By Tarnell Brown. At EconLog.”The Roman Empire was in trouble. During the fifty-plus years known as the Crisis of the Third Century (235-284 AD), the throne of Rome changed some 26 times, with the Roman Army engaging in a steady diet of crowning and removing claimants to the throne. These autocrats, known as “barracks emperors,”…

Diocletian, the Roman Empire, and Forever Failing Price Controls

Diocletian, the Roman Empire, and Forever Failing Price Controls

08 Aug 2025 1 Comment

in applied price theory, economic history, economics of regulation, history of economic thought Tags: price controls, Roman empire

Econ 101 is Underrated: Pharma Price Controls

22 May 2025 Leave a comment

in applied price theory, development economics, economics of regulation, entrepreneurship, health economics, law and economics, politics - USA, property rights Tags: 2024 presidential election, patents and copyrights, price controls, price discrimination

Econ 101 is often dismissed as too simplistic. Yet recent events suggest that Econ 101 is underrated. Take the tariff debate: understanding that a tariff is a tax, that prices represent opportunity costs, that a bilateral trade deficit is largely meaningless, that a so-called trade “deficit” is equally a goods surplus or an investment surplus—these […]

Econ 101 is Underrated: Pharma Price Controls

Supply is elastic, installment #6437

14 May 2025 Leave a comment

in applied price theory, entrepreneurship, health economics, industrial organisation, politics - USA, Public Choice, rentseeking Tags: price controls

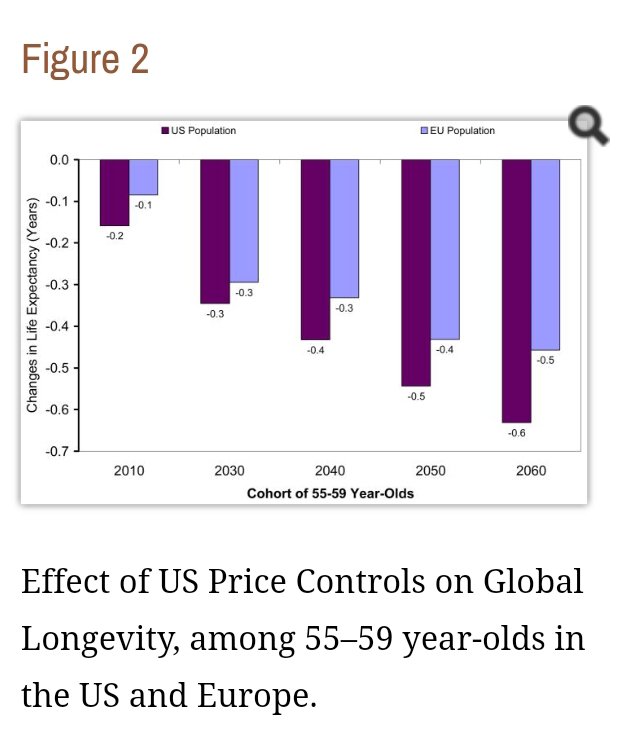

Numerous empirical studies show a relationship between a drug’s expected market size and the magnitude of research and development investments. Early studies focused on changes to market size resulting from the demographics of disease burden (Acemoglu and Linn 2004) and policy changes influencing market demand (Finkelstein 2004). These findings have largely been confirmed by more […]

Supply is elastic, installment #6437

Price controls destroy wealth: California Fire Insurance

11 Jan 2025 Leave a comment

in economics of natural disasters, economics of regulation, environmentalism, financial economics, income redistribution, law and economics, politics - USA, property rights, Public Choice, regulation, rentseeking, urban economics Tags: price controls

Noah Smith via Marginal Revolution, and Kim Mai Cutler. The CA insurance regulator is elected, and is reluctant to allow higher rates for fire insurance, despite the big risks, lest she be voted out of office. As a consequence, expected profits are low, so a majority of top insurers have stopped issuing fire insurance in CA.…

Price controls destroy wealth: California Fire Insurance

Price Controls Reflect Utter Economic Insanity

25 Aug 2024 Leave a comment

in applied price theory, economics of regulation, entrepreneurship, history of economic thought, industrial organisation, liberalism, Marxist economics, politics - USA Tags: 2024 presidential election, price controls, regressive left, rent control

TweetIn the print edition of tomorrow’s (Friday’s) Wall Street Journal, Richard McKenzie and I explain some of the many unintended ill-consequences of the price controls proposed by Kamala Harris. A slice: Price-control proponents often justify their position by claiming that grocery stores are monopolies. They point to a fantasy economic theory that purports to show how…

Price Controls Reflect Utter Economic Insanity

Kamala Harris, Price Controls, and the Contest for the Dumbest Policy Proposal of 2024

17 Aug 2024 Leave a comment

in applied price theory, comparative institutional analysis, economic history, economics of bureaucracy, economics of regulation, energy economics, health economics, history of economic thought, income redistribution, industrial organisation, international economics, liberalism, Marxist economics, politics - USA, Public Choice, rentseeking Tags: 2024 presidential election, price controls, tariffs

As a Senator, Kamala Harris embraced all sorts of terrible ideas, such as the Green New Deal and Medicare for All. But she’s now disavowed those proposals in an attempt to make herself seem more reasonable. Trump, by contrast, is consistent. For better or worse, he’s pushing in 2024 the same agenda that he ran […]

Kamala Harris, Price Controls, and the Contest for the Dumbest Policy Proposal of 2024

On price control

25 Feb 2024 Leave a comment

in applied price theory, comparative institutional analysis, economic history, economics of bureaucracy, energy economics, environmental economics, global warming, income redistribution, industrial organisation, Public Choice, rentseeking Tags: price controls, The fatal conceit, unintended consequences, utility regulation

Create a Black Market the Easy Way!

20 May 2022 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economic history, economics of natural disasters, economics of regulation Tags: offsetting behaviour, price controls, The fatal conceit, unintended consequences

Richard Epstein, “A History of Public Utility Regulation in the Supreme Court”

09 Mar 2020 Leave a comment

in economics of bureaucracy, economics of regulation, energy economics, entrepreneurship, environmental economics, financial economics, income redistribution, industrial organisation, law and economics, property rights, Public Choice, rentseeking, Richard Epstein, survivor principle Tags: competition law, network economics, price controls

@nzlabour’s cunning plan to reduce power prices

03 Oct 2019 Leave a comment

in economics of regulation, energy economics, politics - New Zealand Tags: price controls

The dead will be many from @SenSanders @AOC’s virtue signalling on drug price controls (effects of 22% manufacturing price cut)

16 Feb 2019 Leave a comment

in applied price theory, applied welfare economics, health economics, politics - USA Tags: drug lags, price controls, The fatal conceit

Price Floors: The Minimum Wage

17 Jun 2017 Leave a comment

in applied price theory, applied welfare economics, economics of regulation, labour economics, minimum wage Tags: price controls

How will @nzlabour @NZGreens ration their 100,000 affordable homes?

27 Aug 2016 Leave a comment

in applied price theory, politics - New Zealand, urban economics Tags: affordable housing, housing affordability, land supply, New Zealand Greens, New Zealand Labour Party, price controls

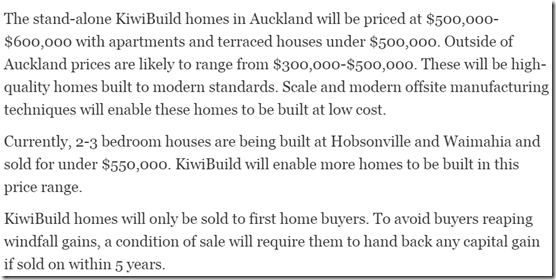

The Labour Party (and Greens) both plan to build 100,000 affordable homes and sell them within a specific price range. In Auckland, where houses cost in excess of $800,000 on average, they hope to enter the market at the $550,000 point with still quite reasonable housing.

What I ask you is how will Labour and the Greens make sure the affordable houses both are proposing are not snapped up by well-to-do buyers rather than families currently locked out of the market? What will the rationing mechanism be?

Source: KiwiBuild – New Zealand Labour Party.

How will Labour and the Greens ration these desirable houses given that they are priced well below the competition? If two buyers both offer $550,000 for the house, which bid will be accepted?

If the next best available house in Auckland is worth more than that because it is not sold by the proposed Housing Affordability Authority, the first bid for these houses will be $550,000 which is the maximum the government under a Labour Party is willing to accept? What happens then?

It is basic economics that if you price at less than the market clearing rate which in Auckland is somewhere near $800,000, people will queue to buy what you have unless you raise the price. The exercise of building 100,000 affordable houses makes no sense unless the purpose is to undercut what the market currently supplies.

As the houses are to be sold by a government agency, there can be no black market nor dilution of quality to even up supply with demand. How will a deadlock in price bids be resolved if the maximum bid for an affordable house starts at $550,000?

Labour acknowledges the possibility of flipping by restricting resale for 5 years. But what stops investors just waiting 5 years as there is any significant price gap between these affordable houses and the private market alternatives.

What stops more affluent buyers living in these houses because they so much cheaper than the competing options in Auckland? If you miss out in bidding on one affordable home, do you go back to the end of the queue for the next that is built or get some priority?

Why Do Governments Enact Price Controls?

03 Jul 2016 Leave a comment

in applied price theory, economics of regulation, law and economics, property rights Tags: price controls

Percentage of fixed and floating mortgages in New Zealand

16 Mar 2016 Leave a comment

in economics of regulation, industrial organisation, monetary economics, politics - New Zealand Tags: antimarket bias, mortgage interest rates, New Zealand Greens, New Zealand Labour Party, price controls, rational irrationality

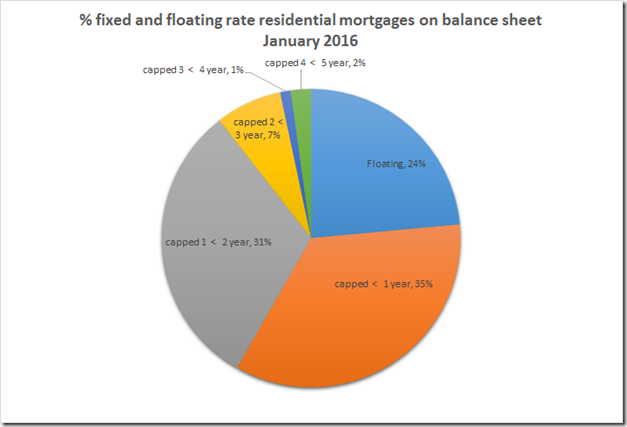

I did not know so many people were on a fixed rate mortgage. Labour is risking its economic credibility on regulating the rates for a minority of mortgages.

Source: S8 Banks: Mortgage lending ($m) – Reserve Bank of New Zealand.

Capped mortgages cannot be linked to the current official cash rate of the Reserve Bank of New Zealand because they are based on expected future interest rates over an up to 5 year span, not current interest rates.

An important motivation for going onto a floating rate is you can repay faster. Fixed rate mortgages have penalties for early repayment.

Source: Price Controls: Price Floors and Ceilings, Illustrated.

In consequence, price controls linking floating rate mortgages to the official cash rate of the Reserve Bank would benefit better off mortgagees expecting to repay quickly. A typical policy of the modern Labour Party.

Recent Comments