@garethmorgannz dogma test: ban bikes, swimming & sugar – updated

14 Feb 2016 1 Comment

in applied price theory, applied welfare economics, economics of regulation, fiscal policy, health and safety, health economics, politics - New Zealand

Do-gooding curmudgeon Gareth Morgan takes great pride in his positions on public policy and health and safety such as a sugar tax are evidence-based.

He is quick to suggest that those that disagree with them are ignorant or steeped in moral turpitude, preferably both. His offsider has even suggested that I am too dogmatic to bother arguing with. Me!

It will be a slow train coming before Gareth Morgan takes an evidence-based health and safety approach to bikes and swimming. They are dangerous activities that should be banned if he is to be consistent. Morgan is a keen motorcyclist and recently asked for exclusive access to a seaside batch.

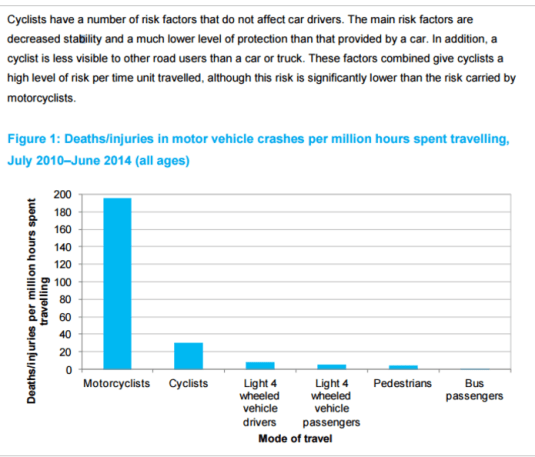

As I have previously argued, all the evidence suggests that riding a bike is dangerous. Both motorcycles and bicycles are way more dangerous than travelling by car.

Riding a motorbike and a bike should both be banned to protect motorcyclists and bicyclists from themselves. Like people who drink sugary drinks, they just do not understand the risks.

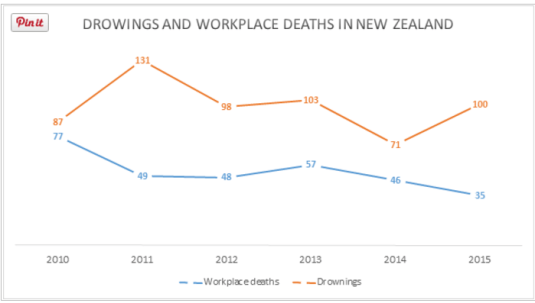

Swimming is an even more dangerous activity with multiple fatalities of a weekend common in summer. Again, people do not understand the risks of swimming both in the city and in rivers. They must be protected from themselves.

The argument that Gareth Morgan and his entourage will make in response to a demand for bans is the exact same one made against the food police.

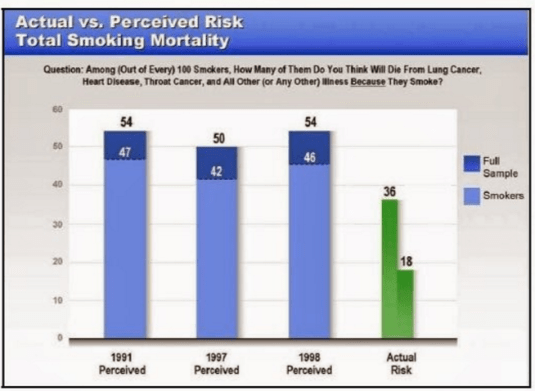

I am sure Morgan will point out that people know that riding a bike or swimming is dangerous. Even those living in a cave also know that drinking sugary drinks and having a smoke is also dangerous. Indeed, the evidence is people overestimate the risks of these socially disapproved activities rather than underestimate them.

The argument that Morgan and his entourage would use against banning bikes, motorbikes and swimming is voluntary assumption of risk.

The argument that Morgan and his entourage would use against banning bikes, motorbikes and swimming is voluntary assumption of risk.

We live in a free society. If people want to lead a risky life, they are free to do so as long as they do not harm others.

Morgan is quick to point out the cost of the public health system of sugary drinks and other targets of the food police and the safety Nazis.

Last time I looked, bicycle and motorbike accidents resulting trips to emergency wards and other expenses to the taxpayer.

You cannot have it both ways. Arguing that the fiscal cost of sugary drinks and other roads is a rationale for regulating their consumption. That argument applies just as strongly to the case for – updated banning motorbikes, bicycles and swimming.

Until Gareth Morgan’s do-gooding extends to calling for the banning of a passion of his life, which is motorcycling, his evidence-based crusades do not have much standing.

You cannot reject voluntary assumption of risk on a selective basis especially when you engage in one of those risky activities yourself.

UPDATE: Morgan has in the past called for the insurance levy on motorbikes to reflect risk better than is the case now.

…research we’ve done at the Motorcycle Safety Advisory Council indicates that the risk of serious and expensive injury on a motorcycle is around 45 times higher per person-kilometre travelled as it is for occupants of other vehicles.

And we have a lot more bumps, scrapes and bruises per person-kilometre as well.

It gets worse. We also found that up to 31 per cent of our injuries arise from incidents involving no other vehicles. In other words we do this to ourselves because we can’t handle the road conditions.

Now of course we can blame the road as some of us are wont to do, but the reality is in most cases it’s pure incompetence or lack of self-management.

Any charging regime that gives riders an incentive to ride within their level of competence, to self-manage risk by wearing better protective clothing for example, or even lifting competency levels has to be a win-win doesn’t it?

This is not a call for a ban. Moreover, this is just a calm discussion of actuarial risk and the rampant cross-subsidies in the New Zealand universal, no fault accident compensation scheme.

Buried in at all these remarks by Morgan is people have the right to take risks and ride a bike if they want. No similar courtesy to people who like sugary drinks and those who support their right to drink and eat what they please. No similar courtesy to honest disagreement over whether a sugar tax is worth the trouble and strife.

What I must also add is the Morgan Foundation is a famous advocate of sugar taxes but a little-known advocate of actuarially fair insurance levies on motorbike. If the notoriety was the other way around, this debate would have more credibility. That is why I missed it in the first draft of this post.

I am still waiting for Gareth Morgan to call for bans on advertising of motorbikes and bicycles to children and on children’s television because they are impressionable. Why are motorbike and bicycle ads safe for children but cigarette and junk food ads not?

I am still waiting for Gareth Morgan to call for bans on advertising of motorbikes and bicycles to children and on children’s television because they are impressionable. Why are motorbike and bicycle ads safe for children but cigarette and junk food ads not?

Milton Friedman argued that people agree on most social objectives, but they differ often on the predicted outcomes of different policies and institutions. This leads us to Robert and Zeckhauser’s taxonomy of disagreement

Positive disagreements can be over questions of:

1. Scope: what elements of the world one is trying to understand?

2. Model: what mechanisms explain the behaviour of the world?

3. Estimate: what estimates of the model’s parameters are thought to obtain in particular contexts?

Values disagreements can be over questions of:

1. Standing: who counts?

2. Criteria: what counts?

3. Weights: how much different individuals and criteria count?

Any positive analysis tends to include elements of scope, model, and estimation, though often these elements intertwine; they frequently feature in debates in an implicit or undifferentiated manner. Likewise, normative analysis will also include elements of standing, criteria, and weights, whether or not these distinctions are recognised.

Obesity by Occupation: In US police, firefighters, & security lead the pack. #dataviz

Source: wsj.com/articles/memo-… http://t.co/fPyQGKIUMk—

Randy Olson (@randal_olson) December 18, 2014

The origin of political disagreement is a broad church in a liberal democracy. Those you disagree with are not evil, they just disagree with you. As Karl Popper observed:

There are many difficulties impeding the rapid spread of reasonableness. One of the main difficulties is that it always takes two to make a discussion reasonable. Each of the parties must be ready to learn from the other.

Feel-good policies attacking sugar in drinks will do nothing but provoke opposition and delay the day when people confront the fact that they are going to the fatter than their parents and their grandparents because they are richer.

https://twitter.com/DKThomp/status/599218426620485633

I lost 18kg after I was diagnosed with type II diabetes. Giving up sugary drinks and biscuits contributed maybe 2 kg to that weight reduction. Central to that weight production was I was well motivated.

A rise in the price of a sugary drink and the political fight over that turns friends into enemies and is a distraction from the larger cause.

https://twitter.com/DKThomp/status/698174875630989316

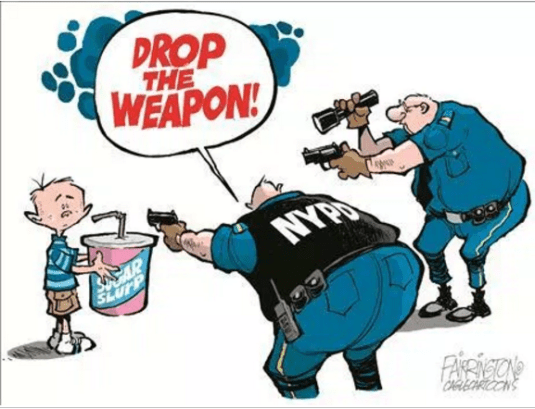

Greg Mankiw was on point when he said that do we really think that meddling at this micro level of sugary drinks serves any purpose and can government be trusted to micromanage our lives with pushes rather than nudges:

To what extent should we use the power of the state to protect us from ourselves? If we go down that route, where do we stop?

Taxing soda may encourage better nutrition and benefit our future selves. But so could taxing candy, ice cream and fried foods. Subsidizing broccoli, gym memberships and dental floss comes next. Taxing mindless television shows and subsidizing serious literature cannot be far behind.

Even as adults, we sometimes wish for parents to be looking over our shoulders and guiding us to the right decisions. The question is, do you trust the government enough to appoint it your guardian?

Percentage of billionaires who inherited their wealth

14 Feb 2016 Leave a comment

in applied welfare economics, entrepreneurship, labour economics, poverty and inequality Tags: entrepreneurial alertness, inherited wealth, superstar wages, superstars, top 1%

China has been capitalist for long enough for a billionaire to actually inherit his wealth.

Waiting for God means you become a couch potato

13 Feb 2016 Leave a comment

in applied welfare economics, population economics

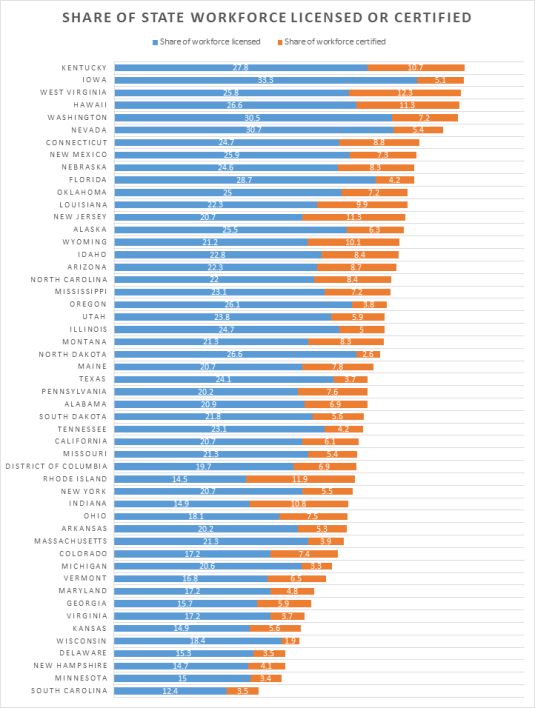

% of workforce requiring license or certification by state– Corrected

13 Feb 2016 2 Comments

in applied welfare economics, economics of regulation, labour economics, occupational regulation, politics - USA

Some American states regulate twice as many occupations as others. This diversity in federalism strains any public interest explanation of occupational regulation.

Source: Reforming Occupational Licensing Policies | The Hamilton Project – Kleiner and Vorotnikov (2015), based on an analysis of data from a Harris poll of 9,850 individuals conducted in the first half of 2013 (Harris Poll Interactive 2013).

The purpose of occupational regulation is to protect buyers from quacks and lemons – to overcome asymmetric information about the quality of the provider of the service.

Adverse selection occurs when the seller knows more than the buyer about the true quality of the product or service on offer. This can make it difficult for the two people to do business together. Buyers cannot tell the good from the bad products on offer so many they do not buy to all and withdraw from the market.

Any entrepreneur who finds ways of providing credible assurances of the quality of this service or work stands to profit handsomely. Brand names and warranties are examples of market generated institutions that overcome these information gaps through screening and signalling.

Screening is the less informed party’s effort, usually the buyer, to learn the information that the more informed party has. Successful screens have the characteristic that it is unprofitable for bad types of sellers to mimic the behaviour of good types. Signalling is an informed party’s effort, usually the seller, to communicate information to the less informed party.

The main issue with quacks in the labour market is whether there is a large cost of less than average quality service, and is there a sub-market who will buy less than average quality products in the presence of competing sellers competing on the basis of quality assurance. This demand for assurance creates opportunities for entrepreneurs to profit by providing assurance.

Mostly disciplinary investigations and deregistrations under the auspices of occupational regulation are for gross misconduct and criminal convictions rather than the shading of quality.

The 1996 US federal welfare reforms at 20

12 Feb 2016 Leave a comment

in applied welfare economics, economic history, labour economics, labour supply, politics - USA, welfare reform

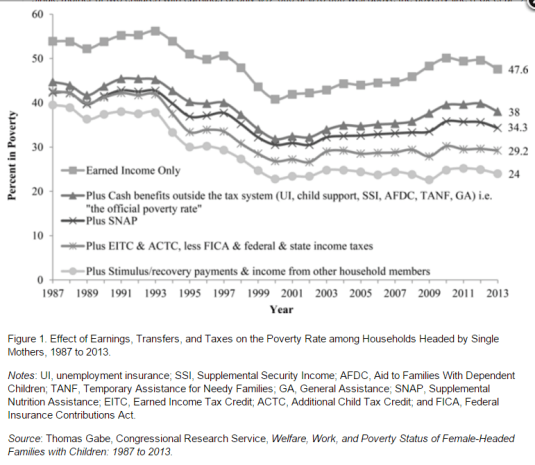

Despite the dire predictions, there has been a permanent reduction in child poverty of 25%, a 35% increase in the employment rates of never married mothers and a 16% increase in the employment rates of single mothers.

Minorities benefited the most from the 1996 US federal welfare reforms in terms of higher employment rates and lower child poverty rates.

As part of the 1996 reforms, Medicaid eligibility was not lost when going off welfare and single parents by getting a job qualified for the Earned Income Tax Credit.

Sugar taxes and expressive politics

11 Feb 2016 1 Comment

in applied welfare economics, economic growth, health economics, liberalism, politics - New Zealand, population economics, Rawls and Nozick

The sugar tax championed by among others the Morgan Foundation is the latest manifestation of do-gooding that dates back to sumptuary laws of mediaeval times. Black’s Law Dictionary defines them as

Laws made for the purpose of restraining luxury or extravagance, particularly against inordinate expenditures in the matter of apparel, food, furniture, etc.

These early attempts through sumptuary laws to regulate how people live their lives to make sure that they did not dress above their social rank as well as risk hellfire and damnation has been critically applied include alcohol prohibition, drug prohibition, gun control laws, bans, and restrictions on dog fighting.

The sugar tax attempts to save us from a bad diet because others know how to run our lives better than we do despite having never met us, much less lived our lives and dreamed our dreams. The calling of the do-gooder is a busy vocation.

The do-gooders want to stop smoking, overeating, and the partaking of too much sugar but undoubtedly support the decriminalisation of marijuana because of the futility of prohibition.

The right to get stoned is a civil liberties issue but sugar is a legitimate topic of public health regulation. Those who do not want to save people from sugar are ignorant or steeped in moral turpitude, preferably both.

We live in an age of obesity. When I was a kid, the poor were thin, they are now fat. I can still remember the names of the 2 boys in my high school class who were in any way overweight. Now the majority of school kids are overweight.

Sugar taxes are also when the Left stage a temporary conversion to supply-side economics. When you tax something, less will be supplied. The Left are surprisingly unwilling to admit that unless it suits their agenda of the day.

The Morgan Foundation is a curious position of advocating a great big new tax: a comprehensive capital taxation. It is also arguing that sugar taxes will cut consumption. I wonder what it estimates to be the response of saving and investment in its capital tax. Does it take the conservative estimates, or the liberal estimates of the responsiveness of savings, investment and labour supply to higher taxes?

Sugar taxes are a blunt instrument. They tax fat people, thin people and the potentially fat of tomorrow. They are not like alcohol and tobacco taxes which are narrowly tailored to taxing sin. Richard Posner said that

People who crave sugar will find no dearth of substitutes for sugar-sweetened sodas. Moreover, most consumers of these sodas are not and never will be obese. They may well be overweight, but all that that means is that they are heavier than the “ideal” weight calculated by physicians; if they are only slightly or even moderately heavier, the consequences for health or social or professional success are apparently slight. To the extent that a soda tax would cause substitution of equally sugared foods, it would not only have no effect on obesity; it would yield no revenue…

Last time I looked, people enjoy food. Some enjoy food quite a lot.

We are in a free society where some people are just simply like eating while others have a bad draw of the genes. Others like to exercise. As Richard Posner said:

The obese are people who by dietary choice and preference for a sedentary style of life have traded off the costs of obesity against the costs of being thin and have decided (at least in a “revealed preference” sense–they may not have consciously chosen a style of life that predisposes them to obesity) that the costs of thinness preponderate over the benefits. And in general we do not try to prevent people from making such trade-offs.

But there are two situations in which preventing people from choosing the style of life that maximizes their utility can be defended (provided certain assumptions are made about cost and efficacy) on economic grounds.

One is where consumers are unable to evaluate a product or to act upon their evaluation; another is where a voluntary transaction imposes costs on other people which the transactors do not take into account.

The fact that car unhealthy lifestyles may impact on the public health budget is not much of an argument for intervention. Private insurers are quite capable of working out whether they need information on people’s lifestyle and diet or not.

If you are to provide people with universal health insurance at the expense of the long-suffering taxpayer, you should at least have the decency not to try and take over their entire lives so that you can be a social justice warrior on the cheap.

As for children seeing advertising for sugar, the sugar tax and a ban on advertising is a token gesture. You trying to take over from their parents. As Gary Becker noted:

Many doctors and others who advocate taxing sugared beverages and fast foods at heart do not believe that consumer taste for sugar and fast foods should be taken into account in devising public policy.

Until the nanny state brigade and sugar tax advocates address that simple question, they have no standing in a public debate. Like all the prohibitionists who came before them, they are simply unwilling to admit the people like food, drink and sugary things.

Women demonstrating against Prohibition, 1932. https://t.co/xE30ApkNBB—

Historical Images (@Historicalmages) January 29, 2016

Until they put forward a way of balancing that common preference to enjoy life including food and risk against their meddlesome preferences in their role as the great central planner of our lives, they are just having us on. As Richard McKenzie said recently

The people most concerned with the country’s weight gain—self-appointed “fat police”—have favoured supposedly easy and direct policy solutions: tax and ban high-sugar and high-fat products.

Such policy courses are a snare and delusion, especially if Americans’ cherished freedoms of choice, which are at the heart of the country’s economic engine, are to be preserved.

The great driver of obesity is prosperity, not sugar. People can simply afford to buy more and enjoy the food they have more.

John Rawls argued that people should have every right to live their lives according to their own lights. In nanny state brigade just do not accept that point of view.

Rawls believed the most distinctive feature of human nature is our ability freely to choose our own ends. The state’s first duty with its citizens is to respect this capacity for autonomy.

Instead, the fat police and the do-gooders want to engage in the futile gesture of pestering you and taxing you when you buy a sugary drink even though there are almost unlimited alternative supplies of sugar laden products.

The fat police are far too busy feeling good about themselves in the expressive politics of public health. They cheer for sugar taxes, boo obesity and feel good about themselves for having told other people how to live their lives better. A good number of them then celebrate by lighting-up a joint. Many of the rest have a wine, not beer.

The particularly annoying ones ride a bike, which is a dangerous activity, or are so boorish as to exercise in a public place, much to the annoyance of the rest of us who are getting on with having a good time.

Matthew Kahn on urban climate change adaptation @RusselNorman @JulieAnneGetner

10 Feb 2016 Leave a comment

in applied price theory, applied welfare economics, environmental economics, global warming, transport economics, urban economics Tags: climate adaptation

If you do not follow this guy’s blog, there is a serious gap in your education in urban and environmental economics especially with regard to climate change.

@realdonaldtrump @BernieSanders are equally ignorant and unfit for office

09 Feb 2016 Leave a comment

in applied welfare economics, economic history, labour economics, macroeconomics, politics - USA Tags: 2016 presidential election, antiforeign bias, antimarket bias, Leftover cab left, pessimism bias, rational rationality, The Great Enrichment, Twitter left

Social justice objections to free tuition at university and polytech

08 Feb 2016 Leave a comment

in applied welfare economics, economics of education, politics - New Zealand

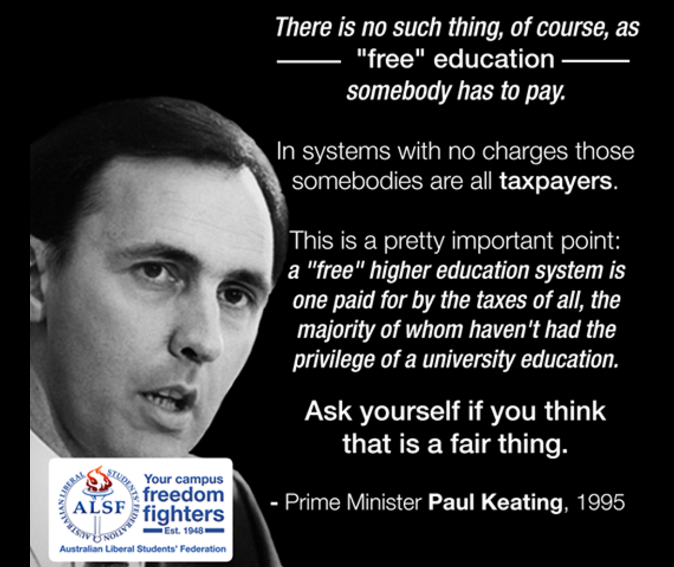

The desire of the recipients to receive the money is the leading motivation for income redistribution according to Gordon Tullock. That particularly applies to university and Polytech students and their desire not to pay tuition fees. There is no case in either economics or social justice for them not to pay.

Free tuition at University is a handout to those already had a good start in life. It will be paid for by those who will never go because they do not have an above average IQ.

An investment in further education, be it at University or Polytechnic, is an investment. It should have some payoff to those that make it rather than just a good thing to do because of a subsidy.

How much more will you earn by going to university? It depends hugely on which country you're from http://t.co/7RMnUTM8nj—

paulkirby (@paul1kirby) September 11, 2015

The wage premium for a tertiary degree was low and stable in New Zealand in the 1990s (Hylsop and Maré 2009) and 2000s (OECD 2013). This stability in the returns to education suggests that supply has tended to kept up with the demand for skills at least over the longer term at the national level. There were no spikes and drops that would be the evidence of a lack of foresight among teenagers in choosing what to study. Whatever rationale may be put forward for free tuition, an undersupply of graduates is not among them.

Wow. I mean, WOW. College completion figures over time by income quartile. bit.ly/16Bb1jh http://t.co/y0MVyiDCEZ—

Richard V. Reeves (@RichardvReeves) February 04, 2015

In 2002, with Pedro Carneiro, James Heckman showed that lack of access to credit is not a major constraint on the ability of young Americans to attend college. Short-term factors such as the ability to borrow to fund higher education has been found to be seriously wanting as an explanation for who and who does not go on to higher education. This has great relevance to New Zealand because the levels of student debt in the USA are much higher than here.

If you have been prevented from going on to university or otherwise studying after completing high school because of financial constraints, there is no social justice nor efficiency reason for free tuition fees. Any problems regarding borrowing against the human capital investment can be solved through student run loans.

The evidence that human capital is a key contributor to higher economic growth is weakening rather than strengthening. As Aghion said:

Economists and others have proposed many channels through which education may affect growth–not merely the private returns to individuals’ greater human capital but also a variety of externalities.

For highly developed countries, the most frequently discussed externality is education investments’ fostering technological innovation, thereby making capital and labour more productive, generating income growth. Despite the enormous interest in the relationship between education and growth, the evidence is fragile at best.

The trend rate of productivity growth did not accelerate over the 20th century despite a massive rise in investments in human capital and R&D because of the rising cost of discovering and adapting new technological knowledge.

The number of both R&D workers and highly educated workers increased many-fold over the 20th century in New Zealand and other OECD member countries including the global industrial leaders such as the USA, Japan and major EU member states.

Gough Whitlam abolished tuition fees at Australian universities in 1972. His idea was to reduce inequality. He instead gave a flying start to those of already above-average talents.

Charles Murray points out that succeeding at college requires an IQ of at least 115, but 84% of the population don’t have this:

Historically, an IQ of 115 or higher was deemed to make someone “prime college material.” That range comprises about 16 per cent of the population. Since 28 per cent of all adults have BAs, the IQ required to get a degree these days is obviously a lot lower than 115.

Those on the margins of this IQ are getting poor advice to go to college. Free tuition makes the likelihood of this poor investment in university in further education more likely.

Murray argues that other occupational and educational choices would serve them better in light of their abilities and likelihood of succeeding at college.Murray believes a lot of students make poor investments by going on to College, in part, because many of them don’t complete their degrees:

…even though college has been dumbed down, it is still too intellectually demanding for a large majority of students, in an age when about 50 per cent of all high school graduates are heading to four-year colleges the next fall. The result is lots of failure. Of those who entered a four-year college in 1995, only 58 per cent had gotten their BA five academic years later.

David Autor in a recent paper has illustrated how the gap between the highly educated and the less educated is growing at a far faster rate than the gap between the top 1% in the bottom 99% in the USA. David Autor argues that

a single minded focus on the top 1% can be counterproductive given that the changes to the other 99% have been more economically significant.

Autor found that in the USA since the early 1980s, the earnings gap between workers with a high school degree and a college education became four times greater that the shift in income during the same period to the very top from the 99%; Between 1979 and 2012, the gap in median annual earnings of households of high-school educated workers and households with college-educated ones expanded from $30,298 to $58,249, or by roughly $28,000.

Will more education decrease inequality? A simulation provided an answer. nyti.ms/1xw5m9W http://t.co/paQp19BEWc—

The Upshot (@UpshotNYT) March 31, 2015

If social justice is to mean anything, it does not involve giving freebies to those who have a head start in life. The standard policy response to growing inequality is to send people on a course. Trouble is that just makes smart people wealthier without helping the not so smart and increases the chances of smart men and women marrying off together. This increases the inequality between power couples and the rest.

Explaining free trade to @realdonaldtrump @BernieSanders with the same biased, bought and paid for video

08 Feb 2016 Leave a comment

in applied welfare economics, international economics, politics - USA Tags: 2016 presidential election, free trade, left-wing popularism, rational ignorance, rational irrationality, right-wing popularism

@berniesanders How America’s middle class is disappearing

08 Feb 2016 Leave a comment

in applied welfare economics, economic history, labour economics, politics - USA, poverty and inequality Tags: living standards, rational ignorance, rational irrationality, withering away of proletariat

Both the proletariat and the middle class are withering away these days thanks to capitalism and freedom.

#TPPANoWay @oxfamNZ @GreenpeaceUSA The Effects of Globalization

07 Feb 2016 Leave a comment

in applied price theory, applied welfare economics, development economics, economic history, growth disasters, growth miracles, international economics, Marxist economics Tags: customs unions, expressive voting, free trade, Leftover Left, ODA, preferential trading agreements, rational ignorance, rational irrationality, The Great Escape, The Great Fact, TPA, TPPA, Twitter left, Tyler Cowen

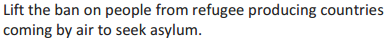

@Greens @sarahinthesen8’s solution to boat people drowning

05 Feb 2016 1 Comment

in applied welfare economics, politics - Australia

Source: Another way for refugees | Australian Greens.

Arriving by boat in Australia does not increase the size of the refugee quota. It just changes who gets to the head of the queue and how many died trying to get to the head of the queue.

Source: Kiwiblog.

There is nothing compassionate about rewarding people for risking their lives. The chances of dying while attempting to come to Australia by boat are about 2%.

The recent experience in Europe confirms that just letting large numbers of refugees come to your country hardens the attitude of the majority of voters in that country to admitting refugees in general, much less more than their current quota.

Recent Comments