The Greek great depression

15 Nov 2014 Leave a comment

in Euro crisis, global financial crisis (GFC), great depression, great recession, macroeconomics, politics Tags: euro crisis, Euroland, Greece

Europe’s dismal economy

15 Nov 2014 Leave a comment

in applied welfare economics, business cycles, Euro crisis, global financial crisis (GFC), great recession, macroeconomics Tags: Euroland, Euros crisis

Romer and Romer vs. Reinhart and Rogoff – MoneyBeat – WSJ

01 Nov 2014 Leave a comment

in business cycles, Euro crisis, global financial crisis (GFC), great depression, great recession, macroeconomics Tags: financial crises, GFC

Identifying financial crises after the fact is problematic: researchers will disagree on what their characteristics were, when they started and ended, and what actually counts as a crisis. This is particularly true of crises before World War II or involving developing economies, for which accurate data are harder to come by.

So the Romers created a measure of financial distress based on real-time accounts of developed-economy conditions prepared semiannually by the Organisation for Economic Co-Operation and Development between 1967 and 2007. And to check that the OECD wasn’t for some reason off-base on conditions, they crosschecked it with central bank annual reports and articles in The Wall Street Journal.

They then scored the severity of financial conditions from zero to 15, thus avoiding quibbles over what is and isn’t a crisis and allowing for more precise readings of economic effects.

Their finding: Declines in economic output, as measured by gross domestic product and industrial production, following crises were on average moderate and often short-lived. There was a lot of variation in outcomes, so there was nothing cut and dried about how economies respond to crises…

via Romer and Romer vs. Reinhart and Rogoff – MoneyBeat – WSJ.

Romers’ work suggests the poor performance of economies around the world in the wake of the 2008 financial crisis shouldn’t be cast as inevitable. In The Current Financial Crisis: What Should We Learn From the Great Depressions of the 20th Century? de Cordoba and Kehoe note that:

Kehoe and Prescott [2007] conclude that bad government policies are responsible for causing great depressions. In particular, they hypothesize that, while different sorts of shocks can lead to ordinary business cycle downturns, overreaction by the government can prolong and deepen the downturn, turning it into a depression.

An Open Letter to Paul Krugman | David K. Levine

31 Oct 2014 3 Comments

in budget deficits, business cycles, comparative institutional analysis, economics of religion, fiscal policy, global financial crisis (GFC), great recession, macroeconomics

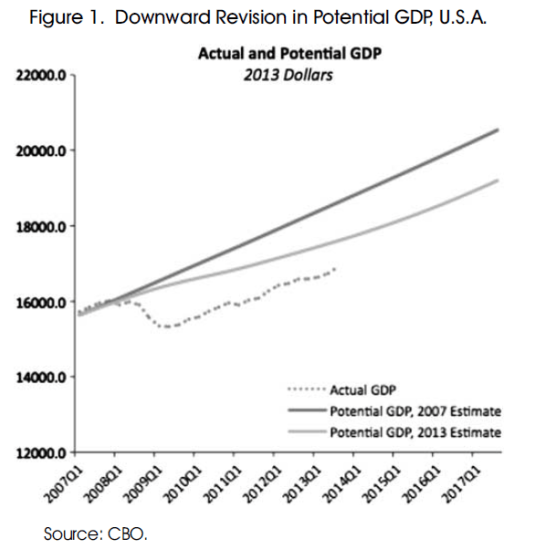

Some graphs on the great deviation on both sides of the Atlantic

31 Oct 2014 Leave a comment

in economic growth, Euro crisis, fiscal policy, global financial crisis (GFC), great depression, macroeconomics Tags: Eurosclerosis, GFC, Great Geviation, great recession

Figure 1: Actual and potential GDP in the US

Sources: Congressional Budget Office, Bureau of Economic Analysis

Figure 2: Actual and potential GDP in the Eurozone

Sources: IMF World Economic Outlook Databases, Bloomberg

HT: Larry Summers

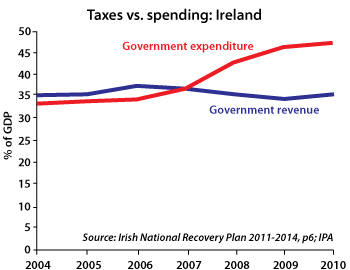

Friday graph: why Ireland is broke

31 Oct 2014 5 Comments

in fiscal policy, global financial crisis (GFC), macroeconomics, monetary economics Tags: GFC, Ireland

I am planning to blog on why the Irish economic crisis of recent years was caused exclusively by government, and in particular, government responses that made an ordinary recession into a depression

Roger Kerr, New Zealand Business Roundtable Executive Director

This is a graph courtesy of the Institute of Public Affairs in Melbourne, an impressive Australian thinktank.

It comes from the Irish government’s own 140 page ‘National Recovery Plan‘ published last week.

It is amazing reading.

- From 2000 to 2009 average public sector salaries increased 59%

- In 2004, 34% of income earners were exempt from tax. In 2010, 45% were exempt

- In 2007 property taxes generated 6.7 billion euros. In 2010 that figure will be 1.6 billion

- In 2009 interest on government debt was 8% of tax revenues. In 2014 it will be 20%.

Naysayers try to tell you that the Celtic Tiger was a myth and that free-market policies brought the Irish economy down.

The truth is exactly the opposite. Liberalisation caused the Irish economy to surge until a return to big government crushed it. Membership of the eurozone, poor banking regulation and the government guarantee of…

View original post 34 more words

A Perspective on Ireland’s Economy

19 Oct 2014 Leave a comment

in business cycles, fiscal policy, global financial crisis (GFC), macroeconomics, Public Choice Tags: GFC, Ireland

Dot point 4 is the key. The bank guarantee caused the depression.

Roger Kerr, New Zealand Business Roundtable Executive Director

Philip Lane is Professor of International Macroeconomics at Trinity College Dublin. He is also a managing editor of the journal Economic Policy, the founder of The Irish Economy blog, and a research fellow of the Centre for Economic Policy Research. His research interests include financial globalisation, the macroeconomics of exchange rates and capital flows, macroeconomic policy design, European Monetary Union, and the Irish economy.

Last week he visited New Zealand as a guest of the Treasury, the Reserve Bank, and Victoria University. During his visit he presented this guest lecture on the troubled Irish economy, drawing on his recent report to the Irish Parliament’s finance committee on ‘Macroeconomic Policy and Effective Fiscal and Economic Governance’.

Some highlights from his talk (also reported here by Brian Fallow in the New Zealand Herald) were:

- Ireland’s is a real depression: 15% fall in GDP 2007-2010

- The Celtic Tiger 1994-2001 was no…

View original post 216 more words

David Friedman on the causes of the global financial crisis and the great recession

16 Oct 2014 Leave a comment

Did the Left profit politically from Euroland crisis

07 Sep 2014 Leave a comment

in currency unions, Euro crisis, global financial crisis (GFC) Tags: EU politics

HT: whaleoil

Free trade weathered well in the global financial crisis

18 Jul 2014 Leave a comment

in global financial crisis (GFC), international economic law Tags: free trade, global financial crisis

Wrong from the start – Joseph Stiglitz

13 Jul 2014 Leave a comment

in business cycles, global financial crisis (GFC), macroeconomics, monetary economics Tags: East Asian economic miracle, global financial crisis, Japan, Japanese banking system, Joseph Stiglitz, zombie banks

A man of his times, back in 1996, smoking Joe Stiglitz used to be an admirer of the Japanese banking system because of its long-range thinking and lending

Cooperative behaviour between firms and their banks was also evident in the operations of capital markets.

In Japan each firm had a long-standing relationship with a single bank, and that bank played a large role in the affairs of the firm.

Japanese banks, unlike American banks, are allowed to own shares in the firms to which they lend, and when their client firms are in trouble, they step in. (The fact that the bank owns shares in the firm means that there is a greater coincidence of interest than there would be if the bank were simply a creditor; see Stiglitz 1985.)

This pattern of active involvement between lenders and borrowers is seen in other countries of East Asia and was actively encouraged by governments.

That praise of the Japanese banking system in 1996 did not stop him criticising the Japanese Zombie banks in 2009. Shame, Stiglitz, shame.

Note: A zombie bank is a bank with an economic net worth of less than zero but continues to operate because its ability to repay its debts is shored up by implicit or explicit government credit support.

Robert Lucas explained his support for U.S. monetary policy in 2008 as follows

10 Jul 2014 Leave a comment

in global financial crisis (GFC), great recession, macroeconomics, Robert E. Lucas Tags: fiscal policy, GFC, monetary policy, Robert Lucas

- There are many ways to stimulate spending, but monetary policy was the most helpful counter-recession action because it was fast and flexible.

- There is no other way that so much cash could have been put into the system as fast, and if necessary it can be taken out just as quickly. The cash comes in the form of loans.

- There is no new government enterprises, no government equity positions in private enterprises, no price fixing or other controls on the operation of individual businesses, and no government role in the allocation of capital across different activities. These were important virtues.

Recent Comments