Milton Friedman – The Negative Income Tax

20 Apr 2016 Leave a comment

in economics, Milton Friedman Tags: negative income tax, universal basic income

4 Lessons for Morgan Foundation on How to Sell the #UBI @JordNZ

13 Apr 2016 Leave a comment

in applied welfare economics, labour economics, labour supply, politics - New Zealand, welfare reform Tags: expressive voting, rational irrationality, universal basic income

Source: Morgan Foundation (12 April 2016) Four Lessons for Labour on How to Sell the UBI.

I will contract out to Geoff Simmons of the Morgan Foundation my reply to the claim yesterday by the Morgan Foundation’s Susan Guthrie that there are no negatives from a Universal Basic income. Simmons said:

With an unconditional basic income, most beneficiaries would be no better off than they are now (in fact sole parents would almost certainly receive a lower benefit).

Single parents are $150 a week worse off and retirees are $50 worse off per week if their current income support were replaced by a Universal Basic Income of $11,000 per adult.

Both were entitled to much more under the current welfare benefit system and New Zealand Superannuation respectively. Unemployment, sickness and invalid beneficiaries are about 5% better off under a Universal Basic Income.

Labour’s background paper described a Universal Basic Income of $11,000 as not enough. Guthrie is even franker yesterday about how inadequate a Universal Basic Income is for the poor:

A basic income policy would provide everyone aged 18 and over with an unconditional, tax free survival-level of income each and every year.

I will contract out to Gareth Morgan (2011) why a Universal Basic Income that provides a “survival-level of income” is not good enough:

Rather than decreeing a minimum wage and discovering the consequences for jobs and top-up payments, let’s agree on what is a minimum income every adult should have in order to live a dignified life and then see what flows from that.

We begin by specifying the income level below which we are not prepared to see anyone having to live.

A survival-level of income and a minimum income on which every adult can live a dignified life are not the same thing.

Gareth Morgan’s universal basic income of $11,000 for adults makes most better off except those for whom the modern welfare state was established to protect.

Most of the evidence against the Universal Basic Income comes from examining the numbers put forward by its proponents such as the Morgan Foundation and its excellent online tool. Brian Easton (2015) put it well when he said:

Many advocates put the UMI forward without doing the sums.

Those who do, find that the required tax rates are horrendous or the minimum income is so low that it is not a viable means of eliminating poverty. Among the latter are New Zealanders Douglas, Gareth Morgan and Keith Rankin.

@garethmorgannz’s @grantrobertson1’s #UBI is worse than I thought @JordNZ

03 Apr 2016 Leave a comment

in applied welfare economics, labour economics, labour supply, politics - New Zealand, poverty and inequality, welfare reform Tags: expressive voting, New Zealand Labour Party, rational irrationality, universal basic income

The Universal Basic Income of $11,000 per adult proposed by the Morgan Foundation and floated as a idea to consider by the New Zealand Labour Party leaves the poor way below even that the stingy as the poverty line switch is that 50% relative poverty line. Little wonder that the Labour Party said that increasing the Universal Basic Income to avoid leaving current beneficiaries worth off would lead to a very high tax rate.

Source: A Universal Basic Income may be a good idea – but we will still need social security that works.

@JordNZ best way to talk yourself out of #UBI is listen to advocate list new taxes required

01 Apr 2016 Leave a comment

in economics, income redistribution, labour economics, labour supply, politics - New Zealand, poverty and inequality, Public Choice, public economics, welfare reform Tags: universal basic income

Questions for @grantrobertson1 on the #UBI @JordNZ

30 Mar 2016 1 Comment

in labour economics, labour supply, politics - New Zealand, poverty and inequality, welfare reform Tags: flat rate tax, New Zealand Labour Party, top tax rate, universal basic income

Labor Party finance spokesman Grant Robertson yesterday ruled out an income rate tax of 50% to fund a Universal Basic Income. Labour is considering a Universal Basic Income. It released a background paper for that purpose as part of its Future of Work Commission.

Source: Taxpayers’ Union rubbishes Universal Basic Income idea | Stuff.co.nz.

Questions arise as to how the Labour Party will fund its Universal Basic Income after ruling out a tax rate of 50%. As Brain Easton said:

Many advocates put the UMI forward without doing the sums. Those who do find that the required tax rates are horrendous or the minimum income is so low that it is not a viable means of eliminating poverty. Among the latter are New Zealanders Douglas, Gareth Morgan and Keith Rankin.

The Labour Party’s background paper already has said that the Universal Basic Income proposed by the Morgan Foundation is insufficient because many beneficiaries and all retirees will be much worse off. They receive much more in income support under the existing welfare state and they would under a Universal Basic Income of $11,000 per adult as proposed by the Morgan Foundation.

The solution proposed by the Labour Party is a supplemental income transfers to ensure no one is worse under a Universal Basic Income. This will greatly increase the cost of a Universal Basic income in comparison to the Morgan Foundation proposals.

https://twitter.com/grantrobertson1/status/711758860659240960

A series of questions come to mind that the Labour Party and its finance spokesman Grant Robinson must answer if they are to go anywhere with a Universal Basic Income;

- Is not the point of a Universal Basic Income to replace the welfare state, not supplement it?

- How will the Labour Party fund its Universal Basic Income plus the supplemental income transfers without introducing a $8 billion tax on capital income (including the family home) as in the Morgan Foundation’s proposals?

- The Universal Basic Income proposed by the Morgan Foundation requires $13 billion in extra taxes ($8 billion from taxing capital and $5 billion from a 30% flat-rate income tax) so how much more to that will Labour need for a Universal Basic Income plus supplemental income transfers?

- What is the maximum top marginal income tax rate that Labour will consider to fund a Universal Basic Income?

- Will the Labour Party’s Universal Basic Income be funded by a flat rate income tax or a progressive income tax system?

Source: How we pay for a universal basic income – Whiteboard Wednesday.It would have been my first point

Just exactly how big is @grantrobertson1’s great big new tax?

20 Mar 2016 1 Comment

in labour economics, labour supply, politics - USA, poverty and inequality, welfare reform Tags: Director's Law, universal basic income

https://twitter.com/grantrobertson1/status/711303279284629505

Gareth Morgan’s universal basic income, by his own calculations, make well-to-do people better off and the poor and old age pensioners worse off at the cost of $12 billion tax rise. The Labour Party has now adopted this policy as worth considering.

Source: Gareth Morgan Presentation Slide 20 of 27 | Big Kahuna Book.

Source: Gareth Morgan Presentation Slide 20 of 27 | Big Kahuna Book.

@GarethMorgannz is repeating Bob Hawke’s mistake that child poverty can be solved by more money

06 Jan 2016 Leave a comment

in applied welfare economics, labour economics, labour supply, politics - New Zealand, welfare reform Tags: 1996 US welfare reforms, child poverty, family poverty, universal basic income

Jess Berentson-Shaw’s series on child poverty in the Dominion Post on child poverty had two major flaws. She argues that the solution to child poverty is to give more families more money.

The first flaw is she does not discuss previous failed attempts to solve poverty with more money. For example, Bob Hawke promised in the 1987 election that no child need live in poverty by 1990. Raising the family allowance to $1 above the family poverty line did not fix child poverty. That promise was the one Hawke later said he regretted most in his public life.

During the 1987 Australian Federal election campaign, Labour Party Prime Minister Bob Hawke announced a Family Allowance Supplement that would ensure no Australian child need live in poverty by 1990. These changes in social welfare benefits and family allowance supplements would ensure that every family would be paid one per week dollar more than the poverty threshold applicable to their family situation. I know child poverty was to be done in this way because I worked in the Prime Minister’s Department at this time.

About 580,000 Australian children lived in poverty in 1987. In 2007, at least 13 per cent of children, or 730,000 people, were poor. This was after social welfare benefits and family allowance supplements were increased to $1 above the child poverty threshold.

There is an infallible test of the practicality of Left over Left dreams such as the abolition of child poverty by writing bigger and bigger cheques to those currently poor.

If you could abolish child poverty simply by increasing welfare benefits and family allowances, the centre-right parties would be all over it like flies to the proverbial as a way of camping over the middle ground and winning the votes of socially conscious swinging voters for decades to come. Many people who would naturally vote for the centre-right parties on all other issues vote for centre-left parties out of a concern for poverty and a belief that centre-left parties will give a better deal to the poor.

The notion that poverty is simply the result of a lack of money and giving people more money will abolish child poverty has never worked. As the OECD (2009, p. 171) observed:

It would be naïve to promote increasing the family income for children through the tax-transfer system as a cure-all to problems of child well-being.

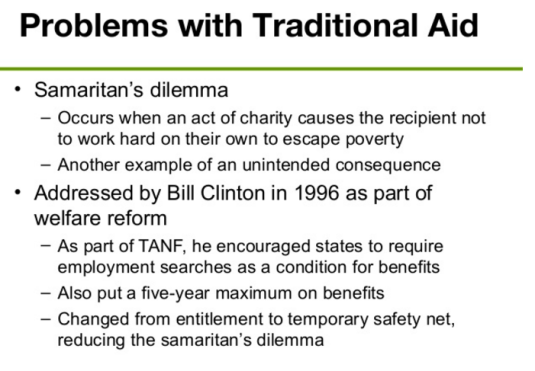

Berentson-Shaw’s second major flaw is she does not discuss the success of the 1996 US federal welfare reforms. Any serious participant in discussions of child poverty must address those 1996 US reforms.

These reforms cut Hispanic and black child poverty rates by 1/3rd in a few years by moving single mothers into employment. Time limits on welfare for single parents reduced caseloads by two thirds, 90% in some states.

After the 1996 US Federal welfare reforms, the subsequent declines in welfare participation rates and gains in employment were largest among the single mothers previously thought to be most disadvantaged: young (ages 18-29), mothers with children aged under seven, high school drop-outs, and black and Hispanic mothers. These low-skilled single mothers were thought to face the greatest barriers to employment. Blank (2002) found that:

…nobody of any political persuasion predicted or would have believed possible the magnitude of change that occurred in the behaviour of low-income single-parent families.

Employment are never married mothers increased by 50% after the US well for a reforms: employment of single mothers with less than a high school education increased by two-thirds; and employment of single mothers aged 18 to 24 approximately doubled.

Working population poverty is unchanged despite declines in elderly and child poverty #PovertyIs http://t.co/i7O7dTEUg2—

Political Line (@PoliticalLine) June 19, 2015

With the enactment of welfare reform in 1996, black child poverty fell by more than a quarter to 30% in 2001. Over a six-year period after welfare reform, 1.2 million black children were lifted out of poverty. In 2001, despite a recession, the poverty rate for black children was at the lowest point in national history.

Proposal to make child-care tax credit refundable would boost employment of working mothers bit.ly/1i1Xzcq https://t.co/2xlQQtPRJs—

The Hamilton Project (@hamiltonproj) October 29, 2015

The only modern welfare reforms to significantly cut child poverty were the US federal welfare reforms. They emphasised helping those who helped themselves, which is the classic Samaritans’ dilemma.

Countless studies show that when comparing the carrot and the stick in welfare reform, the stick is always more effective in reducing poverty and increasing employment.

The typical white family still makes $25,000 more than the typical black one: washingtonpost.com/news/wonkblog/… http://t.co/CEOADLSJdx—

Demos Action (@DemosAction) September 16, 2015

The best solution to child poverty is to move their parents into a job. Simon Chapple is clear in his book last year with Jonathan Boston:

Sustained full-time employment of sole parents and the fulltime and part-time employment of two parents, even at low wages, are sufficient to pull the majority of children above most poverty lines, given the various existing tax credits and family supports.

The best available analysis, the most credible analysis, the most independent analysis in New Zealand or anywhere else in the world that having a job and marrying the father of your child is the secret to the leaving poverty is recently by the Living Wage movement in New Zealand.

According to the calculations of the Living Wage movement, earning only $19.25 per hour with a second earner working only 20 hours affords their two children, including a teenager, Sky TV, pets, annual international travel, video games and 10-hours childcare.

This analysis of the Living Wage movement shows that finishing school so your job pays something reasonable and marrying the father of your child affords a comfortable family life. In the USA this is called the success sequence.

![clip_image002[4] clip_image002[4]](https://utopiayouarestandinginit.com/wp-content/uploads/2016/04/clip_image0024_thumb.gif?w=786&h=72)

Recent Comments