Think it is time for a re-post of @LHSummers' brilliant, brilliant paper on RBC from 1986. minneapolisfed.org/research/qr/qr… http://t.co/S7tGIjEebI—

Simon H (@simonhinrichsen) August 10, 2015

The brilliant monetary economist Scott Freeman was one of the 1st to show the existence of real business cycles without the need of shocks to drive the ups and downs of the economy. He did this when taking time off from showing that much of the apparent correlation between the nominal and the real side of the economy is due to the endogenous response of money created by banks to fluctuations in real activity.

In 1999, Scott Freeman co-wrote Endogenous Cycles and Growth with Indivisible Technological Developments. The paper was about large, discrete technological improvements that required the accumulation of research or infrastructural investment over time before any benefits for realised in terms of increased output. With these lead-times for research or infrastructure investments, growth paths display cyclical patterns even in the absence of any shocks.

This lumpiness over time implied that a costly process such as research or construction must be completed on a large scale before the greatest part of a project’s benefits in output can be realized as Freeman and co. argue:

There are numerous examples of big research or infrastructural projects that are characterized by huge investments and relatively long development periods, where most of the benefits occur only after the project is complete.

Freeman and his co-authors gave as examples space research and satellite programs and major medical research. These are examples of prolonged and costly R & D whose benefits come primarily at the conclusion of the project.

Lags in the development of a new drug between the commencement of the R&D project and any revenues received is routinely now more than a decade. The Human Genome Project seems to be going on without end with few initial benefits.

Infrastructural examples given by Freeman and his co-authors included the installation of telephone, the internet, transportation shipping canals, interregional highways, railroads, mass transit or electricity transmission projects. All of these projects with long lead times, once completed that may increase the productivity of many economic sectors in addition to increasing output in the area concerned. In many cases there are no benefits whatsoever of the project and to after it is completed many years in the future. Oil pipelines can take up to a decade to build.

The 1973 oil price crisis launched a research and development program into alternative sources of energy and alternative sources of oil and gas supply that has lasted to this day.

Classic further examples of long lead times are mega sports events such as the World Cup and Olympic Games. Years of planning, development and construction for any benefits or revenues are obtained.

What is important in terms of the random shocks that drive the business cycle as championed by Ed Prescott is there are a range of sectors within the economy where there are long lead times before the investment leads to any outputs. Not surprisingly the first article in the real business cycle literature included in its title “time to build“.

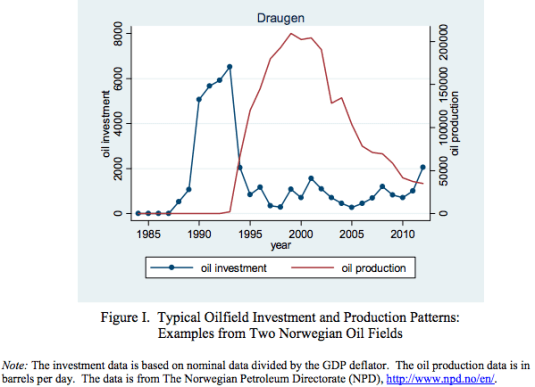

Rabah Arezki, Valerie Ramey, and Liugang Sheng in “News Shocks in Open Economies: Evidence from Giant Oil Discoveries” explore a related theme of real business cycles without shocks. In particular, they investigate news of productivity enhancements. They look at what happens to economies that discover oil. An oil discovery is a well identified “news shock.”

An oil discovery is well publicised and creates an incentive to invest in oil drilling. More importantly, there is news of greater income in the future but no change in current labour productivity or technological opportunities.

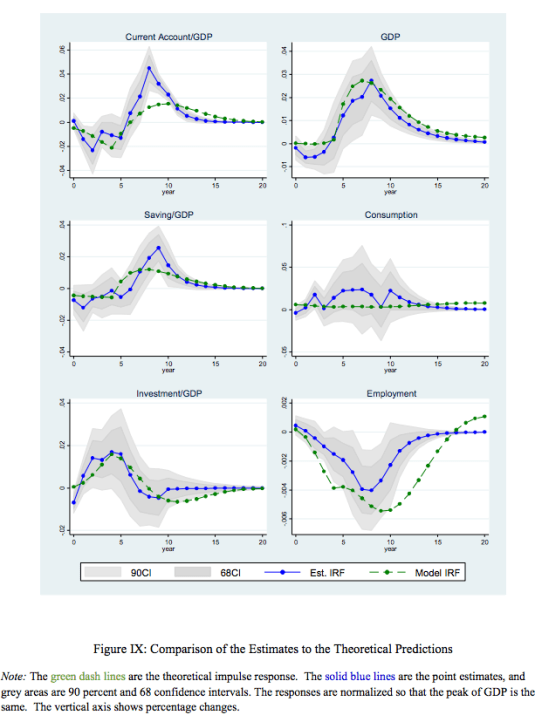

Rabah,Valerie, and Liugang found that after big oil discoveries, during the period of investment, the newly rich oil country borrows from abroad to build oil wells, oil pipelines and associated port infrastructure, obviously, but also borrows to finance higher consumption now. Consumption goes up and stays up in permanent income hypothesis fashion.

Interestingly, employment declines because of the wealth effect from the future income but there is no higher productivity of labour to encourage more work today. Investment rises soon after the news of the oil discovery arrives, while GDP does not increase for 5 years or more.

This is consistent with experience in the oil-rich Arab countries where there was increased consumption of leisure in anticipation of high future income is based on oil.

The same happened in Norway where massive investment was funded by foreign borrowing that led to annual current account deficits of up to 15% of GDP. Domestic savings fell away because Norwegians anticipated higher future incomes and started spending some of it now as predicted by the permanent income hypothesis. Norway now has a huge sovereign wealth fund able to fund a large part of its demographic burden from an ageing society.

After Mexico’s discovery of oil in the early 1970s, investment was high in oil and related industries. Consumption—by households and government—rose because of the increase in prospective real income. Since real GDP was not yet high, Mexico borrowed to pay for both the oil investment and the higher current consumption. Mexico’s foreign debt increased from $3.5 billion or 9% of GDP in 1971 to $61 billion or 26% of GDP in 1981. This boom in consumption and investment occurred without any productivity shock. All that was required was the ability to borrow.

Once the oil comes on line, the economy concern exports oil and pays back debt. This is when GDP including oil production finally rises a good five years and often more after the oil discovery. Consumption continues for its previous high rates while investment falls as the oil wells and pipelines have been built.

As with Scott Freeman, the long lead times not only can lead to large swings in investment, lumpy investments can also lead to increases in consumption, savings and employment without any productivity shocks.

Keynesian macroeconomics postulated that the economy slips into recessions for all sorts of reasons such as shifts and turns in the animal spirits and a loss of consumer confidence leading to a fall in autonomous investment and autonomous consumption. A collapse in autonomous investment and autonomous consumption is the Keynesian explanation for the great depression.

Both Keynesian macroeconomics and real business cycle theories at least at the outset couldn’t explain why there were recessions. Both attributed to them to causes they were yet to explain.

Keynesian macroeconomics could not explain what drove the waves of optimism and pessimism that either sharply increased or reduced investment. At bottom, Keynesian macroeconomics makes an unjustified assumption that technological progress unfolds at a relatively smooth rate and it attributes volatility in the economy to fluctuations in investment unrelated to trends in productivity.

The key inside of Keynesian macroeconomics was that inflation and unemployment were inversely correlated, so as one went up, the other went down as Milton Friedman explains.

Marvellously simple. A key that apparently unlocks the mystery of long-continued unemployment: inadequate autonomous spending or too low a propensity to consume. Increase either, or both, being careful simply not to go too far, and full employment could be attained.

What a wonderful prescription: for consumers, spend more out of your income, and your income will rise; for governments, spend more, and aggregate income will rise by a multiple of your additional spending; tax less, and consumers will spend more with the same result.

Though Keynes himself, and even more, his disciples, produced much more sophisticated and subtle versions of the theory, this simple version contains the essence of its great appeal to non-economists and especially governments.

A well-functioning economy should have no business cycles – no bouts of high inflation or persistent unemployment as Richard Rogerson explained:

So if there are cycles, that’s an indication of a malfunctioning economy. That idea permeated thinking for many years and was deeply ingrained. In effect, if an economy is in recession, someone should fix it.

The Keynesians only retreated as their empirical predictions were thoroughly discredited in the 1970s stagflation. Ad hoc auxiliary hypotheses were included about the supply-side in the Keynesian paradigm to prop up the old-time religion, not find new paths as Robert Barro put it:

At least Prescott and other real business cycle theorists accepted that they must eventually unpack productivity drops and name causes that can be explored further to be found persuasive or perhaps wanting. They argued that periods of temporarily low output growth need not be market failures, but could follow from temporarily slow improvements in production technologies.

As research progressed, real business cycles were viewed as recurrent fluctuations in an economy’s incomes, products, and factor inputs—especially labour—due to changes in technology, tax rates and government spending, tastes, government regulation, terms of trade, and energy prices.

Scott Freeman took this research further. He, his colleagues and his progeny showed that real business cycles can occur without any productivity rises and falls whatsoever. All that was needed was the ability to borrow and invest across time to finance lumpy investments. These lumpy investments can be anything from oil wells, dams to new drugs, anywhere involving time to build and capital accumulation:

HT: The Grumpy Economist: Arezki, Ramey, and Sheng on news shocks.

Recent Comments