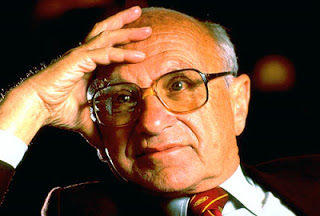

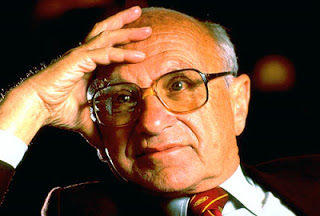

I think the euro is in its honeymoon phase. I hope it succeeds, but I have very low expectations for it.

I think that differences are going to accumulate among the various countries and that non-synchronous shocks are going to affect them. Right now, Ireland is a very different state; it needs a very different monetary policy from that of Spain or Italy.

You know, the various countries in the euro are not a natural currency trading group. They are not a currency area. There is very little mobility of people among the countries.

They have extensive controls and regulations and rules, and so they need some kind of an adjustment mechanism to adjust to asynchronous shocks—and the floating exchange rate gave them one. They have no mechanism now.

If we look back at recent history, they’ve tried in the past to have rigid exchange rates, and each time it has broken down. 1992, 1993, you had the crises. Before that, Europe had the snake, and then it broke down into something else.

So the verdict isn’t in on the euro. It’s only a year old. Give it time to develop its troubles (2000)

AND

The drive for the Euro has been motivated by politics not economics.

The aim has been to link Germany and France so closely as to make a future European war impossible, and to set the stage for a federal United States of Europe.

I believe that adoption of the Euro would have the opposite effect.

It would exacerbate political tensions by converting divergent shocks that could have been readily accommodated by exchange rate changes into divisive political issues.

Recent Comments