More evidence on the emergence of the working rich

25 Oct 2015 Leave a comment

in applied price theory, applied welfare economics, economics of education, entrepreneurship, human capital, labour economics, labour supply, Marxist economics, occupational choice Tags: College premium, creative destruction, education premium, entrepreneurial alertness, graduate premium, Leftover Left, superstar wages, superstars, top 1%

@BernieSanders @HillaryClinton drug price controls will shorten lives

21 Oct 2015 Leave a comment

in applied price theory, applied welfare economics, economics of regulation, entrepreneurship, health economics, politics - USA Tags: 2016 presidential election, creative destruction, drug lags, entrepreneurial alertness, innovations, intellectual property, patents and copyright, price controls

Drug price controls have populist appeal, but patients are the ones they would hurt the most bit.ly/1X3e742 http://t.co/ulXuGHLSld—

Manhattan Institute (@ManhattanInst) October 17, 2015

That’s why there’s a husband’s chair in every quality women’s shop

19 Oct 2015 Leave a comment

in economics of love and marriage, economics of media and culture, television Tags: entrepreneurial alertness, marriage and divorce, search and matching, The battle of the sexes, The Simpsons

Creative destruction in technology acquisitions

19 Oct 2015 Leave a comment

in economic history, entrepreneurship, industrial organisation, survivor principle Tags: creative destruction, entrepreneurial alertness, market for corporate control, mergers and takeovers

The 12 biggest #technology acquisitions of all time wef.ch/1QrO2b5 http://t.co/Dx0YTm8NpA—

World Economic Forum (@wef) October 15, 2015

Creative destruction in newspapers

17 Oct 2015 Leave a comment

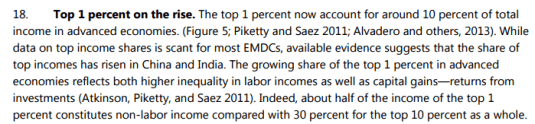

in economic history, economics of media and culture, entrepreneurship, industrial organisation, survivor principle Tags: creative destruction, entrepreneurial alertness

Creative destruction in Twitter

17 Oct 2015 Leave a comment

in economic history, economics of media and culture, entrepreneurship, industrial organisation, survivor principle Tags: creative destruction, entrepreneurial alertness, Twitter

2015 has not been a particularly good year for Twitter. Will share prices go further down? econ.st/1PfOAmW http://t.co/ME1RbnlmNE—

The Economist (@TheEconomist) October 14, 2015

Our interactive chart explains why Twitter remains a minnow in the tech industry econ.st/1LkhVqi http://t.co/sCQWStMEC3—

The Economist (@TheEconomist) October 14, 2015

50 years of creative destruction in desktops

13 Oct 2015 Leave a comment

in applied welfare economics, economic history, economics of media and culture, entrepreneurship, technological progress Tags: creative destruction, desktops, entrepreneurial alertness, innovation

Computers in 1964 vs. 2014: buff.ly/1NoBa3N http://t.co/4MFBCyk1D3—

HumanProgress.org (@humanprogress) June 28, 2015

FA Hayek on competition as a discovery procedure

11 Oct 2015 Leave a comment

in applied price theory, Austrian economics, entrepreneurship, F.A. Hayek Tags: competition is a discovery procedure, creative destruction, entrepreneurial alertness, market process, market selection, The meaning of competition

@GreenpeaceNZ @savethearctic real reason @Shell stopped Arctic drilling @NZGreens

07 Oct 2015 Leave a comment

5 Ways People Power Helped Defeat Shell >> bit.ly/1L4KgAP #savethearctic http://t.co/e3Bn319yOe—

Greenpeace Canada (@GreenpeaceCA) October 06, 2015

Today in Energy: Sustained low oil prices could reduce exploration and production investment go.usa.gov/3twad http://t.co/zH8EpFc4Xx—

EIA (@EIAgov) September 24, 2015

CHART: Thanks to #fracking, US produced >89% of energy consumed this year (through June) for 1st time since 1984 http://t.co/8yEUac1pBA—

Mark J. Perry (@Mark_J_Perry) September 29, 2015

CHART: Thanks to #fracking, US petroleum imports this year through August (25.3%) are lowest in 44 years, since 1971 http://t.co/ThSbPTVDkH—

Mark J. Perry (@Mark_J_Perry) September 29, 2015

New EIA Data: US oil output fell to 9.1 bpd last week, down by 508,000 bpd from July peak ir.eia.gov/wpsr/overview.… http://t.co/VwAjeQ2dEN—

Mark J. Perry (@Mark_J_Perry) September 30, 2015

Energy Milestone: Thanks #fracking US Nat Gas Production Increased in July to New Record High eia.gov/dnav/ng/ng_pro… http://t.co/8KECE6ftxm—

Mark J. Perry (@Mark_J_Perry) September 30, 2015

Humanity keeps finding new reserves of energy: buff.ly/1LbOCcW #progress http://t.co/QhzgYkjWEi—

HumanProgress.org (@humanprogress) October 04, 2015

Creative destruction in music sales

02 Oct 2015 Leave a comment

in economic history, economics of media and culture, entrepreneurship, industrial organisation, Music, survivor principle Tags: creative destruction, entrepreneurial alertness, market selection, The meaning of competition

Money spent on music by average American, 1973-2009

businessinsider.com/these-charts-e… http://t.co/zhJN4j5l1n—

Conrad Hackett (@conradhackett) May 30, 2015

Hayek’s use of knowledge in society

02 Oct 2015 Leave a comment

in applied price theory, economics of information, entrepreneurship, F.A. Hayek, industrial organisation, survivor principle Tags: competition as a discovery procedure, entrepreneurial alertness, market process, The meaning of competition

The IMF’s Causes and Consequences of Income Inequality: A Global Perspective

02 Oct 2015 2 Comments

in entrepreneurship, human capital, industrial organisation, labour supply, occupational choice, politics - USA, poverty and inequality Tags: entrepreneurial alertness, superstar wages, superstars, top 0.01%, top 0.1%, top 1%, working rich

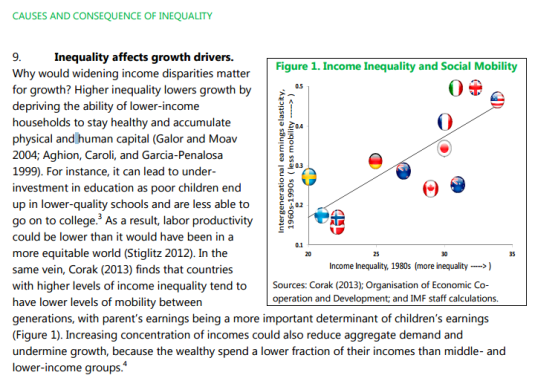

The IMF has joined the OECD in arguing there is an important connection between inequality and who gains from economic growth.

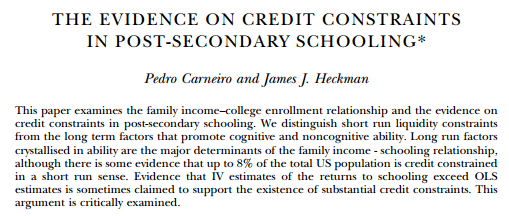

To reach the conclusion that the income distribution matters, the IMF had to tie its master the exact same weak moorings that the OECD did. Specifically the ability of the lower middle class to finance investments in school and higher education.

The IMF has articulated a specific hypothesis that can be confronted with facts and logic.

Many critics of inequality are extremely vague about what exactly is the process that grinds the proletariat down. The withering away of the proletariat in the 20th century has been discussed elsewhere on this blog.

The impact of low income on the ability to accumulate physical and human capital sounds like an interesting question. Not surprisingly, the top labour economists have looked into it.

Short-term factors such as the ability to borrow to fund higher education has been found to be seriously wanting. Only a small percentage of people are in any way constrained from going on to higher education because of the lack of money. This is not surprising in any society with student loans freely available at low or zero rates without any need to post collateral.

Wow. I mean, WOW. College completion figures over time by income quartile. bit.ly/16Bb1jh http://t.co/y0MVyiDCEZ—

Richard V. Reeves (@RichardvReeves) February 04, 2015

The notion that the rich are just replicating the good fortunes of their parents has also fallen on hard times despite the persistence of the OECD and the IMF in championing this old Marxist fantasy.

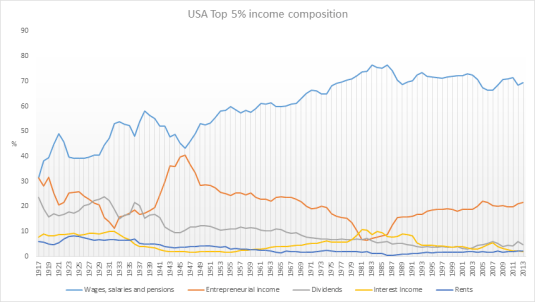

Source: The World Top Incomes Database.

If you look at the income composition of the top 5% of the USA, for example, it is a disappointing story for the IMF and the OECD. Today’s rich are working rich with the majority of their income from wages and salaries and much of the rest from entrepreneurial income. There is no passive rich earning incomes from their inherited investments and grinding the proletariat down.

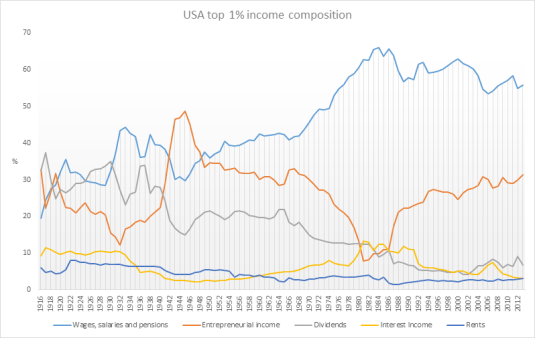

Source: The World Top Incomes Database.

It is the same story with the top 1%. They are working rich with the majority of their incomes paid in wages and salaries and running a business. They are top executives, managers and leading professionals that go to work every day.

Who are today’s supermanagers and why are they so wealthy? equitablegrowth.org/research/today… http://t.co/Ts2OkOUk5g—

Equitable Growth (@equitablegrowth) December 03, 2014

The IMF was simply wrong to claim that at least half the income of the top 1% in the USA was not labour income.

Before 1940, most of the income of the top 0.1% of income earners in the USA was income from investments. By the end of the 20th century, the top 0.1% were earning their incomes as wages and salaries, business incomes and capital gains. Very little of that income of the top 0.1% was in the form of passive income from capital. The top 0.1% of the USA are now working rich – entrepreneurs.

Source: The World Top Incomes Database.

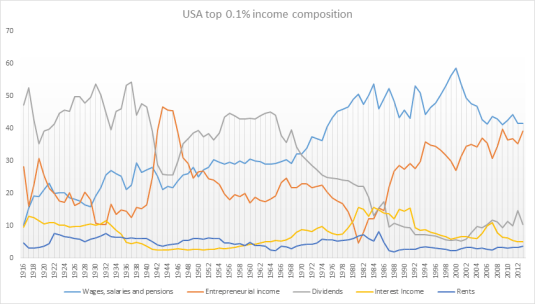

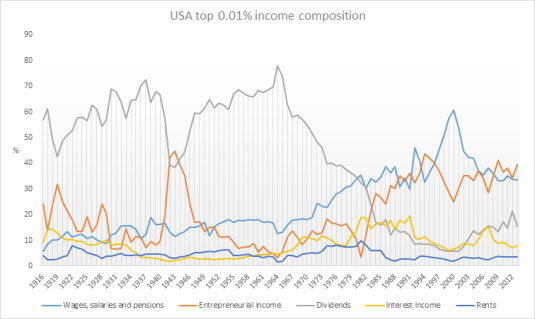

In the good old days of high taxes, the top 0.01% did earn the great majority of their income from passive investment.

Only under the scourge of neoliberalism starting in the 1970s and then massive tax cuts in the Reagan Revolution did the top 0.01% join the working rich. Even the super super-rich have to work for their money these days.

Source: The World Top Incomes Database.

The IMF and before it the OECD were batting from a weak position when they argued that human capital investments of ordinary families is held up by inequality. Student loans to pay for subsidised tuition fees and living expenses solve that problem long ago.

How many of the richest Americans inherited their fortune? Find out. buff.ly/1DNM3g2 http://t.co/QlarE5yAdT—

HumanProgress.org (@humanprogress) August 14, 2015

It was simply wrong of the IMF to claim that the top 5%, 1% and 0.1% of for example the USA are living off the rest of society. In the USA, is usually put forward as the worst-case, the rich and super-rich are working rich making their fortunes by building and running businesses. In The Evolution of Top Incomes: A Historical and International Perspective (NBER Working Paper No. 11955), Thomas Piketty and Emmanuel Saez concluded that:

While top income shares have remained fairly stable in Continental European countries or Japan over the past three decades, they have increased enormously in the United States and other English speaking countries. This rise in top income shares is not due to the revival of top capital incomes, but rather to the very large increases in top wages (especially top executive compensation). As a consequence, top executives (the “working rich”) have replaced top capital owners at the top of the income hierarchy over the course of the twentieth century…

Steven Kaplan and Joshua Rauh make a number of basic points backed up by detailed evidence about top CEO pay:

- While top CEO pay has increased, so has the pay of private company executives and hedge fund and private equity investors;

- ICT advances increase the pay of many – of professional athletes (technology increases their marginal product by allowing them to reach more consumers), Wall Street investors (technology allows them to acquire information and trade large amounts more easily), CEOs and technology entrepreneurs in the Forbes 400; and

- Technology allows top executives and financiers to manage larger organizations and asset pools – a loosening of social norms and a lack of independent control of CEO pacesetting does not explain similar increases in pay for private companies– technology explains it.

The report SuperEntrepreneurs shows that:

- SuperEntrepreneurs founded half the largest new firms created since the end of the Second World War

- There is a strong correlation between high rates of SuperEntrepreneurship in a country and low tax rates

- a low regulatory burden and high rates of philanthropy both correlate strongly with high rates of SuperEntrepreneurship

- Active government and supranational programmes to encourage entrepreneurship – such as the EU’s Lisbon Strategy – have largely failed.

- Yet governments can encourage entrepreneurialism by lowering taxes (particularly capital gains taxes which have a particularly high impact on entrepreneurialism while raising relatively insignificant revenues); by reducing regulations; and by vigorously enforcing property rights.

- High rates of self-employment and innovative entrepreneurship are both important for the economy.

- Yet policy makers should recognise that they are not synonymous and should not assume policies which encourage self-employment necessarily promote entrepreneurship.

John Rawls is often put forward by political progressives as the starting point for political philosophy. Rawls pointed out that behind the veil of ignorance, people will agree to inequality as long as it is to everyone’s advantage. Rawls was attuned to the importance of incentives in a just and prosperous society. If unequal incomes are allowed, this might turn out to be to the advantage of everyone.

Steven Kaplan and Joshua Rauh’s “It’s the Market: The Broad-Based Rise in the Return to Top Talent”, Journal of Economic Perspectives (2013) found that:

- Rising inequality is due to technical changes that allow highly talented individuals or “superstars” to manage or perform on a much larger scale.

- These superstars can now apply their talents to greater pools of resources and reach larger numbers of people and markets at home and abroad. They thus became more productive, and higher paid.

- Those in the Forbes 400 richest are less likely to have inherited their wealth or have grown up wealthy.

- Today’s rich are working rich who accessed education in their youth and then applied their natural talents and acquired skills to the most scalable industries such as ICT, finance, entertainment, sport and mass retailing.

- The U.S. evidence on income and wealth shares for the top 1% is most consistent with a “superstar” explanation. This evidence is less consistent with the gains in earnings of the top 1% coming from greater managerial power over the determination of their own pay in the corporate world, or changes in social norms about what managers could earn.

Today’s super-rich are highly productive because they produce new and better products and services that people want and are willing to pay for. These rewards for entrepreneurship and hard work guide people of different talents and skills into the occupations and industries where their talents are valued the most. The efficient allocation of talent and income maximising occupational choices were important to Rawls’ framework.

The IMF and World Bank should look for policies that remove barriers to riches. Instead, the IMF and OECD are giving support to those who want to tax and regulate the super-rich that drive much of the innovation, entrepreneurship and creative destruction in modern economies.

Creative destruction in start-ups

29 Sep 2015 Leave a comment

in economic history, economics, industrial organisation, survivor principle Tags: business demographics, creative destruction, entrepreneurial alertness, start-ups

More than half of start-ups fail within the first five years. Read more bit.ly/1DtN24o http://t.co/D4VMffLYIF—

OECD Statistics (@OECD_Stat) September 27, 2015

Recent Comments