The toll of a capital gains tax on entrepreneurship and innovation is far greater than previously thought @TaxpayersUnion

15 Jan 2019 Leave a comment

in applied price theory, entrepreneurship, human capital, labour economics, occupational choice, politics - New Zealand, politics - USA, Public Choice, public economics, technological progress Tags: taxation and entrepreneurship, taxation and investment

Chad Jones is a trouble maker on top tax rates @paulkrugman

10 Jan 2019 Leave a comment

in applied price theory, economics of education, entrepreneurship, human capital, income redistribution, industrial organisation, labour economics, labour supply, law and economics, occupational choice, politics - USA, poverty and inequality, Public Choice, public economics Tags: creative destruction, superstars, taxation and entrepreneurship, taxation and investment, taxation and labour supply, top 1%

Chad Jones’ awkward remarks on top tax rates and innovation spillovers

09 Jan 2019 Leave a comment

in applied price theory, applied welfare economics, economic growth, economics of education, entrepreneurship, fiscal policy, human capital, income redistribution, industrial organisation, labour economics, labour supply, macroeconomics, occupational choice, politics - USA, poverty and inequality, Public Choice, public economics, rentseeking Tags: creative destruction, taxation and entrepreneurship, taxation and investment, taxation and labour supply, top 1%

Steven Landsburg Discusses Incentives and Taxes

05 Dec 2018 Leave a comment

in applied price theory, applied welfare economics, development economics, economic growth, economic history, entrepreneurship, fiscal policy, human capital, labour economics, labour supply, macroeconomics, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

Steven Landsburg: taxing capital

02 Dec 2018 Leave a comment

in applied price theory, applied welfare economics, economic growth, financial economics, fiscal policy, macroeconomics, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour

Finn Kydland on the Great Recession

27 Nov 2018 1 Comment

in budget deficits, business cycles, economic growth, fiscal policy, great recession, macroeconomics, public economics Tags: monetary policy, taxation and entrepreneurship, taxation and investment, taxation and labour supply

Do the Rich Pay Their Fair Share?

13 Jul 2016 Leave a comment

in politics - USA, public economics Tags: envy, superstars, taxation and entrepreneurship, taxation and investment, top 1%, top 10%

The effects of cutting the Australian company tax by one percentage point

02 Jun 2016 Leave a comment

in applied price theory, politics - Australia, politics - New Zealand, public economics Tags: Australia, company tax, international tax competition, tax incidents, taxation and entrepreneurship, taxation and investment

#NeverTrump but why no #neverBernie, only #feelthebern?

28 May 2016 Leave a comment

in constitutional political economy, politics - USA Tags: 2016 presidential election, Leftover Left, reactionary left, taxation and entrepreneurship, taxation and investment, taxation and labour supply, Twitter left

Why have no Democrats formed the equivalent of #NeverTrump?

Bernie Sanders is not even a member of their party. Have they no principles?

Many of their republican opponents do in rejecting Trump and planning to vote for either Clinton or Gary Johnson.

Sanders is an old socialist throwback whose economic policies would plunge the American economy into a deep recession harming most of all those that Democrats claim to represent.

Sander’s mind is just as inflexible as that of Trump as is his unwillingness to learn from events.

Why is GST but not company tax incidence so easy to understand

28 Apr 2016 Leave a comment

in public economics Tags: company tax, rational irrationality, tax incidence, taxation and entrepreneurship, taxation and investment

The tax incidence of sales taxes is understood by everybody but who pays company tax is stubbornly misunderstood. The seller is sending the tax cheque to the taxman does not fool anyone regarding who ultimately pays sales taxes.

The tax incidence of sales taxes is understood by everybody but who pays company tax is stubbornly misunderstood. The seller is sending the tax cheque to the taxman does not fool anyone regarding who ultimately pays sales taxes.

Everyone expects that sales tax increases such as of the GST or VAT will be passed on to buyers but sometimes a little bit is absorbed in terms of lower profits by sellers if it is more than the market can bear.

When it comes to company taxes, this intuitive understanding of the economics of the incidence of taxes completely disappears. There is a strong belief that only investors pay the company tax in the form of dividends.

The notion that investors may reduce their investment and therefore the amount of capital with which workers can work is stoutly denied as is the implications for lower than otherwise wages because of this.

The possibility that the entire company tax may show up as lower wages when capital is internationally mobile is just not even contemplated. This is despite foreign direct investment being welcomed on the grounds that more capital means higher wages for local workers.

Likewise, when a factory is re-located offshore, it is understood that that will harm wages. That understanding does not carry through to company tax incidence when the factory relocates offshore because of low company taxes rather than import competition.

@garethmorgannz is getting a little techie about debating optimal tax theory

17 Apr 2016 1 Comment

in politics - New Zealand, public economics Tags: optimal tax theory, taxation and entrepreneurship, taxation and investment, taxation and labour supply, taxation of capital

All I said was “optimal tax theory including that pioneered by Stiglitz and Merrlees, economists of impeccable left-wing credentials, show that taxes on the income from capital should be low because the deadweight social costs of taxes on capital are very high”.

@garethmorgannz gives optimal tax theory a pass once again @JordNZ

17 Apr 2016 Leave a comment

in applied price theory, entrepreneurship, fiscal policy, macroeconomics, politics - New Zealand, public economics Tags: company tax, Gareth Morgan, rational irrationality, taxation and entrepreneurship, taxation and investment, taxation and labour supply, taxation of capital income

The Morgan Foundation gave optimal tax theory a pass in yesterday’s publication about taxes on land and capital. Gareth Morgan is keen on a comprehensive capital tax.

Source: Taxing Wealth & Property – What Works? A Morgan Foundation Report.

This failure to refer to optimal tax theory is despite the Foundation’s strong commitment to evidence-based policy. Any discussion of tax policy that is evidence-based must refer optimal tax theory.

Source: Morgan Foundation, Public Policy Education.

<p>

Taxpayers Alliance mistaken about tax revenues as a stable % of GDP @the_tpa

12 Apr 2016 Leave a comment

in applied price theory, economic history, public economics Tags: British economy, British taxes, growth of government, Margaret Thatcher, size of government, taxation and entrepreneurship, taxation and investment, taxation and labour supply, Taxpayers Alliance

The British Taxpayers Alliance got carried away a bit when it said taxes as a share of British GDP have not varied much over the last 50 years or so. Margaret Thatcher would be turning in her grave.

A stable tax take is more the case in the USA. Federal tax receipts stay within the range of 18-20% of U.S. GDP as shown in the charts below and above.

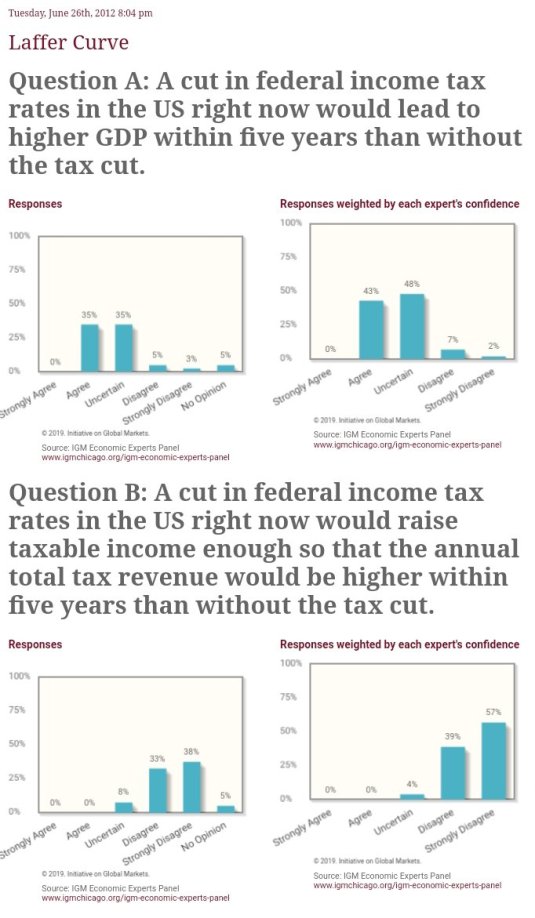

There were large cuts in the top tax rates in the USA without any fall in tax revenues as a percentage of GDP because of base broadening.

Margaret Thatcher really did make a dent in taxes as a share of GDP in the 1980s. They fell by 5% of GDP but then went back up again in the 1990s as is shown in the Centre for Policy Studies chart below.

That 5% drop was a big variation as a share of GDP which is also shown in the Taxpayers Alliance chart if you look closely at the 1980s. That sharp drop in taxes as a share of British GDP is clearer in the Centre for Policy Studies chart because it magnifies the data.

There are also big changes in the British tax mix in the 1970s and 1980s. The large rise in tax in personal income in the 1970s as a percentage of GDP, also shown in both British charts above as well is the one below, coincided with the rise of the British disease and British economy becoming widely known as the sick man of Europe.

Source: OECD Stat.

The large decline in taxation in personal income under Thatchernomics was followed by an economic boom. The UK grew at above the trend annual real GDP growth to 1.9% for most of the period from the early 1980s to 2007 as shown in the detrended data in the chart below.

Source: Computed from OECD Stat Extract and The Conference Board. 2015. The Conference Board Total Economy Database™, May 2015,http://www.conference-board.org/data/economydatabase/.

In the above chart, a flat line is growth at the same rate as the USA for the 20th century, which was 1.9% for GDP per working age person on a purchasing power parity basis. The USA’s trend growth rate in the 20th century is taken as the trend rate of growth of the global technological frontier.

A falling line in the above chart is growth in real GDP per working age person, PPP at less than the trend rate of 1.9% per annum while a rising line is real growth in GDP per working age person in excess of the trend rate.

Recent Comments