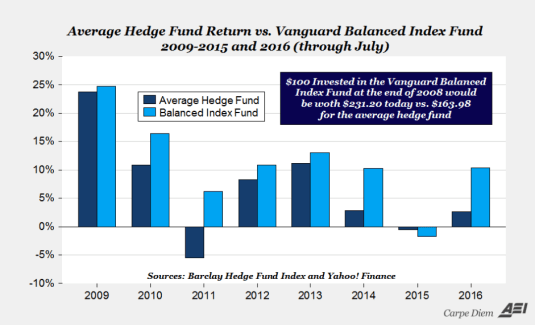

How Expert Are Expert Stock Pickers?

22 Sep 2016 Leave a comment

in economics, financial economics Tags: active investing, passive investing

Weighted average cost of capital by sector in the USA

08 Sep 2016 Leave a comment

in financial economics Tags: efficient markets hypothesis

Cost of debt and equity by sector in the USA 2016

07 Sep 2016 Leave a comment

in financial economics Tags: efficient markets hypothesis

Source: Aswath Damodaran Cost of Capital.

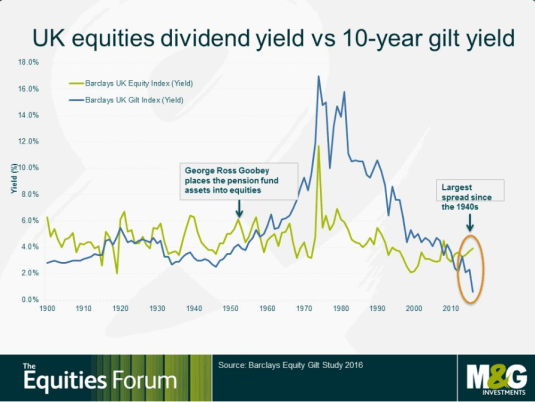

Equities now offering the highest yield premium over bonds since the 1940s

02 Sep 2016 Leave a comment

Index Funds: The 12-Step Recovery Program for Active Investors

19 Aug 2016 Leave a comment

in economics, financial economics Tags: active investing, efficient markets hypothesis, hedge funds, passive investing

Has ethical investing ever beaten the market? @GreenpeaceNZ

29 Jul 2016 Leave a comment

in environmentalism, financial economics Tags: active investing, efficient markets hypothesis, entrepreneurial alertness, ethical investing, passive investing

VFTSX is the Vanguard social investing index fund – a fund that invests in an index made up of ethical investing funds.

Source: VFTSX Vanguard FTSE Social Index Inv Fund VFTSX Quote Price News.

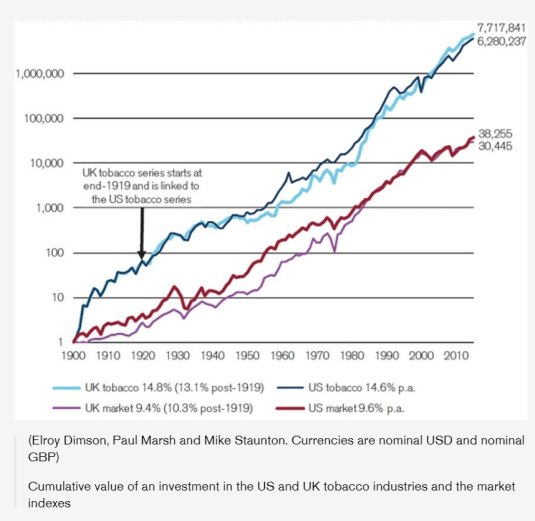

Are tobacco shares a good investment?

27 Jul 2016 Leave a comment

in financial economics, health economics

There was a bit of a hiatus in the mid-20th century but since then, Ben Bernanke’s decision to invest only in tobacco shares was a wise choice.

During the transition period, 1947-1965, shares in the tobacco industry underperformed by 3 percent per year in the USA.

Still, it was a temporary trend and the decades from the 1960s to the 2000s, when the health impact of tobacco was well known, saw tobacco companies outperforming comparable firms by over +3 percent per year.

Source: Responsible Investing: Does It Pay to Be “Bad”? – Credit Suisse.

The Economist Crony Capitalism Index

08 Jul 2016 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, constitutional political economy, development economics, economics of bureaucracy, entrepreneurship, financial economics, growth disasters, growth miracles, industrial organisation, politics - USA, Public Choice, rentseeking, survivor principle Tags: crony capitalism, superstar wages, superstars, top 1%

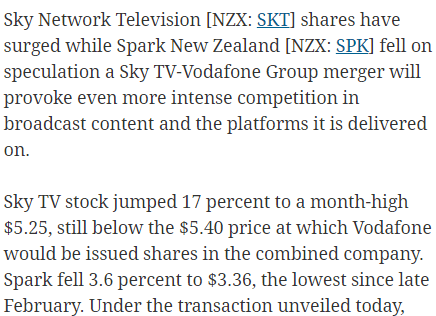

The share market speaks on competition and the Sky TV Vodafone merger

09 Jun 2016 Leave a comment

in applied price theory, financial economics, law and economics

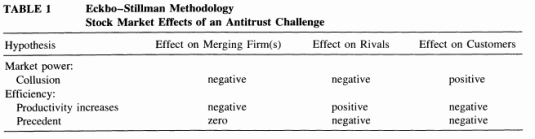

An anti-competitive merger should boost the share prices of the remaining rivals. If there is less competition and higher prices after the merger, the remaining rival firms in the market can follow those price rises up without fear of being undercut.

The Sky TV merger with Vodafone announced today is an example of that. Its competition in broadband, which is Spark, experienced a small fall in its share price. Investors in that company do not anticipate higher prices in the future as a result of the merger announced today.

Source: Sky TV shares surge, Spark falls on Vodafone merger | The National Business Review.

There is a long history of studying share market reactions to mergers first by Eckbo (1983) and Stillman (1983). The change in the value of competitors’ equity can measure the (discounted) additional profits that is expected to accrue to them as a consequence of the merger.

Source: The Competitive Effects of Mergers: Stock Market Evidence from the U.S. Steel Dissolution Suit George L. Mullin, Joseph C. Mullin and Wallace P. Mullin, The RAND Journal of Economics Vol. 26, No. 2 (Summer, 1995), pp. 314-330.

A positive reaction of remaining rivals to a merger indicates that the merger enhances competitors’ profits. This effect has been called the collusion hypothesis. Collusion is easier after the merger so share prices go up. If share prices fall, more effective collusion is not on the horizon. The adjacent snapshot of a table shows what happens to share prices when a competition agency opposes a merger.

Another way to study the competitive effects of mergers is the share market reaction in downstream markets. Do buyers anticipate lower prices from the merged supplier and its rivals?

Another test of the anti-competitive effects of the merger is whether the remaining rival firms oppose it. Was it Frank Easterbrook in the 1980s or Aaron Director in the 1950s who said that the clearest evidence of a pro-competitive merger was if rival firms ask the competition law enforcement agency to take action against it? Do the competitors oppose the merger? If they do, the merger must lower prices and put their profits under more pressure.

General government net financial liabilities as % Portuguese, Italian, Greek, Spanish and Irish GDPs

03 Jun 2016 Leave a comment

in budget deficits, business cycles, economic growth, economic history, Euro crisis, financial economics, fiscal policy, global financial crisis (GFC), macroeconomics Tags: Greece, Ireland, Italy, Portugal, public debt management, sovereign debt crises, sovereign defaults, Spain

I had borrowed a lot of money from scratch after 2007. Greece borrowed a lot of money of its own accord from 2010. Italy always owed a lot of money. Spanish do not know all that much money considering their dire financial circumstances.

Source: OECD Economic Outlook June 2016 Data extracted on 01 Jun 2016 12:57 UTC (GMT) from OECD.Stat

How big are the vice industries?

01 Jun 2016 Leave a comment

in economics of regulation, financial economics, health economics Tags: alcohol regulation, economics of smoking, entrepreneurial alertness, marijuana decriminalisation

Few of the top 50 billionaires inherited their wealth

01 Jun 2016 Leave a comment

in applied price theory, applied welfare economics, economic history, entrepreneurship, financial economics, human capital, labour economics, poverty and inequality, unions Tags: entrepreneurial alertness, inherited wealth, superstar wages, superstars, top 0.1%, top 1%

Of the 15 inheritance based billionaires, three are from the Walton family, two are the Koch brothers and another three are from the Mars family.

Source: The world’s top 50 billionaires: A demographic breakdown.

Recent Comments