Policymakers would do well to heed energy experts like Schernikau and Stein. Chasing luxury beliefs do not cost well-heeled climate bureaucrats and renewables ideologues much, but the burdens of irrational energy policies will be borne by the world’s poorest. The real path forward lies in pragmatic, technology-neutral approaches that prioritise energy abundance over austerity.

Time to Stop Pretending Renewables Are Cheap

Time to Stop Pretending Renewables Are Cheap

14 Dec 2025 1 Comment

in economics of climate change, economics of regulation, energy economics, entrepreneurship, environmental economics, environmentalism, global warming, politics - Australia, politics - New Zealand, politics - USA, Public Choice, rentseeking Tags: celebrity technologies, solar power, wind power

New Zealand’s Planning Revolution: bye bye RMA

13 Dec 2025 Leave a comment

in applied price theory, economics of bureaucracy, economics of regulation, law and economics, politics - New Zealand, property rights, Public Choice, urban economics Tags: housing affordability, land supply, zoning

Inside the reform that will change how New Zealand is built Ani O’Brien writes – If you’ve ever tried to build a deck, subdivide a section, or watched a major infrastructure project slowly suffocate in a decade of “consenting hell,” you already know the RMA is New Zealand’s great productivity killer. For over 30 years, […]

New Zealand’s Planning Revolution: bye bye RMA

Humanity Has a Huge Surplus of Economic Misunderstanding

13 Dec 2025 Leave a comment

in applied price theory, history of economic thought, industrial organisation, international economics, politics - USA, Public Choice, rentseeking Tags: free trade, tarrifs

TweetHere’s a letter to AP Fact Check. Editor: Melissa Goldin does a deep dive into the cause(s) of the U.S. “agricultural trade deficit” (“FACT FOCUS: Trump blames Biden for the agricultural trade deficit. It’s not that simple,” December 10). To what extent is this “deficit” caused by the policies of Biden? To what extent is…

Humanity Has a Huge Surplus of Economic Misunderstanding

Greyhound racing law change is legal overreach

12 Dec 2025 Leave a comment

in economics of bureaucracy, economics of regulation, law and economics, politics - New Zealand, property rights, Public Choice, public economics, sports economics Tags: constitutional law, takings

Oliver Hartwich writes – Let me state this clearly at the outset: I have never placed a bet on a greyhound. I have never owned a greyhound. If I were a dog, I would likely prefer a soft sofa to a hard track. I am not writing this because I have a passion for racing, […]

Greyhound racing law change is legal overreach

Congressional leadership is corrupt

11 Dec 2025 Leave a comment

in applied price theory, econometerics, economic history, financial economics, politics - USA, Public Choice

Using transaction-level data on US congressional stock trades, we find that lawmakers who later ascend to leadership positions perform similarly to matched peers beforehand but outperform them by 47 percentage points annually after ascension. Leaders’ superior performance arises through two mechanisms. The political influence channel is reflected in higher returns when their party controls the…

Congressional leadership is corrupt

The state of the books

11 Dec 2025 Leave a comment

in budget deficits, fiscal policy, macroeconomics, politics - New Zealand, Public Choice, public economics

Eric Crampton writes – StatsNZ has put up its year-end accounts for the government, split out across functional areas. Their data goes back to 2009 in the main table; I’m sure earlier data’s available somewhere in Infoshare. But sticking with the Excel sheet they’ve provided, we can lob in June-year population statistics and June quarter […]

The state of the books

Humphrey’s Estate and Jackson’s Experts: Supreme Court Justice Offers Surprising View of the Separation of Powers

10 Dec 2025 Leave a comment

in economics of bureaucracy, law and economics, politics - USA, Public Choice Tags: constitutional law

As I discussed in yesterday’s coverage of the oral arguments in Trump v. Slaughter, the argument went poorly for those…

Humphrey’s Estate and Jackson’s Experts: Supreme Court Justice Offers Surprising View of the Separation of Powers

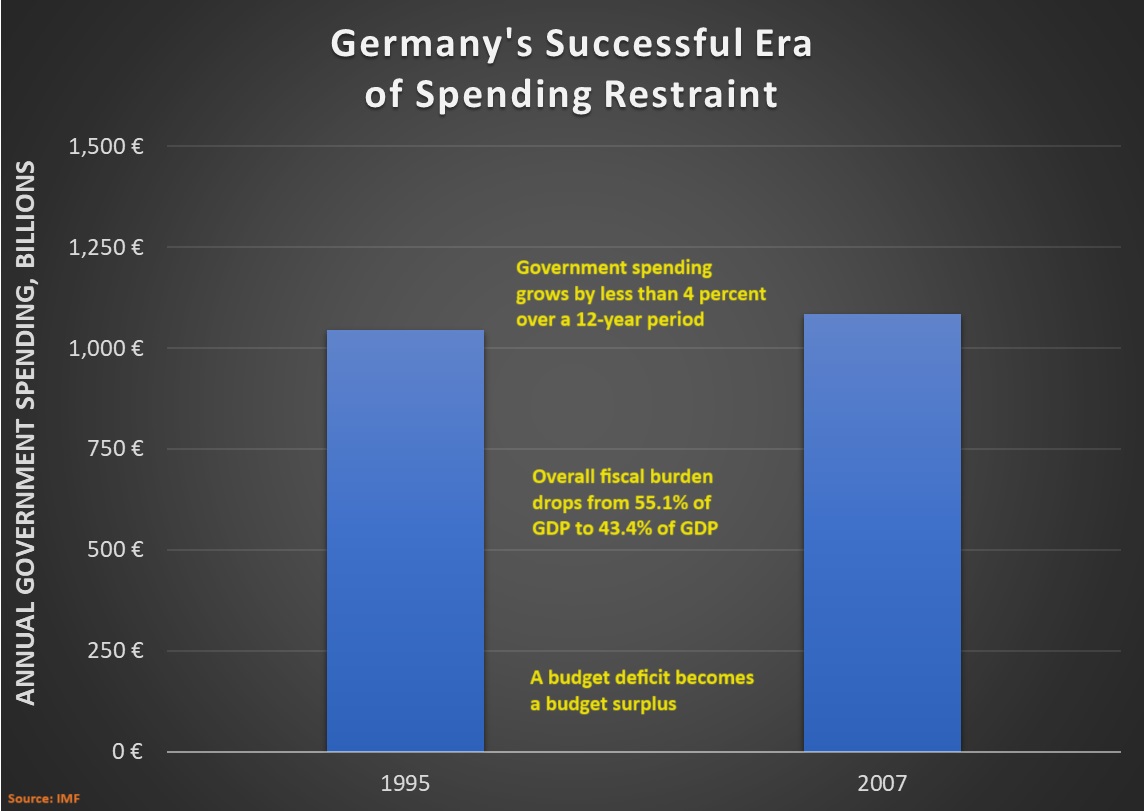

Germany’s Accelerating Fiscal and Economic Decline

09 Dec 2025 Leave a comment

in budget deficits, economic growth, economic history, fiscal policy, income redistribution, labour economics, labour supply, macroeconomics, Public Choice, public economics Tags: ageing society, Germany

A lot has happened if you look at the past 100 years of German economic policy. Hyperinflation leading to Hitler’s National Socialists taking power. An impressive free-market revival after World War II. A growing welfare state after the imposition of a value-added tax in the 1960s. Some semi-impressive spending restraint starting in the mid-1990s. Very […]

Germany’s Accelerating Fiscal and Economic Decline

Political pressure on the Fed

05 Dec 2025 Leave a comment

in business cycles, econometerics, economic history, economics of bureaucracy, macroeconomics, monetary economics, politics - USA, Public Choice Tags: monetary policy

From a forthcoming paper by Thomas Drechsel: This paper combines new data and a narrative approach to identify variation in political pressure on the Federal Reserve. From archival records, I build a data set of personal interactions between U.S. Presidents and Fed officials between 1933 and 2016. Since personal interactions do not necessarily reflect political…

Political pressure on the Fed

The Oddly Worded Instruments That Undid a Prince

05 Dec 2025 Leave a comment

in economics of bureaucracy, law and economics, property rights, Public Choice Tags: British constitutional law, British politics

In late October, it was announced that the King would formally strip Andrew Mountbatten-Windsor of his royal status. At the start of November, the Gazette announced that the King had issued a Warrant directing the Lord Chancellor and Secretary of State for Justice to remove Andrew from the Roll of the Peerage along with Letters […]

The Oddly Worded Instruments That Undid a Prince

Labour and Greens want unlimited rates increases

04 Dec 2025 Leave a comment

in politics - New Zealand, Public Choice, public economics, urban economics

Very pleased to see the Government commit to a law that will tie rates increases to a mixture of inflation and GDP. The era of local government being able to fund every pet project Councillors like is coming to an end. In future they will need to prioritise spending on core infrastructure and facilities. But…

Labour and Greens want unlimited rates increases

The taxing problem of zombie and phoenix companies

04 Dec 2025 Leave a comment

in applied price theory, economics of bureaucracy, economics of crime, fiscal policy, law and economics, macroeconomics, politics - New Zealand, property rights, Public Choice, public economics, rentseeking Tags: Germany

Eric Crampton writes – Damien Grant isn’t normally the one making the case that the government needs to take more in tax. The liquidator and libertarian-minded columnist at the Sunday Star Times more typically wants what libertarians generally want – a government that spends less and that can let each of us keep more of […]

The taxing problem of zombie and phoenix companies

The Sensible Swiss Strike Again, Overwhelmingly Rejecting Class Warfare

03 Dec 2025 Leave a comment

in economic growth, fiscal policy, macroeconomics, Public Choice, public economics Tags: Switzerland, taxation and investment

Congratulations to Switzerland, the “improbable success” that is home to the world’s most sensible voters. The left put a referendum on the ballot to impose a national death tax and the people of Switzerland overwhelmingly voted against the class warfare initiative. Every single canton in every single region voted no. More than 90 percent of […]

The Sensible Swiss Strike Again, Overwhelmingly Rejecting Class Warfare

The Flaw at the Core of the Supreme Court’s Uber Decision

25 Nov 2025 Leave a comment

in economics of regulation, industrial organisation, labour economics, labour supply, law and economics, occupational choice, politics - New Zealand, Public Choice, rentseeking, transport economics, urban economics Tags: creative destruction, employment law

Roger Partridge writes – The Supreme Court’s Uber judgment (Rasier Operations BV v E Tū Inc [2025] NZSC 162) has delivered clarity of a sort. The Court dismissed Uber’s appeal, upholding the finding that the drivers involved in the proceedings are employees when logged into the Uber app. Yet the decision is deeply flawed. The Court […]

The Flaw at the Core of the Supreme Court’s Uber Decision

Argentine Rental Market Natural Experiment

24 Nov 2025 Leave a comment

in applied price theory, development economics, economics of regulation, growth disasters, history of economic thought, income redistribution, law and economics, property rights, Public Choice, public economics, regulation, rentseeking, transport economics, urban economics Tags: Argentina, rent control

One of Argentine President Milei’s radical reforms was to “take a chainsaw” to rent control laws. Argentina had had some of the most restrictive rent control regimes ever. All of that was abandoned almost over night. Many media outlets noted with glee that rents fell dramatically. Even most economists were surprised by how much supply…

Argentine Rental Market Natural Experiment

Recent Comments