Working Class American Families Face Marginal #Tax Rates up to 43.7%

28 Jan 2016 Leave a comment

in Public Choice, public economics Tags: laffer curve, rational irrationality, taxation and labour supply

Everybody agrees there is a Laffer Curve when it suits them.

The Left talks about poverty traps arising from means testing of social insurance and welfare benefits but denies flatly that high marginal tax rates will affect the labour supply of the rich and willing to do.

You cannot have it both ways.

Some #tax cuts produce more growth than others

12 Jan 2016 Leave a comment

in applied price theory, labour economics, politics - USA, public economics Tags: laffer curve

Trigger warning for the Twitter Left

31 Jul 2015 Leave a comment

in applied price theory, applied welfare economics, constitutional political economy, income redistribution, politics - Australia, politics - New Zealand, politics - USA, Public Choice, public economics, rentseeking Tags: antimarket bias, endogenous growth theory, expressive voting, laffer curve, Leftover Left, taxation and entrepreneurship, taxation and human capital, taxation and investment, taxation and the labour supply, top 1%, Twitter left

The Rahn curve explained

23 Jul 2015 Leave a comment

in comparative institutional analysis, constitutional political economy, income redistribution, politics - Australia, politics - New Zealand, politics - USA, Public Choice, public economics Tags: Director's Law, growth of government, laffer curve, optimal tax theory, Rahn curve, size of government

Who is where on the Laffer curve?

20 Jun 2015 Leave a comment

in economic growth, fiscal policy, human capital, labour economics, labour supply, macroeconomics, politics - USA, public economics Tags: endogenous growth theory, EU, Eurosclerosis, laffer curve, optimal tax theory, taxation and entrepreneurship, taxation and investment, taxation and the labour supply

@asymmetricinfo paper:"How Far Are We From The Slippery Slope? The Laffer Curve Revisited" bit.ly/1HMhmqu http://t.co/D9IffNhd92—

Old Whig (@aClassicLiberal) April 20, 2015

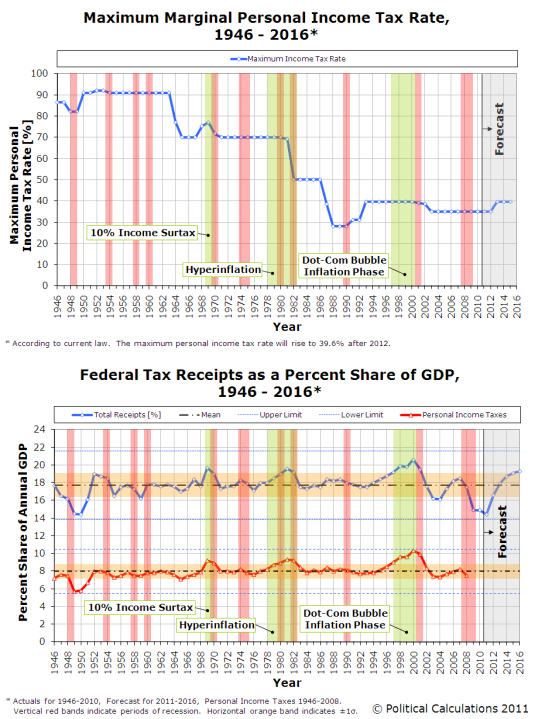

Hauser’s Law: No matter what post-war tax rates have been, tax revenues remained at about 19.5% of GDP in the USA

01 May 2015 Leave a comment

in politics - USA, Public Choice, public economics Tags: Director's Law, laffer curve

What are the revenue effects of capital gains tax cuts?

19 Apr 2015 Leave a comment

in politics - Australia, politics - New Zealand, politics - USA, public economics Tags: dynamic scoring, laffer curve, optimal taxation, taxation of capital income

Is Thomas Piketty a double secret supply-side economist?

03 Jun 2014 Leave a comment

in entrepreneurship, labour supply, public economics Tags: laffer curve, supply-side economics, Thomas Peketty

When a government taxes a certain level of income or inheritance at a rate of 70 or 80 percent, the primary goal is obviously not to raise additional revenue (because these very high brackets never yield much).

It is rather to put an end to such incomes and large estates, which lawmakers have for one reason or another come to regard as socially unacceptable and economically unproductive…

The Company Tax Laffer curve

03 Jun 2014 Leave a comment

in public economics, taxation Tags: company tax rate, laffer curve

The Australian, New Zealand and Irish company taxes raised similar amounts of revenue as a percentage of GDP. The Irish company tax rate was 12.5% in 2003.

from The U.S. Corporate Income Tax System: Once a World Leader, Now A Millstone Around the Neck of American Business by the Tax Foundation via The Solution is the problem blog

![image_thumb[3] image_thumb[3]](https://utopiayouarestandinginit.com/wp-content/uploads/2015/08/image_thumb3_thumb.png?w=709&h=442)

Recent Comments