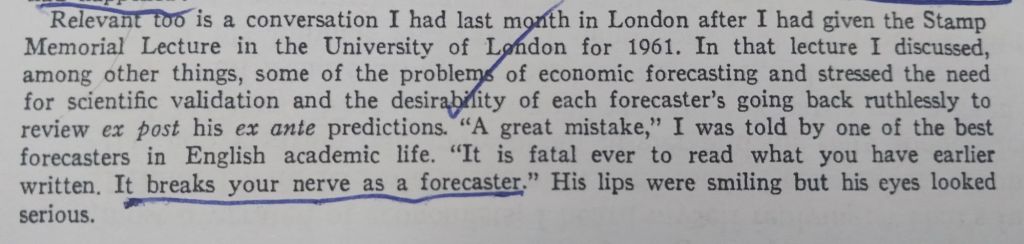

Samuelson on forecasting as a vocation

23 Sep 2025 Leave a comment

in budget deficits, business cycles, economic growth, fiscal policy, human capital, labour economics, macroeconomics, occupational choice Tags: forecasting errors

Partisan Bias in Professional Macroeconomic Forecasts

27 Jul 2025 Leave a comment

in business cycles, economic growth, macroeconomics, politics - USA Tags: forecasting errors

Here is a recent paper by Benjamin S. Kay, Aeimit Lakdawala, and Jane Ryngaert: Using a novel dataset linking professional forecasters in the Wall Street Journal Economic Forecasting Survey to their political affiliations, we document a partisan bias in GDP growth forecasts. Republican-affiliated forecasters project 0.3-0.4 percentage points higher growth when Republicans hold the presidency, […]

Partisan Bias in Professional Macroeconomic Forecasts

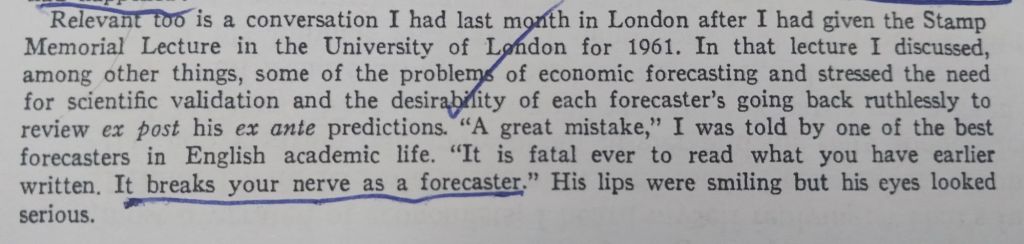

@ProfSteveKeen 15(?) years of erroneous forecasts of an Oz recession. 1st home grants warded off Minsky recession for 10 years!

19 Jul 2019 4 Comments

in business cycles, economic growth, economic history, economics of bureaucracy, global financial crisis (GFC), great recession, macroeconomics, monetary economics, politics - Australia, politics - New Zealand, Public Choice Tags: forecasting errors, Post-Keynesian macroeconomics

The unreliable nature of forecasting

05 Jan 2016 Leave a comment

in macroeconomics Tags: forecasting errors

Milton Friedman and Paul Krugman as inflation forecasters

03 Nov 2015 Leave a comment

in economic history, macroeconomics, monetarism, monetary economics Tags: forecasting errors, Paul Krugman, public intellectuals

Forecasting is not getting any easier

28 Aug 2015 Leave a comment

in business cycles, financial economics, macroeconomics, monetary economics Tags: forecasting errors, monetary policy, The fatal conceit, The pretence to knowledge

Economists: They refuse to accept low interest rates! http://t.co/WyTlm6L1KS—

Tim Fernholz (@TimFernholz) August 18, 2015

Central bank forecasting is a tough business

11 Aug 2015 Leave a comment

in macroeconomics Tags: forecasting errors

but hey don't worry about Sweden. #Riksbank has it all under control. http://t.co/NWdZfvUpaG—

Aurelija Augulyte (@auaurelija) June 12, 2015

Mises and Hayek on the great depression

02 Aug 2015 Leave a comment

in business cycles, F.A. Hayek, great depression, Ludwig von Mises, macroeconomics Tags: Austrian business cycle theory, forecasting errors

The exchange rate “needs” to come down?

01 Aug 2015 Leave a comment

in inflation targeting, macroeconomics, monetary economics, politics - New Zealand Tags: central banking, forecasting errors, The fatal conceit, The pretence to knowledge

Anyone who had a good idea about what the the New Zealand dollar should be would be trading on their own account. These super-rich would not be wasting their time giving advice to others. Their time would be too handsomely rewarded for such meagre returns as pontificating to others as to what they should do with their portfolios.

https://twitter.com/JimRose69872629/status/626597273007296514

One of my delights as a bureaucrat was at a meeting between the Reserve Bank of New Zealand and the International Monetary Fund some 15 years or so ago

The Fund asked whether Bank whether it thought the exchange rate was too high, and what their exchange-rate modelling say about this?

- The reply of the Deputy Governor of the Reserve Bank of New Zealand was we don’t have exchange rate model because we don’t think there are any good. Gone are those days.

- The International Monetary Fund team was quite flabbergasted by this response.

At one stage the Fund team tried to draw me into the conversation about the level of New Zealand dollar because I was there representing the New Zealand Treasury. I was only attended as an observer, so naturally my response to their questions was to waffle incoherently. I could have been blunter and simply said the Reserve Bank of New Zealand spoke for New Zealand in this matter, but that would have been impolite.

I’ve been continuing to reflect on Graeme Wheeler’s repeated observation that New Zealand’s exchange rate “needs” to come down. I’m still not entirely sure what he means. The exchange rate is an asset price and presumably should reflect all expected future relevant information, not just spot information about current dairy prices. And the market has no particular reason to focus on stabilising the net international investment position at around current levels. Indeed, although it is a convenient reference point, neither does the Reserve Bank.

“Need” or not, I’d have thought it was likely that the exchange rate would fall further.

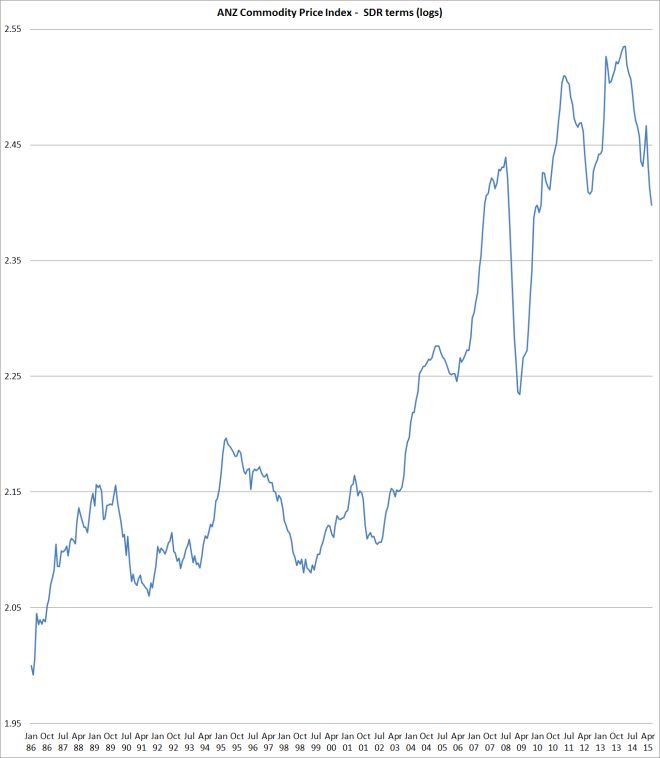

The ANZ Commodity Price Index, which lags behind (for example) falling GDT and futures dairy prices, has already had one of the larger falls in the history of the series.

Meanwhile, the fall in the exchange rate, while material, remains pretty small by the standards of past New Zealand adjustments…

View original post 165 more words

@ReserveBankofNZ will never be any good at forecasting

30 Jul 2015 Leave a comment

in economics of information, entrepreneurship, financial economics, macroeconomics, monetary economics, politics - New Zealand Tags: entrepreneurial alertness, forecasting errors, The pretence to knowledge

.@ReserveBankofNZ MPS inflation forecasts vs. actual. Via @jamespeshaw: http://t.co/TjPvcoVsbI—

Jayne Ihaka (@Jayniehaka) July 29, 2015

A severe commentary

29 Jul 2015 Leave a comment

in macroeconomics, politics - New Zealand Tags: central banks, forecasting errors, monetary policy, The pretence to knowledge

I don’t place much weight on criticisms of forecasting errors. If someone is any good at forecasting the economy, they would be fabulously rich through trading on their own account rather than working in a central bank.

The fact that Reserve Banks can’t forecast with any greater accuracy than anybody else is a bit of an indictment considering they have inside knowledge of the future course of monetary policy.

By the way, I wrote my masters sub thesis on official forecasting errors.

Plenty of commentaries have remarked on the very low inflation numbers out this morning.

None (that I have seen) has highlighted what a severe commentary these numbers are on the Reserve Bank’s conduct of monetary policy over the last few years.

Reciting the history in numbers gets a little repetitive, but:

• December 2009 was the last time the sectoral factor model measure of core inflation was at or above the target midpoint (2 per cent)

• Annual non-tradables inflation has been lower than at present only briefly, in 2001, when the inflation target itself was 0.5 percentage points lower than it is now.

• Non-tradables inflation is only as high as it is because of the large contribution being made by tobacco tax increases (which aren’t “inflation” in any meaningful sense).

• Even with the rebound in petrol prices, CPI inflation ex tobacco was -0.1 over the last year…

View original post 1,600 more words

World’s top climate scientists confess: Global warming just 1/4 what we thought – and computers got the effects of greenhouse gases wrong

18 Jul 2015 Leave a comment

in environmental economics, global warming Tags: climate alarmism, forecasting errors, global warming

Oil forecasting is hard

05 Jul 2015 Leave a comment

in energy economics, macroeconomics Tags: forecasting errors, Oil prices, peak oil

Oil forecasting is hard, EIA edition bloombergview.com/articles/2015-… http://t.co/J2mvpKYrsc—

Justin Fox (@foxjust) April 16, 2015

Recent Comments