Will taxes stall the #COVID19 recovery?

18 May 2020 Leave a comment

in applied price theory, budget deficits, business cycles, econometerics, economic growth, economic history, fiscal policy, global financial crisis (GFC), great recession, labour economics, labour supply, macroeconomics, Public Choice, public economics Tags: real business cycle theory, taxation and investment

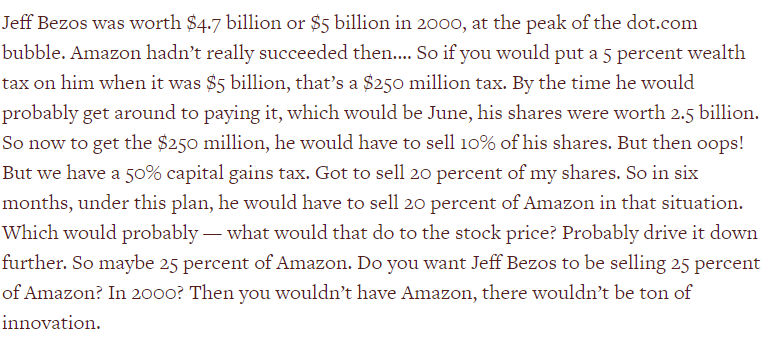

For @BernieSanders @AOC @SenWarren voters relying on @Amazon in the lockdown by Steve Kaplan

14 Apr 2020 Leave a comment

in applied price theory, economic history, entrepreneurship, financial economics, human capital, income redistribution, labour economics, Marxist economics, occupational choice, politics - USA, poverty and inequality, public economics Tags: envy, taxation and entrepreneurship, taxation and investment, top 1%

Policy in 60 Seconds: Why we need a nationwide rates freeze… NOW

06 Apr 2020 Leave a comment

in economics of bureaucracy, fiscal policy, macroeconomics, politics - New Zealand, Public Choice, public economics Tags: economics of pandemics, taxation and entrepreneurship, taxation and investment

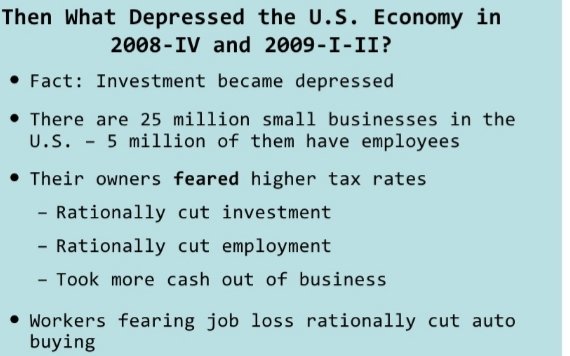

Edward Prescott on the #GFC

24 Mar 2020 Leave a comment

in budget deficits, business cycles, economic growth, Edward Prescott, fiscal policy, global financial crisis (GFC), great recession, labour economics, labour supply, macroeconomics, public economics Tags: real business cycle theory, taxation and entrepreneurship, taxation and investment, taxation and labour supply

@BernieSanders @AOC

13 Mar 2020 Leave a comment

in income redistribution, politics - USA, Public Choice, public economics Tags: 2020 presidential election, taxation and entrepreneurship, taxation and investment, taxation and labour supply, top 1%

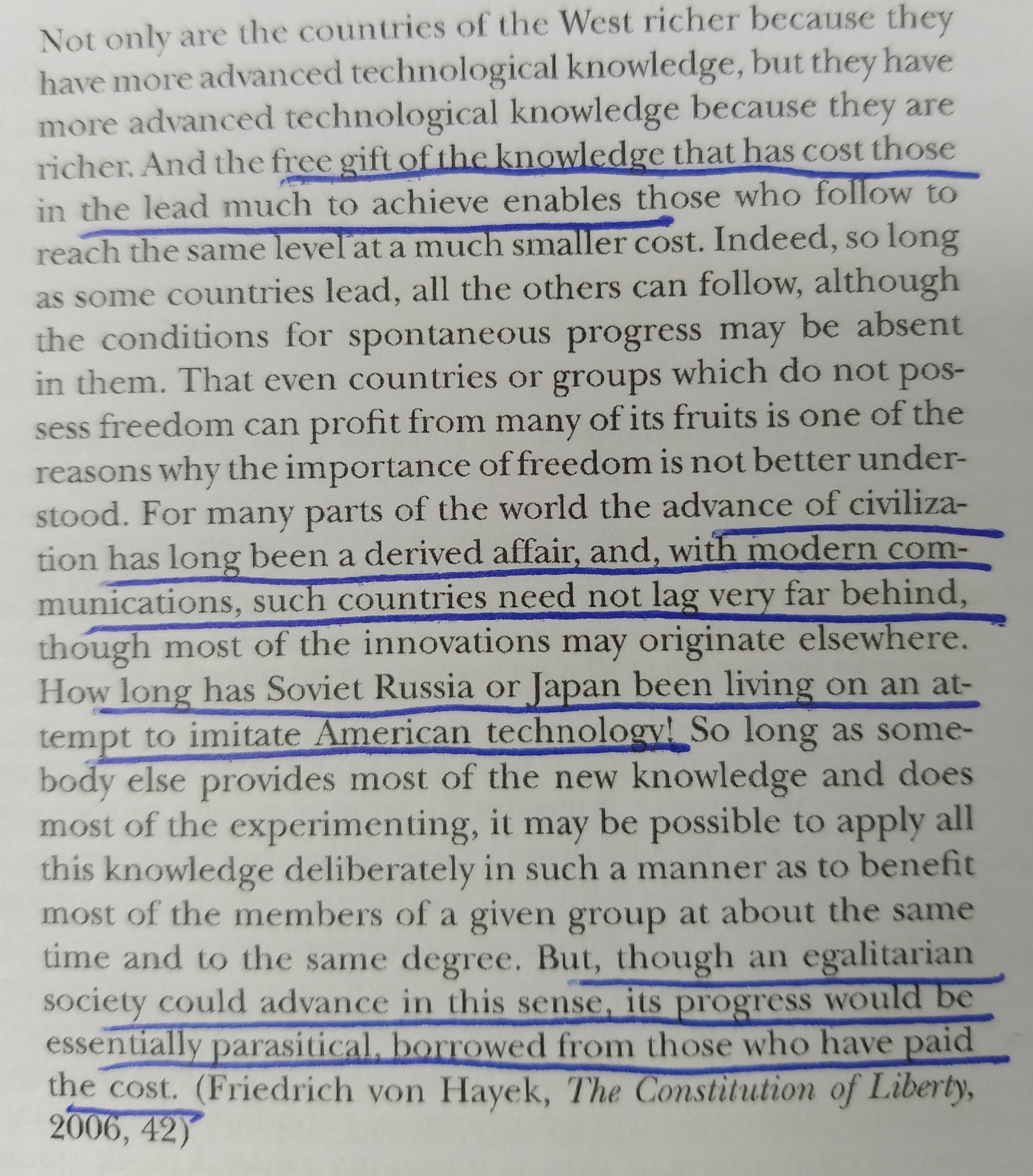

Scandinavian welfare states free-ride

08 Mar 2020 Leave a comment

in applied price theory, Austrian economics, comparative institutional analysis, constitutional political economy, economic growth, economics of education, economics of information, economics of regulation, entrepreneurship, F.A. Hayek, history of economic thought, human capital, income redistribution, industrial organisation, international economics, law and economics, macroeconomics, poverty and inequality, property rights, Public Choice, public economics Tags: creative destruction, taxation and entrepreneurship, taxation and investment, taxation and labour supply

Inequality in America: Taxes and the Ultra-Rich | Emmanuel Saez | Steven Kaplan | Luigi Zingales

08 Mar 2020 Leave a comment

in applied price theory, economics of education, entrepreneurship, financial economics, human capital, income redistribution, industrial organisation, labour economics, labour supply, managerial economics, occupational choice, organisational economics, personnel economics, politics - USA, poverty and inequality, Public Choice, public economics, rentseeking Tags: capital gains tax, envy, taxation and entrepreneurship, taxation and investment, top 1%

The Tax Increases to Come – @WSJ

27 Jan 2020 Leave a comment

in economic growth, economics of education, fiscal policy, human capital, income redistribution, labour economics, labour supply, macroeconomics, Marxist economics, occupational choice, politics - USA, poverty and inequality, Public Choice Tags: 2020 presidential election, taxation and entrepreneurship, taxation and investment, taxation and labour supply

Milton Friedman: Why soaking the rich won’t work

27 Jan 2020 Leave a comment

in economic history, entrepreneurship, income redistribution, Milton Friedman, Public Choice, public economics Tags: envy, taxation and entrepreneurship, taxation and investment, taxation and labour supply, The Great Enrichment, top 1%

No one knew?!

09 Jan 2020 Leave a comment

in applied price theory, comparative institutional analysis, constitutional political economy, development economics, economic history, growth disasters, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply, The fatal conceit

Recent Comments