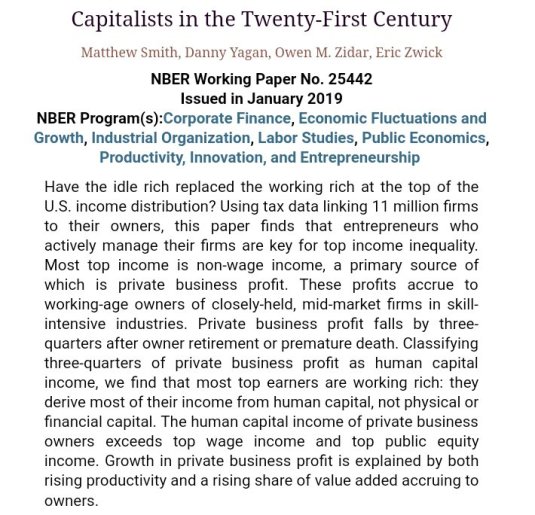

The toll of a capital gains tax on entrepreneurship and innovation is far greater than previously thought @TaxpayersUnion

15 Jan 2019 Leave a comment

in applied price theory, entrepreneurship, human capital, labour economics, occupational choice, politics - New Zealand, politics - USA, Public Choice, public economics, technological progress Tags: taxation and entrepreneurship, taxation and investment

Chad Jones is a trouble maker on top tax rates @paulkrugman

10 Jan 2019 Leave a comment

in applied price theory, economics of education, entrepreneurship, human capital, income redistribution, industrial organisation, labour economics, labour supply, law and economics, occupational choice, politics - USA, poverty and inequality, Public Choice, public economics Tags: creative destruction, superstars, taxation and entrepreneurship, taxation and investment, taxation and labour supply, top 1%

Chad Jones’ awkward remarks on top tax rates and innovation spillovers

09 Jan 2019 Leave a comment

in applied price theory, applied welfare economics, economic growth, economics of education, entrepreneurship, fiscal policy, human capital, income redistribution, industrial organisation, labour economics, labour supply, macroeconomics, occupational choice, politics - USA, poverty and inequality, Public Choice, public economics, rentseeking Tags: creative destruction, taxation and entrepreneurship, taxation and investment, taxation and labour supply, top 1%

Steven Landsburg Discusses Incentives and Taxes

05 Dec 2018 Leave a comment

in applied price theory, applied welfare economics, development economics, economic growth, economic history, entrepreneurship, fiscal policy, human capital, labour economics, labour supply, macroeconomics, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

Steven Landsburg: taxing capital

02 Dec 2018 Leave a comment

in applied price theory, applied welfare economics, economic growth, financial economics, fiscal policy, macroeconomics, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour

Finn Kydland on the Great Recession

27 Nov 2018 1 Comment

in budget deficits, business cycles, economic growth, fiscal policy, great recession, macroeconomics, public economics Tags: monetary policy, taxation and entrepreneurship, taxation and investment, taxation and labour supply

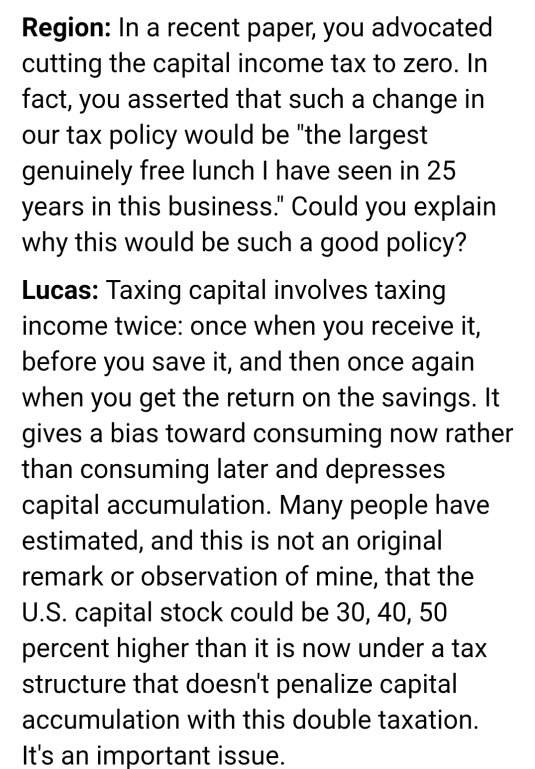

Speaking of capital gains taxes

02 Sep 2018 Leave a comment

in applied price theory, economic growth, macroeconomics, public economics, Robert E. Lucas Tags: capital gains tax, taxation and investment

“You’re all a bunch of socialists” Mises on Friedman

08 Aug 2018 Leave a comment

in applied price theory, applied welfare economics, Austrian economics, comparative institutional analysis, F.A. Hayek, income redistribution, Ludwig von Mises, Milton Friedman, Public Choice, public economics Tags: taxation and investment, taxation and labour supply

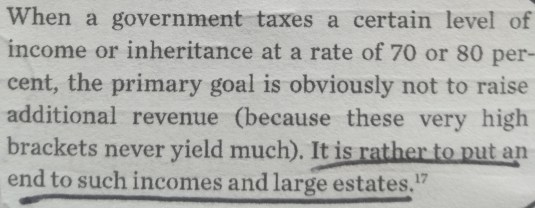

Piketty is a supply-side economists?

12 Jul 2018 Leave a comment

in applied price theory, entrepreneurship, human capital, labour economics, labour supply, occupational choice, poverty and inequality, public economics Tags: taxation and investment, taxation and labour supply, top 1%

Maximum Wages: An absolutely terrible idea

11 Jan 2017 Leave a comment

in applied price theory, fiscal policy, labour economics, labour supply, macroeconomics Tags: British politics, envy, maximum wage, taxation and investment, taxation and labour supply

Do the Rich Pay Their Fair Share?

13 Jul 2016 Leave a comment

in politics - USA, public economics Tags: envy, superstars, taxation and entrepreneurship, taxation and investment, top 1%, top 10%

The effects of cutting the Australian company tax by one percentage point

02 Jun 2016 Leave a comment

in applied price theory, politics - Australia, politics - New Zealand, public economics Tags: Australia, company tax, international tax competition, tax incidents, taxation and entrepreneurship, taxation and investment

#NeverTrump but why no #neverBernie, only #feelthebern?

28 May 2016 Leave a comment

in constitutional political economy, politics - USA Tags: 2016 presidential election, Leftover Left, reactionary left, taxation and entrepreneurship, taxation and investment, taxation and labour supply, Twitter left

Why have no Democrats formed the equivalent of #NeverTrump?

Bernie Sanders is not even a member of their party. Have they no principles?

Many of their republican opponents do in rejecting Trump and planning to vote for either Clinton or Gary Johnson.

Sanders is an old socialist throwback whose economic policies would plunge the American economy into a deep recession harming most of all those that Democrats claim to represent.

Sander’s mind is just as inflexible as that of Trump as is his unwillingness to learn from events.

Recent Comments