American workers toiled for 37 days more than their French counterparts in 2013 econ.st/1M645uQ http://t.co/faN8XtmLAW—

The World If (@EconWorldIf) August 10, 2015

Swedosclerosis and Eurosclerosis compared

10 Aug 2015 Leave a comment

in applied welfare economics, comparative institutional analysis, economic growth, economic history, economics of regulation, industrial organisation, labour economics, labour supply, macroeconomics, survivor principle Tags: Eurosclerosis, Sweden, taxation and entrepreneurship, taxation and investment, taxation and labour supply, welfare state

The taxes paid by the rich, middle-class and the poorer in the USA

09 Aug 2015 Leave a comment

in politics - USA, public economics Tags: creative destruction, entrepreneurial alertness, envy, taxation and entrepreneurship, taxation and investment, taxation and the labour supply, top 1%

Average Income Before & After Federal Taxes from "An Illustrated Guide to Income" bit.ly/1j9ymXF #inequality http://t.co/eabwDATSlU—

Catherine Mulbrandon (@VisualEcon) April 28, 2014

The tax rates of the top 1%

04 Aug 2015 Leave a comment

in applied welfare economics, entrepreneurship, fisheries economics, income redistribution, politics - USA, rentseeking Tags: entrepreneurial alertness, envy, taxation and entrepreneurship, taxation and investment, taxation and the labour supply, top 1%

Historical Tax Rates of Top 0.01% (15,000 returns reporting more than $8 million in 2010) visualizingeconomics.com/blog/2013/8/14… http://t.co/XygW0t0npu—

Catherine Mulbrandon (@VisualEcon) August 15, 2013

Trigger warning for the Twitter Left

31 Jul 2015 Leave a comment

in applied price theory, applied welfare economics, constitutional political economy, income redistribution, politics - Australia, politics - New Zealand, politics - USA, Public Choice, public economics, rentseeking Tags: antimarket bias, endogenous growth theory, expressive voting, laffer curve, Leftover Left, taxation and entrepreneurship, taxation and human capital, taxation and investment, taxation and the labour supply, top 1%, Twitter left

Tax revenues as a percentage of GDP, selected OECD member countries

28 Jul 2015 Leave a comment

in politics - Australia, politics - USA, public economics Tags: Eurosclerosis, growth of government, sick man of Europe, size of government, taxation and entrepreneurship, taxation and investment, taxation and the labour supply

How does America's tax revenue compare to the average collected by OECD countries? bit.ly/1HTtRTg #TaxDay http://t.co/Q17jMuwtNI—

The Hamilton Project (@hamiltonproj) April 15, 2015

Gary Becker and Kevin Murphy on inequality and growth in living standards

23 Jul 2015 Leave a comment

Top marginal income tax rate throughout the 20th century

29 Jun 2015 Leave a comment

in economic history, entrepreneurship, income redistribution, politics - USA, Public Choice, public economics, rentseeking Tags: Eurosclerosis, taxation and entrepreneurship, taxation and investment, taxation and the labour supply, top 1%

Piketty presents the changes in the top marginal income tax rate throughout the 20th century… #GCLIS http://t.co/sFpV0ypC5C—

LIS (@lisdata) April 16, 2014

The impact of top tax rates on the migration of superstars

22 Jun 2015 Leave a comment

in human capital, labour economics, labour supply, occupational choice, politics - Australia, politics - New Zealand, politics - USA, public economics, sports economics Tags: British economy, CEO pay, Denmark, economics of migration, endogenous growth theory, Spain, superstar wages, taxation and entrepreneurship, taxation and superstars, taxation and the labour supply, Thomas Piketty, top 1%

Emmanuel Saez is leading a literature showing how sensitive migration decisions of superstars are to top marginal tax rates. Specifically, he and his co-authors studied Spain’s Beckham’s law.

Cristiano Ronaldo moved from Manchester United to Real Madrid in 2009 partly to avoid the announced 50% top marginal income tax in the UK to benefit from “Beckham Law” in Spain. Beckham’s Law was a preferential tax scheme of 24% on foreign residents in Spain. When David Beckham transferred to Real Madrid, the manager of Arsenal football club commented that the supremacy of British soccer was at risk unless the U.K.’s top marginal tax rate changed.

A number of EU member states offer substantially lower tax rates to immigrant football players, including Denmark (1991), Belgium (2002) and Spain (2004). Beckham’s law had a big impact in Spain:

…when Spain introduced the Beckham Law in 2004, the fraction of foreigners in the Spanish league immediately and sharply started to diverge from the fraction of foreigners in the comparable Italian league.

Moreover, exploiting the specific eligibility rules in the Beckham Law, we show that the extra influx of foreigners in Spain is driven entirely by players eligible for the scheme with no effect on ineligible players.

Suez also found evidence from tax reforms in all 14 countries that the location decisions of players are very responsive to tax rates. Suez in another paper with Thomas Piketty wants the top tax rate to be 80%. However, their work on taxation and the labour supply supports a much lower rate:

First, higher top tax rates may discourage work effort and business creation among the most talented – the so-called supply-side effect. In this scenario, lower top tax rates would lead to more economic activity by the rich and hence more economic growth. If all the correlation of top income shares and top tax rates documented on Figure 1 were due to such supply-side effects, the revenue-maximising top tax rate would be 57%.

Suez and Piketty then go on to argue that the pay of chief executives of public companies, a subset of the top 1% and top 0.1%, may not reflect their productivity but that is a much more complicated argument about agency costs and the separation of ownership and control which they make rather weakly.

Much of their other work on top incomes is about the emergence of a working rich whose top incomes are wages earned by holding superstar jobs in a global economy. It would be peculiar and perhaps overzealous to organise the entire taxation of high incomes around the correction of agency costs arising from the separation of ownership and control of some of the companies listed on the stock exchange.

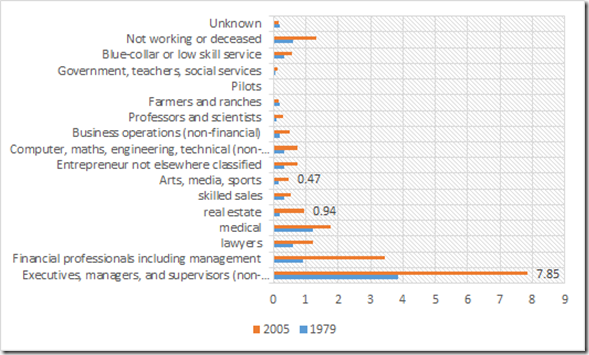

Figure 1: Percentage of national income (including capital gains) received by top 1%, and each primary taxpayer occupation in top 1%, USA

Source: Jon Bakija, Adam Cole and Bradley T. Heim “Jobs and Income Growth of Top Earners and the Causes of Changing Income Inequality: Evidence from U.S. Tax Return Data”.

There is a long history showing how the labour supply of sports stars is highly sensitive to top marginal income tax rates. For a very long time, boxing was the only really big-money sport for athletes:

The 1950s was the era of the 90 percent top marginal tax rate, and by the end of that decade live gate receipts for top championship fights were supplemented by the proceeds from closed circuit telecasts to movie theatres.

A second fight in one tax year would yield very little additional income, hardly worth the risk of losing the title. And so, the three fights between Floyd Patterson and Ingemar Johansson stretched over three years (1959-1961); the two between Patterson and Sonny Liston over two years (1962-1963), as was also true for the two bouts between Liston and Cassius Clay (Muhammad Ali) (1964-1965).

Then, the Tax Reform Act of 1964 cut the top marginal tax rate to 70 percent effective in 1965. The result: two heavyweight title fights in 1965, and five in 1966. You can look it up.

Ufuk Akcigit, Salome Baslandze, and Stefanie Stantcheva found that the migration of superstar inventors is highly responsive to top marginal tax rates.

#Braindrain is real, even quantifiable — as per NBER paper 21024. Geniuses don't tolerate extra taxes easily. http://t.co/HVP8uEFAfz—

Amity Shlaes (@AmityShlaes) June 07, 2015

Ufuk Akcigit, Salome Baslandze, and Stefanie Stantcheva studied the international migration responses of superstar inventors to top income tax rates for the period 1977-2003 using data from the European and US Patent offices.

our results suggest that, given a ten percentage point decrease in top tax rates, the average country would be able to retain 1% more domestic superstar inventors and attract 38% more foreign superstar inventors.

Emmanuel Saez and co-authors also found that a preferential top tax scheme for high earning migrants in their first three years in Denmark was highly successful in attracting highly skilled labour to that country:

…the number of foreigners in Denmark paid above the eligibility threshold (that is the group affected by the tax scheme) doubles relative to the number of foreigners paid slightly below the threshold (those are comparison groups not affected by the tax scheme) after the scheme is introduced.

This effect builds up in the first five years of the scheme and remains stable afterwards. As a result, the fraction of foreigners in the top 0.5% of the earnings distribution is 7.5% in recent years compared to a 4% counterfactual absent the scheme.

This very large behavioural response implies that the resulting revenue-maximising tax rate for a scheme targeting highly paid foreigners is relatively small (about 35%). This corresponds roughly to the current tax rate on foreigners in Denmark under the scheme once we account for other relevant taxes (VAT and excises).

This blog post was motivated by a courageous tweet about Tony Atkinson saying that increases in the top tax rate have little effect on the supply of labour! Not so.

Who is where on the Laffer curve?

20 Jun 2015 Leave a comment

in economic growth, fiscal policy, human capital, labour economics, labour supply, macroeconomics, politics - USA, public economics Tags: endogenous growth theory, EU, Eurosclerosis, laffer curve, optimal tax theory, taxation and entrepreneurship, taxation and investment, taxation and the labour supply

@asymmetricinfo paper:"How Far Are We From The Slippery Slope? The Laffer Curve Revisited" bit.ly/1HMhmqu http://t.co/D9IffNhd92—

Old Whig (@aClassicLiberal) April 20, 2015

The role of new taxes in the Great Recession

24 Apr 2015 Leave a comment

in economic growth, fiscal policy, great recession, labour economics, labour supply, macroeconomics, politics - USA Tags: great recession, obama, Obamacare, taxation and entrepreneurship, taxation and investment, taxation and labour supply

.

Stephen Williamson on Marginal Taxation

03 Aug 2014 Leave a comment

in applied welfare economics, fiscal policy, income redistribution, politics - New Zealand, politics - USA, Public Choice Tags: envy, Stephen Williamson, taxation and entrepreneurship, taxation and human capital, taxation and investment, taxation and labour supply, top 1%

He says a lot. I’ll try to address piece by piece.

Next, some people have shown interest in this paper by Diamond and Saez. A key result that seemed to get these people excited is the calculation of a top optimal marginal tax rate (including all taxes) of 73%, relative to the current rate of 42.5%. There are two key assumptions that Diamond and Saez make to come up with the 73% optimal rate. First, we should not care about the welfare (at the margin) of the rich people. This argument is based solely on the notion that marginal utility of income is low for the top income-earners. Second, Diamond and Saez use a “behavioral elasticity” of tax revenue with respect to the tax rate of 0.25. To see how this matters, if you use their formula and an elasticity of one, you get an optimal top tax rate…

View original post 1,215 more words

Recent Comments