Source: Index of Economic Freedom: Promoting Economic Opportunity and Prosperity by Country.

@OwenJones84 @K_Niemietz Venezuelan, Chilean and Chinese index of economic freedom rankings 2016

06 Feb 2016 Leave a comment

in development economics, economics of regulation, entrepreneurship, fiscal policy, growth disasters, growth miracles, industrial organisation, labour economics, law and economics, macroeconomics, monetary economics, property rights, public economics Tags: capitalism and freedom, Chile, China, The Great Escape, Venezuela

A bizarre Finnish amateur racing car practice for redistributing winning

06 Feb 2016 Leave a comment

in economics of media and culture, fiscal policy, income redistribution, labour economics, labour supply, law and economics, poverty and inequality, property rights, public economics, rentseeking Tags: basic income, car racing, Finland, guaranteed minimum income, negative income tax

The left-wing tax dilemma

06 Feb 2016 Leave a comment

in politics - USA, public economics Tags: 2016 presidential election, entrepreneurial alertness, growth of government, size of government, taxation and entrepreneurship, taxation and investment, taxation and labour supply

US, Danish, British, Canadian, Australian and New Zealand tax and social security burden net of cash benefits as a % of labour costs, one-earner married couple with two children since 2000

05 Feb 2016 Leave a comment

in labour economics, labour supply, politics - Australia, politics - New Zealand, politics - USA, public economics Tags: 2016 presidential election, British election, Canada, Denmark, family tax credit, in work tax credit, taxation and labour supply

For some reason the Labour government in New Zealand in the mid-2000s could not bring itself to admit it was introducing a huge tax cut for families. To avoid admitting it ever gave a tax cut, that Labour government called the huge family tax credit introduced in 2004 and 2005 Working for Families.

Source: Taxing Wages 2015 – OECD 2015

The above data does not include the effects of GST and VAT.

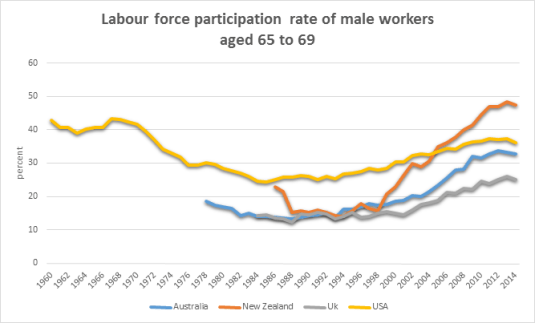

Labour force participation rates of US, UK, Australian and New Zealand male workers aged 65 to 69 since 1960

05 Feb 2016 Leave a comment

in economic history, labour economics, labour supply, politics - New Zealand, public economics

Up until the early 1990s, New Zealand had a universal old age pension that was paid from the age of 60. There was no means test or assets test. The eligibility age for this old age pension was increased to age 65 over the course of the 1990s and early 2000s. It obviously showed up in the labour supply of workers aged 66 and over in New Zealand after the change in the eligibility age.

Data extracted on 05 Feb 2016 04:49 UTC (GMT) from OECD.Stat.

Labour force participation rates of US, UK, Australian and New Zealand workers aged 60 to 64 since 1960

05 Feb 2016 Leave a comment

in applied price theory, economic history, labour economics, labour supply, politics - New Zealand, public economics

Up until the early 1990s, New Zealand had a universal old age pension that was paid from the age of 60. There was no means test or assets test. The eligibility age for this old age pension was increased to age 65 over the course of the 1990s and early 2000s. It obviously showed up in the labour supply of workers aged 60 to 64 in New Zealand both before and after the change in the eligibility age.

Data extracted on 05 Feb 2016 04:49 UTC (GMT) from OECD.Stat.

#Employment rate for workers aged 60-64

05 Feb 2016 Leave a comment

in labour economics, labour supply, politics - New Zealand, poverty and inequality, public economics

The tax code if @BernieSanders got everything he wanted

02 Feb 2016 Leave a comment

in applied price theory, politics - USA, public economics Tags: 2016 presidential election, Australia taxation and labour supply, taxation and investment

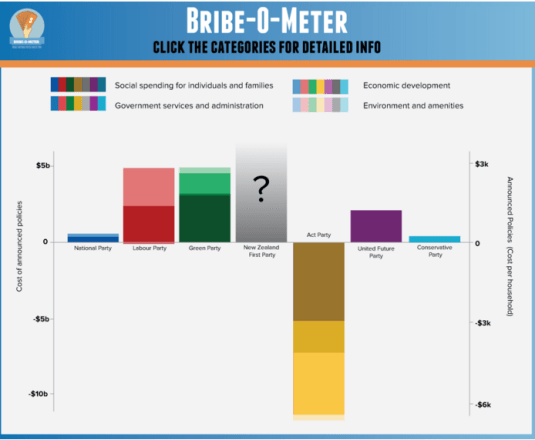

@NZGreens gain the most from an independent costings unit @JulieAnneGenter

01 Feb 2016 1 Comment

in applied welfare economics, constitutional political economy, economics of regulation, income redistribution, politics - New Zealand, public economics

I am sure there will be lots of squabbling over parameters and assumptions of any tax, spending or regulation proposal submitted to the independent costings unit proposed recently by the New Zealand Greens.

The bigger problem is static and dynamic scoring. There is some history of doing this for taxes but little for spending and that is before you consider externalities. Imagine the squabbling over roading proposals and their externalities. The practical hurdles to dynamic scoring are:

- Economists do not know how to accurately measure the growth effects of most policies

- Dynamic scoring relies on less-than-accurate, theory-based macro models

- The macro models undergirding dynamic scoring have numerous controversial and unproven built-in assumptions

- The assumptions embedded in the macro models are not always carefully empirically based

- Macro models exclude theoretically and empirically supported evidence of supply-side effects of public investment

- Macro models exclude evidence-based effects of economic inequality

- Macro models exclude evidence-based effects of numerous policies

- Macro models provide different estimates of growth impacts of policy depending on guesses of how the policy may be finance

Against that is dynamic scoring removes the bias against pro-growth policies in current budgetary scoring:

[A] theoretical advantage of accurate dynamic scoring is that it is not biased against pro-growth policies compared to the current conventional scoring method. By ignoring macroeconomic effects, the conventional method overstates the true budgetary cost of pro-growth policies, such as infrastructure investments, and understates the cost of anti-growth policies.

The bigger problem is something I learnt when costing a tax proposal for an election campaign. There was an error because I did the costing on a spreadsheet while I had a bad head cold.

The advantage of the error was the policy, as a result of this minor error in the tabulations attracted considerable attention from the major parties.

I was advised by a very wise head that this tabulation error in the dynamic scoring was not so bad a problem. This was because the tabulation error gave our side a chance to have a go at them again in the media. The policy announcement stayed in the new cycles for longer than otherwise and attracted attention from the big parties.

If a policy is too good, too perfect, the other parties will kill it with silence. You get only one bite in the news cycle and that is it.

If your policy announcement is killed by silence, at least you are guaranteed a chance to go at it again when the proposed independent costings unit a week or so later in the election campaign. You might disagree of those costings just to attract attention in the next new cycle.

Given the size, ambition and nebulous externality content of Green party proposals, they will benefit considerably from getting another go by questioning the Parliamentary budget office costings. That guarantees at least two new cycles to every one of their budgetary and regulatory announcements. No wonder they have proposed this independent costings unit.

If the New Zealand Greens do not like the costing from their proposed independent costings unit, they can just rage against neoliberalism and the conservative bias of economists. They cannot lose in terms of another bite of the 24-hour news cycle.

As a starter to feigning disagreement with any independent costings of their tax, spending and regulation proposals, Milton Friedman argued that people agree on most social objectives, but they differ often on the predicted outcomes of different policies and institutions. This leads us to Robert and Zeckhauser’s taxonomy of disagreement:

Positive disagreements can be over questions of:

1. Scope: what elements of the world one is trying to understand?

2. Model: what mechanisms explain the behaviour of the world?

3. Estimate: what estimates of the model’s parameters are thought to obtain in particular contexts?

Values disagreements can be over questions of:

1. Standing: who counts?

2. Criteria: what counts?

3. Weights: how much different individuals and criteria count?

Any positive analysis tends to include elements of scope, model, and estimation, though often these elements intertwine; they frequently feature in debates in an implicit or undifferentiated manner. Likewise, normative analysis will also include elements of standing, criteria, and weights, whether or not these distinctions are recognised. There is a rich harvest for nit-picking to keep the story going.

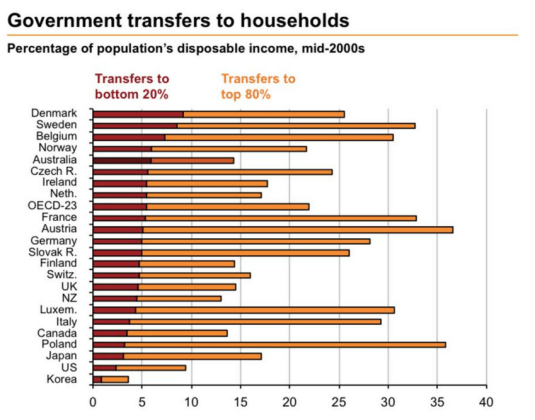

Welfare state targeting across the OECD

01 Feb 2016 Leave a comment

in applied welfare economics, public economics

/cdn0.vox-cdn.com/uploads/chorus_asset/file/5925471/sanders-taxes5002.jpg)

Recent Comments