Source: Revenue Statistics – provisional data on tax ratios for 2014 – OECD.

Taxes on goods and services as a % of US, British, Danish, Canadian, French and German GDPs since 1965

02 Mar 2016 Leave a comment

in economic history, public economics Tags: British economy, Canada, Denmark, France, Germany, GST, indirect taxes, VAT

Japanese, Korean and US tax revenues as a % of GDP since 1965

02 Mar 2016 Leave a comment

in development economics, economic history, growth miracles, public economics Tags: growth of government, Japan, size of government, South Korea

Japanese and Korean growth in the size of government seems to validate Directors’ Law. Government get bigger after countries become rich.

Data extracted on 23 Feb 2016 07:08 UTC (GMT) from OECD.Stat.

Japanese, Korean and US general government expenditure as a % of GDP since 1960

02 Mar 2016 Leave a comment

in development economics, economic history, growth miracles, Public Choice, public economics Tags: growth of government, Japan, size of government, South Korea

Tax revenues as % of US, British, Canadian and Australian GDPs since 1965

01 Mar 2016 Leave a comment

in economic history, public economics Tags: Australia, British economy, Canada, growth of government, size of government

General government expenditure as % of US, British and Canadian GDP since 1960

28 Feb 2016 Leave a comment

in economic history, fiscal policy, macroeconomics, politics - USA, public economics Tags: British economy, Canada, growth of government, Margaret Thatcher, size of government, Thatchernomics, Tony Blair

Both the British and Canadian economies experienced major winding backs in the size of government. Only the UK, under neoliberal pawn and closet Thatcherite Tony Blair, was that undone. He is now despised by many Labour Party members including its current leader for this record.

Data extracted on 23 Feb 2016 07:45 UTC (GMT) from OECD.Stat.

Landcorp dividends and capital injections, 2007 – 2015 @dbseymour @JordNZ

27 Feb 2016 1 Comment

in environmental economics, financial economics, industrial organisation, politics - New Zealand, public economics, survivor principle Tags: agricultural economics, privatisation, state owned enterprises

As cash cows go, Landcorp has had $2.25 million more in capital injections from taxpayers than it returned to them in dividends since 2007.

Source: data released by the New Zealand Treasury under the Official Information Act.

Those $1.5 billion in assets in Landcorp do not appear to be worth a cent in net cash to the long-suffering taxpayer.

Source: data released by the New Zealand Treasury under the Official Information Act.

Landcorp is a state-owned enterprise of the New Zealand government. Its core business is pastoral farming including dairy, sheep, beef and deer. In January 2012, Landcorp managed 137 properties carrying 1.5 million stock units on 376,156 hectares of land.

What do 10 countries spend their #tax revenue on?

26 Feb 2016 Leave a comment

in public economics Tags: size of government

@GarethMP proves the case for privatisation when arguing against privatisation

24 Feb 2016 Leave a comment

in applied price theory, comparative institutional analysis, economics of bureaucracy, industrial organisation, politics - New Zealand, Public Choice, public economics Tags: anti-market bias, New Zealand Greens, privatisation, rational irrationality, state owned enterprises

Green MP Gareth Hughes today nailed the case as to why governments should never run businesses. Too many MPs simply do not understand what dividends represent and what the profits from asset sales represent.

Hughes was reported today saying that taxpayers lost nearly $1 billion in dividends since the recent privatisations of power companies. He is the Green party spokesman on state owned enterprises.

Source: Asset sales cost hits $1 billion | Green Party of Aotearoa New Zealand.

Does the Green Party understand that an asset sells for a price equal to its risk-adjusted discounted net present value of the stream of dividends. When you sell a financial asset, you cash out the net present value of the stream of dividends that might have come from those assets.

The Greens, who are prissy about government transparency and dishonesty of their opponents, did not mention the $4.7 billion in revenue from the asset sale. Taxpayers now receiving more in dividends as a part owner of the privatised power companies than they did as a full owner.

Hughes had the cheek to complain about the politicisation of those privatisations such as favourable terms for small share buyers. That inability of governments to even sell an asset competently is a strong reason why governments should never run businesses in the first place.

If an asset cannot be sold in the full light of day – a major issue in an election campaign and a referendum – without the sale price that is politicised, what is the chance of good management of any state-owned enterprise when it is not the central focus of opposition scrutiny?

It is been many years since dividends from the state-owned enterprise portfolio has been a net positive cash flow for the taxpayer, as the chart below shows.

Source: New Zealand Treasury – data released under the Official Information Act.

KiwiRail and Solid Energy gobbled up whatever dividends came out of the power companies. Aside from power companies, state-owned enterprises not really offer much in the way of dividends to the taxpayer as the chart again shows.

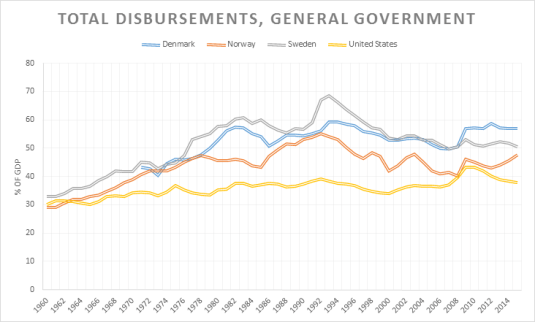

From the same starting place – US, Danish, Swedish and Norwegian general government expenditure as a % of GDP

24 Feb 2016 Leave a comment

in economic history, macroeconomics, public economics

Notice that the welfare states in Scandinavia were recent creations subsequent to post-war prosperity.

Data extracted on 23 Feb 2016 07:45 UTC (GMT) from OECD.Stat.

General government expenditure as % of Portuguese, Italian, Greek and Spanish GDP since 1960

24 Feb 2016 Leave a comment

in economic growth, economic history, Euro crisis, fiscal policy, macroeconomics, public economics Tags: Greece, growth of government, Italy, Portugal, size of government, Spain

I do not think any of these countries have governments who can really handle managing half of national income on a regular basis. The Italian, and I assume Greek GDPs at least are topped up quite considerably to take account of their underground economies. The top up for Italy is 20%.

Data extracted on 23 Feb 2016 07:45 UTC (GMT) from OECD.Stat.

Tax revenue as % of Portuguese, Italian, Greek and Spanish GDP

23 Feb 2016 Leave a comment

in economic history, public economics Tags: Greece, growth of government, Italy, Portugal, size of government, Spain

Tax receipts by source as % of US GDP since 1934

23 Feb 2016 Leave a comment

in economic history, politics - USA, public economics Tags: company taxes, taxation and entrepreneurship, taxation and investment, taxation and labour supply, World War II

Quiz question: spot the Reagan revolution?

Source: The President’s Budget for Fiscal Year 2017, Historical Tables | The White House, table 2.3.

Recent Comments