In our textbook, Tyler and I give an amusing example of how entrepreneurs circumvented U.S. tariffs and quotas on sugar. Sugar could be cheaply imported into Canada and iced tea faced low tariffs when imported from Canada into the U.S., so firms created a high-sugar iced “tea” that was then imported into the US and […]

Tariff Shenanigans

Tariff Shenanigans

15 Jul 2025 Leave a comment

in applied price theory, international economic law, international economics, politics - USA Tags: free trade, offsetting behavior, tarrifs

Very Expensive Affordable Housing

10 Jun 2025 1 Comment

in applied price theory, economics of regulation, law and economics, politics - USA, property rights, urban economics Tags: housing affordability, offsetting behavior, The fatal conceit, unintended consequences

In my post Affordable Housing is Almost Pointless, I highlighted how point systems for awarding tax credits prioritize DEI, environmental features, energy efficiency, and other secondary goals far more than low cost. A near-comic example comes from D.C., where so-called affordable housing units now cost between $800,000 and $1.3 million dollars each! One such unit […]

Very Expensive Affordable Housing

How employers respond to minimum wage increases

15 Feb 2025 Leave a comment

in applied price theory, labour economics, labour supply, minimum wage, unemployment Tags: offsetting behavior, unintended consequences

In yesterday’s post, I made reference to this 2021 article by Jeffrey Clemens (University of California at San Diego), published in the Journal of Economic Perspectives (open access). Clemens puts forward an interesting perspective on the debate about the observed employment impacts of the minimum wage (or lack thereof):…I contend that controversies over the economics of minimum wages…

How employers respond to minimum wage increases

Climate Policies Fail in Fact and in Theory

25 Aug 2024 Leave a comment

in energy economics, environmental economics, global warming Tags: climate alarmism, offsetting behavior, unintended consequences

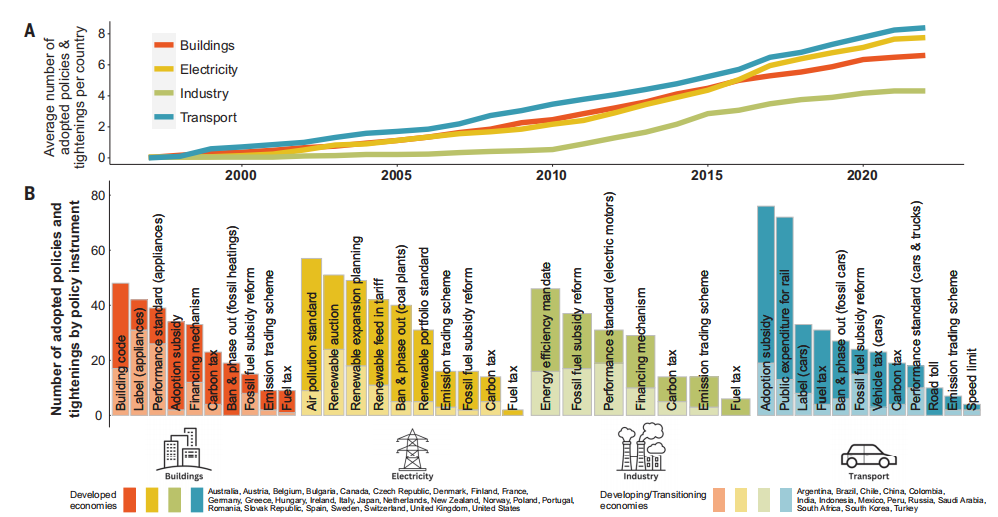

A recent international analysis of 1500 climate policies around the world concluded that 63 or 4% of them were successful in reducing emissions. The paper is Climate policies that achieved major emission reductions: Global evidence from two decades publishes at Science.org. Excerpts in italics with my bolds. Abstract Meeting the Paris Agreement’s climate targets necessitates […]

Climate Policies Fail in Fact and in Theory

Do not stifle supply and then subsidize demand

25 Jun 2024 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, income redistribution, law and economics, politics - USA, Public Choice, rentseeking Tags: offsetting behavior, unintended consequences

That phrasing comes from Arnold Kling, right? It is also the topic of my latest Bloomberg column. Here is one bit: Unfortunately, the US already was setting a bad example for the British. Recent plans from the Biden administration called for a broadly similar approach to housing policy, namely subsidizing demand. Earlier this year, Biden called for […]

Do not stifle supply and then subsidize demand

The Peltzman Effect at Sea

04 May 2024 Leave a comment

in applied price theory, economics of bureaucracy, Economics of international refugee law, labour economics, labour supply, law and economics, Public Choice, public economics Tags: economics of migration, offsetting behavior, unintended consequences

Deiana, Maheshr,and Mastrobuoniand have recently published an analysis of the effects of Search and Rescue operations on migration from Africa to Europe.Nearly half a century ago, Sam Peltzman showed that, because mandatory seat-belts made driving safer, drivers tended to drive more recklessly, partially offsetting the increased safety. Similar effects occurred in the search and rescue…

The Peltzman Effect at Sea

Upzoning with Strings Attached

21 Oct 2023 Leave a comment

in economics of regulation, income redistribution, Public Choice, rentseeking, urban economics Tags: offsetting behavior, unintended consequences, zoning

The subtitle of this paper is: “Evidence from Seattle’s Affordable Housing Mandate.” Here is the abstract: This paper analyzes the effects of a major municipal residential land use reform on new home construction and developer behavior. We examine Seattle’s Mandatory Housing Affordability (MHA) program, which relaxed zoning regulations while also encouraging affordable housing construction in […]

Upzoning with Strings Attached

Offsetting behavior

21 Apr 2023 Leave a comment

in economic history, economics of crime, economics of regulation, law and economics Tags: economics of prohibition, offsetting behavior, The fatal conceit, unintended consequences

Even medicinal stoners are cheapies unwilling to buy legally

02 Mar 2022 Leave a comment

in health economics Tags: black markets, marijuana decrimilization, offsetting behavior, unintended consequences

Whole paper bag for 1 tiny piece of ginger under @EugenieSage’s #plasticbagfascism

06 Jul 2019 Leave a comment

in environmental economics, politics - New Zealand Tags: offsetting behavior, recycling, The fatal conceit

What a $15 Minimum Wage Would Do

20 Apr 2016 Leave a comment

in applied price theory, economics of media and culture, entrepreneurship, job search and matching, labour economics, managerial economics, minimum wage, organisational economics, personnel economics, theory of the firm Tags: living wage, offsetting behavior, The fatal conceit

Many people are far too smart to save for their retirements

01 May 2014 Leave a comment

in applied welfare economics, macroeconomics Tags: Edward Prescott, fatal conceit, offsetting behavior, Other people are stupid fallacy, pretense to knowledge, retirement savings, time inconsistency

Which is better? Save for your retirement through the share market or save to own your own home and then present yourself at the local social security office to collect your taxpayer funded old-age pension?

Under this fine game of bluff, you bleed the taxpayer in your old age and pass on your debt-free home to your children.

This strategy is rational for the less well-paid. The family home is exempt from Income and asset testing for social security. If you lose you bet, sell your house and live off the capital.

For ordinary workers, this is a good bet. The middle class might prefer to live in a more luxurious retirement.

For ordinary workers, whose wages are not a lot more than their old age pension from the government, a government funded pension is a good political gamble. The old-age pension for a couple in New Zealand is set at no less that 60% of average earnings.

Compulsory savings for retirement requires the middle class to do what they can afford to do and would have done anyway.

Compulsory savings for retirement requires the working class to do what they can less afford to do.

Instead compulsory retirement savings deprives them of an old-age pension paid for by the taxes of the middle class.

In Australia, ordinary workers are required by law to save 9% of their wages for their retirements at 65 before they have had a chance to save for a car or a house or the rest of the condiments of life the middle class take for granted.

Edward Prescott argues for compulsory retirement savings account albeit with important twists because it is otherwise irrational for many to save for their retirement:

The reason we need to have mandatory retirement accounts is not because people are irrational, but precisely because they are perfectly rational — they know exactly what they are doing.

If, for example, somebody knows that they will be cared for in old age — even if they don’t save a nickel — then what is their incentive to save that nickel? Wouldn’t it be rational to spend that nickel instead?

…Without mandatory savings accounts we will not solve the time-inconsistency problem of people under-saving and becoming a welfare burden on their families and on the taxpayers. That’s exactly where we are now.

Prescott’s proposals are age specific. Those younger than 25 are not required to save anything because they are more pressing priorities such as buying cars and other consumer durables:

- Before age 25, workers would have no mandatory government retirement savings.

- Beginning at age 25, workers would contribute 3% vis-à-vis the current 10.6%.

- At age 30, that rate would increase to 5.3 percent.

- At 35, the rate would equal the full 10.6 percent.

- Upon retirement, there would be an annuity over the remaining lives of the individual and spouse

Most of all, the retirement savings must go into private savings accounts. These savings remain assets of the individual and therefore the compulsory savings requirements is not a tax and does not discourage labour supply, as Prescott explains:

Any system that taxes people when they are young and gives it back when they are old will have a negative impact on labour supply. People will simply work less.

Put another way: If people are in control of their own savings, and if their retirement is funded by savings rather than transfers, they will work more.

Prescott’s Nobel Prize jointly with Finn Kydland was for showing that policies are often plagued by problems of time inconsistency. They demonstrated that society could gain from prior commitment to economic policies.

Of course, as Tyler Cowen observed, forced savings schemes are easily offset by people rearranging their affairs, and they have their entire adult life to do so:

How much can our government force people to save in the first place?

You can make them lock up funds in an account, but they can respond by borrowing more on their credit cards, taking out a bigger mortgage, and in general investing less in their future.

People do not save for their retirements not because they are short-sighted, but because they are far-sighted. They know that governments will not carry out their threats and other big talk about not providing an adequate old-age pension.

The only way that governments can commit to not bailing people out who retire with no savings is to make them save for their own retirements over their working lives.

Some will be against this compulsion. Their opposition to compulsion cannot be based on opposition to the nanny state because that is faulty reasoning.

These opponents of compulsion and everyone else in the retirement income policy debate are playing in a far more complicated, decades long dynamic political game where ordinary people time and again out-smart conceited governments who pretend they know better:

The government has strategies.

The people have counter-strategies.

Ancient Chinese proverb

Recent Comments