Transition in Eastern Europe – Gary Becker and Ronald Coase

06 Aug 2016 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, constitutional political economy, defence economics, economics, Gary Becker, Ronald Coase Tags: transitional economies

McCloskey explains Modern Economic Growth

06 Aug 2016 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, constitutional political economy, development economics, economic history, economics, growth disasters, growth miracles Tags: Deirdre McCloskey, The Great Enrichment, The Great Escape, The Great Fact

Six Reasons Why the Capital Gains Tax Should Be Abolished

05 Aug 2016 Leave a comment

in applied price theory, applied welfare economics, politics - USA Tags: taxation of investment

Deirdre McCloskey explains the Wilt Chamberlain example

02 Aug 2016 Leave a comment

in applied welfare economics, Rawls and Nozick

Source: Deirdre McCloskey: editorials: Review of Michael J. Sandel’s What Money Can’t Buy: The Moral Limit of Markets , New York: Ferrar, Straus and Giroux, 2012. Pp. 244 +viii. Index. by Deirdre McCloskey August 1, 2012. Shorter version published in the Claremont Review of Books XII(4), Fall 2012.

#feelthe bernie debunked by #MiltonFriedman

31 Jul 2016 Leave a comment

in applied price theory, applied welfare economics, economics, politics - USA Tags: 2016 presidential elections

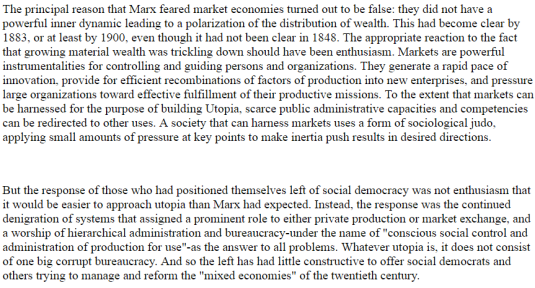

Brad de Long on Marx and adapting to The Great Enrichment

30 Jul 2016 Leave a comment

in applied welfare economics, constitutional political economy, development economics, economic history, poverty and inequality

Source: Brad de Long, The Fall of the Soviet Union

% US top incomes from wages, salaries and pensions, 1913 – 2015,

18 Jul 2016 Leave a comment

in applied welfare economics, economic history, human capital, industrial organisation, labour economics, occupational choice, politics - USA, poverty and inequality, survivor principle Tags: CEO pay, entrepreneurial alertness, superstar wages, superstars, top 1%, top incomes

The rich in the USA long ago became a working rich; most top incomes are from wages and salaries.

Source: The World Wealth and Income Database.

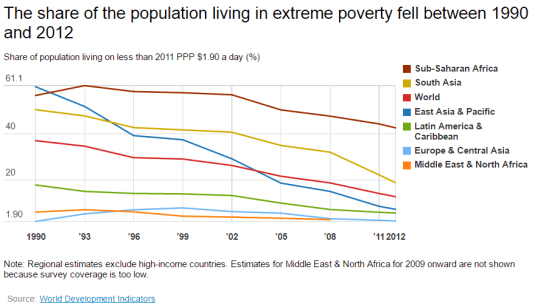

Everything is better now than it ever has been

10 Jul 2016 Leave a comment

in applied welfare economics, development economics, economic history, growth miracles Tags: The Great Enrichment, The Great Escape

Source: Angus Deaton, The Great Escape (2013).

Everything amazing now compared to 1946 but @jacindaardern not happy @dbseymour

10 Jul 2016 Leave a comment

in applied welfare economics, economic history, economics, politics - New Zealand, poverty and inequality Tags: The Great Enrichment, The Great Escape

Yes @greens @GreenpeaceUSA everything is getting better

09 Jul 2016 Leave a comment

in applied welfare economics, development economics, economic history

The Economist Crony Capitalism Index

08 Jul 2016 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, constitutional political economy, development economics, economics of bureaucracy, entrepreneurship, financial economics, growth disasters, growth miracles, industrial organisation, politics - USA, Public Choice, rentseeking, survivor principle Tags: crony capitalism, superstar wages, superstars, top 1%

Nitpicking @stevenljoyce reply 2 @TaxpayersUnion on corporate welfare @JordNZ

05 Jul 2016 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economics of bureaucracy, industrial organisation, politics - New Zealand, Public Choice, rentseeking, survivor principle Tags: creative destruction, endogenous growth theory, industry policy, innovation, picking losers, picking winners, public goods, R&D, water economics

The best the Minister for Economic Development, Steven Joyce, could do in response to my recent report on corporate welfare was nit-picking. Joyce said my definition of corporate welfare was flawed and that spending on R&D will grow the economy. He said

“To brand things like tourism promotion and building cycle-ways as corporate welfare is, I think, creative but not accurate at all.”

Joyce also said my report was

just somebody picking out a whole bunch of government programmes that in many cases don’t involve payments to firms at all…

Those that do involve payments to firms are specifically designed to encourage the development for example of the business R&D industry. Politicians don’t choose them.

Payments in kind are business subsidies. R&D is so important to the economy that the last thing you want is its direction to be biased by funding from government. Bureaucrats have a conservative bias and do not fund oddballs and long shots. The oddballs and hippies in the picture below could only afford the photo because they won a radio competition in Arizona.

The R&D expenditure that was criticised in my report was commercialisation, not basic research, which was specifically praised. Which research to commercialise is for entrepreneurs.

There is no reason whatsoever to think bureaucrats administering R&D subsidy budgets set by politicians are any better than private entrepreneurs at picking the next big thing.

Page 33 of "An Illustrated Guide to Income" more economic #dataviz at: bit.ly/10M7lqR http://t.co/FcmaqZWB32—

Catherine Mulbrandon (@VisualEcon) May 09, 2013

If bureaucrats were any good at picking winners, were any good at beating the market, they would go work for a hedge fund on an astronomically better salary package. The salary package of one top hedge fund manager exceeds the entire payroll budget of most New Zealand government departments including those administering R&D subsidies and other hand-outs.

Government expenditure in vital areas such as innovation should be justified on the basis of cost-benefit ratios and a rationale for why bureaucrats have superior access to information about the entrepreneurial prospects of unproven technologies and product prototypes.

Subsidies should not be defended because of their popularity and sexiness as Mr Joyce did for the film industry, tourism promotion and ultra-fast broadband

If they told New Zealanders that in their view tourism promotion should be cancelled, the film industry should close down, that their shouldn’t be any ultra-fast broadband…I don’t think people would be that enamoured with it.

On irrigation funding, Mr. Joyce cited a report by NZIER that found irrigation contributes $2.2 billion to the economy. Irrigation is a private good which can funded by pricing it properly including the recovery of capital costs. There is no case for a subsidy.

Public goods have spillovers, private goods such as water and irrigation do not. Users can fund the irrigation themselves buying as little or as much water as they are willing to pay out for out their own pockets. The NZIER report noted that it was not about the case for public funding:

… we are not able to quantify the environmental or social impacts if irrigation had never occurred. We also do not attempt to investigate the relative merits of public versus private sector funding of the schemes.

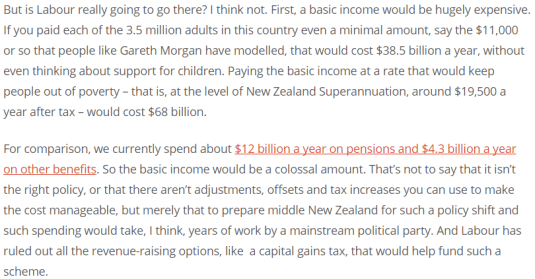

.@MaxRashbrooke kills case for #UBI @GrantRobertson1 @JordNZ

03 Jul 2016 Leave a comment

in applied welfare economics, politics - New Zealand, poverty and inequality, Public Choice, public economics

Rashbrooke in the snap-shot quote describes the massive new taxes to fund a universal basic income as a policy shift for which middle New Zealand must be prepared properly over many years. But the purpose of these great big new taxes is to ensure that those with whom the modern welfare state was designed to protect our left no worse off, not better off, just as good as they were under the previous regime of social insurance. Why take that journey when you can target their poverty directly to the current welfare state?

Source: Is Labour really going to deliver a UBI? – Inequality: A New Zealand Conversation.

Recent Comments