Congratulations Mark Carney. When I went to the UK to study economics, we started off doing a degree called Master of Philosophy in…

My Former Economics MPhil and DPhil Class-Mate for many hard years, Mark Carney, becomes PM of Canada.

My Former Economics MPhil and DPhil Class-Mate for many hard years, Mark Carney, becomes PM of Canada.

10 Mar 2025 Leave a comment

in business cycles, economic history, economics of bureaucracy, economics of education, history of economic thought, human capital, inflation targeting, labour economics, labour supply, macroeconomics, monetary economics, occupational choice, politics - New Zealand, Public Choice Tags: Canada, monetary policy

Bernanke on inflation targeting

09 Mar 2025 Leave a comment

in applied price theory, budget deficits, business cycles, economic growth, economic history, financial economics, fiscal policy, history of economic thought, inflation targeting, labour economics, macroeconomics, monetary economics, politics - New Zealand, unemployment Tags: monetary policy

Former chairman of the Federal Reserve Board of Governors (and FOMC), Ben Bernanke, was yesterday the first of two keynote speakers at the Reserve Bank’s conference to mark 35 years of inflation targeting, which first became a formalised thing here in New Zealand. He indicated that he’d be speaking about inflation targeting in general and […]

Bernanke on inflation targeting

Adrian Orr resigns

05 Mar 2025 Leave a comment

in business cycles, economic history, economics of bureaucracy, fiscal policy, inflation targeting, labour economics, macroeconomics, monetary economics, politics - New Zealand, Public Choice, unemployment Tags: economics of pandemics, monetary policy

Adrian Orr has resigned as Reserve Bank Governor. I normally try to highlight the good as well as the bad when someone resigns, but I have to admit in this case I struggle. I welcomed his appointment in 2017. I noted the currency rose on his appointment and that he had a very good legacy […]

Adrian Orr resigns

Australia’s Pandemic Exceptionalism

05 Mar 2025 Leave a comment

in applied price theory, applied welfare economics, budget deficits, economic growth, economics of bureaucracy, economics of natural disasters, economics of regulation, health economics, labour economics, labour supply, macroeconomics, monetary economics, politics - Australia, politics - New Zealand, Public Choice, unemployment Tags: economics of pandemics

That’s the title of a 2024 book by a couple of Australian academic economists, Steven Hamilton (based in US) and Richard Holden (a professor at the University of New South Wales). The subtitle of the book is “How we crushed the curve but lost the race”. It is easy to get off on the wrong […]

Australia’s Pandemic Exceptionalism

The cost of Reserve Bank regulation

02 Mar 2025 Leave a comment

in applied price theory, business cycles, economics of bureaucracy, economics of natural disasters, economics of regulation, inflation targeting, macroeconomics, monetary economics, politics - New Zealand, Public Choice Tags: monetary policy

Roger Partridge writes: A new submission to the Committee from banking experts Andrew Body and Simon Jensen provides fresh evidence of these costs. Their analysis shows the Reserve Bank’s capital rules add between 0.25 and 0.375 percentage points to mortgage rates compared with Australia. For a million-dollar mortgage, that means between $2,500 and $3,750 in […]

The cost of Reserve Bank regulation

Forty years of floating

01 Mar 2025 Leave a comment

in budget deficits, business cycles, economic growth, economic history, Euro crisis, global financial crisis (GFC), great recession, history of economic thought, inflation targeting, macroeconomics, monetary economics Tags: floating exchange rates

Last year there was an interesting new book out, made up of 29 collected short papers by (more or less) prominent economists given at a 2023 conference to mark Floating Exchange Rates at Fifty. The fifty years related to the transition back to generalised floating of the major developed world currencies in 1973 (think USD, […]

Forty years of floating

$50 million of taxpayer money on a ski field

01 Mar 2025 Leave a comment

in applied price theory, fiscal policy, industrial organisation, macroeconomics, politics - New Zealand, Public Choice, public economics, rentseeking, survivor principle Tags: corporate welfare

Newsroom has a summary of taxpayer money spent on Mt Ruapehu: How often have we been told this is the final assistance. We are now deep into the sunk cost fallacy.

$50 million of taxpayer money on a ski field

Is compulsory saving the answer?

28 Feb 2025 Leave a comment

in international economics, macroeconomics Tags: current account

Economic growth – and the lack of the sustained productivity growth that underpins it – is again briefly in focus. 70 years of relative economic decline still shows no sign of being durably reversed, but the last few years have been particularly tough and there is an election next year, and so the government’s rhetorical […]

Is compulsory saving the answer?

Harvard Polling: Majority Supports DOGE Measures to Reduce the Size of Government

27 Feb 2025 Leave a comment

in fiscal policy, macroeconomics, politics - USA Tags: 2024 presidential election

As the courts hash out the legalities of the orders supporting the Department of Government Efficiency (DOGE), the public appears to support the effort despite the almost universal condemnations in the media. Despite the prediction from James Carville that the Trump Administration will collapse within 30 days, a recent Harvard CAPS/Harris poll shows that most […]

Harvard Polling: Majority Supports DOGE Measures to Reduce the Size of Government

Does the Feldstein-Horioka Puzzle mean National’s Foreign Investment Ambitions Won’t Raise NZ Productivity?

26 Feb 2025 Leave a comment

in applied price theory, econometerics, economic history, financial economics, history of economic thought, international economics, macroeconomics, politics - New Zealand Tags: foreign investment

The NZ Herald’s Editor has declared its journalists will be promoted or fired on the basis of factors like how many clicks they get on their articles. Yes, the Herald is now officially “click bait”. We’re trying to avoid the mistake of writing shallow nonsense at this Blog. So on that note, here’s a somewhat…

Does the Feldstein-Horioka Puzzle mean National’s Foreign Investment Ambitions Won’t Raise NZ Productivity?

Keynes on the Soviet Union

21 Feb 2025 Leave a comment

in history of economic thought, macroeconomics, Marxist economics Tags: British politics, Russian revolution

I had not known of this passage, which I am packaging with its introduction from Gavan Tredoux: John Maynard Keynes has the undeserved reputation of a critic of the USSR. Few know that he reviewed Sidney and Beatrice Webb’s mendacious tome The Soviet Union: a New Civilization (1935/1937/1943) fawningly. Perhaps the most embarrassing thing Keynes […]

Keynes on the Soviet Union

Guest Post: NEW ZEALAND’s RETIREMENT PENSION

17 Feb 2025 Leave a comment

in budget deficits, fiscal policy, income redistribution, labour economics, labour supply, macroeconomics, politics - New Zealand, Public Choice, public economics, welfare reform Tags: ageing society

A guest post by Sir Roger Douglas: Michael Littlewood’s ‘Guest Post’ for David Farrar on pensions, and his belief that our social welfare system is fit for purpose and doesn’t need change, reminded me of why New Zealand is currently well on the way to bankruptcy, and why our brightest young people are leaving the […]

Guest Post: NEW ZEALAND’s RETIREMENT PENSION

LIVE from Parliament: 2025 Jonesie Awards

13 Feb 2025 Leave a comment

in budget deficits, economics of bureaucracy, fiscal policy, macroeconomics, politics - New Zealand, Public Choice, public economics

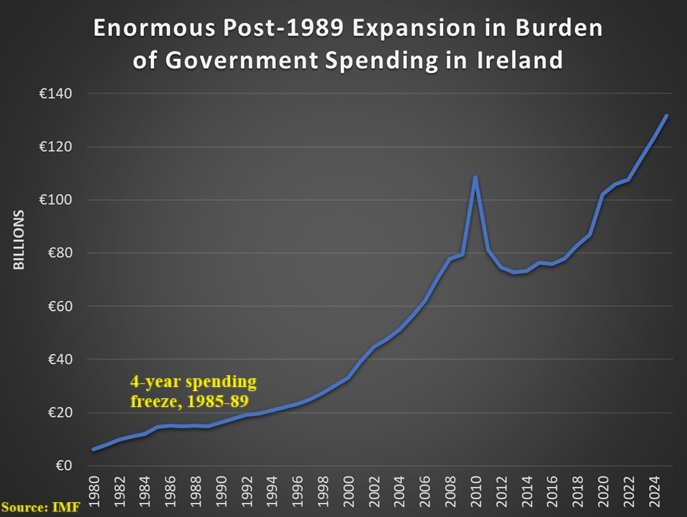

Ireland: Good Corporate Tax Policy vs. Bad Government Spending Policy

11 Feb 2025 Leave a comment

in budget deficits, business cycles, economic growth, economic history, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, labour economics, labour supply, law and economics, macroeconomics, monetary economics, public economics Tags: Ireland, taxation and investment

I’m a big fan of Ireland’s low corporate tax rate for three reasons. First, it shows that good tax policy generates positive economic outcomes as per-capita GDP in Ireland has grown by record amounts. Second, it shows that lower tax rates can in some cases lead to more revenue. Sort of a turbo-charged version of […]

Ireland: Good Corporate Tax Policy vs. Bad Government Spending Policy

Goldilocks and the Laffer Curve

09 Feb 2025 Leave a comment

in applied price theory, budget deficits, economic growth, entrepreneurship, fiscal policy, labour economics, labour supply, macroeconomics, politics - USA, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

Other than Art Laffer, I think of myself as the world’s biggest advocate of the Laffer Curve. I’ve literally written hundreds of columns explaining and promoting the concept. My goal is to help people understand that there is not a linear relationship between tax rates and tax revenue. Why is this the case? Because when […]

Goldilocks and the Laffer Curve

Recent Comments