💰 Inflation, Debt & The Future of the Economy | A Conversation with John Cochrane

12 Sep 2025 1 Comment

in budget deficits, business cycles, currency unions, fiscal policy, history of economic thought, inflation targeting, macroeconomics, Milton Friedman, monetarism, monetary economics Tags: monetary policy

*Crisis Cycle*

02 Jun 2025 Leave a comment

in budget deficits, business cycles, currency unions, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, history of economic thought, international economic law, international economics, macroeconomics, monetarism, monetary economics, Public Choice Tags: European Union

That is the new book by John H. Cochrane, Luis Garicano, and Klaus Masuch, and the subtitle is Challenges, Evolution, and Future of the Euro. Excerpt: Our main theme is not actions taken in crises, but that member states and EU institutions did not clean up between crises. They did not reestablish a sustainable framework […]

*Crisis Cycle*

Brian Christopher Jones: Nigel Farage and the UK Constitution

20 Feb 2024 Leave a comment

in constitutional political economy, currency unions, economic history, law and economics, macroeconomics Tags: British constitutional law, British politics, European Union

The upheaval of the UK constitution from 2016 onwards has been associated with a host of individuals, from David Cameron to Boris Johnson to Dominic Cummings, who have received the significant bulk of academic attention in recent years. And yet, another individual has had a substantial impact upon the UK constitution during this time: Nigel […]

Brian Christopher Jones: Nigel Farage and the UK Constitution

The Euro at 25

03 Feb 2024 Leave a comment

in budget deficits, currency unions, economic history, economics of bureaucracy, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, inflation targeting, macroeconomics, monetary economics, Public Choice Tags: Euro

The euro technically started in 1999, when the 11 founding European members of the currency agreed to keep their exchange rates fixed and to hand over monetary policy to the European Central Bank. The euro then became the actual currency that people and firms used in 2002. I confess that, back in the early 1990s,…

The Euro at 25

Why Argentina’s dollarization is likely to come in sudden, messy ways

30 Nov 2023 Leave a comment

in budget deficits, business cycles, currency unions, development economics, fiscal policy, growth disasters, macroeconomics, monetary economics Tags: Argentina, dollarisation

Yes, I do still favor it, but here is part of the problem, as I explain in my latest Bloomberg column: The simplest way for Argentina to dollarize would be to inflate the peso even more. For purposes of argument, imagine a peso inflation rate of one billion percent a year. Pesos would be worthless, […]

Why Argentina’s dollarization is likely to come in sudden, messy ways

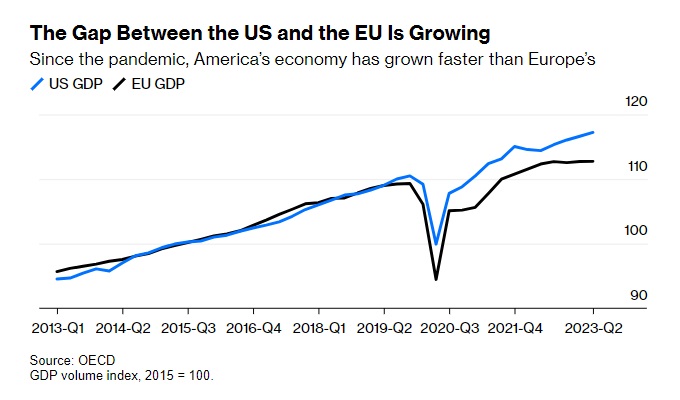

Why Is There Divergence Between the United States and Europe?

11 Nov 2023 Leave a comment

in business cycles, currency unions, economic growth, macroeconomics

In economics, convergence theory is the common-sense observation that poor countries – in general – should grow faster than rich countries. But a general principle sometimes has exceptions, and that’s why I put together my anti-convergence club. If you look at members of that club, you’ll notice that when rich countries grow faster than poor […]

Why Is There Divergence Between the United States and Europe?

Ed Prescott Says ‘Partial’ Default Is Likely for Greece

22 Nov 2021 Leave a comment

in applied price theory, applied welfare economics, budget deficits, business cycles, comparative institutional analysis, currency unions, economic growth, economic history, Edward Prescott, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, history of economic thought, labour economics, labour supply, macroeconomics, monetary economics, unemployment Tags: real business cycles

John Cochrane at talk at the ECB Conference on Monetary Policy

09 Nov 2020 Leave a comment

in budget deficits, business cycles, currency unions, economic growth, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, inflation targeting, macroeconomics, monetary economics Tags: monetary policy

INCU Global Conference 2014 – Thomas J. Sargent – Keynote Address on the effects of opening borders

02 Sep 2020 Leave a comment

in applied price theory, applied welfare economics, budget deficits, business cycles, comparative institutional analysis, constitutional political economy, currency unions, econometerics, economic history, economics of bureaucracy, economics of regulation, entrepreneurship, financial economics, fiscal policy, growth disasters, growth miracles, history of economic thought, human capital, income redistribution, industrial organisation, international economic law, international economics, International law, labour economics, labour supply, law and economics, macroeconomics, politics - Australia, politics - New Zealand, politics - USA, poverty and inequality, property rights, Public Choice, rentseeking, survivor principle, transport economics, unemployment Tags: custom unions, free trade, tariffs

Tom Sargent Honorary Degree Lecture on the European monetary crisis

01 Sep 2020 Leave a comment

in budget deficits, business cycles, currency unions, economic growth, economic history, economics of bureaucracy, Edward Prescott, financial economics, fiscal policy, global financial crisis (GFC), great depression, great recession, income redistribution, inflation targeting, job search and matching, labour economics, labour supply, macroeconomics, Milton Friedman, monetarism, monetary economics, Public Choice, public economics, rentseeking, Robert E. Lucas, unemployment Tags: monetary policy

Thomas J. Sargent on macroeconomics and the crisis 2013

27 Aug 2020 Leave a comment

in budget deficits, business cycles, currency unions, econometerics, economic growth, economic history, Euro crisis, financial economics, fiscal policy, global financial crisis (GFC), great depression, great recession, inflation targeting, Jan van Ours, job search and matching, macroeconomics, Milton Friedman, monetarism, monetary economics, Robert E. Lucas, unemployment Tags: monetary policy

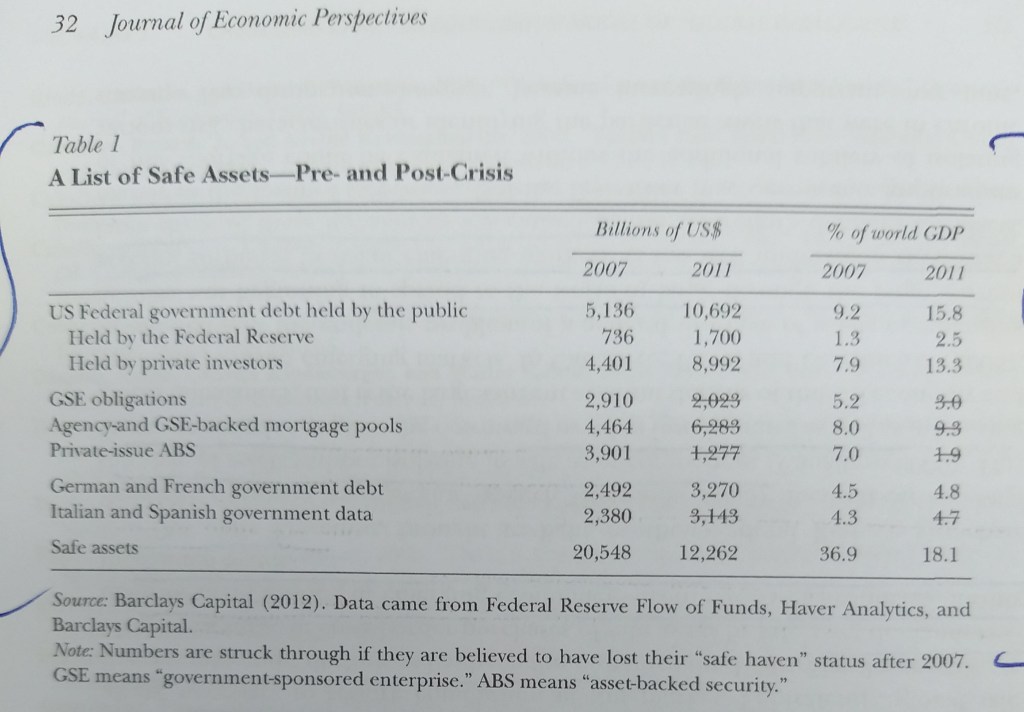

Caballero on the great safe collateral contraction

27 Feb 2020 Leave a comment

in budget deficits, business cycles, currency unions, economic growth, economic history, entrepreneurship, Euro crisis, financial economics, fiscal policy, global financial crisis (GFC), great recession, international economics, law and economics, macroeconomics, monetary economics, property rights, Public Choice Tags: adverse selection, asymmetric information, monetary policy, moral hazard, self-selection, sovereign debt crises, sovereign defaults

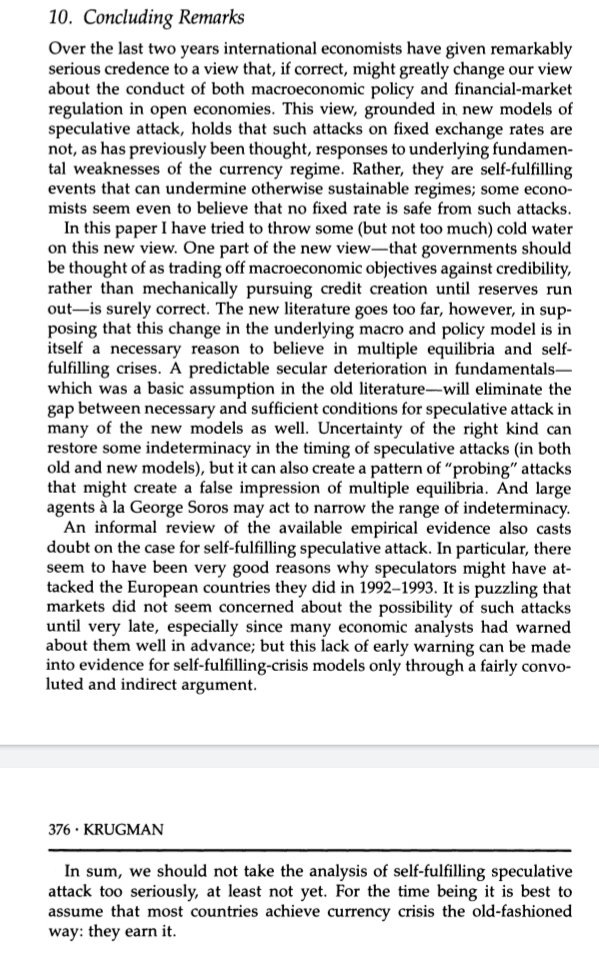

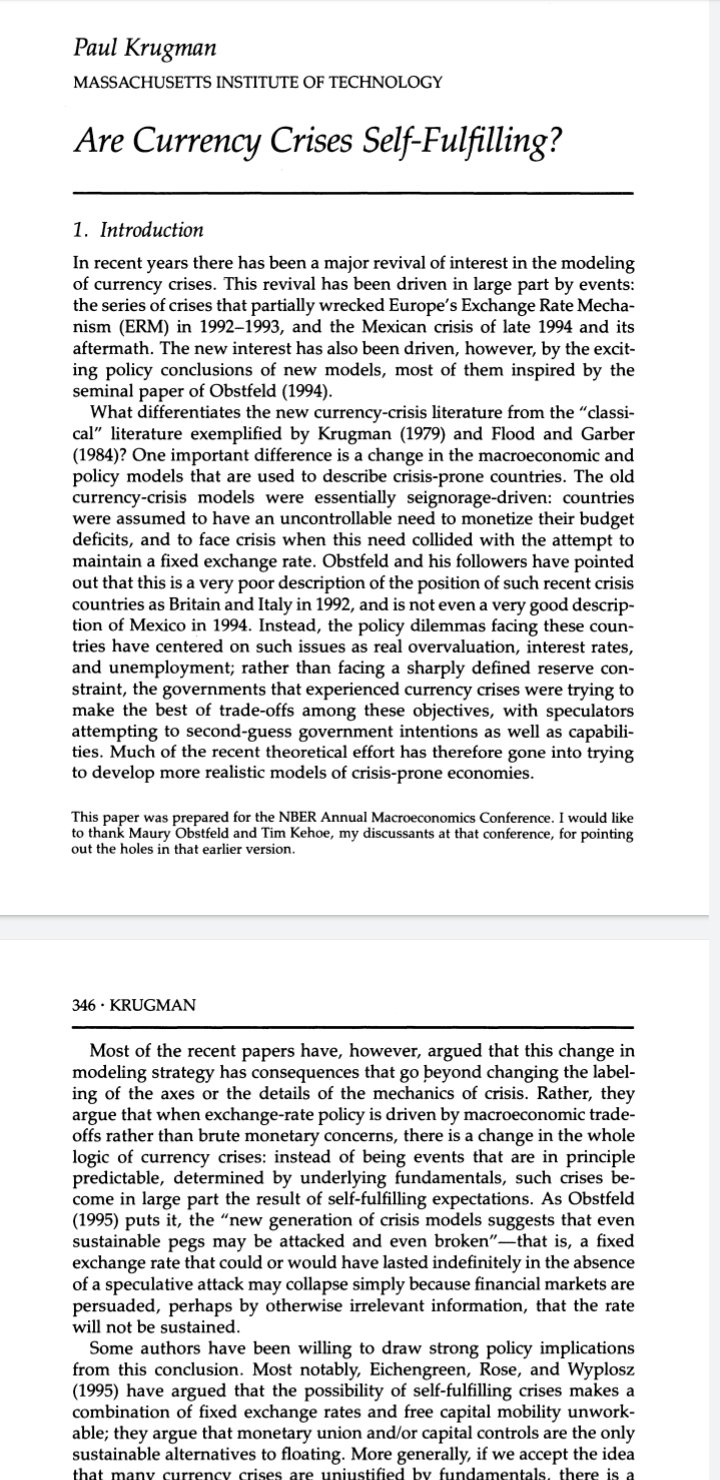

More on @paulkrugman forgetting the literature on self-fulfilling financial crises and speculative attacks

01 Dec 2019 Leave a comment

Recent Comments