Surprisingly few billionaires in any of the 4 countries obtained their wealth through political connections. Founding a company seems to be still the path of great wealth even in Japan these days. Hong Kong is a financial centre so the large number of billionaires in its financial sector is no surprise.

Chinese, Hong Kong, Taiwanese and Japanese billionaires by source of wealth

24 Feb 2016 Leave a comment

in development economics, economic history, entrepreneurship, financial economics, growth miracles, industrial organisation, rentseeking, survivor principle Tags: billionaires, China, entrepreneurial alertness, Hong Kong, Japan, superstar wages, superstars, Taiwan

Percentage of billionaires who inherited their wealth

14 Feb 2016 Leave a comment

in applied welfare economics, entrepreneurship, labour economics, poverty and inequality Tags: entrepreneurial alertness, inherited wealth, superstar wages, superstars, top 1%

China has been capitalist for long enough for a billionaire to actually inherit his wealth.

Did the rich get richer under Rogernomics? New Zealand top income shares since 1921

09 Jan 2016 Leave a comment

in applied welfare economics, economic history, human capital, labour economics, politics - New Zealand, poverty and inequality Tags: Leftover Left, superstar wages, superstars, top incomes

Apart from a bump in the late 80s, the top income earners in New Zealand really are not doing much better than they were in the 1950s or 1920s. The rich are not getting richer in New Zealand. They are just holding their own.

Source: The World Wealth and Income Database.

The rise of the Canadian working rich – composition of top 1% incomes since 1946

08 Jan 2016 Leave a comment

in applied welfare economics, economic history, human capital, labour economics, poverty and inequality Tags: Canada, superstar wages, superstars, top 1%, working rich

Source: The World Wealth and Income Database.

The rise of the working rich in Australia – top income compositions since 1954

08 Jan 2016 Leave a comment

in economic history, human capital, labour economics, politics - Australia, poverty and inequality Tags: Australia, superstar wages, superstars, top incomes, working rich

Over the course of the post-war period top incomes in Australia turned into top wage earners. It is unfortunate that information is not available on the extent to which business incomes make up the balance of top incomes as distinct from dividend incomes.

Source: The World Wealth and Income Database.

The gender gap among the top 1%

19 Dec 2015 Leave a comment

in discrimination, gender, human capital, labour economics, occupational choice Tags: gender wage gap, superstar wages, superstars, top 1%

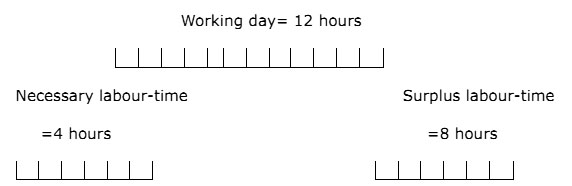

Are CEOs denied their labour surplus?

11 Dec 2015 Leave a comment

in applied price theory, entrepreneurship, fisheries economics, human capital, industrial organisation, labour economics, labour supply, managerial economics, occupational choice, organisational economics, personnel economics, survivor principle Tags: CEO pay, moral hazard, promotion tournaments, superstar, superstar wages

Bang Dang Nguyen and Kasper Meisner Nielsen looked at how share prices reacted to 149 cases of the chief executive or another prominent manager dying suddenly in American companies between 1991 and 2008.

If the shares rise on an executive’s death, he was overpaid; if they fall, he was not. Only 42% of the bosses studied were overpaid. Those with the bigger pay packages gave the best value for money as measured by the share-price slump when they passed away unexpectedly.

Share prices do speak to the value of the company and the contribution of its CEO. The share price of Apple went up and down by billions on the back of rumours about the health of Steve Jobs.

In terms of splitting of what some call the labour surplus increase from a firm hiring an executive, these employees retain on average about 71% and their employer keeps 29%. Others call this rent sharing.

71% going to the CEO might initially sound high, “but it’s not like he’s taking home more than he produced for the company,” says Nguyen.

The exploitation of CEOs gets worse when you consider the extensive use of promotion tournaments by their employers when setting their wages. They are thrust into rat races. Promotion tournaments are an integral and often invisible part of their workplaces.

Executive level employees are often ranked by their employers relative to each other and promoted not for being good at their jobs but for being better than their rivals. These promotion tournaments sent one employee against another – one worker against another – to the profit of the owners of the firm.

The rat race set up by the owners of the firm are so cutthroat that in competitions to determine promotions the capitalists who own the firm may find that their employees discover that the most efficient way of winning a promotion is by sabotaging the efforts of their rivals.

Lazear and Rozen’s tournament theory of executive pay has stood the test of time. The key to this rat race is the larger is your boss’s pay, the bigger the motivation for you as an underling to work for a promotion. As Lazear wrote in his book, Personnel Economics for Managers

The salary of the vice president acts not so much as motivation for the vice president as it does as motivation for the assistant vice presidents.

What does @Walmart do wrong but @APPLEOFFIClAL does right?

16 Nov 2015 Leave a comment

in applied price theory, applied welfare economics, entrepreneurship, industrial organisation, politics - USA Tags: Apple, creative destruction, entrepreneurial alertness, Left-wing hypocrisy, Leftover Left, superstar wages, superstars, top 1%, Twitter left, Walmart

How much do the top sports stars earn?

28 Oct 2015 Leave a comment

in sports economics Tags: superstar wages, superstars

Some athletes make more money endorsing products than on the field: dadaviz.com/i/3810 #datastories #dataviz https://t.co/WI8QBVtgFq—

DataStories (@LindaRegber) October 26, 2015

More evidence on the emergence of the working rich

25 Oct 2015 Leave a comment

in applied price theory, applied welfare economics, economics of education, entrepreneurship, human capital, labour economics, labour supply, Marxist economics, occupational choice Tags: College premium, creative destruction, education premium, entrepreneurial alertness, graduate premium, Leftover Left, superstar wages, superstars, top 1%

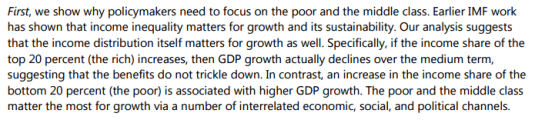

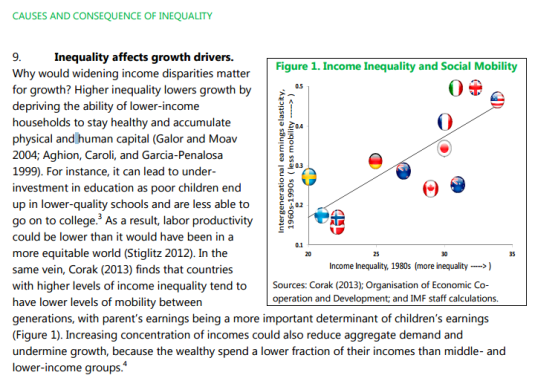

The IMF’s Causes and Consequences of Income Inequality: A Global Perspective

02 Oct 2015 2 Comments

in entrepreneurship, human capital, industrial organisation, labour supply, occupational choice, politics - USA, poverty and inequality Tags: entrepreneurial alertness, superstar wages, superstars, top 0.01%, top 0.1%, top 1%, working rich

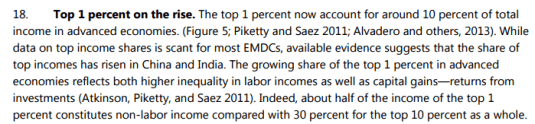

The IMF has joined the OECD in arguing there is an important connection between inequality and who gains from economic growth.

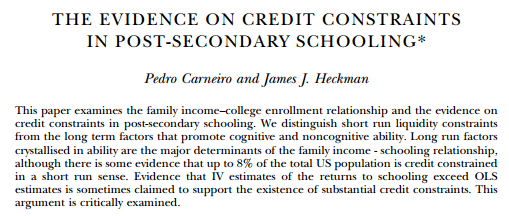

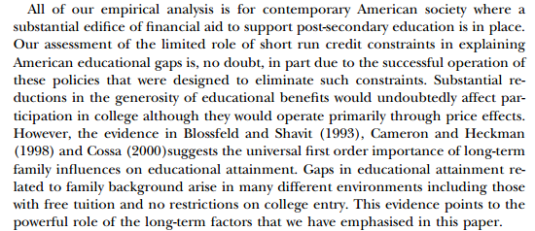

To reach the conclusion that the income distribution matters, the IMF had to tie its master the exact same weak moorings that the OECD did. Specifically the ability of the lower middle class to finance investments in school and higher education.

The IMF has articulated a specific hypothesis that can be confronted with facts and logic.

Many critics of inequality are extremely vague about what exactly is the process that grinds the proletariat down. The withering away of the proletariat in the 20th century has been discussed elsewhere on this blog.

The impact of low income on the ability to accumulate physical and human capital sounds like an interesting question. Not surprisingly, the top labour economists have looked into it.

Short-term factors such as the ability to borrow to fund higher education has been found to be seriously wanting. Only a small percentage of people are in any way constrained from going on to higher education because of the lack of money. This is not surprising in any society with student loans freely available at low or zero rates without any need to post collateral.

Wow. I mean, WOW. College completion figures over time by income quartile. bit.ly/16Bb1jh http://t.co/y0MVyiDCEZ—

Richard V. Reeves (@RichardvReeves) February 04, 2015

The notion that the rich are just replicating the good fortunes of their parents has also fallen on hard times despite the persistence of the OECD and the IMF in championing this old Marxist fantasy.

Source: The World Top Incomes Database.

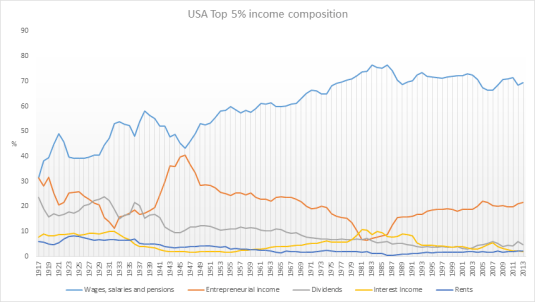

If you look at the income composition of the top 5% of the USA, for example, it is a disappointing story for the IMF and the OECD. Today’s rich are working rich with the majority of their income from wages and salaries and much of the rest from entrepreneurial income. There is no passive rich earning incomes from their inherited investments and grinding the proletariat down.

Source: The World Top Incomes Database.

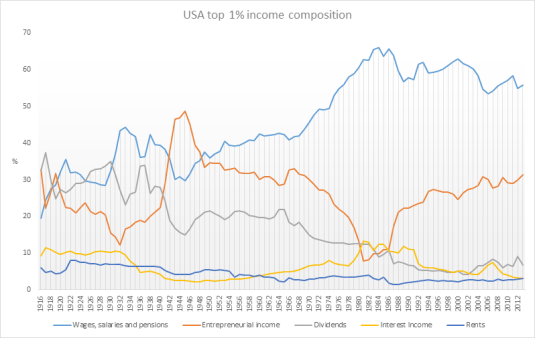

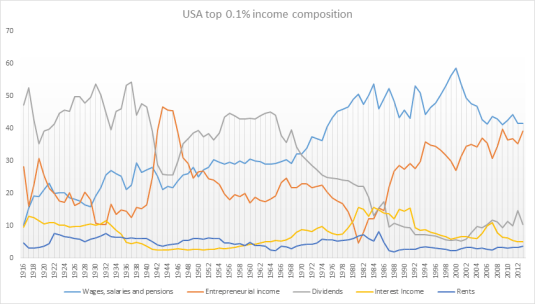

It is the same story with the top 1%. They are working rich with the majority of their incomes paid in wages and salaries and running a business. They are top executives, managers and leading professionals that go to work every day.

Who are today’s supermanagers and why are they so wealthy? equitablegrowth.org/research/today… http://t.co/Ts2OkOUk5g—

Equitable Growth (@equitablegrowth) December 03, 2014

The IMF was simply wrong to claim that at least half the income of the top 1% in the USA was not labour income.

Before 1940, most of the income of the top 0.1% of income earners in the USA was income from investments. By the end of the 20th century, the top 0.1% were earning their incomes as wages and salaries, business incomes and capital gains. Very little of that income of the top 0.1% was in the form of passive income from capital. The top 0.1% of the USA are now working rich – entrepreneurs.

Source: The World Top Incomes Database.

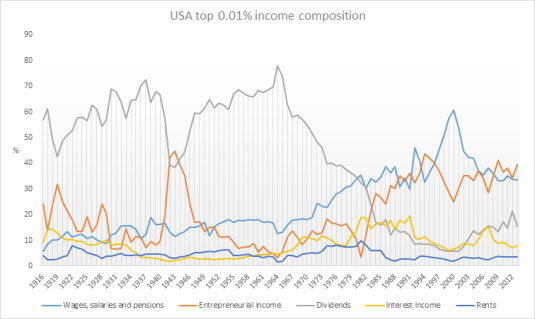

In the good old days of high taxes, the top 0.01% did earn the great majority of their income from passive investment.

Only under the scourge of neoliberalism starting in the 1970s and then massive tax cuts in the Reagan Revolution did the top 0.01% join the working rich. Even the super super-rich have to work for their money these days.

Source: The World Top Incomes Database.

The IMF and before it the OECD were batting from a weak position when they argued that human capital investments of ordinary families is held up by inequality. Student loans to pay for subsidised tuition fees and living expenses solve that problem long ago.

How many of the richest Americans inherited their fortune? Find out. buff.ly/1DNM3g2 http://t.co/QlarE5yAdT—

HumanProgress.org (@humanprogress) August 14, 2015

It was simply wrong of the IMF to claim that the top 5%, 1% and 0.1% of for example the USA are living off the rest of society. In the USA, is usually put forward as the worst-case, the rich and super-rich are working rich making their fortunes by building and running businesses. In The Evolution of Top Incomes: A Historical and International Perspective (NBER Working Paper No. 11955), Thomas Piketty and Emmanuel Saez concluded that:

While top income shares have remained fairly stable in Continental European countries or Japan over the past three decades, they have increased enormously in the United States and other English speaking countries. This rise in top income shares is not due to the revival of top capital incomes, but rather to the very large increases in top wages (especially top executive compensation). As a consequence, top executives (the “working rich”) have replaced top capital owners at the top of the income hierarchy over the course of the twentieth century…

Steven Kaplan and Joshua Rauh make a number of basic points backed up by detailed evidence about top CEO pay:

- While top CEO pay has increased, so has the pay of private company executives and hedge fund and private equity investors;

- ICT advances increase the pay of many – of professional athletes (technology increases their marginal product by allowing them to reach more consumers), Wall Street investors (technology allows them to acquire information and trade large amounts more easily), CEOs and technology entrepreneurs in the Forbes 400; and

- Technology allows top executives and financiers to manage larger organizations and asset pools – a loosening of social norms and a lack of independent control of CEO pacesetting does not explain similar increases in pay for private companies– technology explains it.

The report SuperEntrepreneurs shows that:

- SuperEntrepreneurs founded half the largest new firms created since the end of the Second World War

- There is a strong correlation between high rates of SuperEntrepreneurship in a country and low tax rates

- a low regulatory burden and high rates of philanthropy both correlate strongly with high rates of SuperEntrepreneurship

- Active government and supranational programmes to encourage entrepreneurship – such as the EU’s Lisbon Strategy – have largely failed.

- Yet governments can encourage entrepreneurialism by lowering taxes (particularly capital gains taxes which have a particularly high impact on entrepreneurialism while raising relatively insignificant revenues); by reducing regulations; and by vigorously enforcing property rights.

- High rates of self-employment and innovative entrepreneurship are both important for the economy.

- Yet policy makers should recognise that they are not synonymous and should not assume policies which encourage self-employment necessarily promote entrepreneurship.

John Rawls is often put forward by political progressives as the starting point for political philosophy. Rawls pointed out that behind the veil of ignorance, people will agree to inequality as long as it is to everyone’s advantage. Rawls was attuned to the importance of incentives in a just and prosperous society. If unequal incomes are allowed, this might turn out to be to the advantage of everyone.

Steven Kaplan and Joshua Rauh’s “It’s the Market: The Broad-Based Rise in the Return to Top Talent”, Journal of Economic Perspectives (2013) found that:

- Rising inequality is due to technical changes that allow highly talented individuals or “superstars” to manage or perform on a much larger scale.

- These superstars can now apply their talents to greater pools of resources and reach larger numbers of people and markets at home and abroad. They thus became more productive, and higher paid.

- Those in the Forbes 400 richest are less likely to have inherited their wealth or have grown up wealthy.

- Today’s rich are working rich who accessed education in their youth and then applied their natural talents and acquired skills to the most scalable industries such as ICT, finance, entertainment, sport and mass retailing.

- The U.S. evidence on income and wealth shares for the top 1% is most consistent with a “superstar” explanation. This evidence is less consistent with the gains in earnings of the top 1% coming from greater managerial power over the determination of their own pay in the corporate world, or changes in social norms about what managers could earn.

Today’s super-rich are highly productive because they produce new and better products and services that people want and are willing to pay for. These rewards for entrepreneurship and hard work guide people of different talents and skills into the occupations and industries where their talents are valued the most. The efficient allocation of talent and income maximising occupational choices were important to Rawls’ framework.

The IMF and World Bank should look for policies that remove barriers to riches. Instead, the IMF and OECD are giving support to those who want to tax and regulate the super-rich that drive much of the innovation, entrepreneurship and creative destruction in modern economies.

More evidence of mass kidnappings of #occupywallstreet activists

20 Aug 2015 Leave a comment

in applied price theory, human capital, income redistribution, labour economics, labour supply, politics - USA, poverty and inequality, Public Choice, rentseeking, sports economics Tags: expressive voting, Left-wing hypocrisy, Leftover Left, mass kidnappings, Occupy Wall Street, rational ignorance, rational irrationality, superstar wages, superstars, top 0.1%, top 1%

Ratio of Median Salary of Top 25 Highest Paid MLB Player to Avg. Worker Pay Increased from 100:1 to 700:1 Since 1988 http://t.co/5zLktBXS3D—

Mark J. Perry (@Mark_J_Perry) August 18, 2015

More on the rise and the rise of the working super rich

15 Aug 2015 Leave a comment

in applied price theory, applied welfare economics, economic history, entrepreneurship, industrial organisation, survivor principle Tags: antimarket bias, entrepreneurial alertness, superstar wages, superstars, top 0.1%, top 1%, top wage earners

How many of the richest Americans inherited their fortune? Find out. buff.ly/1DNM3g2 http://t.co/QlarE5yAdT—

HumanProgress.org (@humanprogress) August 14, 2015

The discovery process in student athlete wages

04 Aug 2015 Leave a comment

in economics of education, entrepreneurship, human capital, labour economics, labour supply, sports economics Tags: entrepreneurial alertness, on-the-job training, superstar wages, superstars

FiveThirtyEightSports has a great piece about how much college quarterbacks are really worth in terms of market value. I’m neutral-but-leaning-against on the issue of paying college athletes, but the piece begins with University of Iowa Athletic Director Gary Barta giving a very bad reason to oppose it: it’s too complicated to figure out how much they should be paid. He’s right given how he’s conceiving the issue, he’s just not conceiving the issue in the right way.

Wages are not determined by a person or group of people independently evaluating what a job is “really” worth. That’s what markets do, i.e. that’s what innumerable decisions over time by innumerable anonymous consumers operating within the price system do. The failure to understand how the price system works in allocating resources by preferences is not unique to Barta. Very few people understand it, and lamentably even people who do understand it often…

View original post 619 more words

Recent Comments