Source: The New Zealand Treasury – data released under the Official Information Act.

Source: The New Zealand Treasury – data released under the Official Information Act.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

29 Sep 2015 Leave a comment

in economic history, energy economics, financial economics, industrial organisation, politics - New Zealand, survivor principle, transport economics Tags: KiwiRail, privatisation, Solid Energy, state owned enterprises, suppressing voting

Source: The New Zealand Treasury – data released under the Official Information Act.

Source: The New Zealand Treasury – data released under the Official Information Act.

29 Sep 2015 Leave a comment

in economic history, environmental economics, industrial organisation, politics - New Zealand, resource economics, survivor principle Tags: agricultural economics, Landcorp, privatisation, state owned enterprises

Landcorp is a state-owned enterprise of the New Zealand government. Its core business is pastoral farming including dairy, sheep, beef and deer. In January 2012, Landcorp managed 137 properties carrying 1.5 million stock units on 376,156 hectares of land. Its total return to shareholders, the taxpayers, has been quite up-and-down in recent years.

Source: The New Zealand Treasury – data released under the Official Information Act.

Source: The New Zealand Treasury – data released under the Official Information Act.

Source: The New Zealand Treasury – data released under the Official Information Act.

.

28 Sep 2015 Leave a comment

in energy economics, industrial organisation, politics - New Zealand Tags: expressive voting, privatisation, state owned enterprises

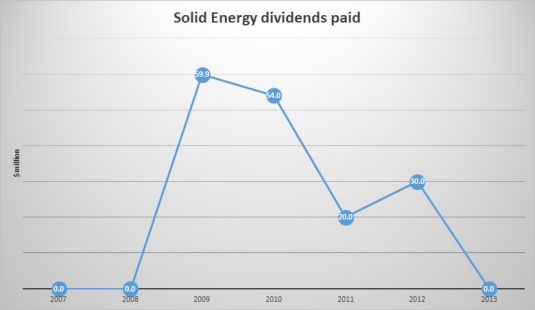

Leaving aside the fortunes and vicissitudes of the mining industry, Solid Energy’s numbers have been up and down by so much that if this was in a private company, you would start to wonder.

Source: The New Zealand Treasury – data released under the Official Information Act.

Taxpayers barely saw a cent of those multibillion-dollar valuations of just a few years ago for a company now under receivership. I doubt the ride was worth the price of passage for the taxpayer.

Source: The New Zealand Treasury – data released under the Official Information Act.

Source: The New Zealand Treasury – data released under the Official Information Act.

28 Sep 2015 Leave a comment

in economic history, economics of media and culture, industrial organisation, politics - New Zealand Tags: creative destruction, expressive voting, legacy media, privatisation, state owned enterprises

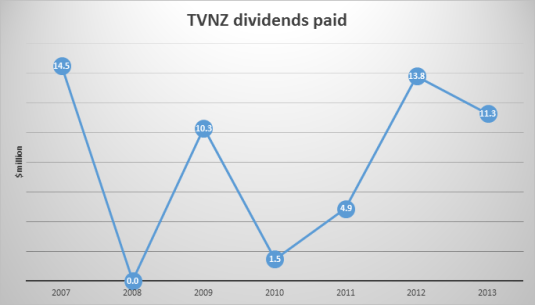

The volatile returns to taxpayers from Television New Zealand shows that continuing to own a state-owned enterprise operating a legacy media adds considerable risk to the taxpayers’ portfolio.

Source: The New Zealand Treasury – data released under the Official Information Act.

Source: The New Zealand Treasury – data released under the Official Information Act.

Source: The New Zealand Treasury – data released under the Official Information Act.

28 Sep 2015 Leave a comment

in economic history, industrial organisation, politics - New Zealand Tags: expressive voting, NZ Post, privatisation, state owned enterprises, sunset industries

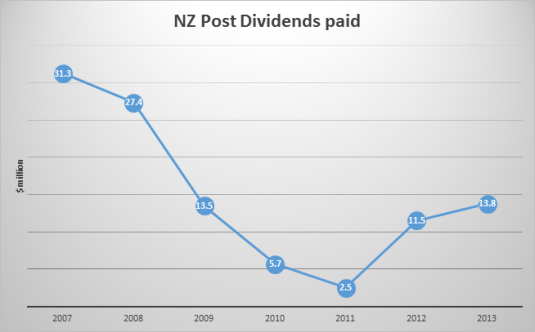

New Zealand Post is slowly going out the door with declining dividends to taxpayers, a sustained decline in its commercial valuation and a negative or poor Total Shareholder Return. Letter volumes declined by a one-half in 10 years but the parcels business is growing because of the rise of e-commerce and Internet shopping.

Source: The New Zealand Treasury – data released under the Official Information Act.

Source: The New Zealand Treasury – data released under the Official Information Act.

Source: The New Zealand Treasury – data released under the Official Information Act.

25 Sep 2015 Leave a comment

in financial economics, industrial organisation, politics - New Zealand, public economics, rentseeking, survivor principle, transport economics Tags: government ownership, KiwiRail, privatisation, rational ignorance, rational rationality, state owned enterprises, suppressive voting

The New Zealand Labour Party and New Zealand Greens both make much of the fact that when you privatise a state-owned enterprise the taxpayer is no longer entitled to dividends from the privatised business. The fact that the sale price is the net present value of those future dividends is a rating fallacy that is not the subject of this post.

Source: New Zealand Treasury – data released under the Official Information Act.

What is the subject of this post is whether there are indeed any dividends paid to taxpayers after capital injections. 2007 was the last year in which dividends to the taxpayer exceeded capital injections. The reason was that dog called KiwiRail.

24 Sep 2015 2 Comments

in financial economics, politics - New Zealand, Public Choice, public economics Tags: expressive voting, government ownership, privatisation, state owned enterprises

I asked for information from the Treasury for as far back as 2000 but could only get information back to 2008 on the return on equity of the portfolio of state-owned enterprises to the taxpayer.

Source: New Zealand Treasury – released under Official Information Act.

Apparently, long-term information on the performance of the state-owned enterprise portfolio is not available. Anyone wanting to know the performance of an individual or group of listed companies simply looks at the share price was far back as they want. The prices of individual shares reflect market expectations of future dividends and future price movements, and they go up and down as new information is revealed. The history of a share price indicates the ups and downs of a company in one number far better than any other available indicator.

I also included the adjusted rate of return on equity taking out the two dogs in the portfolio: Solid Energy and KiwiRail.

Source: New Zealand Treasury – released under Official Information Act.

19 Sep 2015 Leave a comment

in applied price theory, property rights, resource economics Tags: Amazon basin, deforestation, privatisation, public ownership

15 Aug 2015 Leave a comment

in applied price theory, industrial organisation, politics - New Zealand, public economics Tags: privatisation, state owned enterprises

In the editorial today in the Dominion Post on the Solid Energy fiasco, the editorial writer made quite an extraordinary statement:

“Ideologues of the Right will claim that the whole sad fiasco shows the dangers of the state getting into business. This is simple-minded. Not all SOEs have ended up hundreds of millions of dollars in debt. Some SOEs have been well run; some have not.”

It is absurd to claim that making a $20 million net profit on a portfolio of $30 billion in state owned enterprises in 2013 is some sort of reasonable investment for the taxpayer.

Opponents to the sale of minority shareholdings in a few state owned assets would have us believe that the government is selling the family silver.

Treasury’s annual portfolio return shows that silver isn’t returning much:

Government businesses with assets worth $45 billion made a total net profit of just $20 million in the year to June 30, according to the Treasury’s annual portfolio report.

The assets don’t include Meridian Energy, Air New Zealand and Mighty RiverPower, which were partially privatised, but cover troubled entities like KiwiRail, Solid Energy and New Zealand Post, which are all struggling to make their business models work.

The annual review covers Crown-owned assets valued at $125b.

Total shareholder…

View original post 332 more words

21 Jul 2015 Leave a comment

in economics of crime, industrial organisation, law and economics, managerial economics, organisational economics, personnel economics, politics - New Zealand, politics - USA, survivor principle Tags: creative destruction, entrepreneurial alertness, evidence-based policy, Leftover Left, New Zealand Labour Party, prison privatisation, private ownership, private prisons, privatisation, state ownership, Tony Blair

The New Zealand Labour Party would make a lot more progress in its opposition to private prisons if it would drop its ideologically blinkered opposition to privatisation. If it was to do that, it would have a much stronger case against private prisons.

That case would be based on the modern economics of industrial organisation and state and private ownership. In particular, the make or buy decision that any organisation, be they public or private must face when deciding whether to make a particular production input in-house or source it externally.

Labour’s current case against private prisons is a bunch of ideological clichés as it illustrated today in a post on Facebook by Jacinda Ardern. Her post was based on her speech in the House of Representatives:

Yes, part of that opposition is my view that no one should make a profit from incarceration, but it’s also about the complete fallacy that somehow a company like SERCO will do the job better.

The notion that no one should make a profit from incarceration is farcical. There are a whole range of private profit making suppliers of goods and services to prisons and prison officers draw a wage.

The case was state ownership, as well stated by Andrei Shleifer is no different than any other ownership decision taken by an organisation facing the inability to contract fully over hard to measure quality issues with the goods or services supplied to it.

Shleifer in “State versus Private Ownership” argues that you make in-house rather than buy in the market under the following conditions:

What particularly should focus Labour’s attention on Andrei Shleifer’s State versus Private Ownership is it is a simplified version of Hart, Oliver, Andrei Shleifer, and Robert W Vishny. 1997. “The Proper Scope of Government: Theory and an Application to Prisons.” Quarterly Journal of Economics. The abstract to that longer paper says the following:

When should a government provide a service in-house, and when should it contract out provision? We develop a model in which the provider can invest in improving the quality of service or reducing cost.

If contracts are incomplete, the private provider has a stronger incentive to engage in both quality improvement and cost reduction than a government employee has. However, the private contractor’s incentive to engage in cost reduction is typically too strong because he ignores the adverse effect on non-contractible quality. The model is applied to understanding the costs and benefits of prison privatization.

The privatisation of prisons is at the margin of the case was state versus private provision of a good or service.

Labour forecloses this entire literature to itself and bases its arguments on ideology. Any other argument Labour makes are just talking points to a fixed ideological position.There is no give-and-take. When one argument is knocked down, Labour just looks for other arguments to defend the same fixed position.

The reason Labour forecloses this large economic literature on state versus private ownership and its application to private versus public prisons is embracing that literature would mean admitting that same literature makes a strong case for the privatisation of a number of other government services and state-owned enterprises. As Shleifer says in State versus Private Ownership:

Private ownership should generally be preferred to public ownership when the incentives to innovate and to contain costs must be strong.

The main argument, the best argument, against the privatisation of publicly provided services and state-owned enterprises is the dilution of quality once it is supplied privately. This risk of compromises and quality to enhance profits is higher when the privatisation is contracting back to government. Detailed contracts must be written to assure quality. As Hart, Shleifer and Vishny say:

Critics of private schools fear that such schools, even if paid for by the government (e.g., through vouchers), would find ways to reject expensive-to-educate children, who have learning or behavioural problems, without violating the letter of their contracts. Critics also worry that private schools would replace expensive teachers with cheaper teachers’ aides, thereby jeopardizing the quality of education.

In the discussion of public versus private health care, the pervasive concern is that private hospitals would find ways to save money by shirking on the quality of care or rejecting the extremely sick and expensive-to-treat patients. In the case of prisons, concern that private providers hire unqualified guards to save costs, thereby undermining safety and security of prisoners, is a key objection to privatization.

Our model tries to explain both why private contracting is generally cheaper, and why in some cases it may deliver a higher, while in others a lower, quality level than in-house provision by the government.

By basing the argument on the strengths and weaknesses of contracting over quality for specific services, Labour would have to drop its straight ideological opposition to privatisation and run on a case-by-case basis over the ability to successfully contract to assure quality.

That sounds far too much like becoming a Blairite – the horror, the horror if you are a Labour Party member in the 21st century concerned more about ideological purity than winning office and improving the lot of the people claim to you represent.

If it were to embrace the modern economics of state versus private ownership, Labour would have to agree with Hart, Shleifer and Vishny when they say:

the case for privatization is stronger when quality reducing cost reductions can be controlled through contract or competition, when quality innovations are important, and when patronage and powerful unions are a severe problem inside the government.

When the government cannot fully anticipate, describe, stipulate, regulate and enforce exactly what it wants and prisons are a good case this and has difficulty enforce in any contract with regard to quality assurance, it’s better to make it in-house as Hart, Shleifer and Vishny show.

A call to the barricades is not be very uplifting if based on incomplete contracting over service quality rather than the evils of capitalist profit. It is unfortunate that the Labour Party sacrifice the interests of those incarcerated in the prison system to its unwillingness to be denounced as a Blairite.

The case for private prisons is based on public prisons may have fewer incentives to keep costs down, including keeping costs down by skimming on quality to increase profits as Andre Shleifer explains:

Ironically, the government sometimes becomes the efficient producer precisely because its employees are not motivated to find ways of holding costs down.

The modern case for government ownership can often be seen from precisely this perspective. Advocates of such ownership want to have state prisons so as to avoid untrained low-wage guards, state water utilities to force investment in purification, and state car makers to make them invest in environmentally friendly products.

As it turns out, however, this case for state ownership must be made carefully, and even in most of the situations where cost reduction has adverse consequences for non-contractible quality, private ownership is still superior.

That is the twist in the tale for Labour. The case against privatisation is merely a balancing act requiring detailed scrutiny of the potential to successfully enforce contracts with private providers over quality assurance.

The case against prison privatisation is simply for the public sector as fewer incentives to weaken quality because this increases the bottom line of the contractor or salaries of management. It’s a trade-off between cost control and quality dilution. Publicly run prisons have fewer incentives to control costs, but they also have fewer incentives to deliberately cut corners on quality to increase dividends or managerial salaries .

There’s nothing new about the non-profit provision of goods and services in the marketplace. A whole range of non-profit firms emerged through market competition in situations where contracting over quality or trust was costly.

Most life insurance companies were initially mutually owned by customers. Because they were a non-profit firm, there were fewer avenues to run off with the premiums through excessive dividends.

Many private universities and private schools are run by charitable trusts as a way of quality assurance. Another way of quality assurance is heavy involvement of alumni through giving and sports to police the reputation of the university or school they once attended or want their children to attend.

An arguable case can be made against prison privatisation, based on sound economic principles as long as you’re willing to admit that in many cases privatisation is a good idea based on the same economic principles. That’s a bridge too far from the Labour Party in New Zealand.

Maybe the reason is Labour knows that although they may be able to make an arguable case against prisons privatisation, they may still lose to better arguments and, in particular, successful experiments in prison privatisation at home and abroad. Better to keep the debate away from evidence-based policy. This awkwardness in seeking out the best argument is due to the proclivity of Labour in opposition to repudiate the successes of its last time in office and look for reasons to make themselves even less electable by going left rather than going back into the centre.

18 Jul 2015 1 Comment

in economic history, economics of bureaucracy, politics - New Zealand, politics - USA, Public Choice, rentseeking, transport economics Tags: Amtrak, corporate welfare, expressive voting, industry policy, KiwiRail, privatisation, rational ignorance, rational irrationality, state owned enterprises

Figure 1: Amtrak and KiwiRail bailouts, (exchange rate US$1:NZ$1.53), 2008 – 2015

Sources: Federal Funding Received by Amtrak | Mercatus and New report: Corporate welfare in the 2015 budget – Taxpayers’ Union.

New Zealand with its KiwiRail does a good job of keeping up with the Amtrak bailout especially when you look at figure 2, which computes the bailouts on a per capita basis.

Figure 2: Amtrak and KiwiRail bailouts per capita (2014 populations), (exchange rate US$1:NZ$1.53), 2008 – 2015

Sources: Federal Funding Received by Amtrak | Mercatus and New report: Corporate welfare in the 2015 budget – Taxpayers’ Union.

10 Jul 2015 Leave a comment

in applied welfare economics, economics of bureaucracy, economics of media and culture, politics - New Zealand, rentseeking, transport economics Tags: corporate welfare, KiwiRail, media bias, privatisation, public ownership, Radio New Zealand, state owned enterprises

This morning on 9 to noon on Radio New Zealand, Kathryn Ryan, the compere of the program, repeatedly claimed that the government pumped $1 billion into the KiwiRail Turnaround Plan between 2010 and 2014. I was so annoyed by this that I made a broadcasting standards complaint while the program was still being broadcast on my mobile as a one finger typist.

The report on 9 to Noon was in response to the government putting KiwiRail on notice, giving it two years to identify savings and reduce Crown funding required or risk the possibility of closure. Since KiwiRail was acquired in 2008 for $665 million as a commercial investment, Crown investments (taxpayers bailout) totalled $3.4 billion – see Figure 1.

Figure 1: State-owned enterprise welfare, Vote Transport and Vote Finance (KiwiRail), Budgets 08/09 to 15/16

Source: New Zealand budget papers, various years.

Table 1 shows that the KiwiRail Turnaround plan of $1.272 billion since the 2009-10 Budget is only a small part of the bailout of KiwiRail. 9 to Noon simply ignored the $210 million in the 2015 budget for KiwiRail for no explicable reason and instead talked about a $1 billion Turnaround plan rather than the $1.272 billion Turnaround plan.

Table 1: State-Owned Enterprise welfare, Vote Transport and Vote Finance (KiwiRail), Budgets 2008/09 to 2015/16, $million

| 08/09 |

09/10 |

10/11 |

11/12 |

12/13 |

13/14 |

14/15 |

15/16 |

|

|

New Zealand Railways Corporation Loans |

405 |

55 |

250 |

108 |

11 |

|||

|

KiwiRail Turnaround Plan |

20 |

250 |

250 |

250 |

94 |

198 |

210 |

|

|

KiwiRail Equity Injection |

323 |

25 |

29 |

|||||

|

Rail Network and Rolling Stock Upgrade |

105 |

71 |

10 |

|||||

|

New Zealand Railways Corporation Loans |

55 |

|||||||

|

New Zealand Railways Corporation Increase in Capital for the Purchase of Crown Rail |

376 |

|||||||

|

Crown Rail Operator Loans |

140 |

|||||||

|

Crown Rail Operator Equity Injection |

7 |

|||||||

|

Total |

578 |

530 |

376 |

510 |

680 |

119 |

209 |

239 |

Source: New Zealand budget papers, various years.

Other parts of the bailout of KiwiRail include $405 million in loans to the New Zealand Railways Corporation in the 2009-10 budge – see table 1. There was a $323 million equity injection in the 2012-13 Budget – see table 1. KiwiRail has also caused write-downs in the Crown balance sheet of an incredible $9.8 billion since it was repurchased in 2008.

9 to Noon ignored at least two thirds of the cost to the taxpayer of bailing out KiwiRail by only limiting its reporting to part of the KiwiRail Turnaround Plan. It ignored the contribution in the most recent budget to that plan. That does not meet broadcasting standards of accuracy or professional responsibility.

Any reasonable listener will infer, as I did when listening, that the entire cost of the bailout of KiwiRail is represented by the Turnaround Plan of about $1 billion. If listeners were left with that impression, they were misled by 9 to Noon and Radio New Zealand.

09 Jul 2015 1 Comment

in economics of bureaucracy, politics - New Zealand, Public Choice, public economics, rentseeking, transport economics Tags: corporate welfare, hard budget constraints, KiwiRail, privatisation, public ownership, state owned enterprises, state-owned enterprise welfare

In the finest public service traditions of free and frank advice, the New Zealand Treasury in its budget advice this year advised ministers to contemplate shutting down KiwiRail.

Treasury recommended the Government fund KiwiRail for one more year and undertake a comprehensive public study to look into closing the company. The study is public so that people were informed of the costs of running the rail network compared with any benefits it provided. The Government rejected the idea.

Figure 1: State-owned enterprise welfare, Vote Transport and Vote Finance (KiwiRail), Budgets 08/09 to 15/16

Source: New Zealand budget papers, various years.

KiwiRail has been a constant thorn in the taxpayers’ side. Since this rail business was acquired in 2008 for $665 million as a commercial investment, Crown investments have totalled $3.4 billion – see Figure 1.

Fortunately in the 2015 budget, the Minister of Finance signalled that the government’s patience with the KiwiRail deficits is not unlimited. KiwiRail has a 10-year Turnaround Plan to make its freight business commercially viable. The current network of 4,000 km must be reduced to 2,300 km for the company to even breakeven. The Treasury advised, to no avail, that this massive and painful restructuring was required before KiwiRail was purchased. The purchase went through.

The latest developments where Treasury advised ministers to contemplate shutting the network down is an opportunity for ministers, and the opposition spokesmen on finance and transport both to say how much is too much in accumulated KiwiRail losses.

The Minister of Finance and his Cabinet colleagues must say after the public review that there is only so much more left in the cupboard to bailout KiwiRail losses. After that fiscal cap is reached, KiwiRail is on its own. If that means bankruptcy and network closure, so be it.

In the interim, on the side of every KiwiRail train there should be advertising billboards with the following disclosure statements:

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Scholarly commentary on law, economics, and more

Beatrice Cherrier's blog

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Why Evolution is True is a blog written by Jerry Coyne, centered on evolution and biology but also dealing with diverse topics like politics, culture, and cats.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

A rural perspective with a blue tint by Ele Ludemann

DPF's Kiwiblog - Fomenting Happy Mischief since 2003

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

The world's most viewed site on global warming and climate change

Tim Harding's writings on rationality, informal logic and skepticism

A window into Doc Freiberger's library

Let's examine hard decisions!

Commentary on monetary policy in the spirit of R. G. Hawtrey

Thoughts on public policy and the media

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Politics and the economy

A blog (primarily) on Canadian and Commonwealth political history and institutions

Reading between the lines, and underneath the hype.

Economics, and such stuff as dreams are made on

"The British constitution has always been puzzling, and always will be." --Queen Elizabeth II

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

WORLD WAR II, MUSIC, HISTORY, HOLOCAUST

Undisciplined scholar, recovering academic

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Res ipsa loquitur - The thing itself speaks

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Researching the House of Commons, 1832-1868

Articles and research from the History of Parliament Trust

Reflections on books and art

Posts on the History of Law, Crime, and Justice

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Exploring the Monarchs of Europe

Cutting edge science you can dice with

Small Steps Toward A Much Better World

“We do not believe any group of men adequate enough or wise enough to operate without scrutiny or without criticism. We know that the only way to avoid error is to detect it, that the only way to detect it is to be free to inquire. We know that in secrecy error undetected will flourish and subvert”. - J Robert Oppenheimer.

The truth about the great wind power fraud - we're not here to debate the wind industry, we're here to destroy it.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Economics, public policy, monetary policy, financial regulation, with a New Zealand perspective

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Restraining Government in America and Around the World

Recent Comments