Dynamic scoring of the Trump tax cuts

25 Dec 2019 Leave a comment

in applied price theory, applied welfare economics, budget deficits, econometerics, economic growth, economics of education, entrepreneurship, fiscal policy, human capital, industrial organisation, labour economics, labour supply, macroeconomics, politics - USA, Public Choice, public economics Tags: 2020 presidential election, taxation and entrepreneurship, taxation and investment, taxation and labour supply, taxation and savings

Pocahontas is on the warpath against freeloading billionaires @SenWarren

24 Dec 2019 Leave a comment

in economic history, entrepreneurship, human capital, income redistribution, industrial organisation, labour economics, labour supply, Marxist economics, occupational choice, politics - USA, Public Choice, public economics, survivor principle Tags: 2020 presidential election, envy, taxation and entrepreneurship, taxation and investment, taxation and labour supply, top 1%

Why Tax Rates Matter More Than Taxes

18 Dec 2019 Leave a comment

in applied price theory, applied welfare economics, entrepreneurship, industrial organisation, labour economics, labour supply, politics - USA, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

Policy Briefs: John Cochrane on Why a Complicated Tax Code Leads to Negative Outcomes

17 Dec 2019 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, constitutional political economy, economic history, entrepreneurship, industrial organisation, labour economics, labour supply, politics - USA, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

Would a “Wealth Tax” Help Combat Inequality? A Debate with Saez, Summers, and Mankiw

20 Oct 2019 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economics of education, entrepreneurship, financial economics, human capital, income redistribution, industrial organisation, labour economics, labour supply, Marxist economics, occupational choice, politics - USA, poverty and inequality, Public Choice, public economics, rentseeking, survivor principle Tags: envy, superstar wages, superstars, taxation and entrepreneurship, taxation and investment, taxation and labour supply, top 1%, wealth taxes

Friedman Fundamentals: What We Learned About 70% Tax Rates 50 Years Ago

16 Jul 2019 Leave a comment

in applied price theory, economic history, economics of education, entrepreneurship, fiscal policy, human capital, income redistribution, labour economics, labour supply, occupational choice, poverty and inequality, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

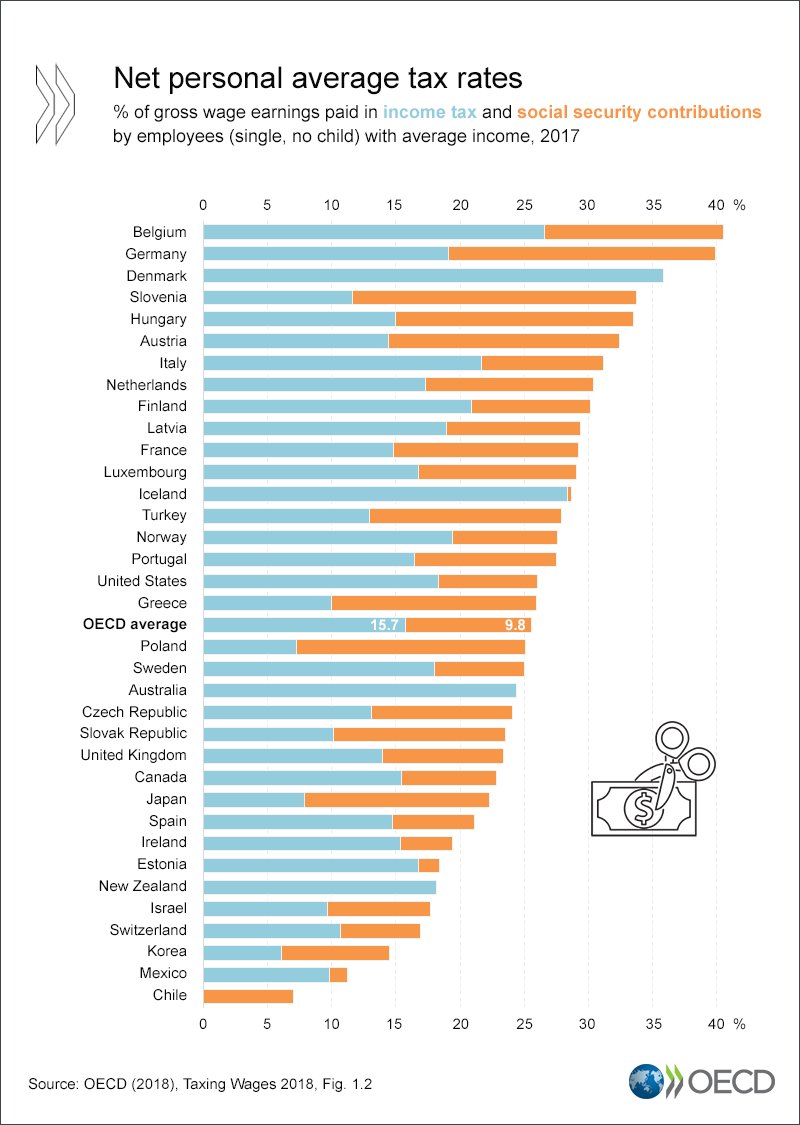

True tax is love is a low top marginal income tax rate

08 Apr 2019 Leave a comment

in applied price theory, economics of education, entrepreneurship, human capital, income redistribution, labour supply, occupational choice, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

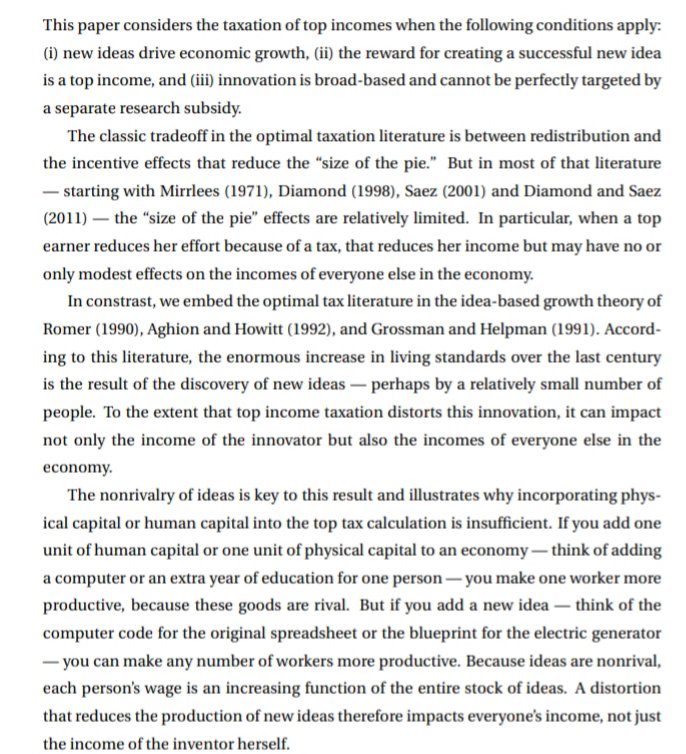

Chad Jones is a trouble maker on top tax rates @paulkrugman

10 Jan 2019 Leave a comment

in applied price theory, economics of education, entrepreneurship, human capital, income redistribution, industrial organisation, labour economics, labour supply, law and economics, occupational choice, politics - USA, poverty and inequality, Public Choice, public economics Tags: creative destruction, superstars, taxation and entrepreneurship, taxation and investment, taxation and labour supply, top 1%

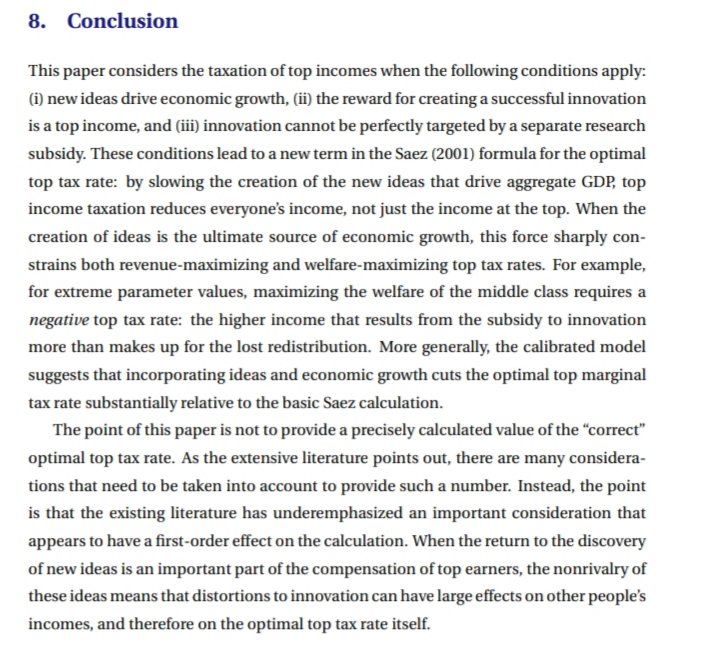

Chad Jones’ awkward remarks on top tax rates and innovation spillovers

09 Jan 2019 Leave a comment

in applied price theory, applied welfare economics, economic growth, economics of education, entrepreneurship, fiscal policy, human capital, income redistribution, industrial organisation, labour economics, labour supply, macroeconomics, occupational choice, politics - USA, poverty and inequality, Public Choice, public economics, rentseeking Tags: creative destruction, taxation and entrepreneurship, taxation and investment, taxation and labour supply, top 1%

Steven Landsburg Discusses Incentives and Taxes

05 Dec 2018 Leave a comment

in applied price theory, applied welfare economics, development economics, economic growth, economic history, entrepreneurship, fiscal policy, human capital, labour economics, labour supply, macroeconomics, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

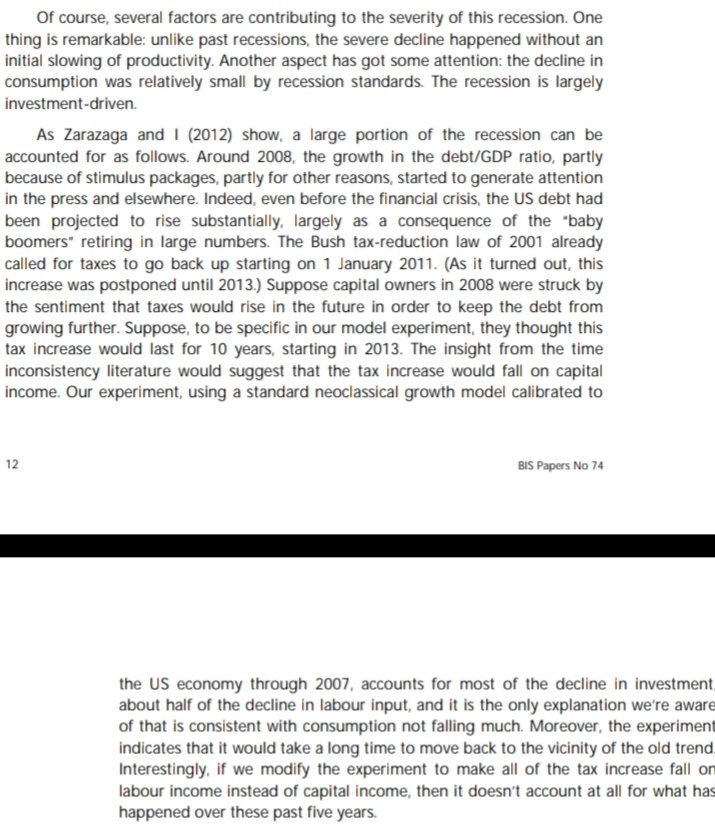

Finn Kydland on the Great Recession

27 Nov 2018 1 Comment

in budget deficits, business cycles, economic growth, fiscal policy, great recession, macroeconomics, public economics Tags: monetary policy, taxation and entrepreneurship, taxation and investment, taxation and labour supply

“You’re all a bunch of socialists” Mises on Friedman

08 Aug 2018 Leave a comment

in applied price theory, applied welfare economics, Austrian economics, comparative institutional analysis, F.A. Hayek, income redistribution, Ludwig von Mises, Milton Friedman, Public Choice, public economics Tags: taxation and investment, taxation and labour supply

Recent Comments