"Paul Samuelson" on the New Zealand superannuation fund beating the market

24 Feb 2015 Leave a comment

Is the best share price forecast whatever it is today?

20 Feb 2015 Leave a comment

in financial economics Tags: efficient markets hypothesis, random walk

More correctly, for the share market, it’s a random walk with a positive drift.

Actively managed share funds are on the way out

20 Feb 2015 Leave a comment

in entrepreneurship, financial economics, industrial organisation, survivor principle Tags: active investing, efficient markets hypothesis, passive investing, William F. Shape

After costs, the return on the average actively managed dollar will be less than the return on the average passively managed dollar for any time period.

—William F. Sharpe, 1990 Nobel Laureate

4 out of 5 actively managed fund portfolios underperformed all index fund portfolios in all scenarios tested.

via The tide is turning as investors switch from high-cost, actively managed funds to index funds for lower costs, higher returns » AEI | Carpe Diem Blog » AEIdeas and Mutual Fund Expenses | Lion’s Share.

.

Deirdre McCloskey on big bills on the sidewalk

08 Feb 2015 Leave a comment

in applied price theory, entrepreneurship, market efficiency Tags: Deirdre McCloskey, efficient markets hypothesis, entrepreneurial alertness, forecasting

HT: Cafe Hayek

Would Keynes Have Been Fired as a Money Manager Today?

30 Jan 2015 Leave a comment

in entrepreneurship, financial economics Tags: active investing, efficient markets hypothesis, index linked investing, John Maynard Keynes

An excellent link by a great blog I have just come across.

Interesting post by Ben Carlson.

Keynes managed an average return of 13.2% in the period 1928-45. The markets gave a return of -0.5% in the same period. This was an exceptional performance albeit came with much higher volatility. So would he have been fired for this performance?

View original post 360 more words

What are the rewards of investing in vice?

05 Dec 2014 Leave a comment

in entrepreneurship, financial economics Tags: efficient markets hypothesis

What is the Vice Fund? It invests in a collection of sinful stocks. As its managers describe it:

Designed with the goal of delivering better risk-adjusted returns than the S&P 500 Index.

It invests primarily in stocks in the tobacco, alcohol, gaming and defense industries.

We believe these industries tend to thrive regardless of the economy as a whole.

via Investing in Vice.

David I. Levine on entrepreneurial alertness and the efficient markets hypothesis

13 Nov 2014 Leave a comment

Who Routinely Trounces the U.S. Stock Market? Try 2 Out of 2,862 Funds – NYTimes.com

30 Jul 2014 Leave a comment

in entrepreneurship, financial economics, survivor principle Tags: active investing, efficient markets hypothesis, indexed linked investing, passive investing, stock picking

For the three years ended March 2014, 14.10% of large-cap funds, 16.32% of mid-cap funds and 25.00% of small-cap funds maintained a top-half ranking over three consecutive 12-month periods. Random expectations would suggest a rate of 25%.

After five years, two funds are still beating the market in each of the last five years.The rest of fallen by the wayside.

via Who Routinely Trounces the Stock Market? Try 2 Out of 2,862 Funds – NYTimes.com

Eugene Fama on share market bubbles

03 Jul 2014 Leave a comment

in economics, entrepreneurship, financial economics Tags: efficient markets hypothesis, Eugene Fama

Q: I guess most people would define a bubble as an extended period during which asset prices depart quite significantly from economic fundamentals.

A: That’s what I would think it is, but that means that somebody must have made a lot of money betting on that, if you could identify it. It’s easy to say prices went down, it must have been a bubble, after the fact.

I think most bubbles are twenty-twenty hindsight. Now after the fact you always find people who said before the fact that prices are too high.

People are always saying that prices are too high. When they turn out to be right, we anoint them. When they turn out to be wrong, we ignore them.

They are typically right and wrong about half the time…

I want people to use the term in a consistent way. For example, I didn’t renew my subscription to The Economist because they use the world bubble three times on every page. Any time prices went up and down—I guess that is what they call a bubble. People have become entirely sloppy.

People have jumped on the bandwagon of blaming financial markets. I can tell a story very easily in which the financial markets were a casualty of the recession, not a cause of it.

A market in which prices always fully reflect available information is called efficient

27 Jun 2014 Leave a comment

in experimental economics, financial economics, market efficiency Tags: efficient markets hypothesis

Source: John Cochrane

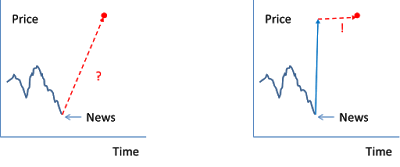

A share market that jumps suddenly when there is news of change in economic corporate fortunes is efficient.

This means that an efficient market can be highly volatile because it is rapidly incorporating changes in information. An efficient market is a volatile market.

As for smart money managers beating an efficient market, John Cochrane explains:

…efficiency implies that trading rules — “buy when the market went up yesterday”– should not work.

The surprising result is that, when examined scientifically, trading rules, technical systems, market newsletters, and so on have essentially no power beyond that of luck to forecast stock prices.

This is not a theorem, an axiom, a philosophy, or a religion: it is an empirical prediction that could easily have come out the other way, and sometimes does.

Efficiency implies that professional managers should do no better than monkeys with darts. This prediction too bears out in the data.

It too could have come out the other way. It should have come out the other way! In any other field of human endeavour, seasoned professionals systematically outperform amateurs. But other fields are not as ruthlessly competitive as financial markets.

Warren Buffett and other business owners

17 Mar 2014 Leave a comment

in entrepreneurship, market efficiency Tags: efficient markets hypothesis, Eugene Fama, Kerry Packer, luck versus skill, Rupert Murdoch, Warren Buffett

The father of the efficient markets hypothesis and a champion of the passive investment index-linked funds Eugene Fama considers Buffett to be more of a businessman than a portfolio investor. To Fama, the high returns by Buffett look great because entrepreneurs that do survive in market competition look good because we ignore the thousands that failed and lost everything.

You should compare Buffett with other businessmen such as Kerry Packer and Rupert Murdoch. These two Australian corporate giants started off with two TV stations and a rather ordinary afternoon newspaper, respectively.

Packer and Murdoch grew their businesses to a global level to move from being millionaires to billionaires. Bill Gates and Steve Jobs also built and ran big companies from scratch.

Packer, Murdoch, Gates and Jobs all had great returns because they were able to obtain a return of their unique management skills and entrepreneurial alertness.

Kaplan and Rauh in “It’s the Market: The Broad-Based Rise in the Return to Top Talent” Journal of Economic Perspectives 2013 found that most of those in the Forbes 400 did not grow up wealthy.

Most of the Forbes 400 are entrepreneurs who accessed education while young and then applied their skills to the technology, finance, and mass retail sectors. In these sectors, through ICT and other innovations, these entrepreneurs could apply their superior talents to larger and larger pools of resources and more and more firms to reach huge numbers of consumers on a national or global scale. They became superstars in terms of their productivity and pay because they could lever their talents so widely over so many firms, workers, consumers and countries.

But remember, hundreds of dot.com firms failed and lost everything for each one that made it big. These are businesses we remember. The dot.com firms that failed are quiz questions, if they are remembered at all.

What is left standing after all this blood letting must be extremely profitable if only to justify the ride for those that risked it all to have it all. Fama estimated that the dot.com bubble was justified if something like 1.4 more Microsofts were born as a result of it!

Frazzini, Kabiller and Pedersen in “Buffett’s Alpha” found that Buffet had “a higher Sharpe ratio than any stock or mutual fund with a history of more than 30 years”. The Sharpe Ratio describes how much excess return you are receiving for the extra volatility in your portfolio because your are holding a riskier asset

Buffett is a volatile investment as Frazzini, Kabiller and Pedersen noted: from July 1998 through February 2000, Berkshire lost 44% of its market value, while the overall share market gained 32%.

A key to Buffett’s success was Berkshire surviving these set-backs.

Both Packer and Murdoch too had a few lucky scraps with their bankers. Steven Jobs was fired by Apple in 1985 because he was no good as a CEO – he was sending the company broke and would not listen. Bill Gates is as good as his next product launch. Nokia shares initially fell by 90% in 2007 when Apple leap-frogged it with a phone that resembled a PC – the iPhone.

Buffett and Murdoch both run an internal capital market where they expect a certain minimum rate of return.

Both are hands-off. Buffett’s corporate head office has 24 employees to do the regulatory and compliance work.

Murdoch reputedly rings the chief executive of each of his companies once a month for one minute. If what the chief executive says is interesting, the call gets longer. This is the essence of entrepreneurial alertness. Noticing what others have not and grasping that opportunity before someone else beats you to it.

Recent Comments