New research finds couples are more likely to move for a job when it benefits the man, even when the woman’s career stands to benefit more by movingBy Dalvin Brown of The WSJ. Excerpts:”Couples are moving again for better job opportunities. They are more likely to make those moves when the husband’s earnings stand to…

Who Matters More in a Move: You or Your Spouse?

Who Matters More in a Move: You or Your Spouse?

04 Nov 2024 Leave a comment

in applied price theory, discrimination, econometerics, economics of love and marriage, gender, human capital, labour economics, labour supply, law and economics, occupational choice, poverty and inequality Tags: gender wage gap, marriage and divorce, sex discrimination

Why are Spain and Italy islands of equality?

31 Oct 2024 Leave a comment

in applied price theory, discrimination, gender, human capital, labour economics, labour supply, poverty and inequality Tags: gender wage gap

Slides Against Sohrab Ahmari

25 Oct 2024 Leave a comment

in development economics, human capital, labour economics, labour supply, poverty and inequality Tags: economics of immigration

Opening statements at my Steamboat Institute debate on open borders versus Sohrab Ahmari were so brief that I failed to even finish my slideshow. Since the audience didn’t get to see the whole thing, I’m sharing it here. Remember: This is the only immigration debate I’ve ever done where the resolution was explicitly about “benefit…

Slides Against Sohrab Ahmari

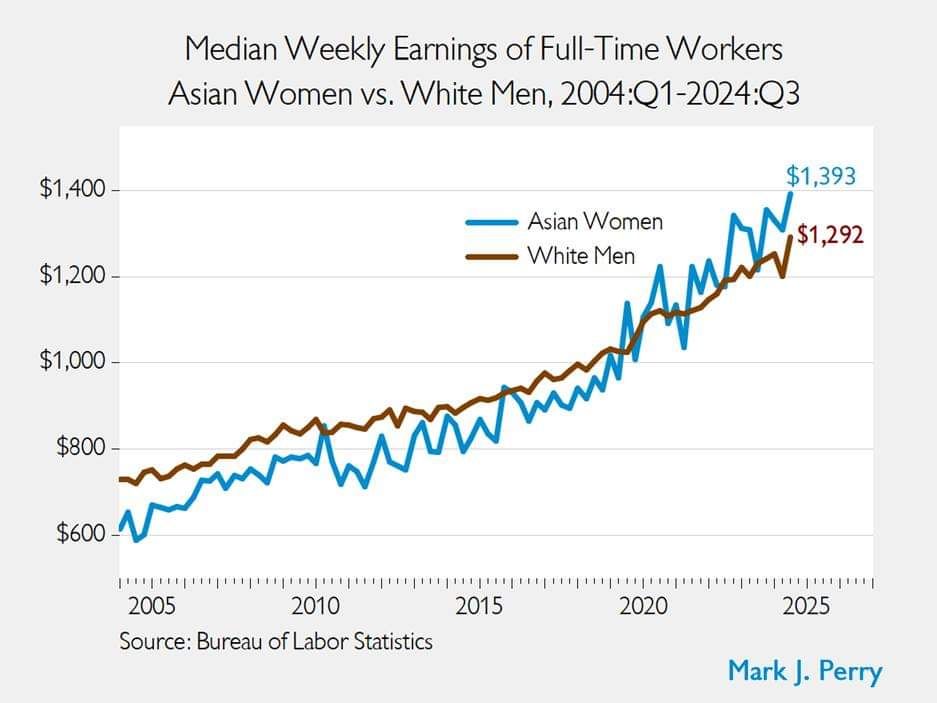

The gender gap that dare not speak its name

18 Oct 2024 Leave a comment

in discrimination, econometerics, economic history, economics of education, gender, human capital, labour economics, labour supply, occupational choice, poverty and inequality Tags: gender wage gap, racial discrimination

The NZ Treasury’s Lack of Imagination Threatens our Future. It has no faith in Economic Magic (Einstein did).

07 Oct 2024 Leave a comment

in applied price theory, health economics, labour economics, labour supply, poverty and inequality, public economics, welfare reform Tags: retirement savings

Our Treasury is at it again. Telling Kiwis a bleak future awaits them, especially in retirement. Its latest report about how NZ Demographic Change will affect the Country’s Finances is enough make the PM’s eyes glaze over, Finance Minister Willis fall asleep, NZ First leader Peters to press Delete on his laptop & everyone else…

The NZ Treasury’s Lack of Imagination Threatens our Future. It has no faith in Economic Magic (Einstein did).

Debunking Hate-and-Envy Tax Policy

27 Sep 2024 Leave a comment

in applied price theory, economic growth, economic history, entrepreneurship, financial economics, fiscal policy, health and safety, income redistribution, labour economics, labour supply, law and economics, macroeconomics, occupational choice, politics - USA, poverty and inequality, property rights, Public Choice, public economics Tags: envy, regressive left, taxation and entrepreneurship, taxation and investment

On tax policy, our friends on the left are motivated by envy and hatred. As shown in this Stossel video, Robert Reich is a sad example of this mindset. John Stossel understates his argument. It’s not that Reich is wrong. He’s wildly wrong. There are four points in the video that deserve attention. It is […]

Debunking Hate-and-Envy Tax Policy

Should we keep the wealthy non-diversified? (from my email)

27 Sep 2024 Leave a comment

in applied price theory, economic history, entrepreneurship, history of economic thought, human capital, income redistribution, industrial organisation, labour economics, labour supply, liberalism, Marxist economics, occupational choice, poverty and inequality, Public Choice Tags: top 1%

Byrne Hobart writes to me: One of the purposes of inheritance taxes is to avoid compounding intergenerational wealth. But The Missing Billionaires points out that if all of America’s millionaires had put their money in broad market indices in 1900, their heirs would number 16,000 billionaires, even accounting for taxes, splitting estates among multiple children, etc. So […]

Should we keep the wealthy non-diversified? (from my email)

Tax-Motivated International Migration

18 Sep 2024 Leave a comment

in applied price theory, entrepreneurship, labour economics, labour supply, poverty and inequality, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

I wrote a few days ago about how Americans are moving from high-tax states to lower-tax states (mostly to states with no income taxes or flat taxes). Today, let’s look at international tax migration. I’ve addressed this issue before, but generally in the context of individual countries that are attracting or repelling entrepreneurs, investors, business […]

Tax-Motivated International Migration

Equality Act 2010

18 Sep 2024 Leave a comment

in applied price theory, comparative institutional analysis, economic history, history of economic thought, human capital, job search and matching, labour economics, labour supply, law and economics, occupational choice, poverty and inequality Tags: British politics, compensating differences, pay equity

The UK’s Orwellian sounding Equality Act 2010 is strikingly Marxist. It demands equal pay for work of equal value where these are defined as follows: A’s work is equal to that of B if it is like B’s work, rated as equivalent to B’s work, or of equal value to B’s work. A’s work is […]

Equality Act 2010

The Economic Consequences of the French Wealth Tax

17 Sep 2024 Leave a comment

in applied price theory, econometerics, economic history, entrepreneurship, fiscal policy, human capital, income redistribution, labour economics, labour supply, macroeconomics, occupational choice, poverty and inequality, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

By Eric Pichet, here is the abstract: Despite attempts to ‘unwind’ the Impôt de Solidarité sur la Fortune (‘Solidarity Wealth Tax,’ the French wealth tax) during the last legislature (2002-2007), ISF yields had soared by 2006, jumping from €2.5 billion in 2002 to €3.6 billion. Analysis of the economic consequences of this ISF wealth tax […]

The Economic Consequences of the French Wealth Tax

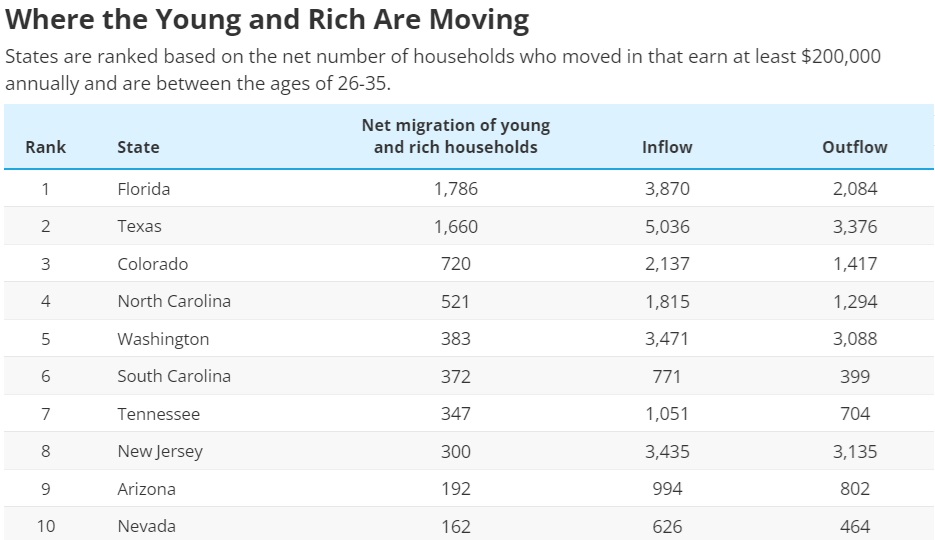

Tax-Motivated Domestic Migration

17 Sep 2024 Leave a comment

in applied price theory, economic growth, entrepreneurship, Federalism, fiscal policy, human capital, income redistribution, labour economics, labour supply, macroeconomics, occupational choice, politics - USA, poverty and inequality, Public Choice, public economics Tags: capital gains tax, taxation and investment taxation and entrepreneurship, taxation and labour supply

I’m a big fan of tax competition. I cheer when jobs, investment, and people (or even booze) move from high-tax jurisdictions to low-tax jurisdictions. This increases the rewards for good policy and also increases the punishment for bad policy. Given my interest in the topic, I obviously can’t resist sharing this chart, which shows the […]

Tax-Motivated Domestic Migration

Recovering from New Zealand’s worst ever economic decision: The cancellation of the Kirk Government’s superannuation scheme

08 Sep 2024 1 Comment

in economic growth, economic history, fiscal policy, income redistribution, labour economics, labour supply, macroeconomics, politics - New Zealand, poverty and inequality, Public Choice, public economics

EEconomists wonder about the “New Zealand paradox”, which is that New Zealand under-performs economically given its policies, institutions, natural resources, educated people, and compliance with trade and other multi-lateral agreements. Our economic reforms from the mid-1980s and on were textbook economic theory and yet the real-world results disappointed. However, New Zealand has different policy settings […]

Recovering from New Zealand’s worst ever economic decision: The cancellation of the Kirk Government’s superannuation scheme

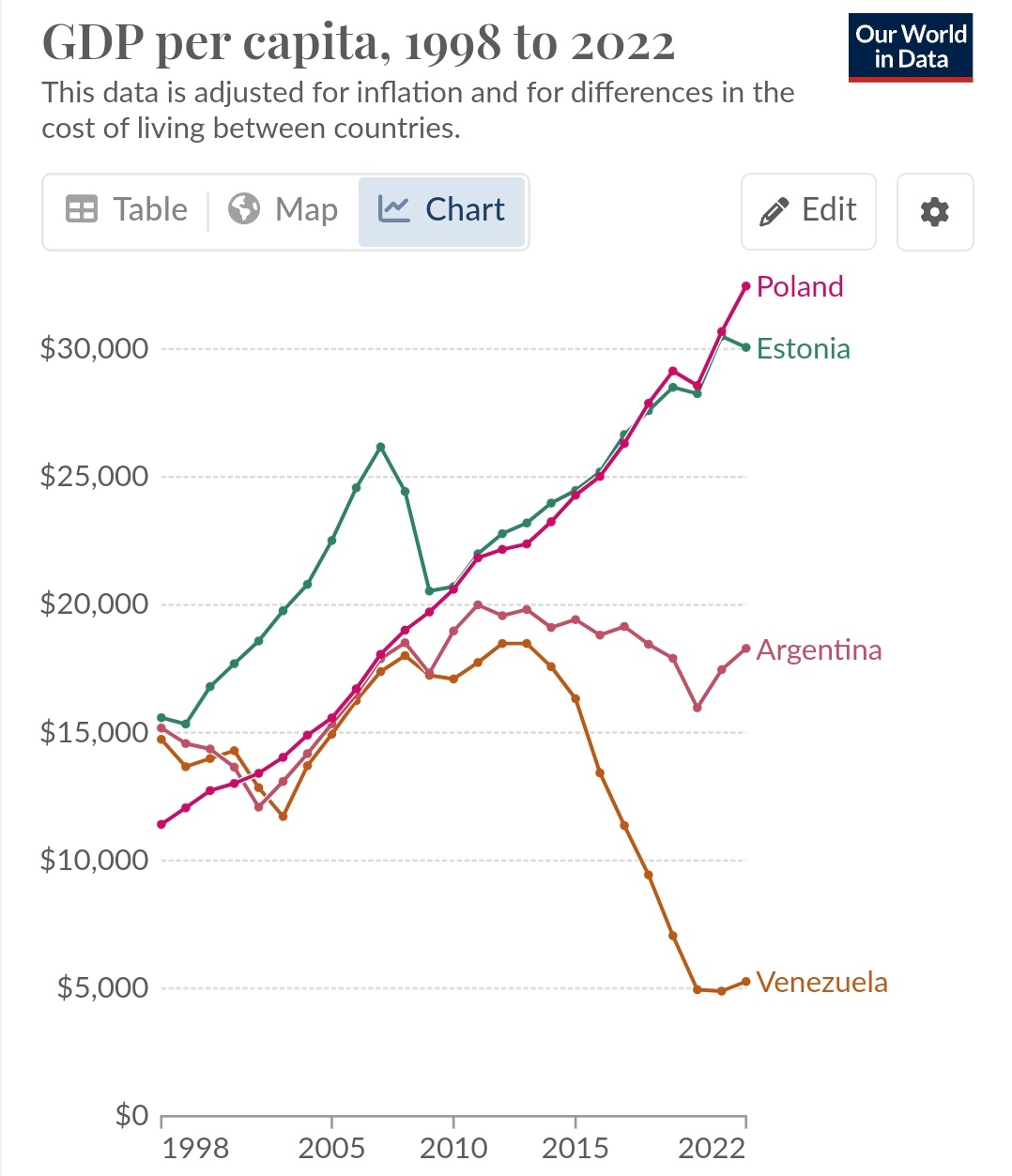

Friedman vs Stiglitz: Estonia and Poland vs. Argentina and Venezuela

06 Sep 2024 Leave a comment

in applied price theory, comparative institutional analysis, development economics, economic history, economics of bureaucracy, entrepreneurship, growth disasters, growth miracles, history of economic thought, income redistribution, industrial organisation, international economics, labour economics, law and economics, liberalism, Marxist economics, poverty and inequality, property rights, Public Choice, rentseeking, survivor principle Tags: Argentina, Chile, Poland, regressive left, Venezuela

About 10 days ago, i showed that Milton Friedman was a much better economist than Joseph Stiglitz by comparing Chile (which followed Friedman’s ideas) and Venezuela (which followed Stiglitz’s ideas). It was a slam-dunk win for Friedman. Chile started poor and has become relatively prosperous. The opposite happened in Venezuela, which started relatively prosperous and […]

Friedman vs Stiglitz: Estonia and Poland vs. Argentina and Venezuela

Jim Crow and Black Economic Progress After Slavery

05 Sep 2024 Leave a comment

in applied price theory, discrimination, economic history, economics of education, human capital, labour economics, labour supply, politics - USA, poverty and inequality Tags: economics of slavery, racial discrimination

This paper studies the long-run effects of slavery and restrictive Jim Crow institutions on Black Americans’ economic outcomes. We track individual-level census records of each Black family from 1850 to 1940, and extend our analysis to neighborhood-level outcomes in 2000 and surname-based outcomes in 2023. We show that Black families whose ancestors were enslaved until […]

Jim Crow and Black Economic Progress After Slavery

Marx explained

01 Sep 2024 Leave a comment

in applied price theory, Austrian economics, entrepreneurship, history of economic thought, human capital, income redistribution, labour economics, labour supply, law and economics, liberalism, Marxist economics, occupational choice, poverty and inequality, property rights, Public Choice

Recent Comments