The origin of immigrants to the US since 1820

Source: bit.ly/1xjTubs http://t.co/km98cdAvTO—

Max Roser (@MaxCRoser) March 19, 2015

Immigration to the USA since 1820

06 Apr 2015 Leave a comment

in economic history, international economics, labour economics, labour supply, politics - USA Tags: economics of immigration

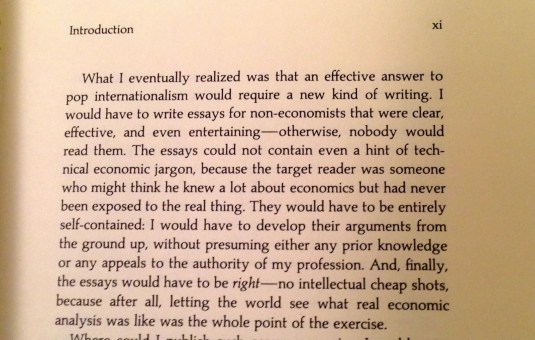

Paul Krugman on the importance of not taking cheap shots in public policy discussions

25 Mar 2015 1 Comment

in applied price theory, applied welfare economics, history of economic thought, industrial organisation, international economics, Public Choice Tags: conjecture and refutation, Paul Krugman, pop internationalism, public intellectual

Why Are Unions So Focused on Fighting Trade Deals? – WSJ

23 Mar 2015 Leave a comment

in applied welfare economics, international economics, poverty and inequality, unions Tags: free trade agreements, middle-class wage stagnation

Half of all U.S. workers represented by unions work for governments, and another 12% are in education or health care. Trade has very little direct impact on them. Another 20% of workers represented by unions are in construction, wholesaling, retailing or transportation doing jobs that are largely immune from import competition.

Less than 10% of all the workers that U.S. unions represent today are in manufacturing or agriculture, the industries most exposed to harm from globalization. Trade creates winners and losers; a small fraction of union workers are among the obvious losers.

The reasons advanced by the American union movement is trade deals enhance the bargaining power of employers over workers and is a major contributor to the wage stagnation over the last 20 years.

I hope the Unions got that analysis of trade and wages growth right because most union members benefit from the lower prices from import competition.

via Why Are Unions So Focused on Fighting Trade Deals? – Washington Wire – WSJ.

Back when Amazon One-Click would have required an import licence every time you used it

03 Mar 2015 Leave a comment

in economic history, economics of regulation, international economics, politics - New Zealand

Wilful ignorance is at its best when criticising the post-1984 economic reforms in New Zealand. Critics can’t be bothered, don’t want to know or pretend they don’t know how heavily regulated the New Zealand economy was up until 1984.

An example is the use of Amazon One-Click which everyone takes for granted. Back in 1984 it would have required an import licence:

To send money overseas you bought money orders from the Post Office. Above a certain amount “about $5 a day” you applied to the Reserve Bank. Same for international magazines – you filled out a form, sent it to the Reserve Bank, and got permission from Nanny to send funds offshore

Of course, when in our intrepid left-wing reactionaries hear of this, they would say that they would agree that that is a bit too much and that regulation should have been repealed. That just makes them Roger Douglas lite!

What else do they want to not bring back: give Telecom back its monopoly; marginal tax rates will go back to 66 per cent, kicking in at $30,000? All shops must close of the weekends?

Importing consumer goods generally required a licence prior to the economic reforms of the labour government that was elected in 1984. In addition, up until 1984, a wide range of goods had quotas that restricted how much could be imported in any one year.

Alan Gibbs recently told a story about every time his tractor company wanted to import a tractor, he needed a new import licence and his competitors could object to the issue of that licence! Nowadays, they would use the Resource Management Act resource consenting process to object to competitors when they try and expanded their business.

Tourist driver accidents as the price for international reciprocity over international driving permits

02 Mar 2015 Leave a comment

in international economic law, international economics, transport economics

I am feuding with Gareth Morgan on Twitter on charging regimes for tourists. I raised the point about whether foreign countries would recognise international driver permits issued in New Zealand if we started imposing tests on international tourists before they could be issued with driver licences and therefore rent a car. Car rentals are a major form of tourist transport

When I pointed out other countries may retaliate and not recognise international driving permits issued in New Zealand, if we started imposing driving tests or other restrictions on tourist that come here, he thought that point was completely irrelevant. His responses show why he is the successor to Sir Bob Jones as the national contrarian and has an equal number of hits as well as big misses as Sir Bob.

Reciprocity is central to a large number of international concessions which New Zealanders enjoy overseas. These reciprocal arrangements include international driving permits as well as working holiday schemes, health insurance and old age pension reciprocal arrangements, double tax treaties and easy access to tourist and business visas to name but a few.

Who Drives on the Wrong Side of the Road? (blue = left) http://t.co/sblf6hgpXl—

Amazing Maps™ (@amazingmap) July 17, 2015

By the way, in common with the Cook Islands, China does not recognise international driving permits. A local licence must be obtained after a payment.

New Zealand recognises international driver permits issued in China because that such a huge and growing tourist market.

The price of having foreign tourists drive New Zealand roads is more accidents because of their inexperience, including because they are driving on the wrong side of the road and are tired from the international flight.

The benefit is New Zealanders can drive in other countries on international driving permits, including where they drive on the wrong side of the road and have more accidents because they are tired from the international flight. That’s the brutal calculus behind it that people prefer to ignore.

Default and Lost Opportunities: A Message from Argentina for Euro-Zone Countries – Dallas Fed

22 Feb 2015 Leave a comment

in applied welfare economics, development economics, economic history, growth disasters, growth miracles, international economics Tags: Argentina, sovereign defaults

What happens when you play “chicken” with a game theorist (The Greek Finance Minister)?

14 Feb 2015 Leave a comment

in currency unions, Euro crisis, international economics Tags: game theory, Greece, Greek default, optimal currency areas, sovereign default

Luke Froeb suggests:

However, opting for forgiveness risks creating dangerous incentives for other countries to act in the same way as Athens. “Germany may decide that if the eurozone does not punish Greece, it will have problems with other countries such as Spain and Italy,” says Roger Myerson, a Nobel-winning economist at the University of Chicago.

Mr Varoufakis should therefore try to convince Germany that Athens’ situation is unique and that other eurozone countries will not seek debt relief as a result, he says. In doing so, he would follow the illustrious precedent of the citizens of Melos, to whom Athens, during the Peloponnesian war between Athens and Sparta, gave the choice of surrendering or facing annihilation.

“The Melians sought to argue that they were different and that sparing them would not set a dangerous precedent vis-à-vis other islands,” says Mr Myerson.

The problem with this strategy, however, is that the other player may choose to build a reputation for toughness. This is what Athens opted for — it laid siege to the island and starved the inhabitants into submission.

via Managerial Econ: What happens when you play “chicken” with a game theorist? and Greek Game Theory: Default, Devaluation, Deliverance?..

The Evolution of Trade Agreements — Information is Beautiful Awards

09 Feb 2015 Leave a comment

in economic history, international economics Tags: free trade agreements, preferential trading agreements, regional trade agreements, trade creation, trade diversion

Undiscovered Arctic oil and potential trade routes

06 Feb 2015 Leave a comment

in energy economics, international economics Tags: Arctic oil

Why is NZ so hostile to foreign investment, 32nd in the Index of Economic Freedom 2015? USA is 66th!

02 Feb 2015 Leave a comment

in applied price theory, applied welfare economics, economics of media and culture, economics of regulation, international economics, politics - New Zealand Tags: bootleggers and baptists, foreign direct investment, foreign investment, free trade, Index of Economic Freedom

Source: 2015 Index of Economic Freedom

According to the Index of Economic Freedom 2015, in New Zealand

Foreign investment is welcomed, but the government may screen some large investments.

There was a major review of New Zealand foreign investment regulations about 10 years ago. The purpose of that review commissioned by the Labour government’s Minister of Finance, Dr Michael Cullen, was to deregulate the regulation of foreign investment in New Zealand.

At the time,under the Overseas Investment Act, the Minister of Finance could refuse permission to any investment. Australia’s current overseas investment regulations are the same. The federal treasurer may reject foreign investment proposals on the basis of an open-ended definition of national interest.

The last time that foreign investors had been refused permission to invest in New Zealand was in the early 1980s under then National Party Government Prime Minister Robert Muldoon. In a fit of pique, he refused permission to an Australian investor.

The revised foreign investment regulations limits the ability of government to reject foreign investors to narrow criteria such as the acquisition of sensitive land and large New Zealand companies. As part of this theme that foreign acquisitions of land was the main policy concern regarding foreign investment, the administration of the foreign investment regulations was moved out of a Overseas Investment Commission housed at the Reserve Bank of New Zealand to the very low key Land Information Office:

The Overseas Investment Office (OIO) assesses applications from overseas investors seeking to invest in sensitive New Zealand assets – being ‘sensitive’ land, high value businesses (worth more than $100 million) and fishing quota.

Naturally, subsequent to this genuine attempt by the Labour government of 10 years ago to deregulate foreign investment regulation, a number of investments have been refused since then often on the pretext that some part of the investment acquired sensitive coastal land door or rural land. The criteria for regulating foreign investment is as follows:

As regards the criteria relating to the relevant “overseas person”, the OIO needs to be satisfied that:

- the “overseas person” has demonstrated financial commitment to the investment; and

- the “overseas person” or (if that person is not an individual) the individuals with ownership and control of the overseas person (such as the shareholders and directors of the overseas purchaser):

- have the business experience and acumen relevant to that investment;

- are of good character; and

- are not prohibited from entering New Zealand by reason of sections 15 or 16 of the Immigration Act 2009 (e.g. persons who have been imprisoned for certain periods of time).

As regards the criteria relating to the particular investment, the OIO needs to be satisfied that the overseas investment will, or is likely to, benefit New Zealand (or any part of it or group of New Zealanders). When considering this, the OIO has a range of factors that it must consider (including, for example, whether the investment will create new job opportunities, introduce new technology or business skills, advance a significant Government policy or strategy, or bring other consequential benefits to New Zealand).

The New Zealand Initiative recently reviewed this criteria for regulating overseas investment into New Zealand and found that:

the report finds that the criteria for approval do not test the economic benefit to New Zealanders, where sensitive land is sold to an overseas person not intending to live in New Zealand indefinitely.

Indeed, the criteria are unambiguously hostile, even excluding the gain to a New Zealand vendor. This opens the way for the imposition of approval conditions that could impose net costs on New Zealanders given the regime’s potentially adverse effects on land values

The regulation of foreign investment in other countries is much more specific about what it is trying to achieve,as New Zealand Initiative also noted in its recent review:

New Zealand’s comprehensive screening regime accounts for our poor international ranking in the OECD’s FDI Regulatory Restrictiveness Index.

Most other countries focus their regimes more narrowly on national security considerations, often relating to particularly sensitive industries or sectors.

The main reason the public supports foreign investment regulation is because the public doesn’t like foreigners, and politicians pander to that xenophobia. If foreign investment is reduced, more of total investment spending has to be funded from domestic saving.

Access to foreign savings – trade in savings – allows investment to be made sooner, consumption to be smoothed over hiatuses such as recessions, and consumption to be bought forward in the light of better times such higher output and higher future incomes as because of foreign investment.The

The large national gains from foreign capital inflows is not part of that debate. A recent review of the gains from foreign capital inflows to New Zealanders found access to foreign saving led to national income per head, net of the servicing cost of foreign capital:

- average income gains of $2,600 per worker arising on a cumulative basis from capital inflow over the period 1996 – 2006; and

- growth in the value of New Zealand’s assets has greatly exceeded the rise in external liabilities to the extent that national wealth per head has risen by $14,000 in 2007 prices between 1996 and 2006.

You can’t let facts bugger a good story.

The foreign investment is in response to the high returns in the local market and the inflow of foreign capital will continue until local rates of return match those in other countries. Equalisation of risk-adjusted rate of returns is central to the operation of capital markets.

Stopping this process of equalisation of returns on capital through regulation only benefits the capitalists inside the country because the curbing of foreign investment stops rates of return falling to those overseas. Foreign investment regulation reduces the wages of New Zealand workers because they have less capital and fewer modern technologies to work with.

Fortunately, local capitalists can work in league with economic populists on the left and the right and the anti-foreign bias of the voting public to make it more difficult for foreign investors to come to New Zealand and drive down the profits of New Zealand capitalists. Who gains from that? As Paul Krugman said:

The conflict among nations that so many policy intellectuals imagine prevails is an illusion; but it is an illusion that can destroy the reality of mutual gains from trade.

I, iPhone

30 Jan 2015 Leave a comment

in international economics Tags: division of labour, global value chains, globalisation

Recent Comments