There are 74 "unicorns” in US tech sector, valued at $273 billion. Will they become extinct? econ.st/1ISYkvd http://t.co/ATyuzMsZwA—

The Economist (@EconBizFin) August 11, 2015

The unicorns of the US tech sector share market

13 Aug 2015 Leave a comment

in entrepreneurship, industrial organisation, survivor principle Tags: competition as a discovery procedure, efficient markets hypothesis, entrepreneurial alertness, market selection, technology diffusion, Uber

Cost control at Google in two charts

12 Aug 2015 Leave a comment

in economics of media and culture, entrepreneurship, industrial organisation, survivor principle Tags: competition as a discovery procedure, creative destruction, economics of advertising, entrepreneurial alertness, Google, innovation, legacy media, market selection, The meaning of competition

Google's core business explained in two charts buff.ly/1UBysMC http://t.co/V6uRrPVKMk—

Business Insider (@businessinsider) August 12, 2015

There is an economic literature on feuds and duelling

07 Aug 2015 Leave a comment

in applied price theory, comparative institutional analysis, economic history, economics of media and culture Tags: adverse selection, asymmetric information, competition as a discovery procedure, duals, feuds, game theory, moral hazard, screening, signalling

How they resolved spats before Twitter existed

thepoke.co.uk/2015/07/26/res… http://t.co/a04CTYT2aX—

The Poke (@ThePoke) July 27, 2015

The first-ever video played on MTV TD 1981 was?

01 Aug 2015 Leave a comment

in economic history, economics of media and culture, entrepreneurship, industrial organisation, Music, survivor principle Tags: competition as a discovery procedure, creative destruction, entrepreneurial alertness, legacy media, The meaning of competition

Creative destruction in advertising revenue around the globe

30 Jul 2015 Leave a comment

in development economics, economic history, economics of media and culture, growth miracles, industrial organisation, survivor principle Tags: competition as a discovery procedure, creative destruction, digital media, legacy media, technology diffusion, The meaning of competition

Why I'm optimistic about digital media, in 2 charts vox.com/2015/7/28/9050… http://t.co/FrVpJC2e2F—

Vox (@voxdotcom) July 28, 2015

Matthew Kahn on Climate Change Adaptation

17 Jul 2015 Leave a comment

in applied price theory, applied welfare economics, environmental economics, global warming, urban economics Tags: climate alarmism, climate change adaptation, competition as a discovery procedure, global warming

Was the Chinese share market crash rational asset-price movements without news?

14 Jul 2015 1 Comment

in business cycles, entrepreneurship, financial economics, macroeconomics Tags: competition as a discovery procedure, dot.com bubble, entrepreneurial alertness, event studies, learning by doing, sharemarket bubbles, sharemarket crashes

Large share market crashes such as over the recent months in China and the 1987 Wall Street crash do not necessarily imply an economic slowdown.

As the stock market gets rocked, let's remember this one thing about the crash of 1987 businessinsider.com/lets-remember-… http://t.co/BDgy5h5UN0—

Elena Holodny (@elenaholodny) August 21, 2015

The majority of major share market movements occur without any particular news hitting the market. Studies of the 50 largest share market movements in the US stock market between 1946 and 1987 found that the majority of them could not be explained by news. That includes the 1987 share market crash. In October 1987, shares fell by 20% in one day for no obvious reason.

China's stock market selloff explained in 6 charts bloom.bg/1HStJSe http://t.co/0CpoU21RpY—

Bloomberg Business (@business) July 13, 2015

David Romer explained these booms and busts, including the 1987 share market crash in two ways: investor uncertainty about the quality of other investors’ information; and dispersion of information and small costs to trading:

Asset prices can change because initially the market does an imperfect job of revealing the relevant information possessed by different investors and because developments within the market can then somehow cause more of that information to be revealed…

The possibility of imperfect aggregation implies an alternative to external news and irrationality as a potential source of asset-price movements: some price changes may be caused by “internal” news.

That is, asset prices can change because initially the market does an imperfect job of revealing the relevant information possessed by different investors and because developments within the market can then somehow cause more of that information to be revealed.

Either of these models are perfectly plausible. Investors learn from each other through trading and improve their estimations of the value of various shares.

#China Reality Check: #Stocks Are Still Too Expensive for @MarkMobius bloom.bg/1Monzct via @business @frostyhk http://t.co/e3Lv3KwgTZ—

Fion Li (@fion_li) July 13, 2015

As such, through internal learning and discovery within the share market there can be booms and crashes despite no new information, no communication, and no coordination among the participants in trading. Underneath the surface, there is a gradual updating of information by the participants and at a certain point in time, this causes a sudden change of behaviour.

Dow and Gorton made similar points to David Romer about how share market learning is a process of learning, judgement and error correction rather than an instant adjustment:

Strategic interaction and the complexity of the information result in a protracted price response.

Indeed, equilibrium price paths of the model may display reversals in which the two traders rationally revise their beliefs, first in one direction, and then in the opposite direction, even though no new information has entered the system.

A piece of information which is initially thought to be bad news may be revealed, through trading, to be good news.

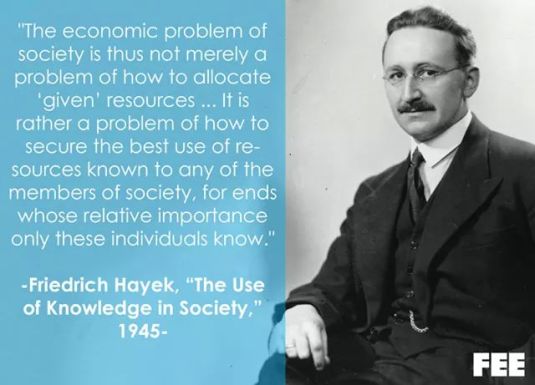

Bubbles and crashes are consistent with private information held by a few slowly dispersing among market participants until this knowledge was reflected in stock prices as in Hayek’s (1945) analysis of the price mechanism as a means of communicating information.

HT: The one thing you should remember about the stock market crash of 1987 | Business Insider.

Which companies are the most innovative?

07 Jul 2015 Leave a comment

in entrepreneurship, industrial organisation, survivor principle Tags: competition as a discovery procedure, creative destruction, entrepreneurial alertness, ICT, innovation, market selection, R&D, The meaning of competition

There is rampant height discrimination in the movie business?

13 Jun 2015 Leave a comment

in discrimination, industrial organisation, labour economics, movies, survivor principle Tags: competition as a discovery procedure, height discrimination, Hollywood economics, market selection, statistical discrimination, The meaning of competition

Spare me the conspiracy theories. When an actor or actress walks into a scene, the first impression of the audience is not supposed to be about how tall they are or how they differ in height from those already on the stage or film set.

This casting decision can be deliberate or simply that actors who do not differ as much in height seem to work well together and have more successful careers because of better rapport.

David Friedman on global warming, population and problems with the externality argument

02 Mar 2015 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, constitutional political economy, David Friedman, economic history, economics of information, economics of regulation, environmental economics, environmentalism, global warming, law and economics, population economics, property rights Tags: climate alarmism, competition as a discovery procedure, David Friedman, externalities, global warming, population bomb, The fatal conceit, The pretence to knowledge

Recent Comments