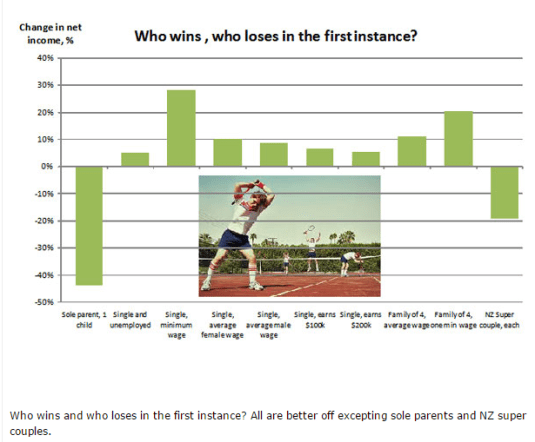

Who loses from Morgan’s #UBI of $11,000?

13 Aug 2017 Leave a comment

in labour economics, politics - New Zealand, poverty and inequality, public economics, welfare reform Tags: 2017 New Zealand election, universal basic income

Debt repayment does not rule out tax cuts

20 Jul 2017 Leave a comment

in budget deficits, politics - New Zealand, public economics

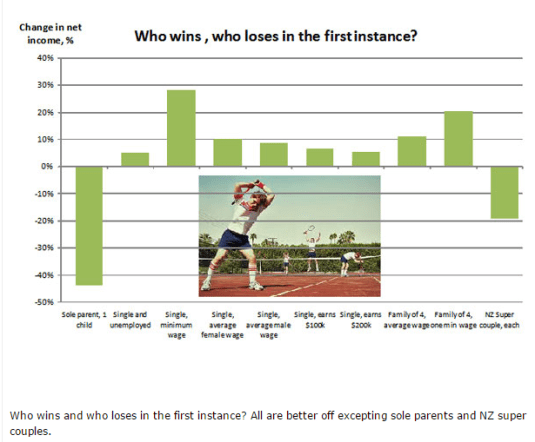

The case for a tax cut is a distinct issue from repaying the recent large budget deficits and balancing the budget over the business cycle.

Ministers of Finance should pay more attention to the concept of tax smoothing. Unless something special is happening, income tax rates should be similar from one year to another. We should keep tax rates fairly smooth by borrowing during recessions and emergencies.

Instead, the Government not indexing the income tax thresholds for inflation collected $2.1 billion in extra revenue since 2008 according to Parliamentary Library calculations. Raising the income tax rate thresholds is becoming more pressing. Income growth is starting to push many ordinary taxpayers uncomfortably close to the next threshold and a much higher marginal tax rate. For example, 30% rather than the 17.5% income tax rate many taxpayers face.

New Zealand is already left behind on company tax rates; ours is currently 28%. The Australian company tax rate may drop to 25%; the British company tax rate is going down to 17% by 2020.

Large public deficits have their place

Prudent public debt management dictates that governments run temporary budget deficits in recessions and other emergencies such as the Canterbury earthquake and repay that debt as better times return. Recessions and natural disasters are infrequent so this extra debt should be paid down at a measured speed, not a frantic pace at the expense of other tax policy goals.

An increase in the budget deficit smooths over these bad times and avoids taxes going up and down like a Jack-in-the-Box over the business cycle. Who raises taxes in a recession?

Beware of foul-weather fiscal conservatives

After the start of the recession in 2009, foul weather fiscal conservatives wanted to do just that. The same usual suspects who always advocate bigger government argued for higher taxes rather than running a larger budget deficit, which New Zealand did. Imagine the massive income tax rises required every recession and in the last recession in particular if the large budget deficits were not run?

The large public debt from the temporary budget deficits that smoothed over the last recession is no special or additional reason to postpone income tax cuts. A sound long-term fiscal strategy has tax rates at levels that make up on the deficits in bad times with surpluses in the good times. Slowly repaying debts accumulated in a recession is a routine part of prudent public debt management.

There is room for tax cuts

Every budget allocates about $1.5 billion for new policy proposals that can be adopted without the Treasury thinking that they might harm long-term fiscal stability.

New Zealand budget allows for up to $1.5 billion on new policies every year. If this new spending was justified despite the large public debt from the recent recession, some tax cuts are too. They could start with raising the income tax rate thresholds to make up for past inflation.

Badge of honour: blocked by Morgan on Twitter and now Facebook @top_nz

18 Jul 2017 Leave a comment

in applied price theory, politics - New Zealand, public economics

Cannot comment on Gareth Morgan’s Facebook page anymore. Can’t handle the truth. I wrote an extensive critique of his universal basic income but he does not want to discuss the evidence or the logical flaws of his policy proposal. The only people who lose out from his universal basic income are those for whom the modern welfare state was founded to protect.

What set Gareth Morgan off on his Facebook page was when I commented pointing out that the optimal rate of tax on income from capital to zero. All I said was “optimal tax theory including that pioneered by Stiglitz and Merrlees, economists of impeccable left-wing credentials, show that taxes on the income from capital should be low because the deadweight social costs of taxes on capital are very high”. His response was anti-intellectualism.

Economics of California’s AB32 Global Warming Regulation

25 May 2017 Leave a comment

in economics, energy economics, environmental economics, global warming, Public Choice, public economics, rentseeking, transport economics, urban economics Tags: carbon tax, carbon trading, club goods, expressive voting, public goods

Matthew E. Kahn on California Voter Support for Low Carbon Policies

18 May 2017 Leave a comment

in applied price theory, energy economics, environmental economics, global warming, politics - USA, Public Choice, public economics, rentseeking Tags: carbon tax, carbon trading, expressive voting, global warming, voter demographics

Short Cut: Macron’s Scandi-Solution for France

16 May 2017 Leave a comment

in economics, fiscal policy, labour supply, macroeconomics, minimum wage, Public Choice, public economics, welfare reform

Macroeconomic Consequences of Taxing the Rich

11 May 2017 Leave a comment

in fiscal policy, macroeconomics, politics - USA, Public Choice, public economics, sports economics Tags: taxation and labour supply, top 1%

Who Really Pays Business Taxes?

06 May 2017 Leave a comment

in applied price theory, Milton Friedman, Public Choice, public economics Tags: tax incidence

Trailblazers: The New Zealand Story – Full Video

29 Apr 2017 Leave a comment

in economic history, economics of regulation, industrial organisation, politics - New Zealand, Public Choice, public economics, rentseeking, survivor principle

Important to mention tax credits when discussing the working poor? @JordNZ

21 Apr 2017 Leave a comment

in labour economics, politics - New Zealand, poverty and inequality, public economics, welfare reform Tags: child poverty, family poverty, family tax credits, taxation and labour supply

Which matters more to the incentive effects of income tax? @JordNZ

20 Apr 2017 Leave a comment

in politics - New Zealand, public economics Tags: average tax rates, family taxation, Marginal tax rates, taxation and labour supply

So New Zealanders do not pay much income tax @TaxpayersUnion

19 Apr 2017 Leave a comment

in politics - USA, public economics Tags: family tax credits, family taxation, Marginal tax rates, taxation and labour supply

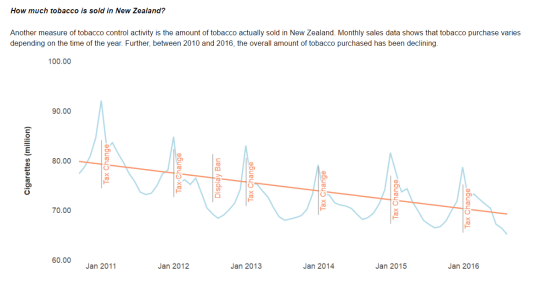

Do smokers stockpile in anticipation of tax rises?

16 Apr 2017 Leave a comment

Source: TCDR – Overview

Recent Comments