Did government pick the Internet as a winner? @stevenljoyce @dpfdpf

31 Oct 2015 Leave a comment

in applied price theory, Austrian economics, comparative institutional analysis, economic history, economics of bureaucracy, economics of media and culture, industrial organisation, Public Choice, survivor principle Tags: creative destruction, entrepreneurial alertness, industry policy, Internet, picking losers, picking winners, The fatal conceit, The meaning of competition, The pretense to knowledge

Should We Subsidize Scientific Research?

18 Aug 2015 Leave a comment

in applied price theory, applied welfare economics, entrepreneurship, industrial organisation, Public Choice, rentseeking, survivor principle Tags: competition as a discovery procedure, economics of science, industry policy, losers, picking winners, R&D, The meaning of competition, The pretence the knowledge

If bureaucrats were any good at picking winners, they would be hedge funds managers

30 Jul 2015 Leave a comment

in applied price theory, comparative institutional analysis, economics of bureaucracy, entrepreneurship, financial economics, human capital, industrial organisation, labour economics, managerial economics, occupational choice, organisational economics, rentseeking, survivor principle Tags: active investing, corporate welfare, efficient markets hypothesis, entrepreneurial alertness, hedge funds, industry policy, passive investing, picking winners, The fatal conceit, The pretence to knowledge

Page 32 of "An Illustrated Guide to Income" more economic #dataviz at: bit.ly/12SEI9p http://t.co/HYm0II2UNI—

Catherine Mulbrandon (@VisualEcon) May 08, 2013

Page 33 of "An Illustrated Guide to Income" more economic #dataviz at: bit.ly/10M7lqR http://t.co/FcmaqZWB32—

Catherine Mulbrandon (@VisualEcon) May 09, 2013

The hedge fund industry held $2.9 trillion of assets in June. Exchange-traded funds did better econ.st/1DdXgWS http://t.co/CK2foqMOpw—

The Economist (@EconEconomics) August 01, 2015

Moondoggle: The Forgotten Opposition to the Apollo Program – The Atlantic

05 Mar 2015 Leave a comment

in applied welfare economics, defence economics, economic history, politics - USA Tags: industry policy, picking winners, R&D, smart industry policy, space programme

…many people believe that Project Apollo was popular, probably because it garnered significant media attention, but the polls do not support a contention that Americans embraced the lunar landing mission.

Consistently throughout the 1960s a majority of Americans did not believe Apollo was worth the cost, with the one exception to this a poll taken at the time of the Apollo 11 lunar landing in July 1969.

And consistently throughout the decade 45-60 percent of Americans believed that the government was spending too much onspace, indicative of a lack of commitment to the spaceflight agenda. These data do not support a contention that most people approved of Apollo and thought it important to explore space.

HT: Moondoggle: The Forgotten Opposition to the Apollo Program – The Atlantic.

Why governments cannot pick winners

11 Jun 2014 Leave a comment

in applied price theory, entrepreneurship, financial economics Tags: efficient market hypothesis, hedge fund managers, picking winners, The fatal conceit, The pretence to knowledge

|

The salary of one top hedge fund manager exceeds the entire payroll of any of the government departments in New Zealand. To get on the list of top 25 hedge fund manager you must earn at least $300 million a year. The best of these earned $3 billion last year. Anyone who was any good at picking the share market would certainly not accept government wages. Government employees have neither the aptitude nor the taste for risk that betting it all every day and losing everything perhaps requires. |

The market process picks unusual winners

10 Jun 2014 Leave a comment

in entrepreneurship, industrial organisation, international economics, Public Choice, rentseeking Tags: picking winners

What World Bank consultant would risk his fee and return business on advising Egypt to specialise in the export of toilets to Italy? But Egypt’s largest single manufacturing export is toilets to Italy where it captured 93% of the market.

Kenya has a booming export business in cut flowers for men to buy for their wives. Kenya has 40% of the European markets for cut flowers. Nigeria has 84% of the Norwegian market for floating docks. The Philippines has 71% of the global market for electronic integrated circuits.

What development expert would have picked these winners? They’re far too far away from the conventional wisdom and the safe bets that are behind picking winners in government circles.

Picking winners by governments requires heroic assumptions not only about the information politicians and bureaucrats have about the present and their ability to predict the future, but also about their motivations and their ability to resist capture by special interests. The Economist explains:

None of these studies addresses a deeper problem with the way industrial policy tends to develop over time.

Earlier efforts have tended to degenerate into rent-seeking, lobbying and cosy deals between incumbent firms and bureaucrats, stifling innovation and the process of creative destruction.

The problem, of course, is that … industrial policy requires disinterested, benevolent policymakers who can do it well. Unfortunately, they do not yet have a recipe for how such policymakers can be created.

Policy is made by real people with political and personal motivations. What they come up with is unlikely to be as well designed as the ones in the models.

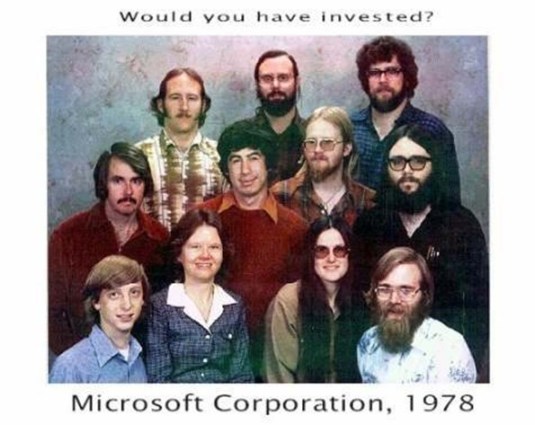

The case against industry policy in one photo

22 Apr 2014 Leave a comment

in industrial organisation, market efficiency, politics - New Zealand, Public Choice, survivor principle Tags: industry policy, picking losers, picking winners

Industry policy is back in vogue in New Zealand:

- The National Party-led Government is keen on smart specialisation.

- The Labour Party wants a Manufacturing Upgrade targeting R&D and innovation.

The case against picking winners is the answer to the question in the picture of the weirdoes below.

One of the people in the photo won a competition on the radio that offered free company photos. That is how Microsoft could afford the photo. That photo became one of the most iconic photos in American business history.

I first saw this photo 12-14 years ago at a presentation, so who first designed the caption is lost in time.

If you are so smart, why aren’t you rich? MITI version

14 Mar 2014 4 Comments

in entrepreneurship, human capital, Public Choice, Wall Street Tags: Deirdre McCloskey, efficient markets, MITI, picking winners, Wall Street, Wolf of Wall Street

If you are so smart, why aren’t you rich? This is the American question – asked of MIT’s Paul Cootner by a money market manager in the 1960s.

Why do investment advisors sell and often give away their sage advice? If their insights were any good, they could trade on the share market before others caught on and make a killing!

Deirdre McCloskey wrote a book about the limits of economic expertise. For a summary, see http://www.deirdremccloskey.com/docs/pdf/Article_168.pdf.

I will give a personal example based on the skills of bureaucracies in picking winners. The test of my hypothesis is based on the transferability of human capital across jobs.

My graduate school professors in Japan included many retired bureaucrats from the Ministry of Finance and MITI. These agencies were heralded by Joe Stiglitz and others for picking winners and guiding Japanese companies to choose the right technologies and what to export.

The skills that my graduate school professors learned at picking winners over their careers with the Ministry of Finance and MITI in the high-growth years in the 1970s would now be available to them in their retirements to trade on their own account.

My graduate school professors should quickly become very rich after retiring because of the skills they learned in picking winners while at the Ministry of Finance and MITI, which should cross over into their private share portfolios. The rich lists world-wide should be full of retired industry and finance ministry bureaucrats.

Instead, my graduate school professors took the train and bus to work and their families lived off their salaries in standard sized Japanese government apartments. All looked forward to their annual bonus of 5.15 months salary.

If governments are any good at picking winners, people should be willing to pay big time to get jobs at ministries of finance and ministries of international trade and industry to get access to their unique and highly secret skills they learn therein on how to pick winners. I am still waiting for that tell-all book by an insider on these skills. Why is there no Picking Winners for Dummies on Amazon kindle as yet?

P.S. McCloskey argued that the advising industry lives off 19th century case law on directors’ and trustees’ duties. If you take advice – from an accountant, a lawyer or an economist – and the business or investment still fails, it can’t be your fault. You took advice.

P.P.S. Cootner’s reply was “If you’re so rich, why aren’t you smart?” The answer to this was Wall Street investment brokers didn’t have to be smart to get rich; they can make money off fees and brokerage commissions even when their investment advice stank. Didn’t you watch The Wolf of Wall Street?

Recent Comments