Source: OECD Income Distribution database.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

16 Feb 2016 Leave a comment

in applied welfare economics, economics of bureaucracy, labour supply, politics - USA, welfare reform

In common with New Zealand, Maine found that a number could not complete work requirements because they could not get time off work from their off the books job.

Lindsay Mitchell found through Official Information Act requests that one in 10 beneficiaries are working full-time and one in 5 have no intention of looking for a job in the next year despite a requirement to actively look for work as a condition of receipt of their benefit.

15 Feb 2016 Leave a comment

in applied welfare economics, politics - USA, welfare reform

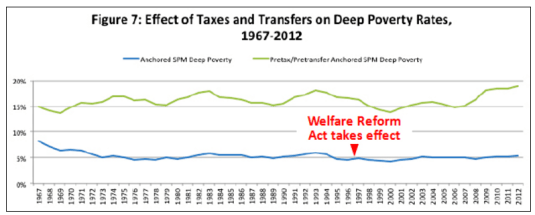

The 1996 federal welfare reforms were supposed to condemn the poor to homelessness and no money to buy food. Deep poverty did not get worse as a result of those reforms. That alone refutes its critics.

Source: Take 2: Another Look at Bernie Sanders, Welfare Reform, and Deep Poverty | Mother Jones.

Source: New Study Says Poverty Rate Hasn’t Budged For 40 Years | Mother Jones.

Source: Weekend Follow-Up #1: Welfare Reform and Deep Poverty | Mother Jones.

12 Feb 2016 Leave a comment

in applied welfare economics, economic history, labour economics, labour supply, politics - USA, welfare reform

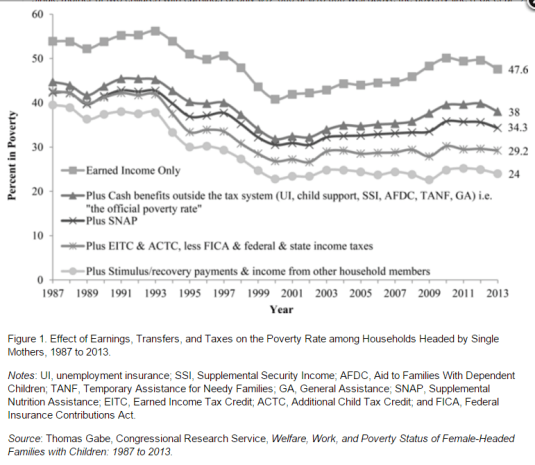

Despite the dire predictions, there has been a permanent reduction in child poverty of 25%, a 35% increase in the employment rates of never married mothers and a 16% increase in the employment rates of single mothers.

Minorities benefited the most from the 1996 US federal welfare reforms in terms of higher employment rates and lower child poverty rates.

As part of the 1996 reforms, Medicaid eligibility was not lost when going off welfare and single parents by getting a job qualified for the Earned Income Tax Credit.

01 Feb 2016 Leave a comment

in labour economics, labour supply, politics - New Zealand, poverty and inequality, welfare reform Tags: Maori economic development, single mothers, single parents, welfare state

17 Jan 2016 Leave a comment

in economic history, gender, labour economics, labour supply, politics - USA, welfare reform Tags: child poverty, family poverty, single mothers, single parents, US welfare reforms

14 Jan 2016 Leave a comment

in applied welfare economics, economics of education, politics - New Zealand, politics - USA, poverty and inequality, welfare reform

There is a large literature on what money can buy in terms of improved child outcomes. Central to the left-wing view is the poorer are just like everyone else but they have less money. Susan Mayer, a proud registered Democrat all her life, kick-started the literature challenging this with her book in 1997.

More money does help the children of poor families but the effect is considerably less–and more complicated–than is generally thought because as Mayer says ‘once children’s basic material needs are met, characteristics of their parents become more important to how they turn out than anything additional money can buy.

Doubling the income of poor families would lift most children above the poverty line, it would have virtually no effect on their test scores and only a slight effect on social behaviour. Among her findings, which have largely survive the test of time, are:

Mayer found that as parents have more money to spend, they usually spend the extra money on food, especially food eaten in restaurants; larger homes; and on more automobiles. As a result, children are likely to be better housed and better fed, but not necessarily better educated or better prepared for high-income jobs. Mayer said that her findings do not endorse massive cuts in welfare:

My results do not show that we can cut income support programs with impunity…Indeed, they suggest that income support programs have been relatively successful in maintaining the material living standard of many poor children.

Mayer found that non-monetary factors play a bigger role than previously thought in determining how children overcome disadvantage as she explains. Parent-child interactions appear to be important for children’s success, but the study shows little evidence that a parent’s income has a large influence on parenting practices.

Mayer said that if money alone were responsible for overcoming such problems as unwed pregnancy, low educational achievement and male idleness, states with higher welfare benefits could expect to see reductions in these problems. In reality

once we control all relevant state characteristics, the apparent effect of increasing Aid to Families with Dependent Children benefits is very small.

Social economics has been here before. In the 1960s, the Coleman Report rather than finding that investing in schools improved child outcomes found that most variation between child outcomes depended on family backgrounds. When we talking about schools not matter in too much we are talking about average bad schools and average good school not American inner-city schools into war zones.

Source: Savings, Genes, and Fade-Out, Bryan Caplan | EconLog | Library of Economics and Liberty.

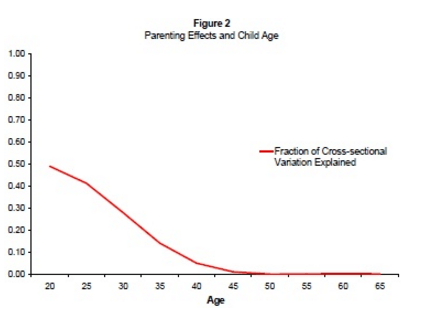

Behavioural genetics has been a bit of a blow to those that think greater parental investment can raise child outcomes as Bryan Caplan has explained:

Economists like Nobel laureate Gary Becker have been studying the family for decades. Like most modern parents, economists usually take it for granted that “parental investment” has large, lasting effects on adult outcomes.

And yet adoption and twin researchers find surprisingly little evidence for this this assumption(link is external)! With a few notable exceptions, the measured effect of upbringing on adult outcomes is small to zero. Adoptees barely resemble their adopting families, identical twins are much more similar than fraternal twins, and identical twins raised apart are often as similar as identical twins raised together. Almost all traits run in families, but the overarching reason is heredity.

Caplan notes that while it is extremely difficult for parental investments to change the adult outcomes of his children, it is well within his power to give his children a happy childhood.

08 Jan 2016 Leave a comment

in economics of education, labour economics, labour supply, occupational choice, politics - USA, poverty and inequality, welfare reform Tags: child poverty, family poverty, high school dropouts, marriage and divorce, single parents, success sequence

Source: The success sequence: Conservatives think they have a formula for raising people out of poverty.

.

06 Jan 2016 Leave a comment

in applied welfare economics, labour economics, labour supply, politics - New Zealand, welfare reform Tags: 1996 US welfare reforms, child poverty, family poverty, universal basic income

Jess Berentson-Shaw’s series on child poverty in the Dominion Post on child poverty had two major flaws. She argues that the solution to child poverty is to give more families more money.

The first flaw is she does not discuss previous failed attempts to solve poverty with more money. For example, Bob Hawke promised in the 1987 election that no child need live in poverty by 1990. Raising the family allowance to $1 above the family poverty line did not fix child poverty. That promise was the one Hawke later said he regretted most in his public life.

During the 1987 Australian Federal election campaign, Labour Party Prime Minister Bob Hawke announced a Family Allowance Supplement that would ensure no Australian child need live in poverty by 1990. These changes in social welfare benefits and family allowance supplements would ensure that every family would be paid one per week dollar more than the poverty threshold applicable to their family situation. I know child poverty was to be done in this way because I worked in the Prime Minister’s Department at this time.

About 580,000 Australian children lived in poverty in 1987. In 2007, at least 13 per cent of children, or 730,000 people, were poor. This was after social welfare benefits and family allowance supplements were increased to $1 above the child poverty threshold.

There is an infallible test of the practicality of Left over Left dreams such as the abolition of child poverty by writing bigger and bigger cheques to those currently poor.

If you could abolish child poverty simply by increasing welfare benefits and family allowances, the centre-right parties would be all over it like flies to the proverbial as a way of camping over the middle ground and winning the votes of socially conscious swinging voters for decades to come. Many people who would naturally vote for the centre-right parties on all other issues vote for centre-left parties out of a concern for poverty and a belief that centre-left parties will give a better deal to the poor.

The notion that poverty is simply the result of a lack of money and giving people more money will abolish child poverty has never worked. As the OECD (2009, p. 171) observed:

It would be naïve to promote increasing the family income for children through the tax-transfer system as a cure-all to problems of child well-being.

Berentson-Shaw’s second major flaw is she does not discuss the success of the 1996 US federal welfare reforms. Any serious participant in discussions of child poverty must address those 1996 US reforms.

These reforms cut Hispanic and black child poverty rates by 1/3rd in a few years by moving single mothers into employment. Time limits on welfare for single parents reduced caseloads by two thirds, 90% in some states.

After the 1996 US Federal welfare reforms, the subsequent declines in welfare participation rates and gains in employment were largest among the single mothers previously thought to be most disadvantaged: young (ages 18-29), mothers with children aged under seven, high school drop-outs, and black and Hispanic mothers. These low-skilled single mothers were thought to face the greatest barriers to employment. Blank (2002) found that:

…nobody of any political persuasion predicted or would have believed possible the magnitude of change that occurred in the behaviour of low-income single-parent families.

Employment are never married mothers increased by 50% after the US well for a reforms: employment of single mothers with less than a high school education increased by two-thirds; and employment of single mothers aged 18 to 24 approximately doubled.

Working population poverty is unchanged despite declines in elderly and child poverty #PovertyIs http://t.co/i7O7dTEUg2—

Political Line (@PoliticalLine) June 19, 2015

With the enactment of welfare reform in 1996, black child poverty fell by more than a quarter to 30% in 2001. Over a six-year period after welfare reform, 1.2 million black children were lifted out of poverty. In 2001, despite a recession, the poverty rate for black children was at the lowest point in national history.

Proposal to make child-care tax credit refundable would boost employment of working mothers bit.ly/1i1Xzcq https://t.co/2xlQQtPRJs—

The Hamilton Project (@hamiltonproj) October 29, 2015

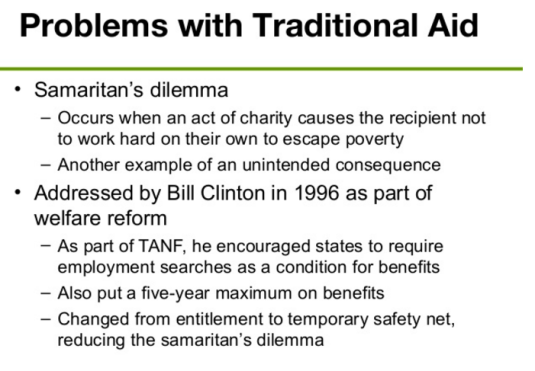

The only modern welfare reforms to significantly cut child poverty were the US federal welfare reforms. They emphasised helping those who helped themselves, which is the classic Samaritans’ dilemma.

Countless studies show that when comparing the carrot and the stick in welfare reform, the stick is always more effective in reducing poverty and increasing employment.

The typical white family still makes $25,000 more than the typical black one: washingtonpost.com/news/wonkblog/… http://t.co/CEOADLSJdx—

Demos Action (@DemosAction) September 16, 2015

The best solution to child poverty is to move their parents into a job. Simon Chapple is clear in his book last year with Jonathan Boston:

Sustained full-time employment of sole parents and the fulltime and part-time employment of two parents, even at low wages, are sufficient to pull the majority of children above most poverty lines, given the various existing tax credits and family supports.

The best available analysis, the most credible analysis, the most independent analysis in New Zealand or anywhere else in the world that having a job and marrying the father of your child is the secret to the leaving poverty is recently by the Living Wage movement in New Zealand.

According to the calculations of the Living Wage movement, earning only $19.25 per hour with a second earner working only 20 hours affords their two children, including a teenager, Sky TV, pets, annual international travel, video games and 10-hours childcare.

This analysis of the Living Wage movement shows that finishing school so your job pays something reasonable and marrying the father of your child affords a comfortable family life. In the USA this is called the success sequence.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Scholarly commentary on law, economics, and more

Beatrice Cherrier's blog

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Why Evolution is True is a blog written by Jerry Coyne, centered on evolution and biology but also dealing with diverse topics like politics, culture, and cats.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

A rural perspective with a blue tint by Ele Ludemann

DPF's Kiwiblog - Fomenting Happy Mischief since 2003

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

The world's most viewed site on global warming and climate change

Tim Harding's writings on rationality, informal logic and skepticism

A window into Doc Freiberger's library

Let's examine hard decisions!

Commentary on monetary policy in the spirit of R. G. Hawtrey

Thoughts on public policy and the media

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Politics and the economy

A blog (primarily) on Canadian and Commonwealth political history and institutions

Reading between the lines, and underneath the hype.

Economics, and such stuff as dreams are made on

"The British constitution has always been puzzling, and always will be." --Queen Elizabeth II

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

WORLD WAR II, MUSIC, HISTORY, HOLOCAUST

Undisciplined scholar, recovering academic

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Res ipsa loquitur - The thing itself speaks

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Researching the House of Commons, 1832-1868

Articles and research from the History of Parliament Trust

Reflections on books and art

Posts on the History of Law, Crime, and Justice

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Exploring the Monarchs of Europe

Cutting edge science you can dice with

Small Steps Toward A Much Better World

“We do not believe any group of men adequate enough or wise enough to operate without scrutiny or without criticism. We know that the only way to avoid error is to detect it, that the only way to detect it is to be free to inquire. We know that in secrecy error undetected will flourish and subvert”. - J Robert Oppenheimer.

The truth about the great wind power fraud - we're not here to debate the wind industry, we're here to destroy it.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Economics, public policy, monetary policy, financial regulation, with a New Zealand perspective

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Restraining Government in America and Around the World

Recent Comments