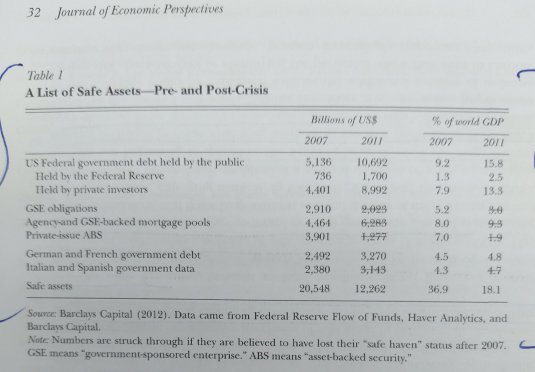

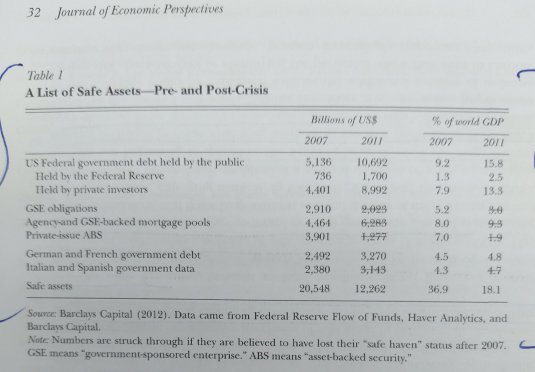

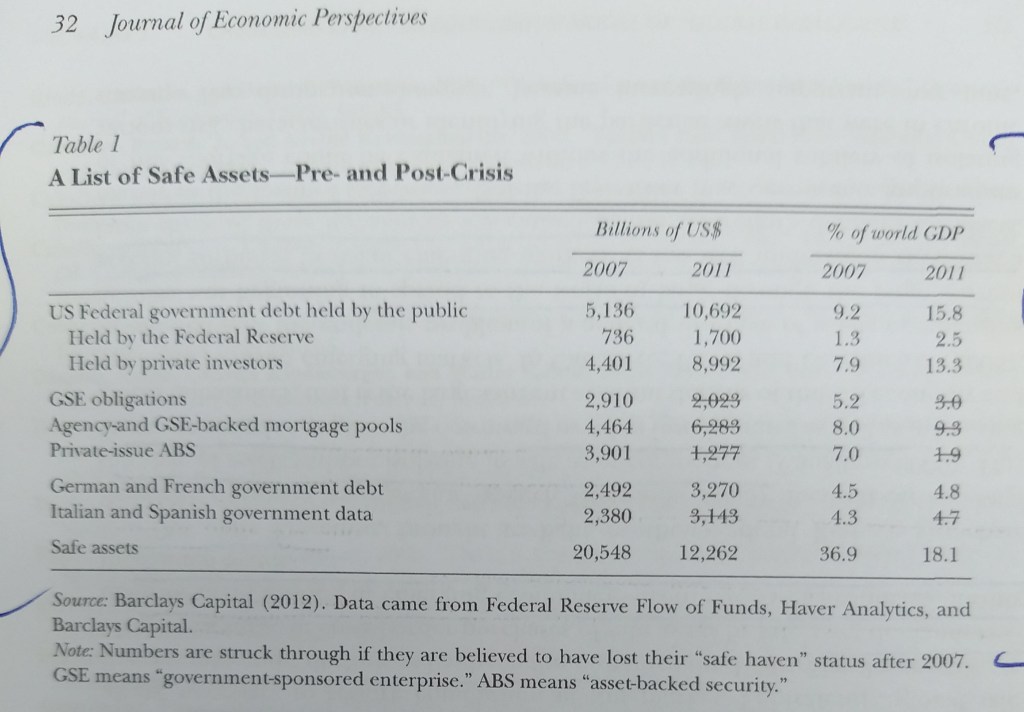

The great contraction in safe collateral

09 Mar 2020 Leave a comment

in business cycles, economic history, economics of information, Euro crisis, financial economics, fiscal policy, global financial crisis (GFC), great recession, law and economics, macroeconomics, monetary economics, property rights, Public Choice, public economics Tags: adverse selection, asymmetric information, efficient markets hypothesis, moral hazard

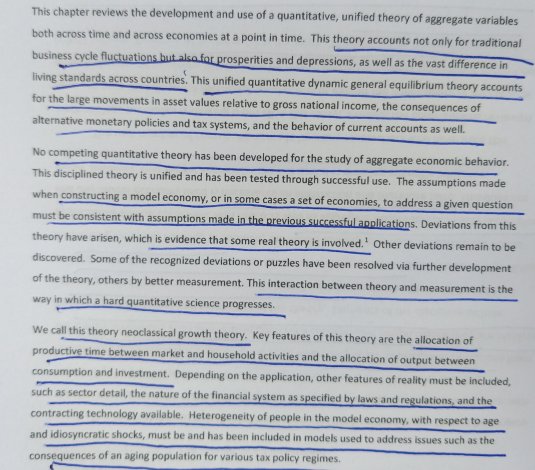

Prescott on real business cycle theory ignoring depressions

08 Mar 2020 Leave a comment

in budget deficits, business cycles, economic growth, economic history, Edward Prescott, Euro crisis, fiscal policy, global financial crisis (GFC), great depression, great recession, history of economic thought, labour supply, macroeconomics, monetary economics Tags: real business cycle theory

Nobel Symposium Gary Gorton Financial regulation

08 Mar 2020 Leave a comment

in business cycles, economics of information, economics of regulation, financial economics, global financial crisis (GFC), great recession, law and economics, macroeconomics, monetary economics

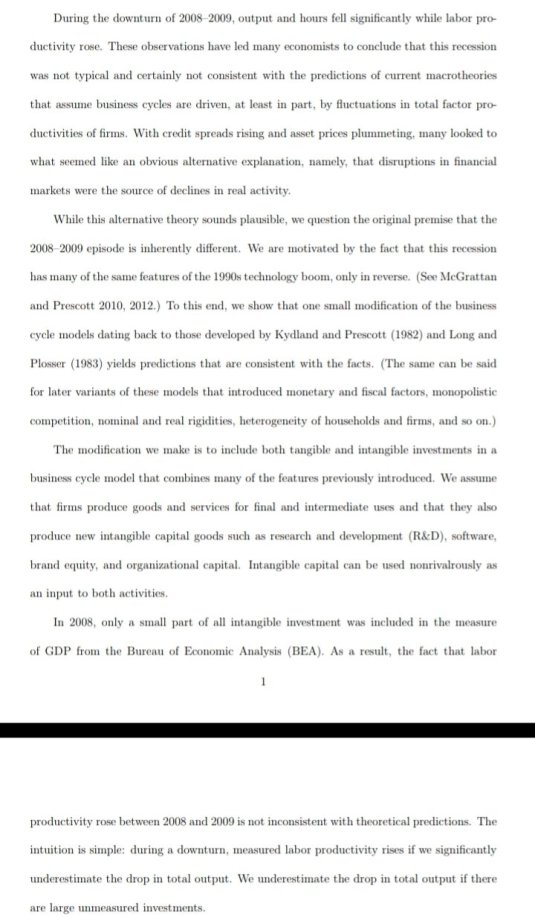

Prescott and McGrattan on intangible investment and real business cycle theory

04 Mar 2020 Leave a comment

New classical macroeconomics and real business cycle theory are different macroeconomic schools

28 Feb 2020 Leave a comment

Caballero on the great safe collateral contraction

27 Feb 2020 Leave a comment

in budget deficits, business cycles, currency unions, economic growth, economic history, entrepreneurship, Euro crisis, financial economics, fiscal policy, global financial crisis (GFC), great recession, international economics, law and economics, macroeconomics, monetary economics, property rights, Public Choice Tags: adverse selection, asymmetric information, monetary policy, moral hazard, self-selection, sovereign debt crises, sovereign defaults

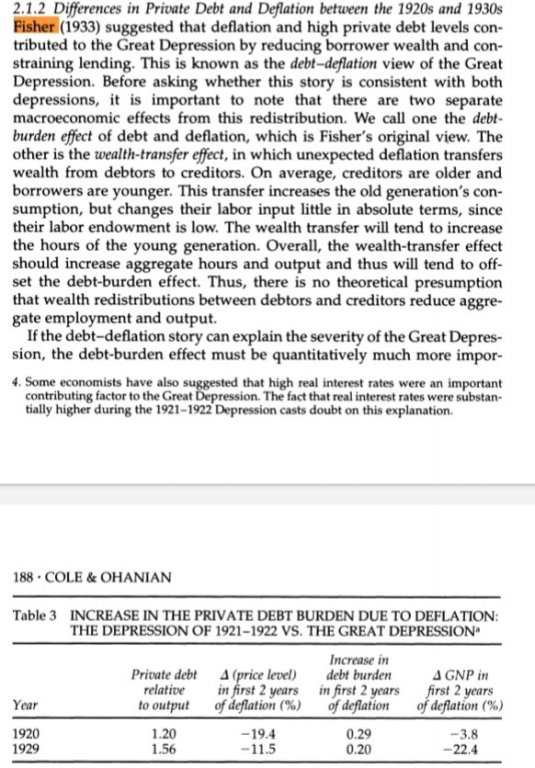

Does neoclassical macroeconomics rule out depressions?

27 Feb 2020 Leave a comment

in business cycles, econometerics, economic history, Edward Prescott, global financial crisis (GFC), great depression, great recession, history of economic thought, job search and matching, labour economics, labour supply, macroeconomics, monetary economics, politics - USA, public economics, Robert E. Lucas, unemployment, unions Tags: Keynesian macroeconomics, new classical macroeconomics, New Keynesian macroeconomics, real business cycle theory

Fama in full on fiscal policy

27 Feb 2020 Leave a comment

Fama on a fiscal stimulus

25 Feb 2020 1 Comment

in applied price theory, budget deficits, business cycles, economic growth, financial economics, fiscal policy, global financial crisis (GFC), great recession, labour economics, labour supply, macroeconomics, monetary economics, politics - USA, Public Choice, public economics Tags: fiscal policy

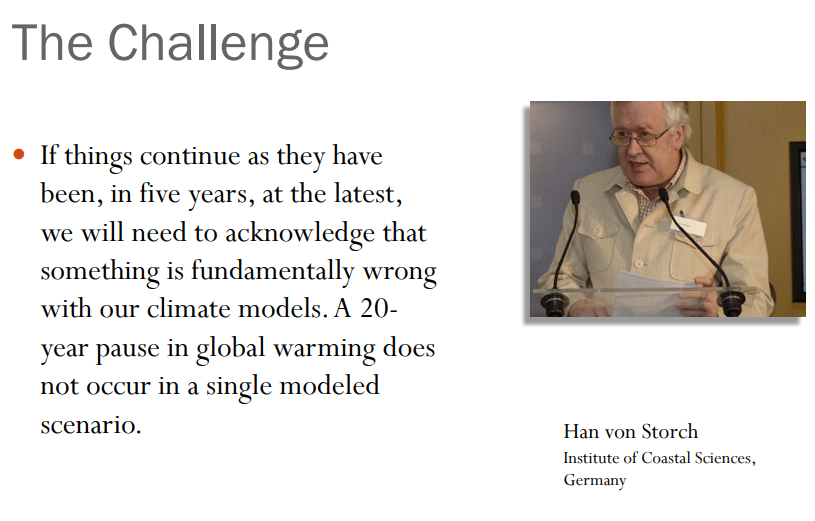

When does the pause matter?

22 Feb 2020 Leave a comment

in applied welfare economics, econometerics, energy economics, environmental economics, global financial crisis (GFC)

See https://www.friendsofscience.org/assets/documents/McKitrick2014_ThePause.pdf and https://www.rossmckitrick.com/uploads/4/8/0/8/4808045/model_obs_comp_nov_2019.pdf

The fact that CO2 emissions lead to changes in the atmospheric carbon concentration is not controversial. Nor is the fact that CO2 and other greenhouse gases (GHGs) absorb infrared energy in the atmosphere and contribute to the overall greenhouse effect. Increases in CO2 levels are therefore expected to lead to atmospheric warming, and this is the basis for the current push to enact policies to reduce GHG emissions.

For more than 25 years, climate models have reported a wide span of estimates of the sensitivity of the climate to CO2 emissions, ranging from relatively benign to potentially catastrophic. These continuing uncertainties have direct policy implications. Economic models for analyzing climate policy are calibrated using climate models, not climate data. In a low-sensitivity model, GHG emissions lead only to minor changes in temperature, so the socioeconomic costs associated with the emissions are minimal. In a high-sensitivity model, large temperature changes would occur, so marginal economic damages of CO2 emissions are larger.

The data show that, over the past two decades, warming has actually slowed down to a pace well below most model projections. Depending on the data set used, there has been no statistically significant temperature change for the past 15 to 20 years. Yet atmospheric GHG levels have increased rapidly over this interval, and there is now a widening discrepancy between most climate model projections and observed temperatures.

Since economic models are trained to match climate models, if climate models overstate the effect of CO2 emissions, economic models will overstate the social damages associated with them. Consequently, there is good reason to suppose that economic models too may be subject to revision over the next few years. Hence, it is essential to build into the policy framework clear feedback mechanisms that connect new data about climate sensitivity to the stringency of the emissions control policy. And since important new information about climate sensitivity is expected within a few years, there is value to waiting for this information before making any irreversible climate policy commitments, in order to avoid making costly decisions that are revealed a short time later to have been unnecessary.

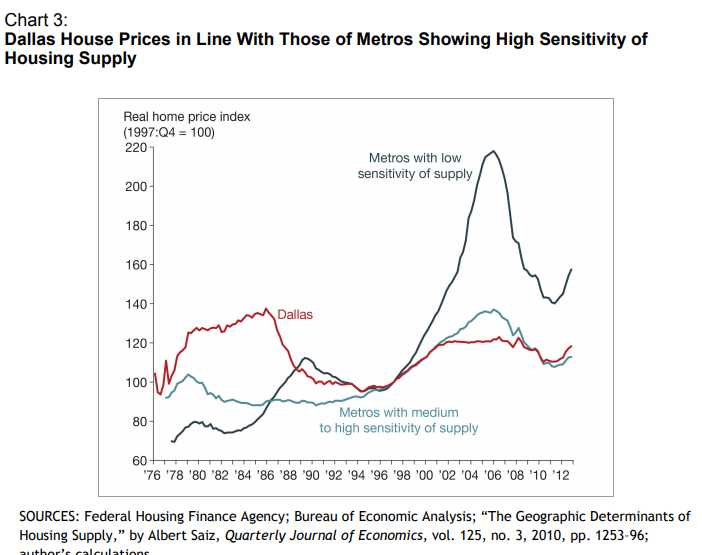

No housing bubbles if land supply is flexible

19 Feb 2020 Leave a comment

in applied price theory, business cycles, comparative institutional analysis, economics of regulation, global financial crisis (GFC), macroeconomics, politics - USA, Public Choice, rentseeking, urban economics

Nobel Symposium Randall Kroszner Lessons from the global financial crisis, and crises past

19 Feb 2020 Leave a comment

in budget deficits, business cycles, economic growth, economic history, economics of information, economics of regulation, Euro crisis, financial economics, global financial crisis (GFC), great depression, great recession, law and economics, macroeconomics, monetary economics, property rights, Public Choice, public economics Tags: sovereign defaults

Edward Prescott, Monetary Policy with 100% Reserve Banking: An Exploration

12 Feb 2020 Leave a comment

in applied price theory, applied welfare economics, budget deficits, business cycles, econometerics, economic history, Edward Prescott, global financial crisis (GFC), great depression, great recession, industrial organisation, macroeconomics, Milton Friedman, monetarism, monetary economics, property rights, Public Choice, Robert E. Lucas Tags: real business cycles

Nobel Symposium Emi Nakamura Monetary policy: Conventional and unconventional

12 Feb 2020 Leave a comment

in budget deficits, business cycles, econometerics, economic growth, economic history, Euro crisis, fiscal policy, global financial crisis (GFC), great depression, great recession, macroeconomics, monetarism, monetary economics Tags: New Keynesian macroeconomics

Recent Comments