How labour and other markets work

18 Nov 2015 Leave a comment

in applied price theory, Austrian economics, entrepreneurship, human capital, industrial organisation, labour economics, labour supply, Milton Friedman, minimum wage, occupational choice, poverty and inequality, survivor principle, unions Tags: market process, The meaning of competition

Unions – not the cause of our 40 hour workweek

10 Nov 2015 Leave a comment

in applied price theory, applied welfare economics, economic history, entrepreneurship, health and safety, human capital, industrial organisation, labour economics, labour supply, Marxist economics, minimum wage, politics - Australia, politics - New Zealand, politics - USA, poverty and inequality, unions Tags: The Great Enrichment, union power, union wage premium

@CloserTogether @FairnessNZ nail case for neoliberalism @chrishipkins @Maori_Party

06 Nov 2015 Leave a comment

in econometerics, economic history, labour economics, labour supply, minimum wage, politics - USA, unions Tags: conspiracy theories, conspiracy theorists, Leftover Left, living standards, Maori economic development, neoliberalism, top 1%, Twitter left, union power, union wage premium

The Council of Trade Unions and Closer Together Whakatata Mai charted similar statistics to show that everything has gone to hell in a hand basket since neoliberalism seized power in New Zealand in 1984 and in particular after the passing of the Employment Contracts Act in 1991.

Source: Income Gap | New Zealand Council of Trade Unions – Te Kauae Kaimahi.

The passage of the Employment Contracts Act greatly reduced union power and union membership and with it wages growth in New Zealand, according to what is left of the New Zealand union movement.

Source: Income Gap | New Zealand Council of Trade Unions – Te Kauae Kaimahi.

Unfortunately, both charts of the same statistics show the exact opposite to what was intended by The Council of Trade Unions and Closer Together Whakatata Mai.

Even the most casual inspection of the data charted above and reproduced below with some annotations shows that real wages growth returned to New Zealand in the early 1990s after 20 years of real wage stagnation.

Source: Income Gap | New Zealand Council of Trade Unions – Te Kauae Kaimahi.

The reforms of the 1980s stopped what was a long-term decline in average real wages. The reforms of the early 1990s including the passing of the Employment Contracts Act was followed by the resumption of sustained growth in average real wages with little interruption since.

Closer Together Whakatata Mai has even stumbled onto the great improvements in household incomes across all ethnicities since the early 1990s.

The increase in percentage terms of Maori and Pasifika real household income is much larger than for Pakeha. As Bryan Perry (2015, p. 67) explains when commenting on the very table D6 sourced by Closer Together Whakatata Mai:

From a longer-term perspective, all groups showed a strong rise from the low point in the mid 1990s through to 2010. In real terms, overall median household income rose 47% from 1994 to 2010: for Maori, the rise was even stronger at 68%, and for Pacific, 77%. These findings for longer- term trends are robust, even though some year on year changes may be less certain. For 2004 to 2010, the respective growth figures were 21%, 31% and 14%.

Source: Bryan Perry, Household Incomes in New Zealand: trends in indicators of inequality and hardship 1982 to 2014 – Ministry of Social Development, Wellington (August 2015), Table D6.

As Closer Together Whakatata Mai documented, incomes increased in real terms by 14% for the bottom and 19% for the middle.

Perry noted that in the lowest decile had too many implausible incomes including many on zero income so he was wary of relying on it. I have therefore charted the second, median and top decile before and after housing costs below. All three deciles charted showed substantial improvements in incomes both before and after housing costs.

Source: Bryan Perry, Household Incomes in New Zealand: trends in indicators of inequality and hardship 1982 to 2014 – Ministry of Social Development, Wellington (August 2015).

Naturally, measuring changes in living standards over long periods of time is fraught with under-estimation. There are new goods to be accounted for and product upgrades too.

The apps in your smartphone cost $900,000 thirty years ago —@datarade https://t.co/pjw7q4QGDp—

Vala Afshar (@ValaAfshar) October 29, 2015

Is the living wage a form of indirect sex discrimination?

03 Nov 2015 Leave a comment

in applied price theory, discrimination, gender, labour economics, Marxist economics, minimum wage, politics - New Zealand Tags: expressive voting, living wage, offsetting behaviour, rational irrationality, The fatal conceit, unintended consequences

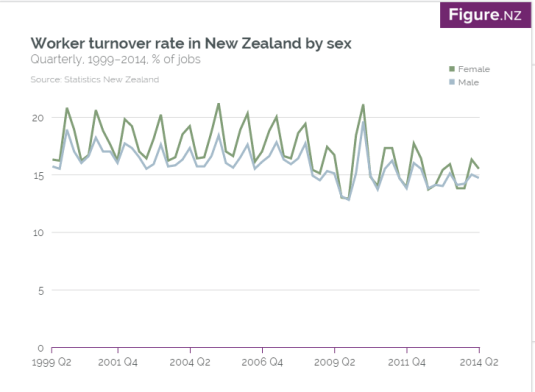

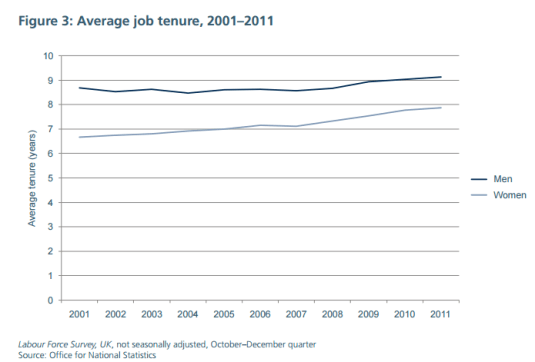

The living wage will certainly be to the profit of incumbent workers at the time of the wage increase but that is provided that their employer stays in business. The introduction of a living wage will result in indirect sex discrimination because of the higher job turnover rates of women. Women also have shorter average job tenures than men in any particular job.

Source: Worker turnover rate in New Zealand by sex – Figure.NZ.

Any benefit premised on not quitting jobs discriminates against women because of their higher job quit rates. More women than men will have to quit living wage jobs because of motherhood and other changes in their personal circumstances. Isn’t that discrimination?

One in six workers change their jobs every year. That job turnover rate is higher among the workers with less human capital simply because both sides of the job match have less reasons to continue. A job quit or job layoff for a less skilled worker does not result as much of a loss of job specific and firm specific human capital than would be the case if the worker was more skilled with more firm-specific human capital.

One of the iconic empirical facts of the labour market is job turnover rates are higher and job layoff rates are higher for less skilled workers. As workers acquire more job specific human capital, they are more reluctant to quit and their employer hesitate before laying them off. This is because of the firm specific human capital which both invested would have to be written off.

Women quit jobs more often than men, work part-time or switch between part-time and full-time work more often than men and enter and re-enter to the workforce because of motherhood and maternity leave. Women also tend to invest in more generalised, more mobile human capital. Women anticipate a more intermittent labour force participation and more spells of part-time work. As such, women have less reasons to invest in specific human capital if they anticipate leaving because of motherhood and either changing jobs more often are working part-time. If you are changing jobs more often, such as women do, investing in more general human capital and less in specific capital increases options when searching for vacancies.

Any benefit of the living wage will erode faster for women because they quit jobs at a higher rate than men. Is this indirect sex discrimination? This higher job turnover rate is driven by human capital investment strategies and career plans. The living wage, which privileges the incumbent workers at the time the living wage increases implemented, discriminates against female workers because they change jobs more often or are likely to quit sooner after the living wage was initially implemented.

The particular form of indirect sex discrimination at hand arises from the Golden Handcuffs effect of the living wage. Closer Together Whakatata Mai – reducing inequalities explain the Golden Handcuffs effect this way:

You may have noticed in the article it is actually the SAME people being paid the living wage (“all of them have stayed on as staff”). This is how labour markets can work if employers make different choices. If you look at the Living Wage employers – they haven’t hired a whole new set of people – they have invested in the people they already have. The world has not ended and many more people are happy and businesses and organisations are doing just fine.

Even the proponents of the living wage admit that a living wage increase will segment the labour market and create insiders and outsiders with the insiders paid more than what used to be called the reserve army in the unemployed by the same crowd of activists. A reduction in job turnover will increase unemployment durations because there are fewer vacancies posted every period.

Hopefully all the existing employees of the living wage employer are capable of the requisite up skilling they need to match their new productivity targets. Not everyone did well at school. One of the reasons workers on low wages are on those low wages because they perhaps didn’t do as well at school as activists who appointed themselves to speak for them. A harsh reality of life is 50% of the population have below-average IQs.

This up skilling answer to the cost to employers of a living wage increase is a variation of the standard policy response in a labour market crisis. That standard labour market policy response in crisis is send them on a course. Sending them on a course as a response to a crisis makes you look like you care and by the time they graduate the problem will probably have fixed itself. Most problems do. I found this bureaucratic response to labour market crises to repeat itself over and over again while working in the bureaucracy.

The reason was sending them on a course was so popular with geeks as yourself sitting at your desk as a policy analysis, minister or political activist all did well at university. You assume others will do well through further education and training including those who have neither the ability or aptitude to succeed in education. People don’t go on from high school to higher education for a range of reasons that include a lack of motivation to study or a simple lack of ability no matter how hard they try.

The living wage hypothesis about reduced turnover, up-skilling and greater motivation is a small example of the American company that decided to pay a minimum wage of $70,000 a year. Those workers who cannot earn as much of this elsewhere would never quit. Some of his better employers quit because they resented being paid the same as less productive employees. Hopefully, the minority shareholder suing his brother who is the CEO for offering that above market wage doesn’t end up bankrupting the company. As such, the incumbent workers’ fortunes are unusually closely tied to their existing employer if they are paying above the going rate in their industry and occupation.

I suppose you could hold on like grim death but women tend to have more reasons to move on than men if only because of pregnancy and motherhood. These golden handcuffs are of less value to them than to men. Younger workers are also less advantaged because many young New Zealanders take a overseas working holiday of several years, if not more. If they have a living wage job now that have to give up that advantage.

Workers who lack the labour productivity to earn a wage equivalent of the living wage elsewhere will never quit a living wage job, and will have a much reduced incentive to up-skill or seek promotion. There will be less internal reward for undertaking additional training or job responsibilities among low skilled is because the living wage will mean they will not get a wage rise. That wage rise is gobbled up by the living wage increase if you’re already a low-paid worker.

Naturally, as vacancies arise, recruits will be drawn from a much higher quality recruitment attracted by the higher wage at the living wage employer. The less skilled workers who don’t currently work for the living wage employer will miss out completely.

The low skilled won’t be hired for living wage jobs @nmjyoung @EtuUnion @WellingtonMayor @FIRST_Union

30 Oct 2015 3 Comments

in applied price theory, human capital, labour economics, minimum wage, personnel economics, politics - New Zealand, rentseeking Tags: entrepreneurial alertness, expressive voting, living wage

The upshot of the Wellington City Council paying a living wage to employees and including those of sub-contractors is over time the composition of their low skilled labour force will change. The Council will recruit people who can earn in other jobs $19.25. Workers who don’t have the capability of producing at that level of productivity will never be interviewed.

The Council is required by law to recruit on merit and to be a good employer. Workers who would never have previously applied for Wellington City Council jobs covered by the living wage decision because they can earn better pay elsewhere will now do so because of the higher pay of these council jobs.

These higher skilled workers will crowd out the lower skilled workers that currently apply for the low paid jobs covered by the upcoming living wage increase. The workers with the type of skills that currently win those jobs covered by the living wage increase will not be shortlisted because the quality of the recruitment pool will increase because of the living wage. There will be an influx of more skilled workers attracted by the higher wages for council jobs because of the living wage policy. They will go to the head of the queue and displaced workers who currently apply for and win those council jobs.

A living wage is an exclusionary policy where ordinary workers, often with families who are not productive enough to produce $19.25 per hour plus overheads will never be interviewed by the Wellington City Council or council subcontractors for a job covered by the living wage increase.

In a cruel twist of fate, because the council is implementing its living wage on 1 July 2016, higher quality workers will start applying for jobs covered by the living wage increase now. This will further reduce the number of initial beneficiaries of the living wage increase. Council workers recruited between now on 1 July 2016 will be applying in anticipation of that increase.

The living wage adopted by the Wellington City Council is a classic case of rent capitalisation. With the council paying over the odds for a job, workers will have every incentive to compete for the higher wages. The most obvious way of winning that race for these limited number of higher paying jobs is to be a more productive worker than the other job applicants.

The living wage jobs will attract a higher quality pool of job applicants. These higher quality job applicants who would not otherwise applied but for the living wage will outcompete existing low skilled low paid workers who would otherwise benefited from the living wage increase. In some cases, these higher quality, more skilled recruits will be taking a job at the Council or its contractors covered by the living wage increase on much the same pay as they command anywhere else in the labour market. As such, ratepayers are paying about 20% more for no reduction in poverty.

The existing employees of the Wellington City Council and its subcontractors will be locked into golden handcuffs. Workers who lack the labour productivity to command a wage equivalent of the living wage elsewhere in the job market will never quit. Wellington City Council employees covered by the living wage will also have a much reduced incentive to up-skill will seek promotion. There will be no internal reward for undertaking additional training or job responsibilities among low skilled is because the living wage will mean they will not get a wage rise at the Council.

The windfall gains to the current low paid council employees but no future council employees illustrate the folly of a living wage policy at the Wellington City Council. Some of these existing Wellington City Council employees will have children so child poverty rates may improve. That is all that will be gained for a permanent increase of about 20% in the price paid for council services.

Because of the change in the recruitment pool for all future vacancies, the impact on the poverty rates among future council employees will be minimal. These recruits to future council vacancies covered by the living wage increase will be recruited from other jobs where they already earn a similar pay to the living wage paid at the Council. Ratepayers will pay about 20% more for services in return for a small reduction in child poverty among its existing council employees.

As these existing employees move on, and they will one day, ratepayers will continue to pay about 20% more until either the Council sees the errors of its ways or the policy is overturning on judicial review. There will be no reduction in family poverty because new recruits are switching to the Council for the usual wage premium from moving to one job to another and that’s it. As the existing council employees leave, any child poverty reduction from the living wage policy will fade to zero.

As mentioned, potential recruits who are productive enough to earn a competitive market wage equal to the living wage level in their existing jobs will be the most qualified applicants. The best of these higher quality applicants will fill future council vacancies covered by the living wage policy. Workers who are not productive enough to earn the living wage in other jobs simply won’t be shortlisted for council jobs. The Council must by law hire the best qualified applicant for any vacancy.

Source: Peter Kolesar, Garrett van Rysin and Wayne Cutler.

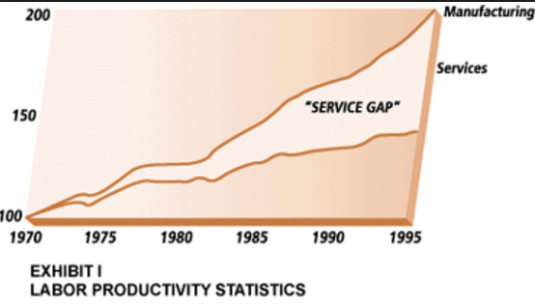

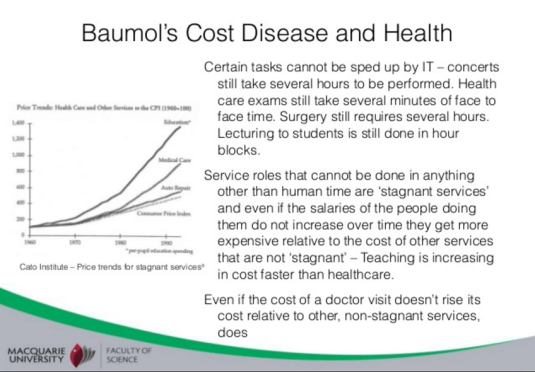

Any extra labour productivity from a living wage at the Wellington City Council is in doubt because low skilled service sectors are notorious for their low potential for productivity gains. They are the bread-and-butter of Baumol’s disease.

Source: Chris Rauchle.

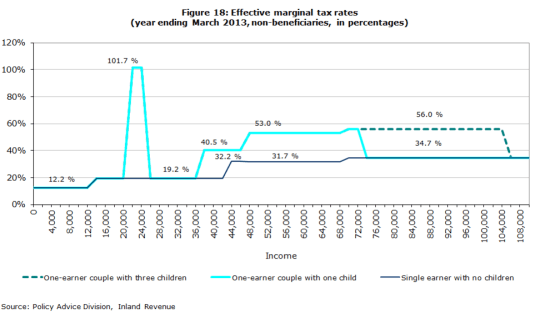

It’s kicking the Wellington City Council when it is down to mention that low paid workers with families will lose a considerable part of the living wage increase because of reductions in their family tax credits – reductions in the Working for Families in-work tax credit. Any living wage increase at the Wellington City Council is the subject of multiple clawbacks by IRD. There is income tax, a 25% abatement rate on Working for Families tax credits on any family income above about $36,000 and 15% GST. All in all, the transfer out of the pockets of ratepayers to IRD would be at least one-third.

I have not included any accommodation supplement, childcare subsidy or community services card the low paid worker is receiving from WINZ. The winding back of these social benefits to the low paid worker and his or her family is a pointless transfer from Wellington City ratepayers to the national taxpayer.

It will be kicking Wellington City Council even further to remind of the enforcement and compliance costs of living wage ordinances in the USA at the city level.

The Wellington City Council this week acted against legal advice to require contractors under joint services agreements with other councils in the Wellington region to pay employees who work within the boundaries of Wellington city the living wage. The American cities had to define the minimum number of hours in a day that minimum wage workers who are mobile for their jobs had to spend within their city limits before their employer was subject to their living wage ordinance.

It is standard to put forward an efficiency wage argument for a living wage. The higher wage paid as result of the introduction of the living wage will motivate workers to work harder and cheer each other on.

Source: John Horton.

These workers paid the efficiency wage will require less supervision because under an efficiency wage, a rate of pay that is more than the going rate for their skills and experience with other employers and in other industries and occupations, these workers paid the efficiency wage have more to lose if disciplined or dismissed. By the way, the theory of the efficiency wages is an American theory where there is employment at will.

This additional effort and greater motivation from the efficiency wage, from the above market rate of pay, will reduce the costs of supervision to the employer of teams of employees as well as increase output per worker. This is supposed to offset some of the costs of the living wage increase.

At bottom, this efficiency wage hypothesis is entrepreneurs are unaware of the higher quality and greater self-motivation of better paid recruits for vacancies but wise bureaucrats and farsighted politicians notice these gaps in the market. Bureaucrats and politicians notice these gaps in the market before those who gain from superior entrepreneur alertness to hitherto untapped opportunities for profit do so and instead leave that money on the table.

I won’t mention that many of the modern theories of the firm focus, in part or in full on reducing opportunistic behaviour, cheating and fraud in employment relationships. The cost of discovering prices and making and enforcing contracts and getting what you pay for are central to the Coase’s theory of the firm put forward in 1937.

In Barzel’s (1982) theory of the firm, measurement costs drive the emergence and organisation of the firm. The firm arose to minimising the cost of measuring what is to be exchanged by bringing some of those measuring tasks in-house. Much of the organisation of the firm, including the degree of vertical and horizontal integration and many different forms of contracting are driven by ensuring owners and managers get what they pay for and are not overcharged through manipulation or cheating.

Alchian and Demsetz’s (1972) theory of the firm focused on moral hazard in team production. As they explain

Two key demands are placed on an economic organization-metering input productivity and metering rewards.

The main rationale in personnel economics from everything ranging from employer funding of retirement pensions to the structure of promotions and executive pay including stock options is around better rewarding self-motivating employees and reducing the costs of monitoring employee effort.

Source: Department of Labour (2009).

The profits of entrepreneurs for running a firm is directly linked from their successful policing of the efforts of employees and sub-contractors to ensure the team and each member perform as promised and individual rewards matched individual contributions (Alchian and Demsetz 1972; Barzel 1987). The entrepreneur is a residual claimant to the revenues of the firm net of paying all other inputs. Entrepreneurs must successfully police the contributions of their employers and contractors if they are to survive in competition. The better they are at this, the more the alert entrepreneur profits.

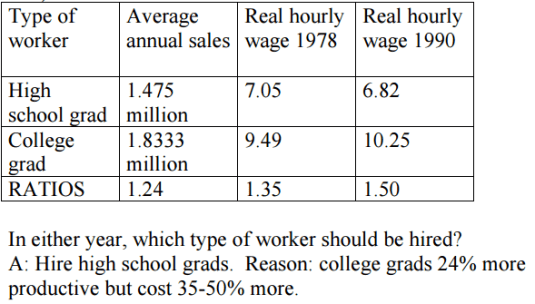

Every profit minded entrepreneur seeks to hire the group of workers with the lowest cost per unit of output produced by them. Those that do not will not survive in competition with more alert rivals. The trade-off between worker quality and wages in setting hiring standards is a routine entrepreneurial decision in every firm when recruiting:

Managers often say that their goal in hiring is to obtain the best quality workers. It sounds like a good idea, but is it? The most productive workers are also likely to be the most expensive. Should the goal instead be to hire the least expensive workers? …The best worker is not the cheapest, nor the most productive, but the one with the highest ratio of productivity to cost. We should hire as long as the marginal productivity of the last worker hired is greater than or equal to the cost of the worker.

Source: Lazear and Gibbs.

@Noahpinion wants to use teenagers for policy experiments @arindube

28 Oct 2015 1 Comment

in applied price theory, labour economics, minimum wage, politics - USA, public economics Tags: expressive voting, Leftover Left, rational ignorance, rational irrationality

Noah Smith is OK with local experiments with higher minimum wages such as a $15 minimum wage in San Francisco. At least half of these workers sold out for minimum wage policy experiments will be teenagers and young adults.

Source: Finally, an Answer to the Minimum Wage Question – Noah Smith.

My most grating experience in the public service was reversing the slope of the demand curve for labour and education and training to argue that a minimum wage would increase opportunities for the low paid.

I drafted a briefing to the minister pointing out that minimum wage increases make investments in training less attractive to lower skilled workers. This is because the minimum wage increase increases the opportunity cost of training and reduces the rewards in terms of the wage increase. The would be trainee must give up a higher minimum wage in return for a smaller wage increase because the minimum wage increase swallows part of the wage premium from the now an increasingly pointless investment in training. There is only a small literature on the impact of the minimum wage on investment in human capital.

My manager told me to argue that increases in the minimum wage will make low skilled workers more likely to seek training. That conclusion was based on a consultant’s machine-gun econometrics research showing that the confidence interval was plus or minus regarding the minimum wage and employment training. This study contradicted everything known about the minimum wage and the incentive to invest in human capital. You do not increase of demand for human capital by reducing the rewards for investments in human capital.

Does a higher minimum wage really reduce employment? econ.st/1gp4Jbs http://t.co/WGMZGLKHmI—

The Economist (@EconBizFin) July 30, 2015

Back to Noah Smith. He admits freely that increases in the minimum wage reduce employment. He tries to ride out on the conclusion that that increase in unemployment after a small minimum wage increase isn’t much.

Source: Finally, an Answer to the Minimum Wage Question – Noah Smith.

Obviously the teenagers and adults thrown onto the scrapheap of society by the increased minimum wage don’t count in the brutal utilitarian calculus Noah Smith employs.

It's pretty simple: Minimum Wage = Compulsory Unemployment http://t.co/6xiX6YCp9Z—

Mark J. Perry (@Mark_J_Perry) July 25, 2015

Fortunately, many economists prefer Pareto improvements. This is where after a policy change at least one person gains and no one loses or at least the winners compensates the losers for their losses. Not so bad and isn’t much as suggested by Noah Smith for the welfare consequences of a minimum wage increase on unemployment are not good enough from an applied welfare economics perspective.

Most of the Left over Left are of the same view about the priority of losers and the need to compensate them whenever those evil neoliberals want to deregulate or remove the tariff. The Left over Left are completely preoccupied the fate of the workers who have lost their privileges from regulation or tariff protection rather than the consumers who are now richer. Without missing a beat, the Left over Left changes sides and become brutal utilitarians when it comes to the minimum wage and unemployment and investment in human capital.

Minimum wage advocates fail to take seriously that low paid workers who lose their jobs because of minimum wage increases are real living people who suffer when their interests are traded off for the greater good of their fellow low paid workers, some of whom come from much wealthier households. As Rawls pointed out, a general problem that throws utilitarianism into question is some people’s interests, or even lives, can be sacrificed if doing so will maximize total satisfaction. As Rawls says:

[ utilitarianism] adopt[s] for society as a whole the principle of choice for one man… there is a sense in which classical utilitarianism fails to take seriously the distinction between persons.

What is underplayed in the minimum wage debate is Noah Smith, Arindrajit Dube and other scholars are careful in what they say but politicians and living wage lobbyists don’t listen to those careful qualifications.

The key qualification of these academics is there are policy trade-offs that cannot be avoided when the minimum wage is increased. Some jobs will be lost if the minimum wage increases. Some say this effect is small, others say this effect is large, hardly anyone says it’s zero.

The claims that the minimum wage can be lifted without hurting employment are a long bow from what Andrajit Dube said about small changes in the minimum wage having small adverse effects on unemployment. What Andrajit Dube said is not much different from everyone else on the minimum wage – Nuemark is an example:

a 10 per cent increase in the minimum wage could reduce young adult employment by up to 2 per cent

David Card was always very careful amount about how his pioneering research was about how small increases in the minimum wage not reducing employment in the presence of search and matching costs:

From the perspective of a search paradigm, these policies make sense, but they also mean that each employer has a tiny bit of monopoly power over his or her workforce. As a result, if you raise the minimum wage a little—not a huge amount, but a little—you won’t necessarily cause a big employment reduction. In some cases, you could get an employment increase.

Noah Smith is wrong. We do know what will happen if the minimum wage is raised $15 per hour. Some people will lose their jobs. More importantly, there is a reduced incentive for the low paid to invest in skills to improve their earning power because the minimum wage is already delivered that assuming they still have a job.

In 1965 an editor at Look asked an MIT economist why "liberal" economists hadn't signed an anti-minimum wage letter. http://t.co/ONuQKIWhG7—

Garett Jones (@GarettJones) December 02, 2014

How you handle these casualties of policy changes such as minimum wage increases is a central dilemma of applied welfare economics. This dilemma is usually solved by pointing out that it’s far less risky in terms of employment and welfare improvements and losses to increase the Earned Income Tax Credit (EITC) because that places no jobs at risk.

Now along comes Steve Landsburg to point out that the incidence of an Earned Income Tax Credit (EITC) changes when there is a minimum wage, when there is a price floor. Remember everyone agrees that when there is an earned income tax credit, some of the benefits go to the employer. When you raise the EITC, more people enter the labour market. This increase in the supply of labour drives wages down, which transfers some of the benefit of the tax credit from the workers you intended to help to the employers but not all of the benefits of the tax credit.

Steve Landsburg shows that in any labour market where the minimum wage is above the wage that would prevail but for the minimum wage law, the minimum wage cannot fall to cope with the increase in labour supply induced by the earned income tax credit. For that reason, all of the benefits of the earned income tax credit go to employers. Employers can hire more people without having to increase the wage they offer above the minimum wage. As long as the minimum wage is above the market clearing wage, more people get a job as a result of the tax credit, but no one takes home pay that is higher than the minimum wage.

One of the purposes of applied price theory, the study of economic history and even labour econometrics is to spare us policy experiments that we already know that they will not turn out well.

Real hourly minimum wage, PPP, USA, UK, Canada, New Zealand, Ireland, Germany, Australia and France before & after taxes, 2013

27 Oct 2015 Leave a comment

in labour economics, minimum wage, politics - Australia, politics - New Zealand, politics - USA

Source: OECD (2015), “Minimum wages after the crisis: Making them pay”.

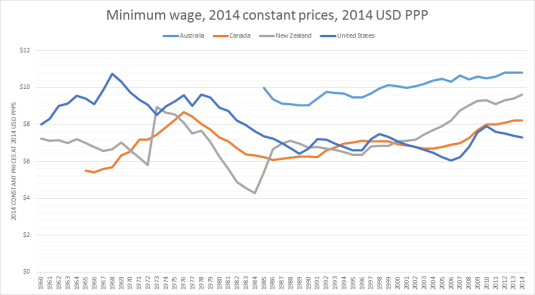

Real minimum wage PPP, USA, Canada, Australia and New Zealand since 1960

27 Oct 2015 Leave a comment

in economic history, labour economics, minimum wage

@arindube Vernon Smith on the cruelty of the minimum wage

25 Oct 2015 Leave a comment

in economics of education, human capital, labour economics, labour supply, minimum wage, occupational choice, politics - Australia, politics - New Zealand, politics - USA Tags: living wage, minimum wage, on-the-job training

Great quote on the cruelty of the minimum wage from Nobel economist Vernon Smith, illustrated by Henry Payne https://t.co/Lwch51acEY—

Mark J. Perry (@Mark_J_Perry) October 24, 2015

Number of beers you can buy with your monthly minimum wage in Europe

29 Sep 2015 Leave a comment

in economics of regulation, labour economics, law and economics, minimum wage Tags: alcohol regulation, EU

Number of beers you can buy with your monthly minimum wage in Europe http://t.co/uvuunx5mkF—

Amazing Maps (@Amazing_Maps) June 21, 2015

@DavidLeyonhjelm on deregulating the Australian labour market

17 Sep 2015 1 Comment

in applied price theory, economic history, economics of regulation, industrial organisation, job search and matching, labour economics, minimum wage, survivor principle, unions Tags: Australia, employment law, employment protection law, federalism, labour market deregulation, labour market regulation, union power, unions

Recent Comments