed that the government pumped $1 billion into the KiwiRail Turnaround Plan between 2010 and 2014. I was so annoyed by this that I made a broadcasting standards complaint while the program was still being broadcast on my mobile as a one finger typist.

The report on 9 to Noon was in response to the government putting KiwiRail on notice, giving it two years to identify savings and reduce Crown funding required or risk the possibility of closure. Since KiwiRail was acquired in 2008 for $665 million as a commercial investment, Crown investments (taxpayers bailout) totalled $3.4 billion – see Figure 1.

Figure 1: State-owned enterprise welfare, Vote Transport and Vote Finance (KiwiRail), Budgets 08/09 to 15/16

Source: New Zealand budget papers, various years.

Table 1 shows that the KiwiRail Turnaround plan of $1.272 billion since the 2009-10 Budget is only a small part of the bailout of KiwiRail. 9 to Noon simply ignored the $210 million in the 2015 budget for KiwiRail for no explicable reason and instead talked about a $1 billion Turnaround plan rather than the $1.272 billion Turnaround plan.

Table 1: State-Owned Enterprise welfare, Vote Transport and Vote Finance (KiwiRail), Budgets 2008/09 to 2015/16, $million

| 08/09 |

09/10 |

10/11 |

11/12 |

12/13 |

13/14 |

14/15 |

15/16 |

|

|

New Zealand Railways Corporation Loans |

405 |

55 |

250 |

108 |

11 |

|||

|

KiwiRail Turnaround Plan |

20 |

250 |

250 |

250 |

94 |

198 |

210 |

|

|

KiwiRail Equity Injection |

323 |

25 |

29 |

|||||

|

Rail Network and Rolling Stock Upgrade |

105 |

71 |

10 |

|||||

|

New Zealand Railways Corporation Loans |

55 |

|||||||

|

New Zealand Railways Corporation Increase in Capital for the Purchase of Crown Rail |

376 |

|||||||

|

Crown Rail Operator Loans |

140 |

|||||||

|

Crown Rail Operator Equity Injection |

7 |

|||||||

|

Total |

578 |

530 |

376 |

510 |

680 |

119 |

209 |

239 |

Source: New Zealand budget papers, various years.

Other parts of the bailout of KiwiRail include $405 million in loans to the New Zealand Railways Corporation in the 2009-10 budge – see table 1. There was a $323 million equity injection in the 2012-13 Budget – see table 1. KiwiRail has also caused write-downs in the Crown balance sheet of an incredible $9.8 billion since it was repurchased in 2008.

9 to Noon ignored at least two thirds of the cost to the taxpayer of bailing out KiwiRail by only limiting its reporting to part of the KiwiRail Turnaround Plan. It ignored the contribution in the most recent budget to that plan. That does not meet broadcasting standards of accuracy or professional responsibility.

Any reasonable listener will infer, as I did when listening, that the entire cost of the bailout of KiwiRail is represented by the Turnaround Plan of about $1 billion. If listeners were left with that impression, they were misled by 9 to Noon and Radio New Zealand.

09 Jul 2015 1 Comment

in economics of bureaucracy, politics - New Zealand, Public Choice, public economics, rentseeking, transport economics Tags: corporate welfare, hard budget constraints, KiwiRail, privatisation, public ownership, state owned enterprises, state-owned enterprise welfare

In the finest public service traditions of free and frank advice, the New Zealand Treasury in its budget advice this year advised ministers to contemplate shutting down KiwiRail.

Treasury recommended the Government fund KiwiRail for one more year and undertake a comprehensive public study to look into closing the company. The study is public so that people were informed of the costs of running the rail network compared with any benefits it provided. The Government rejected the idea.

Figure 1: State-owned enterprise welfare, Vote Transport and Vote Finance (KiwiRail), Budgets 08/09 to 15/16

Source: New Zealand budget papers, various years.

KiwiRail has been a constant thorn in the taxpayers’ side. Since this rail business was acquired in 2008 for $665 million as a commercial investment, Crown investments have totalled $3.4 billion – see Figure 1.

Fortunately in the 2015 budget, the Minister of Finance signalled that the government’s patience with the KiwiRail deficits is not unlimited. KiwiRail has a 10-year Turnaround Plan to make its freight business commercially viable. The current network of 4,000 km must be reduced to 2,300 km for the company to even breakeven. The Treasury advised, to no avail, that this massive and painful restructuring was required before KiwiRail was purchased. The purchase went through.

The latest developments where Treasury advised ministers to contemplate shutting the network down is an opportunity for ministers, and the opposition spokesmen on finance and transport both to say how much is too much in accumulated KiwiRail losses.

The Minister of Finance and his Cabinet colleagues must say after the public review that there is only so much more left in the cupboard to bailout KiwiRail losses. After that fiscal cap is reached, KiwiRail is on its own. If that means bankruptcy and network closure, so be it.

In the interim, on the side of every KiwiRail train there should be advertising billboards with the following disclosure statements:

07 Jul 2015 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economics of bureaucracy, entrepreneurship, income redistribution, industrial organisation, managerial economics, organisational economics, politics - New Zealand, Public Choice, public economics, rentseeking, survivor principle Tags: corporate welfare, entrepreneurial alertness, industry policy, industry targeting, The fatal conceit, The pretence to knowledge

I didn’t notice any discussion in the Cabinet paper of a government doing this before and whether their investment promotion efforts succeeded or not. This latest policy proposal cannot even count as evidence-based policy dreaming, much less a serious contribution to public policy.

Hoping to double incoming foreign investor and entrepreneur migration from $3.5 billion to $7 billion inside three years without spending any extra public money is breathless public policy making. I am sure lots of governments previously tried to get something for nothing.

It will be helpful if ministers pointed to where overseas governments have been successful in doubling foreign investment by simply reprioritising existing investment promotion efforts.

There are at least 2,500 national, provincial and city investment promotion agencies out. Some of them must have been subject to some sort of evaluation as to their success.

This overseas literature review would be in addition to the recent findings of the Ministry of Economic Development about the poor performance and perhaps futility of the foreign direct investment promotion by New Zealand Trade and Enterprise.

Imagine how much bigger a boost in foreign investor and entrepreneur migration lays before us if actual real new money was put on the table.

via beehive.govt.nz – Strategy targets international investors and Evaluation of NZTE investment support activities [929 KB PDF]

.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Scholarly commentary on law, economics, and more

Beatrice Cherrier's blog

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Why Evolution is True is a blog written by Jerry Coyne, centered on evolution and biology but also dealing with diverse topics like politics, culture, and cats.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

A rural perspective with a blue tint by Ele Ludemann

DPF's Kiwiblog - Fomenting Happy Mischief since 2003

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

The world's most viewed site on global warming and climate change

Tim Harding's writings on rationality, informal logic and skepticism

A window into Doc Freiberger's library

Let's examine hard decisions!

Commentary on monetary policy in the spirit of R. G. Hawtrey

Thoughts on public policy and the media

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Politics and the economy

A blog (primarily) on Canadian and Commonwealth political history and institutions

Reading between the lines, and underneath the hype.

Economics, and such stuff as dreams are made on

"The British constitution has always been puzzling, and always will be." --Queen Elizabeth II

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

WORLD WAR II, MUSIC, HISTORY, HOLOCAUST

Undisciplined scholar, recovering academic

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Res ipsa loquitur - The thing itself speaks

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Researching the House of Commons, 1832-1868

Articles and research from the History of Parliament Trust

Reflections on books and art

Posts on the History of Law, Crime, and Justice

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Exploring the Monarchs of Europe

Cutting edge science you can dice with

Small Steps Toward A Much Better World

“We do not believe any group of men adequate enough or wise enough to operate without scrutiny or without criticism. We know that the only way to avoid error is to detect it, that the only way to detect it is to be free to inquire. We know that in secrecy error undetected will flourish and subvert”. - J Robert Oppenheimer.

The truth about the great wind power fraud - we're not here to debate the wind industry, we're here to destroy it.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Economics, public policy, monetary policy, financial regulation, with a New Zealand perspective

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Restraining Government in America and Around the World

Recent Comments