Profits Are Progressive

10 May 2016 Leave a comment

in applied price theory, economics of media and culture, entrepreneurship, industrial organisation, survivor principle, theory of the firm Tags: anti-market bias, entrepreneurial alertness, profit and loss, rational irrationality, superstars

Common response to new technology: "Commercial Use In Doubt"

08 May 2016 Leave a comment

in economic history, industrial organisation, survivor principle, technological progress Tags: creative destruction, economics of television, entrepreneurial alertness, pessimism bias

#NewZealand’s top 1% is getting even lazier under neoliberal @johnkeyMP

07 May 2016 Leave a comment

in politics - New Zealand, public economics Tags: entrepreneurial alertness, Leftover Left, reactionary left, superstar wagers, superstars, top 1%

The share of incomes of the top 1% in New Zealand has not increased since the 1950s – they are just bone lazy at extracting labour surplus.

Veteran left-wing grumbler Max Rashbrooke was good enough to collect Inland Revenue Data data that show that getting even lazier under right-wing government elected in 2008. Their share of taxable income has dropped from 9% when labour lost power to 8.4% now. These figures exclude capital gains.

How much do you get paid if you can pick winners? @JulieAnneGenter @simonjbridges

05 May 2016 Leave a comment

in applied price theory, comparative institutional analysis, entrepreneurship, fisheries economics, politics - New Zealand Tags: entrepreneurial alertness, hedge fund managers, industry policy, picking winners, superstar wages, superstars

Electric cars have joined the long list of mendicant mendicant businesses that have been backed by the New Zealand government of late. Picking winners again.

The payrolls of entire government departments in New Zealand are not enough to hire a single successful hedge fund manager to pick winners for their political masters. To get on the list of the top 25 hedge fund managers, you need to earn at least $300 million a year.

The 25 highest-earning hedge fund managers and traders made a combined $12 billion in 2015, slightly less than the $12.5 billion the 25 top-earning hedge fund managers together made in 2014.

Why do investment advisors sell and often give away their sage advice? If their insights were any good, they could trade on the share market before others caught on and make a killing!

I will give a personal example based on the skills of bureaucracies in picking winners. The test of my hypothesis is based on the transferability of human capital across jobs.

My graduate school professors in Japan included many retired bureaucrats from the Ministry of Finance and MITI. These agencies were heralded by Joe Stiglitz and others for picking winners and guiding Japanese companies to choose the right technologies and what to export.

The skills that my graduate school professors learned at picking winners over their careers with the Ministry of Finance and MITI in the high-growth years in the 1970s would now be available to them in their retirements to trade on their own account.

Page 32 of "An Illustrated Guide to Income" more economic #dataviz at: bit.ly/12SEI9p http://t.co/HYm0II2UNI—

Catherine Mulbrandon (@VisualEcon) May 08, 2013

My graduate school professors should quickly become very rich after retiring because of the skills they learned in picking winners while at the Ministry of Finance and MITI, which should cross over into their private share portfolios. The rich lists world-wide should be full of retired industry and finance ministry bureaucrats.

Instead, my graduate school professors took the train and bus to work and their families lived off their salaries in standard sized Japanese government apartments. All looked forward to their annual bonus of 5.15 months salary.

If governments are any good at picking winners, people should be willing to pay big time to get jobs at ministries of finance and ministries of international trade and industry to get access to their unique and highly secret skills they learn therein on how to pick winners.

I am still waiting for that tell-all book by an insider on these skills. Why is there no Picking Winners for Dummies on Amazon kindle as yet?

Does ethical investment pay? @JulieAnneGenter @jamespeshaw @RusselNorman

05 May 2016 Leave a comment

in financial economics Tags: BDS, efficient markets hypothesis, entrepreneurial alertness, ethical investing

The Vanguard Investment Fund has set up an passive investment index to invest in ethical investments. No flies on them regarding entrepreneurial alertness.

The drawback of ethical investing is the higher management expenses to administer negative screens (to eliminate arms manufacturers and other frowned upon activities) and positive screens (to favour businesses with a good record on corporate social responsibility or that are involved in low-carbon industries etc.)

An index-linked passive fund allows socially conscious investor to have a diversified ethical portfolio at least cost. Vanguard pitches its ethical investing passive fund thus

Some individuals choose investments based on social and personal beliefs. For this type of investor, we have offered Vanguard FTSE Social Index Fund since 2000.

This low-cost fund seeks to track a benchmark of large- and mid-capitalization stocks that have been screened for certain social, human rights, and environmental criteria.

In addition to stock market volatility, one of the fund’s other key risks is that this socially conscious approach may produce returns that diverge from those of the broad market.

The expenses ratio of this index linked passive fund for socially conscious investors is 0.25%. The usual investment expenses ratio of a Vanguard Fund is 0.1% which is much less than that of active funds.

As is well known, ethical investing offers a poorer return on standard diversification strategies as the chart below show.

Source: The case against socially responsible investing (SRI) – Flannel Guy ROI.

Virtue must be its own reward because it does not pay off in the share market

As you can see value of $10,000 at the end of 10 years would be worth almost $24,000 with the total stock market ETF but only about $20,000 with the FTSE social index.

The initial reaction is that $4,000 over 10 years isn’t that big of a deal, but there are two things to point out. First, that $4,000 difference is worth almost half the initial investment! Secondly, on a compound annual basis, the SRI fund returns about 2% less than the total stock market fund.

Creative destruction in top ICT company pay

05 May 2016 Leave a comment

in human capital, industrial organisation, labour economics, labour supply, occupational choice, survivor principle Tags: Apple, CEO pay, creative destruction, entrepreneurial alertness, Facebook, Google, Microsoft, superstar wages, superstars, top 1%, Twitter, Uber, Yahoo

I am surprised to see that Yahoo is in business much less competing for top talent. Microsoft is in decline too. Apple does not pay people as much as everybody else.

Source: Paysa Company Rank | Paysa.

Some other colours seem to duplicate so you will have to work out which is which by when they exploded in hiring top talent.

Does ethical investing pay? Barrier Fund and Ave Maria Catholic Values Fund head to head

04 May 2016 Leave a comment

in economics of regulation, economics of religion, entrepreneurship, financial economics Tags: efficient markets hypothesis, entrepreneurial alertness, ethical investing

Virtue is not its own reward if you invest in the Ave Maria Catholic Values Fund which is AVEMX in the head-to-head comparison with the Barriers Fund, formerly the Vice Fund. The Ave Maria Catholic Values Fund return since inception was 5.63% as compared to the 9.95% return of the Barrier Fund.

Source: VICEX – USA Mutuals Barrier Fund Investor Class Shares Mutual Fund Quote – CNNMoney.com

The S&P index grew by 8 .34% since the inception of the then Vice Fund, now the Barrier Fund. Such is the price of risking of going to hell if you lose Pascal’s wager by investing in tobacco, alcoholic beverage, gaming and defence/aerospace industries.

All of the equity investments (which include common stocks, preferred stocks and securities convertible into common stock) and at least 80% of the net assets of the Ave Maria Catholic Values Fund is invested in companies meeting its religious criteria as the fund manager explains

Morally Responsible Investing (MRI) is a subset of socially responsible investing, which often screens out companies engaged in environmental issues, tobacco products, alcohol, nuclear power, defense, oil and “unfair” labor practices. MRI is different in that it screens out companies engaged in activities that are not pro-life or pro-family…

All investments are screened to eliminate any company engaged in abortion, pornography, embryonic stem cell research, or those that make corporate contributions to Planned Parenthood

Traditional ethical funds use negative screens (to eliminate arms manufacturers and other frowned upon activities) and positive screens (to favour businesses with a good record on corporate social responsibility or that are involved in low-carbon industries etc).

The Vice Fund (now the Barriers Fund) continues to outperform S&P 500

03 May 2016 Leave a comment

in defence economics, energy economics, entrepreneurship, financial economics, health economics Tags: BDS, efficient markets hypothesis, entrepreneurial alertness, ethical investing

Source: VICEX – USA Mutuals Barrier Fund Investor Class Shares Mutual Fund Quote – CNNMoney.com

The Vice Fund has outperformed the S&P 500 since 2004 as shown by the green line. This mutual fund invests invest in sinful stocks as its managers describe it:

Designed with the goal of delivering better risk-adjusted returns than the S&P 500 Index. It invests primarily in stocks in the tobacco, alcohol, gaming and defence industries. Vice Funds believes these industries tend to thrive regardless of the economy as a whole.

The Vice Fund is now known as the Barrier Fund because it extended out of sinful stocks into industries with high barriers to entry. Minimum Investment is $2,000.

The Barrier Fund primarily invests in the following industries: Aerospace/Defense, Gaming, Tobacco and Alcoholic Beverages. These four industries were chosen because they demonstrate one or more of these compelling and distinctive investment characteristics:

- Natural barriers to new competition

- Steady demand regardless of economic condition

- Global Marketplace – not limited to the U.S. economy

- Potentially high profit margins

- Ability to generate excess cash flow and pay and increase dividends

The Barrier Fund believes numerous investment opportunities in these industries which have been largely overlooked by other funds.

The Fund has high management fees of 2%. Americans can buy Vanguard’s or Fidelity’s index funds and pay only 0.1% in expenses.

German city installs traffic lights in pavements to protect texting pedestrians

28 Apr 2016 Leave a comment

in economics of media and culture, transport economics Tags: entrepreneurial alertness, road safety, smart phones

Creative destruction in billionaires

25 Apr 2016 Leave a comment

in economic history, entrepreneurship, industrial organisation, survivor principle Tags: billionaires, entrepreneurial alertness, superstars

Source: Price Waterhouse Coopers (2016) BILLIONAIRES INSIGHTS The changing faces of billionaires.

48% Of People Who Buy Vinyl Don’t Even Listen To It, Study Finds – Digital Music News

20 Apr 2016 Leave a comment

in economics of media and culture, entrepreneurship, Music Tags: entrepreneurial alertness

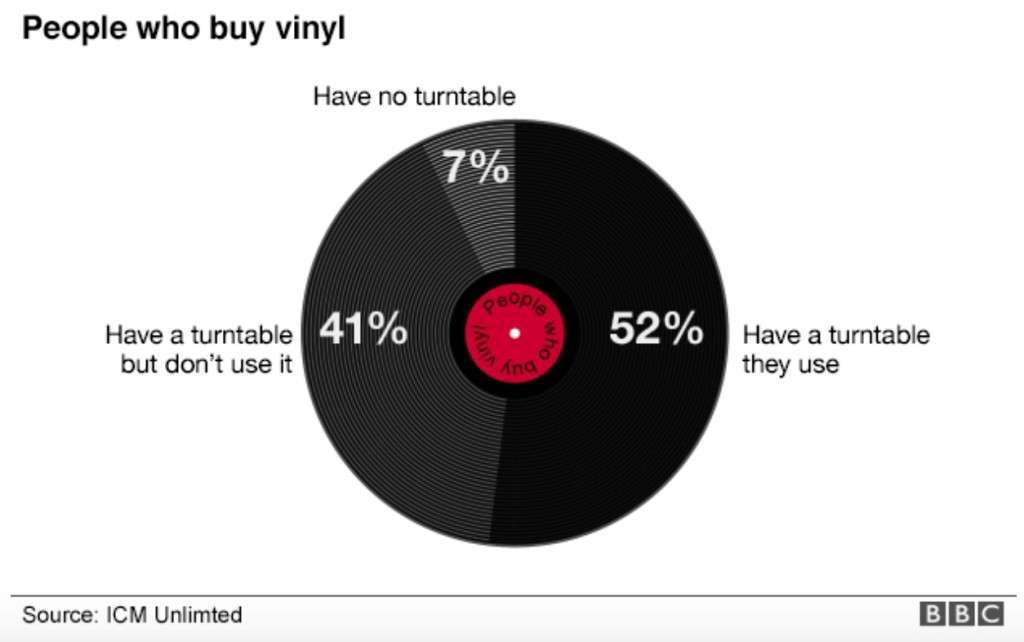

There is a growing trend of people who purchase vinyl for collecting purposes. A study found 48% of people who buy vinyl don’t even listen to the records.

Source: 48% Of People Who Buy Vinyl Don’t Even Listen To It, Study Finds – Digital Music News

Picking winners and @stevenljoyce’s repayable grants to 11 more tech start-ups @JordNZ

13 Apr 2016 Leave a comment

in applied price theory, entrepreneurship, industrial organisation, politics - New Zealand, Public Choice, rentseeking, survivor principle Tags: corporate welfare, creative destruction, entrepreneurial alertness, Hollywood economics, industry policy, picking losers, picking winners

Minister for Science and Innovation Steven Joyce picked a few more winners today. Eleven more start-up technology companies are to be funded $450,000 each in repayable loans to commercialise their technology. The loans are from Callaghan Innovation’s incubator network.

Minister for Science and Innovation Steven Joyce picked a few more winners today. Eleven more start-up technology companies are to be funded $450,000 each in repayable loans to commercialise their technology. The loans are from Callaghan Innovation’s incubator network.

To cut a long diatribe short, I find these sums of money rather piddling. I have encountered this corporate welfare program before at a presentation.

My reaction then as is now: by handing out such small grants, some will succeed, some will fail. Importantly, there will never be one big disaster to bring the whole show down. There is political safety in diversification.

This is not the case with, for example, film subsidies. If Sir Peter Jackson and others finally produce a box office bomb, it will be all too glaring that the taxpayers backed a Hollywood loser with hundreds of millions of dollars. $500 million in subsidies in the case of Avatar.

By peppering small sums of money across the economy, there is no similar risk from this repayable grant scheme for the commercialisation of products.

Recent Comments