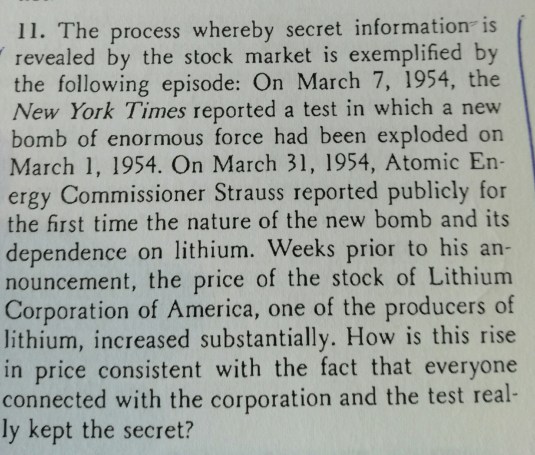

Alchian and Allen on the share market as spy

24 Dec 2016 Leave a comment

in applied price theory, entrepreneurship, financial economics Tags: efficient markets hypothesis

The Soviets first suspected an atomic program on 1942 by the simple detail that all the top scientists stopped publishing. All in the details.

Are markets efficient? Eugene Fama (yes!) and Richard Thaler (no!) debate

30 Nov 2016 Leave a comment

in applied price theory, behavioural economics, entrepreneurship, financial economics Tags: active investing, efficient markets hypothesis, Eugene Fama, passive investing

Should firms be financed by debt or equity? | Franco Modigliani

05 Nov 2016 Leave a comment

in financial economics Tags: efficient markets hypothesis

Where does the Vice Fund invest? @EricCrampton

28 Oct 2016 Leave a comment

in entrepreneurship, financial economics Tags: efficient markets hypothesis, entrepreneurial alertness

The Vice Fund, now called the Barrier Fund, is a mutual fund investing in companies that have significant involvement in, or derive a substantial portion of their revenues from the tobacco, gambling, defence/weapons, and alcohol industries. It continues to beat the market.

Can You Beat the Market?

28 Oct 2016 Leave a comment

in entrepreneurship, financial economics Tags: active investing, efficient markets hypothesis, passive investing

The rewards of buying and holding

20 Oct 2016 Leave a comment

in economic history, financial economics Tags: active investing, efficient markets hypothesis, entrepreneurial alertness, passive investing

Source: How Are We Doing? – AEI.

Weighted average cost of capital by sector in the USA

08 Sep 2016 Leave a comment

in financial economics Tags: efficient markets hypothesis

Cost of debt and equity by sector in the USA 2016

07 Sep 2016 Leave a comment

in financial economics Tags: efficient markets hypothesis

Source: Aswath Damodaran Cost of Capital.

Index Funds: The 12-Step Recovery Program for Active Investors

19 Aug 2016 Leave a comment

in economics, financial economics Tags: active investing, efficient markets hypothesis, hedge funds, passive investing

Has ethical investing ever beaten the market? @GreenpeaceNZ

29 Jul 2016 Leave a comment

in environmentalism, financial economics Tags: active investing, efficient markets hypothesis, entrepreneurial alertness, ethical investing, passive investing

VFTSX is the Vanguard social investing index fund – a fund that invests in an index made up of ethical investing funds.

Source: VFTSX Vanguard FTSE Social Index Inv Fund VFTSX Quote Price News.

Has the Vice Fund ever not outperformed the share market?

28 Jul 2016 3 Comments

in fisheries economics Tags: active investing, efficient markets hypothesis, entrepreneurial alertness, ethical investing, passive investing

The Vice Fund is a mutual fund investing in companies that have significant involvement in, or derive a substantial portion of their revenues from the tobacco, gambling, defense/weapons, and alcohol industries. A primary focus of stock selection is the ability to pay and grow dividends.

Source: VICEX USA Mutuals Barrier Investor Fund VICEX Quote Price News.

Recent Comments