In work tax credits for families in Working For Families certainly makes a difference to the after-tax, after government transfers living standards of the family on an average wage.

Data extracted on 25 Jan 2016 01:07 UTC (GMT) from OECD.Stat.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

25 Jan 2016 Leave a comment

in politics - New Zealand, public economics Tags: family tax credits, family taxation, in-work tax credits, taxation and labour supply, working for families

In work tax credits for families in Working For Families certainly makes a difference to the after-tax, after government transfers living standards of the family on an average wage.

Data extracted on 25 Jan 2016 01:07 UTC (GMT) from OECD.Stat.

25 Jan 2016 Leave a comment

in public economics Tags: Denmark, Finland, Norway, Sweden, taxation and labour supply

23 Jan 2016 Leave a comment

in fiscal policy, macroeconomics, public economics Tags: British economy, France, Germany, Italy, taxation and labour supply

23 Jan 2016 Leave a comment

in economics of education, Marxist economics, politics - New Zealand, public economics

22 Jan 2016 Leave a comment

in labour economics, labour supply, politics - USA, public economics Tags: British economy, Canada, earned income tax credits, family tax credits, family taxation, taxation and labour supply

21 Jan 2016 Leave a comment

in economic growth, fiscal policy, labour economics, labour supply, macroeconomics, politics - New Zealand, public economics Tags: Gareth Morgan, optimal tax theory, taxation of capital

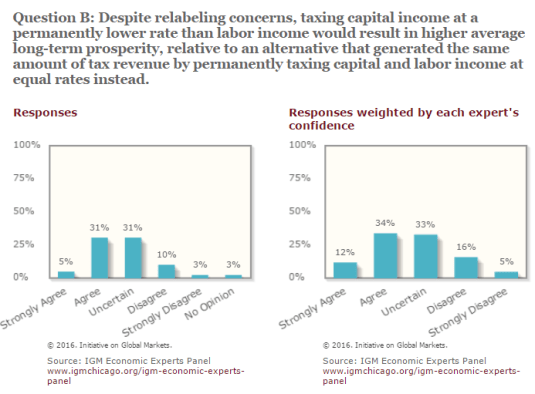

Source: Poll Results | IGM Forum.

20 Jan 2016 Leave a comment

in applied price theory, politics - New Zealand, public economics

Source: Poll Results | IGM Forum.

18 Jan 2016 Leave a comment

in constitutional political economy, international economic law, international economics, politics - New Zealand, public economics

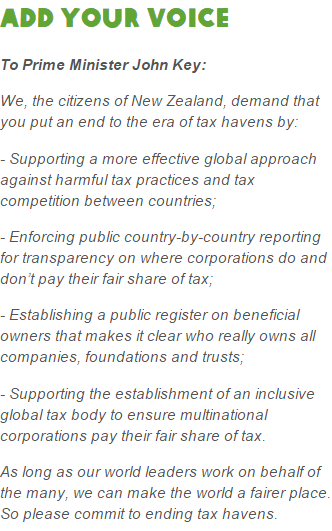

Oxfam New Zealand and fellow travellers at home and abroad are attacking the sovereignty of the Cook Islands and other tax havens by demanding that the developed countries gang up on them because they offer low company tax rates.

All that plucky rhetoric of TPPA no way and how international economic agreements violate the sovereignty of countries and developing countries in particular is forgotten in a flash.

Apparently, the same governments that were at the beck and call of the corporate elites when negotiating international trade agreements, can be trusted to negotiate international tax treaties that take into the account the interests of developing countries, the Pacific Islands and small states.

Oxfam manages to have the blinding hypocrisy of opposing the Transpacific Partnership on national sovereignty grounds and at the same time call for international treaties to bully small countries about their tax policies, which overrides their economic sovereignty.

The sovereign rights of developing countries to find their own way does not extend to undermining the tax bases of the rich countries struggling to finance their welfare states.

The Pacific Islands, the once were heroes of the recent Paris climate talks, turn into pariahs once they start looking out for themselves and setting up offshore financial centres and tax havens.

Developing countries are free to impoverish themselves by embracing socialism, but if they decide to attract investment and jobs through low tax rates and offshore financial centres, a new form of colonialism is embraced by the Twitter Left.

Source: Oxfam.

The Cook Islands is one such tax haven. The Cook Islands is self-governing in free association with New Zealand. New Zealand is responsible for its defence and foreign affairs but it has full internal sovereignty.

14 Jan 2016 Leave a comment

in economic history, politics - Australia, politics - New Zealand, politics - USA, public economics Tags: growth of government, Norway, size of government, Sweden

12 Jan 2016 Leave a comment

in applied price theory, labour economics, politics - USA, public economics Tags: laffer curve

04 Jan 2016 Leave a comment

in economic history, politics - New Zealand, public economics

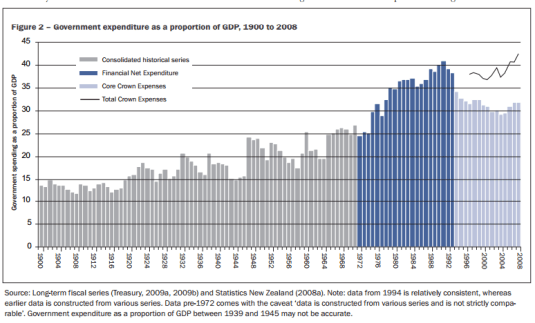

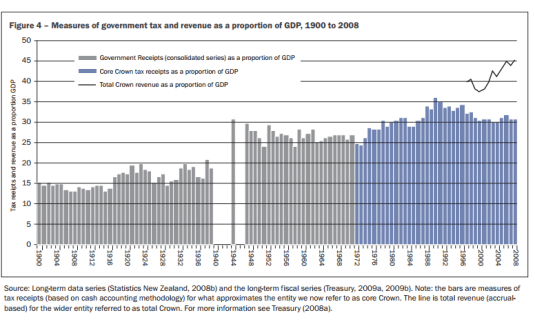

Oddly enough, the lost decades of New Zealand growth coincide with the rapid growth in the size of government between 1974 and 1992. The return of growth to New Zealand from 1992 after 17 years of stagnation and next to no real GDP growth coincided with the decline in the size of government.

Source: David Rea 2009.

Source: David Rea 2009.

27 Dec 2015 1 Comment

in politics - USA, public economics Tags: top 1%

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Scholarly commentary on law, economics, and more

Beatrice Cherrier's blog

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Why Evolution is True is a blog written by Jerry Coyne, centered on evolution and biology but also dealing with diverse topics like politics, culture, and cats.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

A rural perspective with a blue tint by Ele Ludemann

DPF's Kiwiblog - Fomenting Happy Mischief since 2003

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

The world's most viewed site on global warming and climate change

Tim Harding's writings on rationality, informal logic and skepticism

A window into Doc Freiberger's library

Let's examine hard decisions!

Commentary on monetary policy in the spirit of R. G. Hawtrey

Thoughts on public policy and the media

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Politics and the economy

A blog (primarily) on Canadian and Commonwealth political history and institutions

Reading between the lines, and underneath the hype.

Economics, and such stuff as dreams are made on

"The British constitution has always been puzzling, and always will be." --Queen Elizabeth II

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

WORLD WAR II, MUSIC, HISTORY, HOLOCAUST

Undisciplined scholar, recovering academic

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Res ipsa loquitur - The thing itself speaks

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Researching the House of Commons, 1832-1868

Articles and research from the History of Parliament Trust

Reflections on books and art

Posts on the History of Law, Crime, and Justice

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Exploring the Monarchs of Europe

Cutting edge science you can dice with

Small Steps Toward A Much Better World

“We do not believe any group of men adequate enough or wise enough to operate without scrutiny or without criticism. We know that the only way to avoid error is to detect it, that the only way to detect it is to be free to inquire. We know that in secrecy error undetected will flourish and subvert”. - J Robert Oppenheimer.

The truth about the great wind power fraud - we're not here to debate the wind industry, we're here to destroy it.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Economics, public policy, monetary policy, financial regulation, with a New Zealand perspective

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Restraining Government in America and Around the World

Recent Comments