What happened to the US labor market after the Emergency Unemployment Compensation Act expired after the Great Recession?By Tyler Smith of The AEA. “In December 2013, when Congress failed to reauthorize the Emergency Unemployment Compensation Act, many prominent economists predicted a substantial decline in employment and labor force participation. In a paper in the American Economic Journal:…

The effects of unemployment benefit duration

Intangible Capital and Measured Productivity

23 Sep 2025 Leave a comment

in business cycles, economic growth, economic history, global financial crisis (GFC), great recession, macroeconomics Tags: real business cycle theory

*Crisis Cycle*

02 Jun 2025 Leave a comment

in budget deficits, business cycles, currency unions, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, history of economic thought, international economic law, international economics, macroeconomics, monetarism, monetary economics, Public Choice Tags: European Union

That is the new book by John H. Cochrane, Luis Garicano, and Klaus Masuch, and the subtitle is Challenges, Evolution, and Future of the Euro. Excerpt: Our main theme is not actions taken in crises, but that member states and EU institutions did not clean up between crises. They did not reestablish a sustainable framework […]

*Crisis Cycle*

Why the housing market imploded

29 Apr 2025 Leave a comment

in applied price theory, behavioural economics, economic history, economics of information, financial economics, global financial crisis (GFC), great recession, macroeconomics, monetary economics

In a recent paper, Christopher L. Foote, Kristopher S. Gerardi, and Paul S. Willen report (pdf): This paper presents 12 facts about the mortgage market. The authors argue that the facts refute the popular story that the crisis resulted from financial industry insiders deceiving uninformed mortgage borrowers and investors. Instead, they argue that borrowers and […]

Why the housing market imploded

When Genius Failed

10 Apr 2025 1 Comment

in applied price theory, business cycles, economic growth, economics of information, economics of regulation, entrepreneurship, financial economics, global financial crisis (GFC), history of economic thought, industrial organisation, macroeconomics, politics - USA

Myron Scholes was on top of the world in 1997, having won the Nobel Prize in economics that year for his work in financial economics, work that he had applied in the real world in a wildly successful hedge fund, Long Term Capital Management. But just one year later, LTCM was saved from collapse only […]

When Genius Failed

Forty years of floating

01 Mar 2025 Leave a comment

in budget deficits, business cycles, economic growth, economic history, Euro crisis, global financial crisis (GFC), great recession, history of economic thought, inflation targeting, macroeconomics, monetary economics Tags: floating exchange rates

Last year there was an interesting new book out, made up of 29 collected short papers by (more or less) prominent economists given at a 2023 conference to mark Floating Exchange Rates at Fifty. The fifty years related to the transition back to generalised floating of the major developed world currencies in 1973 (think USD, […]

Forty years of floating

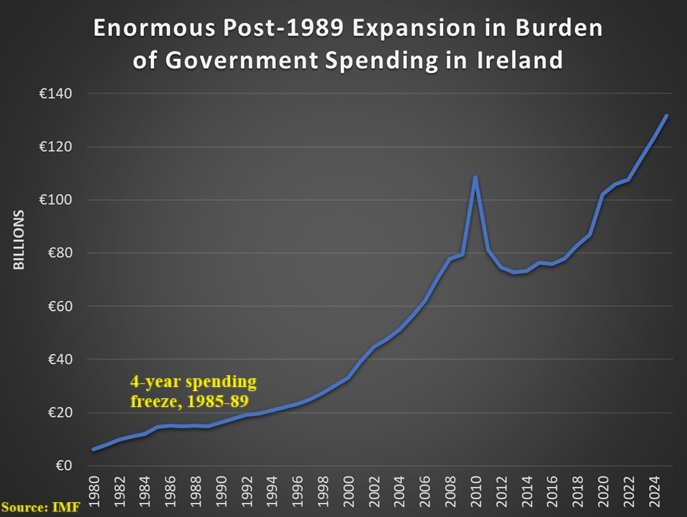

Ireland: Good Corporate Tax Policy vs. Bad Government Spending Policy

11 Feb 2025 Leave a comment

in budget deficits, business cycles, economic growth, economic history, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, labour economics, labour supply, law and economics, macroeconomics, monetary economics, public economics Tags: Ireland, taxation and investment

I’m a big fan of Ireland’s low corporate tax rate for three reasons. First, it shows that good tax policy generates positive economic outcomes as per-capita GDP in Ireland has grown by record amounts. Second, it shows that lower tax rates can in some cases lead to more revenue. Sort of a turbo-charged version of […]

Ireland: Good Corporate Tax Policy vs. Bad Government Spending Policy

Some Links

12 Jan 2025 Leave a comment

in applied price theory, budget deficits, development economics, economic growth, economic history, economics of regulation, entrepreneurship, fiscal policy, global financial crisis (GFC), great recession, growth disasters, growth miracles, human capital, income redistribution, industrial organisation, international economics, job search and matching, labour economics, labour supply, macroeconomics, monetary economics, poverty and inequality, Public Choice, rentseeking, survivor principle, unemployment

TweetGMU Econ alum Holly Jean Soto busts the myth of “greedflation.” Scott Lincicome identifies an interesting contrast between the facts and opinion about China. George Will decries the spinelessness of the modern U.S. Congress. A slice: The incoming president will be able, on a whim, to unilaterally discombobulate international commerce — and the domestic economy…

Some Links

Failing Banks

11 Sep 2024 Leave a comment

in business cycles, economic history, financial economics, global financial crisis (GFC), great depression, great recession, macroeconomics, monetary economics, politics - USA Tags: bank panics, bank runs

From Sergio Correia, Stephan Luck, and Emil Verner: Why do banks fail? We create a panel covering most commercial banks from 1865 through 2023 to study the history of failing banks in the United States. Failing banks are characterized by rising asset losses, deteriorating solvency, and an increasing reliance on expensive non-core funding. Commonalities across…

Failing Banks

Caught out! The NZ Initiative’s Article in the Herald Blaming the RBNZ for our Rip-Off Big Banks is Contradicted by its Own Expert Witness. (Willis Beware).

06 Jun 2024 Leave a comment

in applied price theory, global financial crisis (GFC), great recession, industrial organisation, law and economics, macroeconomics, monetary economics, politics - New Zealand Tags: competition law

When it comes to the question of how best to avoid a banking collapse and multi-billion dollar bailout that can drag a whole nation into depression, the best solution, according to Chicago-Stanford economist, John Cochrane, is to require banks to set aside a fraction of their own funds as reserves to cover losses they may…

Caught out! The NZ Initiative’s Article in the Herald Blaming the RBNZ for our Rip-Off Big Banks is Contradicted by its Own Expert Witness. (Willis Beware).

Bailouts Forever

02 Jun 2024 Leave a comment

in business cycles, economic history, financial economics, global financial crisis (GFC), macroeconomics, monetary economics, politics - USA Tags: deposit insurance

When interest rates rise, the price of long-term assets falls. Consequently, when the Fed began raising interest rates in 2022, the value of bonds and mortgages dropped, causing significant accounting losses for banks heavily invested in these assets. Silicon Valley Bank went bust, for example, because depositors fled upon realizing it was holding lots of […]

Bailouts Forever

The Euro at 25

03 Feb 2024 Leave a comment

in budget deficits, currency unions, economic history, economics of bureaucracy, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, inflation targeting, macroeconomics, monetary economics, Public Choice Tags: Euro

The euro technically started in 1999, when the 11 founding European members of the currency agreed to keep their exchange rates fixed and to hand over monetary policy to the European Central Bank. The euro then became the actual currency that people and firms used in 2002. I confess that, back in the early 1990s,…

The Euro at 25

190308 [Webinar] Consistent Economic Policy and Economic Development

29 Dec 2023 Leave a comment

in applied price theory, budget deficits, business cycles, defence economics, economic growth, economic history, economics of information, Euro crisis, fiscal policy, fisheries economics, global financial crisis (GFC), great recession, growth disasters, growth miracles, history of economic thought, human capital, inflation targeting, labour economics, labour supply, macroeconomics, monetary economics, Public Choice, public economics, unemployment

FMI Public Speaker Series – Finn Kydland

23 Dec 2023 Leave a comment

in applied price theory, budget deficits, business cycles, comparative institutional analysis, development economics, economic growth, economic history, economics of bureaucracy, fiscal policy, global financial crisis (GFC), great depression, great recession, growth disasters, growth miracles, history of economic thought, human capital, income redistribution, labour economics, labour supply, macroeconomics, Public Choice, public economics, rentseeking

Finn E. Kydland Nobel Lecture at CERGE-EI

22 Dec 2023 Leave a comment

in applied price theory, budget deficits, business cycles, comparative institutional analysis, development economics, economic growth, economic history, economics of regulation, fiscal policy, global financial crisis (GFC), great depression, great recession, growth disasters, growth miracles, history of economic thought, human capital, income redistribution, labour economics, labour supply, macroeconomics, monetary economics, Public Choice, public economics

Recent Comments