How Taxes Affect Investment Decisions For Multinational Firms onforb.es/1Oe5lKu by @ErikCederwall http://t.co/BduZZbHs2n—

Tax Foundation (@taxfoundation) April 15, 2015

How Taxes Affect Investment Decisions For Multinational Firms

11 May 2015 Leave a comment

in applied price theory, politics - Australia, politics - New Zealand, politics - USA, public economics Tags: company tax rates, foreign investment, multinational corporations, tax competition

Swedosclerosis and the British disease compared, 1950–2013

03 May 2015 2 Comments

in economic growth, economic history, entrepreneurship, macroeconomics, Public Choice, public economics Tags: British disease, British economy, Margaret Thatcher, poor man of Europe, Sweden, Swedosclerosis, taxation and the labour supply, welfare state

In 1970, Sweden was labelled as the closest thing we could get to Utopia. Both the welfare state and rapid economic growth – twice as fast as the USA for the previous 100 years.

Of course the welfare state was more of a recent invention. Assar Lindbeck has shown time and again in the Journal of Economic Literature and elsewhere that Sweden became a rich country before its highly generous welfare-state arrangements were created

Sweden moved toward a welfare state in the 1960s, when government spending was about equal to that in the United States – less that 30% of GDP.

Sweden could afford to expand its welfare state at the end of the era that Lindbeck labelled ‘the period of decentralization and small government’. Swedes in the 60s had the third-highest OECD per capita income, almost equal to the USA in the late 1960s, but higher levels of income inequality than the USA.

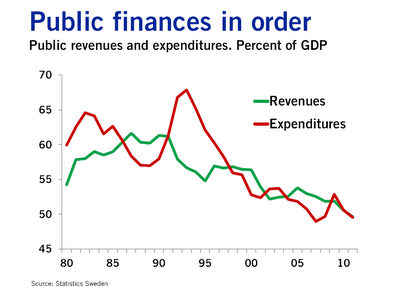

By the late 1980s, Swedish government spending had grown from 30% of gross domestic product to more than 60% of GDP. Swedish marginal income tax rates hit 65-75% for most full-time employees as compared to about 40% in 1960. What happened to the the Swedish economic miracle when the welfare state arrived?

In the 1950s, Britain was also growing quickly, so much so that the Prime Minister of the time campaigned on the slogan you never had it so good.

By the 1970s, and two spells of labour governments, Britain was the sick man of Europe culminating with the Winter of Discontent of 1978–1979. What happened?

Sweden and Britain in the mid-20th century are classic examples of Director’s Law of Public Expenditure. Once a country becomes rich because of capitalism, politicians look for ways to redistribute more of this new found wealth. What actually happened to the Swedish and British growth performance since 1950 relative to the USA as the welfare state grew?

Figure 1: Real GDP per Swede, British and American aged 15-64, converted to 2013 price level with updated 2005 EKS purchasing power parities, 1950-2013, $US

Source: Computed from OECD Stat Extract and The Conference Board, Total Database, January 2014, http://www.conference-board.org/economics

Figure 1 is not all that informative other than to show that there is a period of time in which Sweden was catching up with the USA quite rapidly in the 1960s. That then stopped in the 1970s to the late 1980s. The rise of the Swedish welfare state managed to turn Sweden into the country that was catching up to be as rich as the USA to a country that was becoming as poor as Britain.

Figure 2: Real GDP per Swede, British and American aged 15-64, converted to 2013 price level with updated 2005 EKS purchasing power parities, detrended, 1.9%, 1950-2013

Source: Computed from OECD Stat Extract and The Conference Board, Total Database, January 2014, http://www.conference-board.org/economics

Figure 2 which detrends British and Swedish growth since 1950 by 1.9% is much more informative. The US is included as the measure of the global technological frontier growing at trend rate of 1.9% in the 20th century. A flat line indicates growth at 1.9% for that year. A rising line in figure 2 means above-trend growth; a falling line means below trend growth for that year. Figure 2 shows the USA growing more or less steadily for the entire post-war period. There were occasional ups and downs with no enduring departures from trend growth 1.9% until the onset of Obamanomics.

Figure 2 illustrates the volatility of Swedish post-war growth. There was rapid growth up until 1970 as the Swedes converged on the living standards of Americans. This growth dividend was then completely dissipated.

Swedosclerosis set in with a cumulative 20% drop against trend growth. The Swedish economy was in something of a depression between 1970 and 1990. Swedish economists named the subsequent economic stagnation Swedosclerosis:

- Economic growth slowed to a crawl in the 1970s and 1980s.

- Sweden dropped from near the top spot in the OECD rankings to 18th by 1998 – a drop from 120% to 90% of the OECD average inside three decades.

- 65% of the electorate receive (nearly) all their income from the public sector—either as employees of government agencies (excluding government corporations and public utilities) or by living off transfer payments.

- No net private sector job creation since the 1950s, by some estimates!

Prescott’s definition of a depression is when the economy is significantly below trend, the economy is in a depression. A great depression is a depression that is deep, rapid and enduring:

- There is at least one year in which output per working age person is at least 20 percent below trend; and

- there is at least one year in the first decade of the great depression in which output per working age person is at least 15 percent below trend; and

-

There is no significant recovery during the period in the sense that there is no subperiod of a decade or longer in which the growth of output per working age person returns to rates of 2 percent or better.

The Swedish economy was not in a great depression between 1970 and 1990 but it meets some of the criteria for a depression but for the period of trend growth between1980 and 1986.

Between 1970 and 1980, output per working age Swede fell to 10% below trend. This happened again in the late 80s to the mid-90s to take Sweden 20% below trend over a period of 25 years.

Some of this lost ground was recovered after 1990 after tax and other reforms were implemented by a right-wing government. The Swedish economic reforms from after 1990 economic crisis and depression are an example of a political system converging onto more efficient modes of income redistribution as the deadweight losses of taxes on working and investing and subsidies for not working both grew.

The Swedish economy since 1950 experienced three quite distinct phases with clear structural breaks because of productivity shocks. There was rapid growth up until 1970; 20 years of decline – Swedosclerosis; then a rebound again under more liberal economic policies.

The sick man of Europe actually did better than Sweden over the decades since 1970. The British disease resulted in a 10% drop in output relative to trend in the 1970s, which counts as a depression.

There was then a strong recovery through the early-1980s with above trend growth from the early 1980s until 2006 with one recession in between in 1990. So much for the curse of Thatchernomics?

After falling behind for most of the post-war period, the UK had a better performance compared with other leading countries after the 1970s.

This continues to be true even when we include the Great Recession years post-2008. Part of this improvement was in the jobs market (that is, more people in work as a proportion of the working-age population), but another important aspect was improvements in productivity…

Contrary to what many commentators have been writing, UK performance since 1979 is still impressive even taking the crisis into consideration. Indeed, the increase in unemployment has been far more modest than we would have expected. The supply-side reforms were not an illusion.

John van Reenen goes on to explain what these supply-side reforms were:

These include increases in product-market competition through the withdrawal of industrial subsidies, a movement to effective competition in many privatised sectors with independent regulators, a strengthening of competition policy and our membership of the EU’s internal market.

There were also increases in labour-market flexibility through improving job search for those on benefits, reducing replacement rates, increasing in-work benefits and restricting union power.

And there was a sustained expansion of the higher-education system: the share of working-age adults with a university degree rose from 5% in 1980 to 14% in 1996 and 31% in 2011, a faster increase than in France, Germany or the US. The combination of these policies helped the UK to bridge the GDP-per-capita gap with other leading nations.

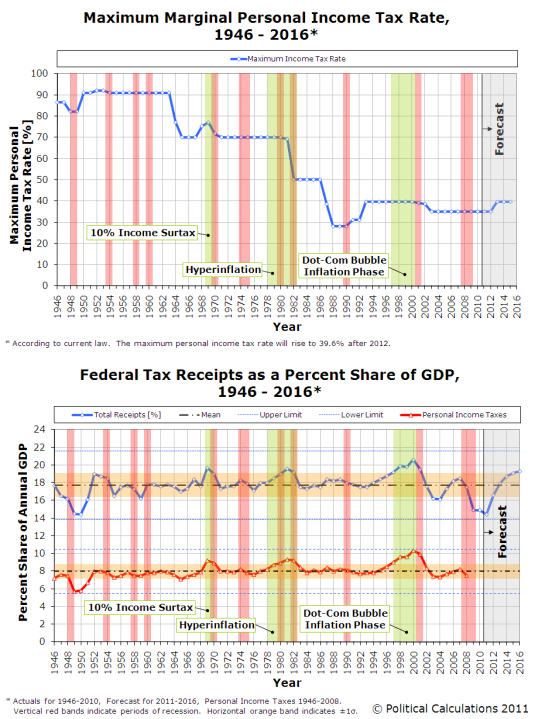

Hauser’s Law: No matter what post-war tax rates have been, tax revenues remained at about 19.5% of GDP in the USA

01 May 2015 Leave a comment

in politics - USA, Public Choice, public economics Tags: Director's Law, laffer curve

Who pays the highest income tax rate?

01 May 2015 Leave a comment

in politics - Australia, politics - New Zealand, politics - USA, public economics Tags: average tax rates, Marginal tax rates, vaccination and the labour supply

Highest income #tax rate among #OECD countries? Belgium with 42.8% statista.com/chart/3337/whe… http://t.co/RgaWxsGPzB—

Statista (@StatistaCharts) March 25, 2015

In yet another victory for the top 1% and neoliberalism, they pay most of of the income tax in the USA

30 Apr 2015 Leave a comment

in entrepreneurship, income redistribution, Public Choice, public economics Tags: capital of freedom, entrepreneurial alertness, neoliberalism, top 1%

Taxpayers in every country should get one of these charts

29 Apr 2015 Leave a comment

in income redistribution, politics - Australia, politics - New Zealand, politics - USA, Public Choice, public economics, rentseeking Tags: public sector transparency

Tax summary: here's another honest/informative version of @hmtreasury chart by @StrongerInNos that explains "welfare" http://t.co/SeH9FJIRWq—

Jonathan Portes (@jdportes) November 02, 2014

In another neoliberal victory, income taxes became more progressive in recent decades

28 Apr 2015 Leave a comment

in economic history, politics - USA, Public Choice, public economics Tags: conspiracy theories, Leftover Left, neoliberalism, taxation in the labour supply, top 1%

How much does each income group pay in taxes? bit.ly/1JHSCik by @aplundeen http://t.co/B66ynsUrkc—

Tax Foundation (@taxfoundation) April 14, 2015

The U.S. Income Tax system is progressive bit.ly/1FG9Usm by @aplundeen http://t.co/HXDWbvv1xy—

Tax Foundation (@taxfoundation) April 15, 2015

In another neo-liberal victory, health and welfare spending shares have doubled in the last 50 years

24 Apr 2015 Leave a comment

in income redistribution, politics - USA, Public Choice, public economics Tags: Director's Law, Leftover Left, median voter theorem, neoliberalism, tax reform, welfare state

The impact of the top tax rate in the depth and severity of the great depression

24 Apr 2015 Leave a comment

in business cycles, fiscal policy, great depression, macroeconomics, politics - New Zealand, politics - USA, public economics Tags: capital taxation, New Zealand, taxation and the labour supply, top tax rate

Source: Ellen McGrattan.

There were large differences in increases in the 1930s in the top marginal income tax rate between Sweden, the UK, France with Australia and New Zealand and between the USA and Canada and the rest as McGrattan explains:

These data show that there is a strong negative correlation, roughly −94%, between the change in the top income tax rates and the deviation in per capita real GDP relative to trend in 1933.

Company tax rates around the world

24 Apr 2015 Leave a comment

in international economics, politics - Australia, politics - New Zealand, politics - USA, Public Choice, public economics Tags: company tax rate, tax competition

The UK Greens tax and spending plans

22 Apr 2015 Leave a comment

in income redistribution, Public Choice, public economics Tags: British general election, expressive voting, rational ignorance, rational irrationality, Uk Greens, UK politics

What are the revenue effects of capital gains tax cuts?

19 Apr 2015 Leave a comment

in politics - Australia, politics - New Zealand, politics - USA, public economics Tags: dynamic scoring, laffer curve, optimal taxation, taxation of capital income

Average tax rates on consumption, investment, labour and capital in USA, UK and Canada, 1950-2013

17 Apr 2015 5 Comments

in business cycles, economic growth, economic history, fiscal policy, global financial crisis (GFC), great recession, macroeconomics, politics - USA, public economics Tags: British economy, Canada, sick man of Europe, tax incidence, tax reform

Income taxes in the USA and UK didn’t change all that much after the mid-70s. Prior to that, income tax rose quite steadily in the UK in the 1950s and 1960s and not surprisingly, Britain was the sick man of Europe in the 1970s. Income taxes rose quite steadily in Canada for most of the post-war period up until 1990 and then levelled out for most of that decade before a small tapered downwards.

Source: Cara McDaniel.

Taxes on consumption expenditure were very different stories across the Atlantic. There has been a tapering down in the average tax rate on American consumption expenditure since 1970 after modest increases before that. Canadian taxes on consumption expenditure rose steadily until the 1970s, then drop steadily in the 1970s and than rose in the 1980s and dropped again after 1992. British taxes on consumption expenditure rose sharply in the late 1960s, dropped sharply and then rose again in the 1970s and was pretty steady after that.

The sleeper tax in all three countries was payroll taxes to fund social security and the welfare state. These rose steadily in the USA, UK and Canada up until the 1990s.

Source: Cara McDaniel.

Despite all that nonsense about neoliberalism from the Left over Left, the average rate of tax on capital income did not appear to change much at all over the last 50 years. There was a modest taper in US capital income taxation from the mid-30s to the mid-20s over the entire post-war period. The average Canadian tax rate on income from capital rose steadily in the 60s, fell steadily in the 70s before rising again in the mid-1980s and fell again after 2000. The average British tax rate on capital income rose steadily in the 60s and 70s, coinciding with the emergence of Britain as a sick man of Europe, and then stabilised in the the 1980s onwards but with a dip in the late 80s before a rise in the early 1990s.. Despite the large cuts in the statutory corporate tax rate in the UK, there was only a mild taper in the average tax rate on capital income in the UK.

Source: Cara McDaniel.

The average tax rate on investment expenditures is pretty stable in the USA for the entire post-war period. The only significant increase in the average tax rate on investment expenditures in the UK coincided with the emergence of the sick man in Europe after a drop in the early 70s. The average tax rate on investment expenditures do not change at all in the UK after the 1970s. The Canadian average tax rate on investment expenditures is higher than elsewhere. It rose steadily in the 50s and 60s, dropped in the 70s and rose again in the 80s before tapering from 1992 onwards.

Source: Cara McDaniel.

These higher on rising taxes and the UK and Canada did nothing for either country in catching up with the USA. The figure 1 below shows real GDP per working age per American, Canadian and British.

Figure 1: Real GDP per Canadian, British and American aged 15-64, converted to 2013 price level, updated 2005 EKS purchasing power parities, 1950-2013

Source: Computed from OECD StatExtract and The Conference Board, Total Database, January 2014, http://www.conference-board.org/economics

The USA is pulling away from Canada and the UK in GDP per working age person. The exception is British economy from about 1990 onwards which caught up with Canada.

Figure 2, which is detrended GDP data, illustrates the British economic boom in the 1990s. Each country’s annual economic growth rate is detrended by 1.9%, the detrending value currently used by Ed Prescott. A flat line is growth at 1.9%, a rising line is above trend growth, a falling line is below trend growth.

Figure 2: Real GDP per Canadian, British and American aged 15-64, converted to 2013 price level, updated 2005 EKS purchasing power parities, detrended 1.9%, 1950-2013

Source: Computed from OECD Stat Extract and The Conference Board, Total Database, January 2014, http://www.conference-board.org/economics

Figure 2 shows that Canada has been in a long-term decline since the mid-1980s with much of this decline coinciding with periods of rising taxes on income from labour.

The British economy boomed in the 1990s, after the tax hikes of the 1970s and early 80s were reversed. This growth dividend was squandered by the Blair government in the 2000.

Figure 2 also shows that US growth was rather stable with some ups and downs up until 2007, expect during the productivity slowdown in the 1970s. The first major departure from trend growth of 1.9% was with the onset of the great recession.

The Obamas’ tax return

17 Apr 2015 Leave a comment

in politics - USA, public economics Tags: obama

You know you're curious– take a look at Obama's 1040: urbn.is/1JHnxvd #taxday http://t.co/M958cQoLVv—

Urban Institute (@urbaninstitute) April 15, 2015

Average tax rates on consumption, investment, labour and capital in Australia and New Zealand, 1959-2011–updated

16 Apr 2015 1 Comment

in economic growth, fiscal policy, macroeconomics, politics - Australia, politics - New Zealand, public economics Tags: GST, lost decades, taxation and the labour supply, taxation of capital

Cara McDaniel went to the mammoth task of constructing average tax rates for 15 OECD countries over the period 1950-2003 for consumption, investment, labour and capital:

Total tax revenue is divided into revenue generated from four different sources: consumption expenditures, investment expenditures, labour income and capital income.

To find the average tax rate, tax revenue from each source is then divided by the appropriate income or expenditure base.

She used that data to examine the role of taxes and productivity growth as forces influencing market hours. She used a calibrated growth model extended to include home production and subsistence consumption, both of which were key features influencing market hours. Her model was simulated for 15 OECD countries. She found the primary force driving changes in market hours is found to be changing labour income tax rates and productivity catch-up relative to the United States is found to be an important secondary force.

I thought I would summarise the tax rate data computed by Cara McDaniel for Australia and New Zealand.

Source: Cara McDaniel.

McDaniel’s data on average tax rates on household incomes in Australia and New Zealand suggests that the average tax rate New Zealand household incomes fell by a third since 1986. No estimates were calculated for earlier years for New Zealand.

As for Australia, taxes steadily increased between 1959 and 1987 stabilised until 2005 and then fell a bit.

Source: Cara McDaniel.

There is a big spike in the average tax rate on consumption expenditure in New Zealand in 1986 when a GST replaced the pre-existing sales taxes. The average tax rate on New Zealand consumption expenditures and tapered away until the end of2009 and started to increase again.

Not much happened in Australia regarding the average tax rate in consumption expenditures since about 1983 despite the introduction of a GST in 1998.

Source: Cara McDaniel.

The average tax rate in capital income in Australia is much higher than in New Zealand. On the other hand, the average tax rate on investment expenditure is much higher New Zealand as compared to Australia.

Source : Cara McDaniel.

Taxes on investment expenditures increased quite significantly at the same time that a GST was introduced in New Zealand.

All in all, New Zealand cut taxes on personal income but that tax cut seemed to be pretty much offset by higher taxes on personal consumption through the introduction of a 10% and then 12.5% GST.

The most interesting finding in this database is the sharp increase in the average tax on investment expenditures in the mid-1980s. This prolonged New Zealand’s lost decades – the two decades of next to no GDP growth per working age New Zealander.

Real GDP per New Zealander and Australian aged 15-64, converted to 2013 price level with updated 2005 EKS purchasing power parities, 1956-2013

Source: Computed from OECD Stat Extract and The Conference Board, Total Database, January 2014.

New Zealand’s lost decades ended when the average tax rate on investment expenditures started to fall.

Recent Comments