The Reserve Bank announced: “Following the completion of the review commissioned by the Board in March, we are pleased to announce modernised capital rules that will support an efficient and resilient financial system,” said Rodger Finlay, Chair of the RBNZ Board. “We recalibrated our risk appetite to have regard to our new Financial Policy Remit,…

Reserve Bank sees sense

Reserve Bank sees sense

08 Jan 2026 Leave a comment

in business cycles, macroeconomics, monetary economics, politics - New Zealand

Political pressure on the Fed

05 Dec 2025 Leave a comment

in business cycles, econometerics, economic history, economics of bureaucracy, macroeconomics, monetary economics, politics - USA, Public Choice Tags: monetary policy

From a forthcoming paper by Thomas Drechsel: This paper combines new data and a narrative approach to identify variation in political pressure on the Federal Reserve. From archival records, I build a data set of personal interactions between U.S. Presidents and Fed officials between 1933 and 2016. Since personal interactions do not necessarily reflect political…

Political pressure on the Fed

Some simple economics of AI and macro cycles

20 Oct 2025 Leave a comment

in applied price theory, business cycles, economic growth, entrepreneurship, history of economic thought, macroeconomics

Has AI been propping up the American economy? For instance “the Bureau of Economic Analysis’s category for investment in information processing equipment and software accounts for over 90 percent of economic growth in the first half of 2025.” The key question is what would have been done with those resources otherwise. Regardless of their specific […]

Some simple economics of AI and macro cycles

My excellent Conversation with George Selgin

19 Oct 2025 Leave a comment

in applied price theory, business cycles, economic history, fiscal policy, great depression, history of economic thought, macroeconomics, monetary economics Tags: monetary policy

Here is the audio, video, and transcript. Here is part of the episode summary: Tyler and George discuss the surprising lack of fiscal and monetary stimulus in the New Deal, whether revaluing gold was really the best path to economic reflation, how much Glass-Steagall and other individual parts of the New Deal mattered, Keynes’ “very […]

My excellent Conversation with George Selgin

Ninth Karl Brunner Distinguished Lecture by John H. Cochrane, 02.10.2025

14 Oct 2025 Leave a comment

in budget deficits, business cycles, economic growth, fiscal policy, history of economic thought, macroeconomics, monetarism, monetary economics

Understanding Financial Instability in Argentina

01 Oct 2025 Leave a comment

in business cycles, economic growth, fiscal policy, international economics, liberalism, libertarianism, macroeconomics, monetary economics, politics - USA Tags: Argentina

Earlier this month, shortly after some depressing results in a regional election in Argentina, I was interviewed by Patrick Young. In this clip, I express concern Argentine voters will backslide to Peronism. As one might expect, some people are concerned the Peronist victory in the Buenos Aires regional election could be a harbinger of bad […]

Understanding Financial Instability in Argentina

Monetary policy needs mates

29 Sep 2025 Leave a comment

in budget deficits, business cycles, economic growth, fiscal policy, inflation targeting, macroeconomics, monetary economics, politics - New Zealand Tags: monetary policy

The NZ Initiative has a research note out on how fiscal policy needs to work with monetary policy. They comment: This analysis does not dispute that the RBNZ’s high interest rates were the proximate cause of the downturn. However, it argues the Bank had little choice. It was confronted with the insidious threat of inflation […]

Monetary policy needs mates

Revisiting Empirical Macroeconomics with Robert Barro (Harvard Economics…

28 Sep 2025 Leave a comment

in budget deficits, business cycles, economic growth, fiscal policy, history of economic thought, macroeconomics, monetary economics

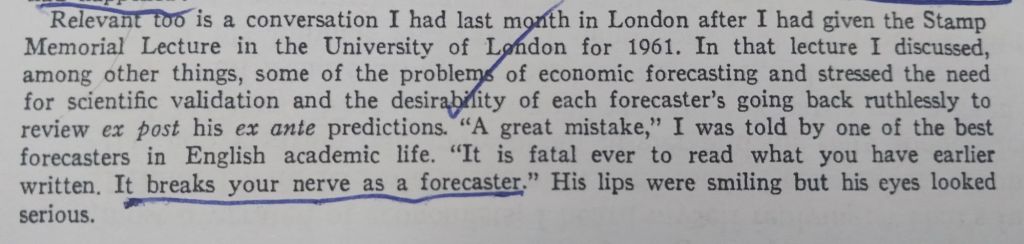

Samuelson on forecasting as a vocation

23 Sep 2025 Leave a comment

in budget deficits, business cycles, economic growth, fiscal policy, human capital, labour economics, macroeconomics, occupational choice Tags: forecasting errors

Intangible Capital and Measured Productivity

23 Sep 2025 Leave a comment

in business cycles, economic growth, economic history, global financial crisis (GFC), great recession, macroeconomics Tags: real business cycle theory

💰 Inflation, Debt & The Future of the Economy | A Conversation with John Cochrane

12 Sep 2025 1 Comment

in budget deficits, business cycles, currency unions, fiscal policy, history of economic thought, inflation targeting, macroeconomics, Milton Friedman, monetarism, monetary economics Tags: monetary policy

Reading Grant Robertson

25 Aug 2025 Leave a comment

in budget deficits, business cycles, economic growth, economic history, economics of bureaucracy, fiscal policy, inflation targeting, macroeconomics, monetary economics, politics - New Zealand, Public Choice Tags: economics of pandemics, monetary policy

I got home from Papua New Guinea at 1:30 on Saturday morning and by 3:30 yesterday afternoon I’d finished Grant Robertson’s new book, Anything Could Happen, and in between I’d been to two film festival movies, a 60th birthday party, and church. It is that sort of book, a pretty easy read. In some respects, […]

Reading Grant Robertson

Partisan Bias in Professional Macroeconomic Forecasts

27 Jul 2025 Leave a comment

in business cycles, economic growth, macroeconomics, politics - USA Tags: forecasting errors

Here is a recent paper by Benjamin S. Kay, Aeimit Lakdawala, and Jane Ryngaert: Using a novel dataset linking professional forecasters in the Wall Street Journal Economic Forecasting Survey to their political affiliations, we document a partisan bias in GDP growth forecasts. Republican-affiliated forecasters project 0.3-0.4 percentage points higher growth when Republicans hold the presidency, […]

Partisan Bias in Professional Macroeconomic Forecasts

Greg Mankiw on Modern Monetary Theory

30 Jun 2025 Leave a comment

in applied price theory, budget deficits, business cycles, economic growth, economics of education, fiscal policy, macroeconomics, monetary economics Tags: cranks, monetary policy

Modern Monetary Theory (MMT) had a real moment in the spotlight in the late 2010s, with political support in the US from Presidential hopefuls Bernie Sanders and Alexandria Ocasio-Cortez. However, mainstream economists mostly didn’t understand it, or ridiculed it, or both. I mostly ignored the detail of it, only picking up what I knew about it from…

Greg Mankiw on Modern Monetary Theory

Recent Comments