US federal revenue has always hovered around 17% of GDP.

07 Sep 2015 Leave a comment

in economic history, politics - USA, public economics Tags: growth of government, Houser's law, size of government

Marginal tax rates of 2-income couples with 2 children in USA, UK, Australia and New Zealand since 2000

23 Aug 2015 Leave a comment

in economic history, economics of love and marriage, labour economics, labour supply, politics - Australia, politics - New Zealand, politics - USA, public economics Tags: Australia taxation and labour supply, British economy, marriage and divorce

Taxes on dividend income across the OECD

21 Aug 2015 Leave a comment

The U.S. places a high #tax on corporate income: tax.foundation/1Jf0ytp http://t.co/6inEfqftpQ—

Tax Foundation (@taxfoundation) August 18, 2015

The U.S. has the highest corporate income #tax rate in the developed world: tax.foundation/1WlGhIf http://t.co/Cp35sRwHjo—

Tax Foundation (@taxfoundation) August 13, 2015

The U.S. corporate #tax rate is out of line with our trading partners: tax.foundation/1UO4gy5 http://t.co/FzWDDTNrvC—

Tax Foundation (@taxfoundation) August 17, 2015

Marginal tax rate of average earners in USA, UK, Australia and New Zealand since 2000

21 Aug 2015 Leave a comment

in applied price theory, business cycles, economic growth, economic history, labour economics, labour supply, macroeconomics, politics - Australia, politics - New Zealand, politics - USA, public economics Tags: Australia, British economy, productivity shocks, real business cycles, taxation and labour supply

Interesting to notice that in New Zealand and the USA after these increases in marginal tax rates on single taxpayers, their economies slowed down. What appears to have happened is a number of people reached the next income tax marginal tax rate threshold.

Source: OECD StatExtract.

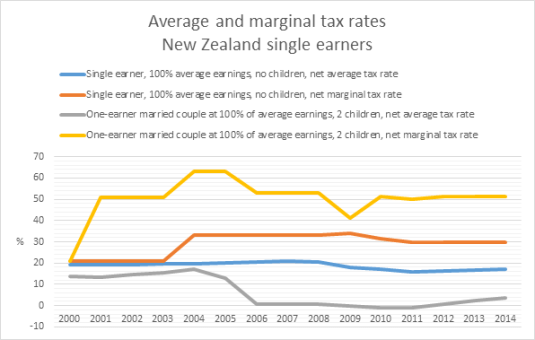

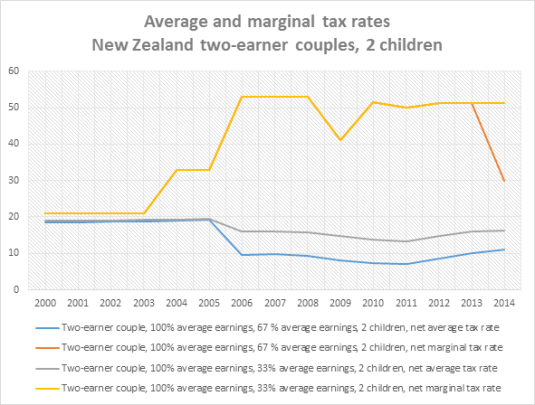

The great divergence in average and marginal tax rates in New Zealand since 2000

20 Aug 2015 1 Comment

in applied price theory, applied welfare economics, human capital, labour supply, politics - New Zealand, public economics Tags: family tax credits, lost decades, taxation and the labour supply

21% would have been a good guess of the average and marginal tax rates of the New Zealand single earner or couple including with children and even a second earner in 2001. New Zealand average and marginal tax rates have been on a wild ride since the year 2000.

Sources: OECD StatExtract and OECD Taxing Wages.

As the above chart shows, while the average tax rate of a single earner with no children is pretty much unchanged at about 20%, he now faces a marginal tax rate of 30% or more rather than 21% in 2001.

For a married couple with one income, as the above chart shows, their average tax rate has been about zero for a good 10 years now but their net marginal tax rate is a good 50% or more because of abatement rates on family tax credits, which is a skewed incentive situation. A large income effect from the family tax credit encourages the consumption of leisure but a high marginal tax rate discourages working more.

Sources: OECD StatExtract and OECD Taxing Wages.

For two earner couples, their average tax rates have fallen because of family tax credits but their marginal tax rates have gone through the roof as the above chart shows. A tax system that discourages quite severely any further work or investment in human capital by average earners may have adverse effects on the long-term trend growth rate of New Zealand.

Some tax cuts for families! Average tax rates on married couple with one income, 2 kids in USA, UK, Australia and New Zealand since 2000

20 Aug 2015 Leave a comment

in economic history, labour economics, labour supply, politics - Australia, politics - New Zealand, politics - USA, public economics Tags: Australia, British economy, taxation and labour supply

UK has the lowest company tax rate in the G20

16 Aug 2015 Leave a comment

in applied price theory, economic growth, fiscal policy, macroeconomics, politics - Australia, politics - New Zealand, politics - USA, Public Choice, public economics Tags: British economy, company tax rate, company taxation, optimal tax theory, race to the top, tax competition

IFS Friday Figure: UK has the lowest corporate tax rate in the G20 #Budget2015 announced a 2% cut by 2020 #IFSFriFig http://t.co/T4Oq6ZXYd4—

IFS (@TheIFS) July 24, 2015

Washington Supreme Court Fines State $100,000.00 Per Day For Legislature Failing To Fund Education

15 Aug 2015 Leave a comment

in constitutional political economy, law and economics, politics - USA, public economics Tags: constitutional law, rule of law, separation of powers

By Darren Smith, Weekend contributor

Nearly eleven months after holding the State of Washington in contempt for failing to provide an adequate funding plan for financing primary education in the state, the Washington Supreme Court issued an order fining the state $100,000.00 per day until the legislature satisfies the Court’s judgement in its landmark McCleary decision.

Nearly eleven months after holding the State of Washington in contempt for failing to provide an adequate funding plan for financing primary education in the state, the Washington Supreme Court issued an order fining the state $100,000.00 per day until the legislature satisfies the Court’s judgement in its landmark McCleary decision.

After three special sessions, the Legislature failed to provide a clear and fully funded plan. The Court acted, much to the chagrin of many of the state legislators. A few of which had some rather interesting solutions to address their failures to act.

View original post 1,375 more words

“Family silver’ looking a bit tarnished

15 Aug 2015 Leave a comment

in applied price theory, industrial organisation, politics - New Zealand, public economics Tags: privatisation, state owned enterprises

In the editorial today in the Dominion Post on the Solid Energy fiasco, the editorial writer made quite an extraordinary statement:

“Ideologues of the Right will claim that the whole sad fiasco shows the dangers of the state getting into business. This is simple-minded. Not all SOEs have ended up hundreds of millions of dollars in debt. Some SOEs have been well run; some have not.”

It is absurd to claim that making a $20 million net profit on a portfolio of $30 billion in state owned enterprises in 2013 is some sort of reasonable investment for the taxpayer.

Opponents to the sale of minority shareholdings in a few state owned assets would have us believe that the government is selling the family silver.

Treasury’s annual portfolio return shows that silver isn’t returning much:

Government businesses with assets worth $45 billion made a total net profit of just $20 million in the year to June 30, according to the Treasury’s annual portfolio report.

The assets don’t include Meridian Energy, Air New Zealand and Mighty RiverPower, which were partially privatised, but cover troubled entities like KiwiRail, Solid Energy and New Zealand Post, which are all struggling to make their business models work.

The annual review covers Crown-owned assets valued at $125b.

A return of just $20 million on $125b is lamentably low.

“For the residual commercial priority portfolio, overall performance (with some notable exceptions) was mediocre,” the Treasury’s Crown Ownership Monitoring Unit says in the report. . .

Total shareholder…

View original post 332 more words

Shocker! EPA chief admits nature can ‘restore’ itself (but only if the EPA caused the problem)

15 Aug 2015 Leave a comment

in comparative institutional analysis, economics of bureaucracy, economics of media and culture, economics of regulation, environmental economics, industrial organisation, Public Choice, public economics Tags: constitutional law, sovereign immunity

Puerto Rico’s predicaments: Is its minimum wage the culprit?

15 Aug 2015 Leave a comment

in applied price theory, development economics, economic history, industrial organisation, politics - USA, public economics, rentseeking, survivor principle Tags: Puerto Rico

(Co-authored with Ben Zipperer. Posted at Washington Center for Equitable Growth)

Puerto Rico today faces a serious debt crisis, recently defaulting on a bond payment. The proximate cause is a slowdown in economic growth since the mid-2000s, which has reduced tax revenues, and a declining labor market, where employment growth has been mostly in the red since 2007.

There are many explanations for the economic downturn and the resulting fiscal crisis, but some commentators have incorrectly blamed the island’s high minimum wage. To be sure, the federal minimum wage—which has applied to Puerto Rico since 1983—is much more binding there than it is on the mainland. Because hourly wages are substantially lower in Puerto Rico compared to the U.S. mainland, the federal minimum wage policy affects more of the workforce there. In 2014, for example, the federal minimum wage stood at 77 percent of the median hourly wage in Puerto Rico…

View original post 117 more words

Director’s Law in New Zealand?

14 Aug 2015 Leave a comment

in applied price theory, income redistribution, labour economics, politics - New Zealand, poverty and inequality, Public Choice, public economics Tags: child poverty, Director's Law, family poverty, family tax credits, welfare state

One group with negative net tax liability is low- to middle-income households with dependent children. For example, single-earner families with two children can earn up to around $60,000 pa before they pay any net tax.

Around half of all households with children receive more in welfare benefits and tax credits than they pay in income tax.

![image_thumb[3] image_thumb[3]](https://utopiayouarestandinginit.com/wp-content/uploads/2015/08/image_thumb3_thumb.png?w=709&h=442)

![clip_image002[6] clip_image002[6]](https://utopiayouarestandinginit.com/wp-content/uploads/2015/08/clip_image0026_thumb.jpg?w=268&h=177)

Recent Comments