A guest post by Sir Roger Douglas: Michael Littlewood’s ‘Guest Post’ for David Farrar on pensions, and his belief that our social welfare system is fit for purpose and doesn’t need change, reminded me of why New Zealand is currently well on the way to bankruptcy, and why our brightest young people are leaving the […]

Guest Post: NEW ZEALAND’s RETIREMENT PENSION

Guest Post: NEW ZEALAND’s RETIREMENT PENSION

17 Feb 2025 Leave a comment

in budget deficits, fiscal policy, income redistribution, labour economics, labour supply, macroeconomics, politics - New Zealand, Public Choice, public economics, welfare reform Tags: ageing society

LIVE from Parliament: 2025 Jonesie Awards

13 Feb 2025 Leave a comment

in budget deficits, economics of bureaucracy, fiscal policy, macroeconomics, politics - New Zealand, Public Choice, public economics

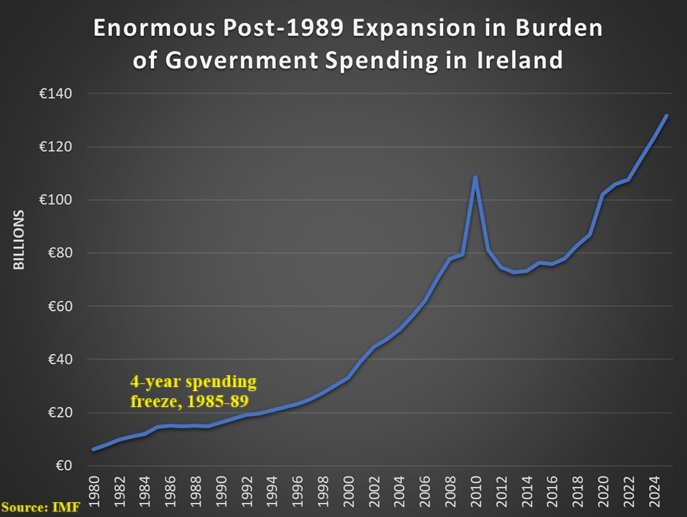

Ireland: Good Corporate Tax Policy vs. Bad Government Spending Policy

11 Feb 2025 Leave a comment

in budget deficits, business cycles, economic growth, economic history, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, labour economics, labour supply, law and economics, macroeconomics, monetary economics, public economics Tags: Ireland, taxation and investment

I’m a big fan of Ireland’s low corporate tax rate for three reasons. First, it shows that good tax policy generates positive economic outcomes as per-capita GDP in Ireland has grown by record amounts. Second, it shows that lower tax rates can in some cases lead to more revenue. Sort of a turbo-charged version of […]

Ireland: Good Corporate Tax Policy vs. Bad Government Spending Policy

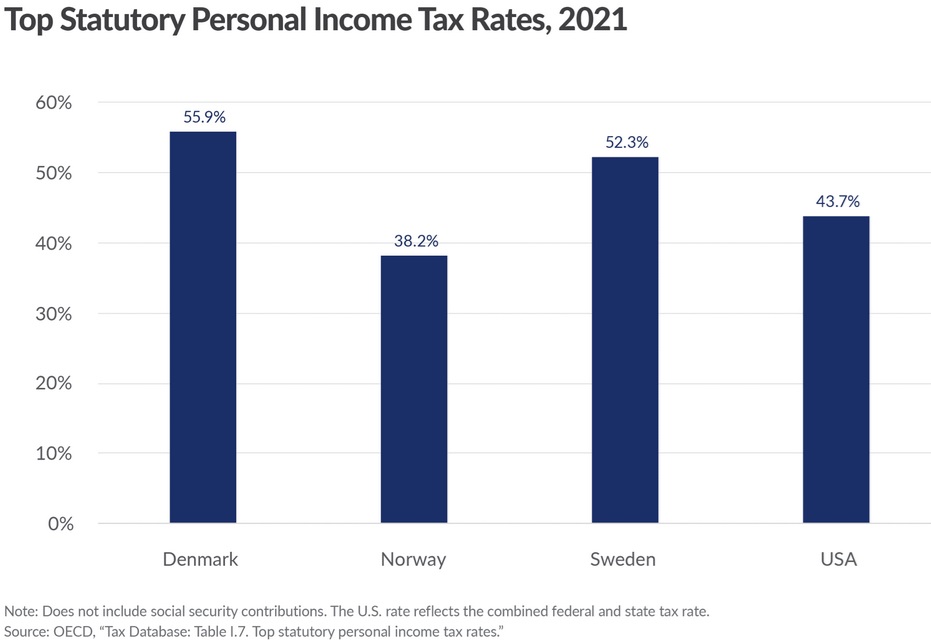

Goldilocks and the Laffer Curve

09 Feb 2025 Leave a comment

in applied price theory, budget deficits, economic growth, entrepreneurship, fiscal policy, labour economics, labour supply, macroeconomics, politics - USA, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

Other than Art Laffer, I think of myself as the world’s biggest advocate of the Laffer Curve. I’ve literally written hundreds of columns explaining and promoting the concept. My goal is to help people understand that there is not a linear relationship between tax rates and tax revenue. Why is this the case? Because when […]

Goldilocks and the Laffer Curve

Can President Trump break the International Corporate Tax Cartel?

01 Feb 2025 Leave a comment

in entrepreneurship, financial economics, fiscal policy, industrial organisation, International law, macroeconomics, politics - USA, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment

From the Economist: The international tax system has long suffered from two related problems: firms go to great lengths to book profits in low-tax jurisdictions, and governments thus have strong incentives to compete with each other in cutting levies so as to attract investment [only a dirigiste would consider this a problem]. Hoping to forestall…

Can President Trump break the International Corporate Tax Cartel?

Reviewing Covid experiences and policies

30 Jan 2025 Leave a comment

in applied price theory, applied welfare economics, economic history, economics of bureaucracy, economics of regulation, fiscal policy, health and safety, health economics, labour economics, labour supply, law and economics, macroeconomics, politics - Australia, politics - New Zealand, property rights, Public Choice Tags: economics of pandemics

I’ve spent the last week writing a fairly substantial review of a recent book (“Australia’s Pandemic Exceptionalism: How we crushed the curve but lost the race”) by a couple of Australian academic economists on Australia’s pandemic policies and experiences. For all its limitations, there isn’t anything similar in New Zealand. What we do have is […]

Reviewing Covid experiences and policies

Good Riddance, Joe Biden

20 Jan 2025 Leave a comment

in applied price theory, budget deficits, economic growth, economic history, economics of regulation, energy economics, environmental economics, fiscal policy, global warming, industrial organisation, labour economics, macroeconomics, monetary economics, politics - USA, Public Choice, rentseeking, survivor principle Tags: 2024 presidential election, regressive left

This is the last full day of Joe Biden’s dismal presidency, so let’s do what we did with Justin Trudeau and reflect on his pathetic legacy. I’ve already provided my own economic assessment of Biden’s record, so now let’s review how he is seen by others. We’ll start with the American people. According to a […]

Good Riddance, Joe Biden

Margaret Thatcher, Michael Curley, and the 19th Theorem of Government

16 Jan 2025 Leave a comment

in applied price theory, applied welfare economics, Austrian economics, comparative institutional analysis, constitutional political economy, economic growth, economic history, economics of regulation, energy economics, environmental economics, financial economics, fiscal policy, human capital, income redistribution, international economics, labour economics, labour supply, law and economics, liberalism, libertarianism, macroeconomics, Marxist economics, politics - USA, poverty and inequality, property rights, Public Choice, public economics, regulation, rentseeking

In this 12-second video, Margaret Thatcher is talking about the Labour Party in the United Kingdom, but her warning has universal application. And when I say her warning has universal application, I’m not joking. Politicians generally can’t resist the temptation to buy votes. And I fear that this can and will happen at all levels […]

Margaret Thatcher, Michael Curley, and the 19th Theorem of Government

Some Links

12 Jan 2025 Leave a comment

in applied price theory, budget deficits, development economics, economic growth, economic history, economics of regulation, entrepreneurship, fiscal policy, global financial crisis (GFC), great recession, growth disasters, growth miracles, human capital, income redistribution, industrial organisation, international economics, job search and matching, labour economics, labour supply, macroeconomics, monetary economics, poverty and inequality, Public Choice, rentseeking, survivor principle, unemployment

TweetGMU Econ alum Holly Jean Soto busts the myth of “greedflation.” Scott Lincicome identifies an interesting contrast between the facts and opinion about China. George Will decries the spinelessness of the modern U.S. Congress. A slice: The incoming president will be able, on a whim, to unilaterally discombobulate international commerce — and the domestic economy…

Some Links

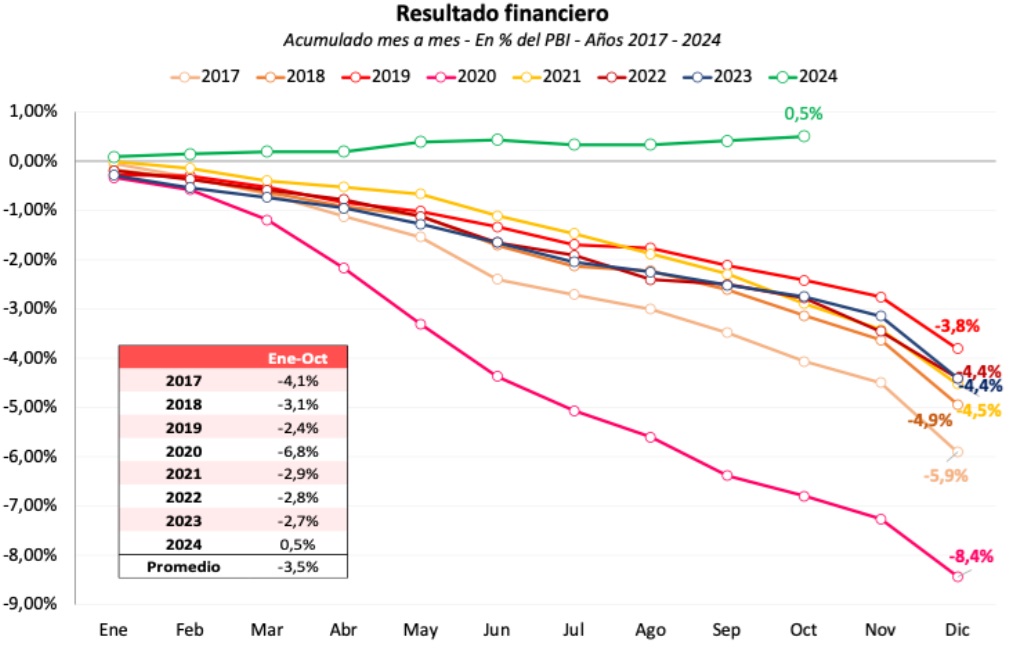

Left-Wing Economists Were Wildly Wrong about Javier Milei and his Libertarian Agenda for Argentina

10 Jan 2025 Leave a comment

in applied price theory, Austrian economics, budget deficits, business cycles, comparative institutional analysis, constitutional political economy, development economics, economic growth, economics of regulation, financial economics, fiscal policy, growth disasters, growth miracles, history of economic thought, income redistribution, international economics, labour economics, law and economics, liberalism, libertarianism, macroeconomics, Marxist economics, monetarism, monetary economics, political change, politics - USA, property rights, Public Choice, public economics, rentseeking, unemployment Tags: Argentina

It’s easy to mock economists. Consider the supposedly prestigious left-leaning academics who asserted in 2021 that Biden’s agenda was not inflationary. At the risk of understatement, they wound up with egg on their faces.* Today, we’re going to look at another example of leftist economists making fools of themselves. It involves Argentina, where President Javier […]

Left-Wing Economists Were Wildly Wrong about Javier Milei and his Libertarian Agenda for Argentina

Argentina facts of the day

29 Dec 2024 Leave a comment

in budget deficits, comparative institutional analysis, development economics, economic growth, economics of bureaucracy, economics of regulation, F.A. Hayek, financial economics, fiscal policy, growth disasters, income redistribution, international economics, labour economics, law and economics, liberalism, libertarianism, macroeconomics, Milton Friedman, monetarism, monetary economics, property rights, Public Choice, rentseeking, unemployment Tags: Argentina

Argentina’s bonds have already rallied dramatically. One gauge of the nation’s hard-currency debt, the ICE BofA US Dollar Argentina Sovereign Index, has generated a total return of about 90% this year. Meanwhile, the S&P Merval Index has risen more than 160% this year through Monday, far outpacing stock benchmarks in developed, emerging and frontier markets […]

Argentina facts of the day

The Secretary to the Treasury defending govt fiscal policy

27 Dec 2024 Leave a comment

in budget deficits, economics of bureaucracy, fiscal policy, inflation targeting, macroeconomics, politics - New Zealand, Public Choice

I wasn’t envisaging writing anything more for a while, but….Welllington’s weather certainly isn’t conducive to either the beach or the garden, and the Herald managed to get an interview with Iain Rennie, the new Secretary to the Treasury (not usually the sort of stuff for 27 December either). I’ve always been rather uneasy about heads […]

The Secretary to the Treasury defending govt fiscal policy

Bye and Bye: Washington State Moves To Toward a “Wealth Tax” As the Wealthy Move to Leave the State

26 Dec 2024 Leave a comment

in applied price theory, entrepreneurship, financial economics, fiscal policy, income redistribution, macroeconomics, Marxist economics, politics - USA, Public Choice, public economics Tags: regressive left, taxation and entrepreneurship, taxation and investment, taxation and savings, wealth tax

Washington State’s unofficial state motto has long been “Al-ki” which means either “bye and bye” or “by and by” in Chinook. The former meaning now seems official as Gov. Jay Inslee pushed for a “wealth tax.” Wealthy citizens are already saying bye to the state in anticipation of what one Democratic billionaire recently called a […]

Bye and Bye: Washington State Moves To Toward a “Wealth Tax” As the Wealthy Move to Leave the State

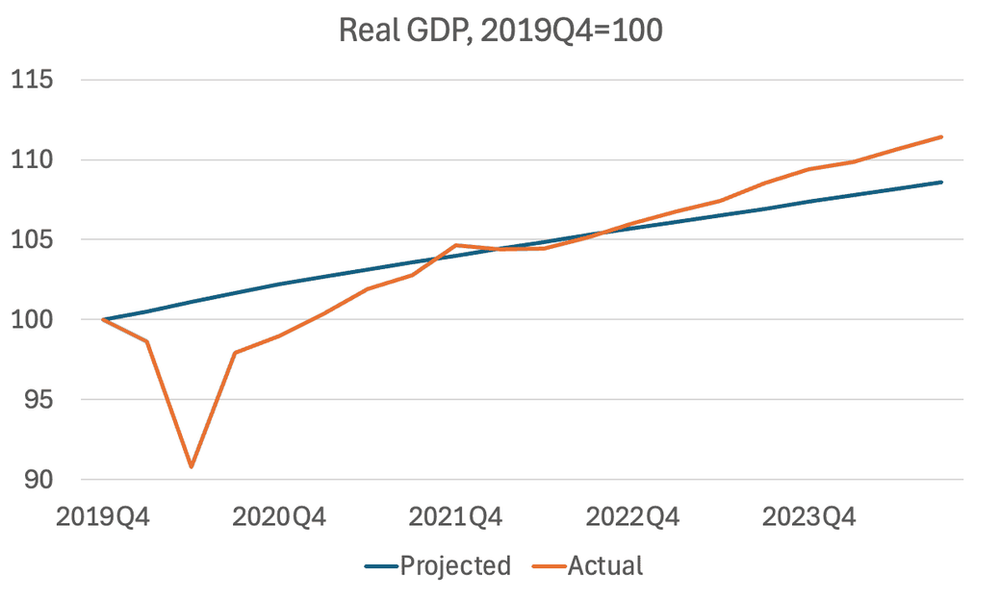

Nobel Laureate Paul Krugman’s GDP Graph Confirms the Bottom has Fallen Out of the New Zealand Economy

18 Dec 2024 Leave a comment

in budget deficits, business cycles, economic growth, economic history, fiscal policy, macroeconomics, monetary economics, politics - New Zealand

High profile US Economist Paul Krugman has written a New York Times article in which he shows in one graph the incredible resilience and performance of the American Economy. The dark blue line below tracks the pre-pandemic long-run trend in Real GDP. Meanwhile the orange line is actual real GDP. Krugman remarks that now, in…

Nobel Laureate Paul Krugman’s GDP Graph Confirms the Bottom has Fallen Out of the New Zealand Economy

Recent Comments