By Paul Homewood London: 14 November 2024 Another windfarm surpasses £1 billion in subsidy payments

Another windfarm surpasses £1 billion in subsidy payments

Another windfarm surpasses £1 billion in subsidy payments

18 Nov 2024 1 Comment

in energy economics, entrepreneurship, environmental economics, global warming Tags: British politics, wind power

Hedy Lamarr and ‘WiFi’ during WWII

10 Nov 2024 Leave a comment

in defence economics, economic history, entrepreneurship, movies, war and peace Tags: World War II

Hedy Lamarr, born Hedwig Eva Maria Kiesler in 1914 in Vienna, Austria, is best known for her work as a Hollywood actress during the Golden Age of cinema. However, her contributions to science and technology, particularly her co-invention of a technology that laid the groundwork for WiFi, Bluetooth, and GPS, have garnered increasing recognition. Lamarr’s […]

Hedy Lamarr and ‘WiFi’ during WWII

Biden-Harris policies and their consequences were no surprise to those paying attention

30 Oct 2024 Leave a comment

in applied price theory, applied welfare economics, budget deficits, business cycles, econometerics, economic growth, economic history, economics of bureaucracy, economics of regulation, energy economics, entrepreneurship, environmental economics, financial economics, fiscal policy, global warming, health economics, income redistribution, industrial organisation, law and economics, macroeconomics, monetary economics, politics - USA, property rights, Public Choice, public economics, rentseeking Tags: 2024 presidential election, drug lags, taxation and entrepreneurship, taxation and investment

Milton Friedman used to advise researchers to focus on large policy changes rather than attempting to separate a small change’s signal from the noise. In this sense, the “ambitious” policy agenda of the Biden-Harris administration was expected to be a gift to the research community. Accepting this gift, since 2020 I have been making forecasts…

Biden-Harris policies and their consequences were no surprise to those paying attention

Scott Alexander on the Progress Studies conference

25 Oct 2024 Leave a comment

in applied price theory, economic growth, economic history, economics of climate change, economics of regulation, energy economics, entrepreneurship, environmental economics, environmentalism, global warming, liberalism, macroeconomics Tags: creative destruction

Here is one excerpt: Over-regulation was the enemy at many presentations, but this wasn’t a libertarian conference. Everyone agreed that safety, quality, the environment, etc, were important and should be regulated for. They just thought existing regulations were colossally stupid, so much so that they made everything worse including safety, the environment, etc. With enough political will, […]

Scott Alexander on the Progress Studies conference

What planet are they on?

09 Oct 2024 Leave a comment

in applied price theory, economics of media and culture, economics of regulation, entrepreneurship, industrial organisation, law and economics, politics - New Zealand, property rights, survivor principle Tags: creative destruction, legacy media

New Zealand’s newspaper chiefs’ views on how the Fair Digital News Bargaining Bill works is somewhat at odds with the text of the Bill. Google today, admirably, said they’ll stop linking to New Zealand news outlets in search if the Bill goes ahead. News Publishers’ Association’s Andrew Holden and Stuff’s Sinead Boucher aren’t happy about that. But…

What planet are they on?

US Productivity Growth: Downside, Upside

08 Oct 2024 Leave a comment

in applied price theory, econometerics, economic growth, economic history, entrepreneurship, history of economic thought, industrial organisation, labour economics, labour supply, macroeconomics Tags: The Great Enrichment

Over time, a rising US standard of living is driven by productivity growth. Michael Peters succinctly describes the problem in “America Must Rediscover Its Dynamism” (Finance & Development, September 2024). He writes: The US economy has a multitrillion-dollar problem. It’s the dramatic slowdown in productivity growth over the past couple of decades. Between 1947 and…

US Productivity Growth: Downside, Upside

Debunking Hate-and-Envy Tax Policy

27 Sep 2024 Leave a comment

in applied price theory, economic growth, economic history, entrepreneurship, financial economics, fiscal policy, health and safety, income redistribution, labour economics, labour supply, law and economics, macroeconomics, occupational choice, politics - USA, poverty and inequality, property rights, Public Choice, public economics Tags: envy, regressive left, taxation and entrepreneurship, taxation and investment

On tax policy, our friends on the left are motivated by envy and hatred. As shown in this Stossel video, Robert Reich is a sad example of this mindset. John Stossel understates his argument. It’s not that Reich is wrong. He’s wildly wrong. There are four points in the video that deserve attention. It is […]

Debunking Hate-and-Envy Tax Policy

Should we keep the wealthy non-diversified? (from my email)

27 Sep 2024 Leave a comment

in applied price theory, economic history, entrepreneurship, history of economic thought, human capital, income redistribution, industrial organisation, labour economics, labour supply, liberalism, Marxist economics, occupational choice, poverty and inequality, Public Choice Tags: top 1%

Byrne Hobart writes to me: One of the purposes of inheritance taxes is to avoid compounding intergenerational wealth. But The Missing Billionaires points out that if all of America’s millionaires had put their money in broad market indices in 1900, their heirs would number 16,000 billionaires, even accounting for taxes, splitting estates among multiple children, etc. So […]

Should we keep the wealthy non-diversified? (from my email)

Why the Fed Cut Sent Stocks Soaring

23 Sep 2024 Leave a comment

in applied price theory, entrepreneurship, financial economics, macroeconomics, monetary economics Tags: monetary policy

When rates go low, future profits go high. Everyone wants a cutBy Richard B. McKenzie. Excerpt:”Profits in the future, dollar for dollar, are worth less than current dollars. This is because current profits can earn interest between now and the future, which means that future profits must be discounted by some percentage to make them…

Why the Fed Cut Sent Stocks Soaring

Tax-Motivated International Migration

18 Sep 2024 Leave a comment

in applied price theory, entrepreneurship, labour economics, labour supply, poverty and inequality, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

I wrote a few days ago about how Americans are moving from high-tax states to lower-tax states (mostly to states with no income taxes or flat taxes). Today, let’s look at international tax migration. I’ve addressed this issue before, but generally in the context of individual countries that are attracting or repelling entrepreneurs, investors, business […]

Tax-Motivated International Migration

The Economic Consequences of the French Wealth Tax

17 Sep 2024 Leave a comment

in applied price theory, econometerics, economic history, entrepreneurship, fiscal policy, human capital, income redistribution, labour economics, labour supply, macroeconomics, occupational choice, poverty and inequality, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

By Eric Pichet, here is the abstract: Despite attempts to ‘unwind’ the Impôt de Solidarité sur la Fortune (‘Solidarity Wealth Tax,’ the French wealth tax) during the last legislature (2002-2007), ISF yields had soared by 2006, jumping from €2.5 billion in 2002 to €3.6 billion. Analysis of the economic consequences of this ISF wealth tax […]

The Economic Consequences of the French Wealth Tax

Tax-Motivated Domestic Migration

17 Sep 2024 Leave a comment

in applied price theory, economic growth, entrepreneurship, Federalism, fiscal policy, human capital, income redistribution, labour economics, labour supply, macroeconomics, occupational choice, politics - USA, poverty and inequality, Public Choice, public economics Tags: capital gains tax, taxation and investment taxation and entrepreneurship, taxation and labour supply

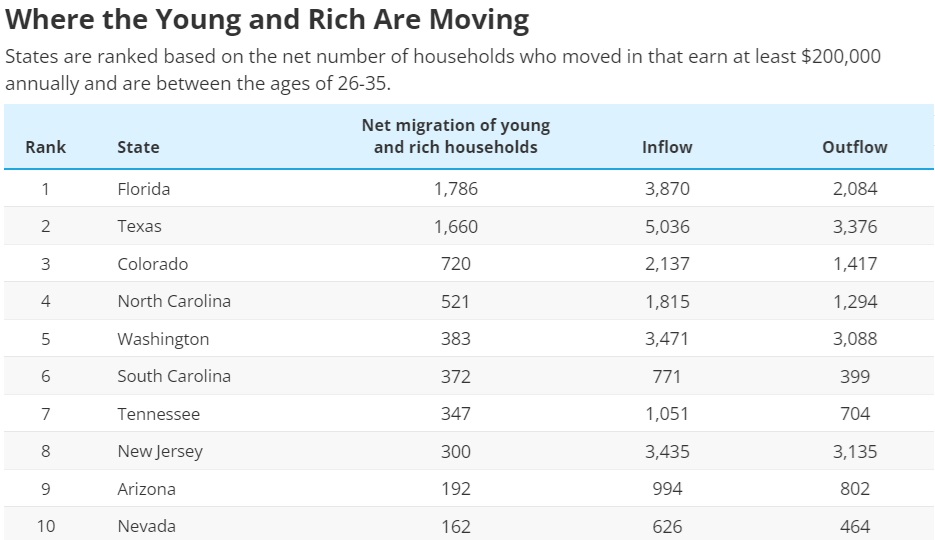

I’m a big fan of tax competition. I cheer when jobs, investment, and people (or even booze) move from high-tax jurisdictions to low-tax jurisdictions. This increases the rewards for good policy and also increases the punishment for bad policy. Given my interest in the topic, I obviously can’t resist sharing this chart, which shows the […]

Tax-Motivated Domestic Migration

The Santa Claus Election

15 Sep 2024 Leave a comment

in applied price theory, comparative institutional analysis, economic growth, economics of education, entrepreneurship, fiscal policy, health and safety, income redistribution, industrial organisation, labour economics, labour supply, macroeconomics, politics - USA, Public Choice, public economics, unions Tags: 2024 presidential election, taxation and entrepreneurship, taxation and investment, taxation and labour supply

For libertarians, this is a very depressing election (a feeling we tend to have every four years, so a familiar experience). What basically happens is that two politicians try to bribe us with our own money. This year, we have Kamala Harris, who was even worse than Bernie Sanders in the big-spender contest. And we […]

The Santa Claus Election

Uber messy

11 Sep 2024 Leave a comment

in applied price theory, comparative institutional analysis, economics of regulation, entrepreneurship, industrial organisation, labour economics, labour supply, law and economics, occupational choice, politics - New Zealand, property rights, Public Choice, transport economics, urban economics Tags: employment law, Uber

Caught a fun phone call from an accountant after this week’s column over at the Dom Post (and Christchurch Press, etc) on the court’s decision in the Uber case.If Uber drivers are employees, rather than contractors, as the Court sees things, how will depreciation on their cars be handled? Contractors can count all those expenses…

Uber messy

Friedman vs Stiglitz: Estonia and Poland vs. Argentina and Venezuela

06 Sep 2024 Leave a comment

in applied price theory, comparative institutional analysis, development economics, economic history, economics of bureaucracy, entrepreneurship, growth disasters, growth miracles, history of economic thought, income redistribution, industrial organisation, international economics, labour economics, law and economics, liberalism, Marxist economics, poverty and inequality, property rights, Public Choice, rentseeking, survivor principle Tags: Argentina, Chile, Poland, regressive left, Venezuela

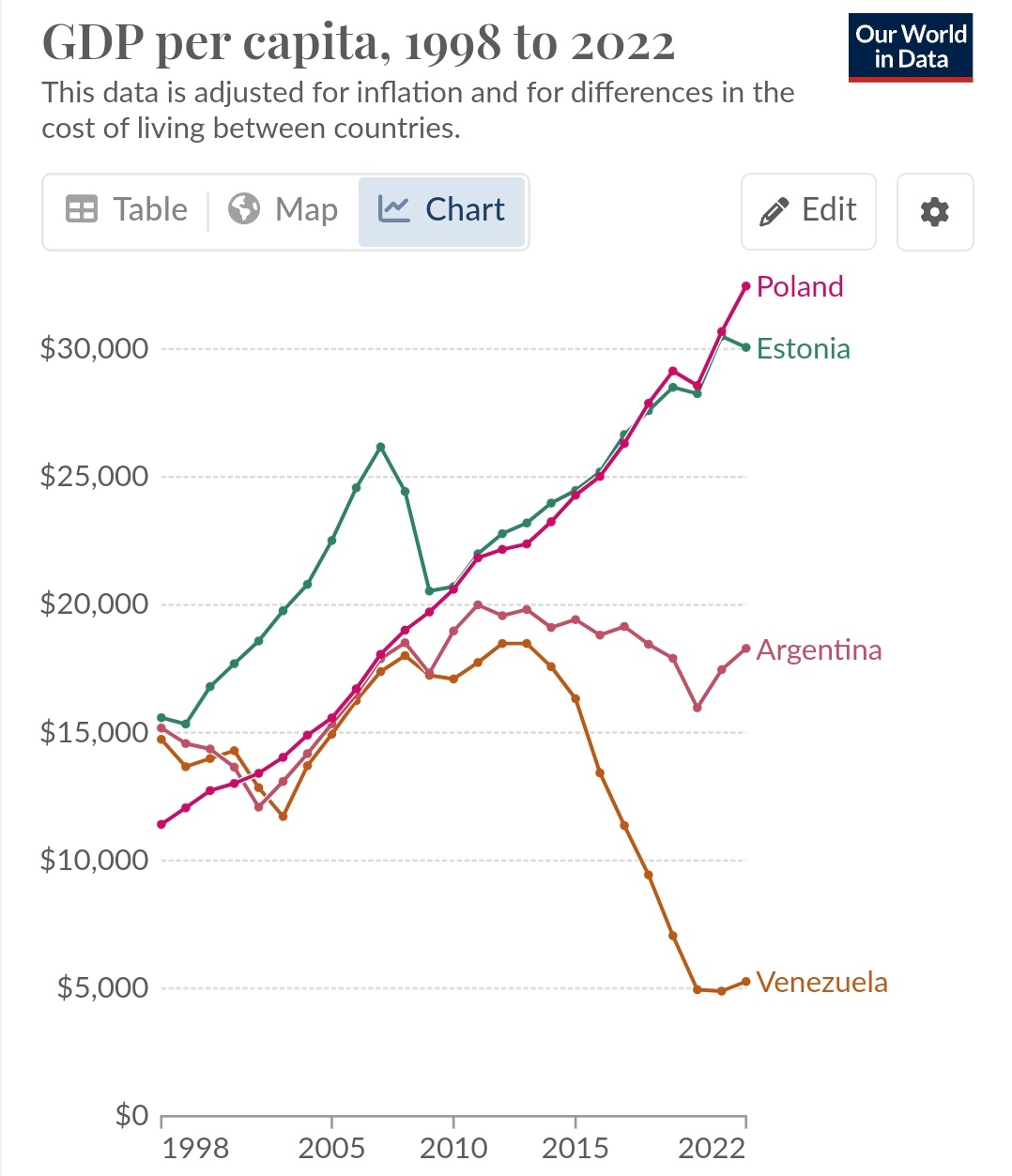

About 10 days ago, i showed that Milton Friedman was a much better economist than Joseph Stiglitz by comparing Chile (which followed Friedman’s ideas) and Venezuela (which followed Stiglitz’s ideas). It was a slam-dunk win for Friedman. Chile started poor and has become relatively prosperous. The opposite happened in Venezuela, which started relatively prosperous and […]

Friedman vs Stiglitz: Estonia and Poland vs. Argentina and Venezuela

Recent Comments