How frequent are simultaneous financial crises in one country?

04 Sep 2015 Leave a comment

in business cycles, currency unions, development economics, economic growth, economic history, Euro crisis, financial economics, global financial crisis (GFC), great depression, great recession, growth disasters, growth miracles, law and economics, macroeconomics, monetary economics, property rights Tags: bank runs, banking crises, banking panics, currency crises, current account crises, debt crises, pseudo financial crises, real financial crises, sovereign debt crises, sovereign default

The ups and downs of the Greek economy

25 Aug 2015 1 Comment

in budget deficits, business cycles, currency unions, economic history, Euro crisis, fiscal policy, macroeconomics, Public Choice, rentseeking Tags: Eurosclerosis, Greece, sovereign debt crisis, sovereign defaults

@ObsoleteDogma @rodrikdani http://t.co/xKx43wjWHy—

David Andolfatto (@dandolfa) June 30, 2015

Incidence of long-term unemployment in the PIGS since 1983

17 Aug 2015 Leave a comment

in business cycles, currency unions, economic growth, economic history, Euro crisis, job search and matching, labour economics, labour supply, macroeconomics, occupational choice, unemployment, unions, welfare reform Tags: employment law, equilibrium unemployment, Greece, Italy, labour market regulation, natural unemployment rate, Portugal, Spain, unemployment duration

The boom that preceded the bust in the Greek economy did nothing for the rate of long-term unemployment among Greeks. Long-term unemployment had been pretty stable prior to the economic boom after joining the euro currency union.

Source: OECD StatExtract.

Nothing much happened to long-term unemployment in Italy or Portugal in recent decades. Spanish long-term unemployment fell in line with the economic boom in Spain over the 1980s and 1990s up until the global financial crisis.

Union density rates in Germany, France and Italy

14 Aug 2015 Leave a comment

in economic history, Euro crisis, labour economics, unions, urban economics Tags: Eurosclerosis, France, German unification, Germany, Italy, union membership, union power, union wage premium

There are large differences in unionisation rates between the three countries. France has always had low levels of unionisation which halved since the 1970s. Italy had a sharp boost in union membership in the number of unions in the 1960s and 70s. This may have been associated with increased urbanisation. Union membership rate stayed pretty high in Italy ever since with a small taper downwards. Germany had stable unionisation rates prior to German unification after which the numbers about halved up in a slow taper.

Source: OECD Stat Extract.

Italian unemployment incidence by duration since 1983

12 Aug 2015 Leave a comment

in business cycles, economic history, Euro crisis, job search and matching, labour economics, macroeconomics, unemployment Tags: employment law, equilibrium unemployment rate, Eurosclerosis, Italy, labour market regulation, natural unemployment rate, unemployment duration

Unemployment of more than a year was slowly tapering down in Italy before the global financial crisis, but ever so slowly.

Source: OECD StatExtract.

German unemployment incidence by duration since 1983

11 Aug 2015 Leave a comment

in economic history, Euro crisis, fiscal policy, job search and matching, labour economics, labour supply, macroeconomics, unemployment, welfare reform Tags: equilibrium unemployment rate, Eurosclerosis, German unification, Germany, natural unemployment rate, poverty traps, unemployment duration, unemployment insurance, welfare state

German long term unemployment has been pretty stable albeit with an up-and-down after German unification. There is also a fall in long-term unemployment after some labour market reforms around 2005.

Source: OECD StatExtract.

Unemployment rates and the minimum wage in the European Union

08 Aug 2015 Leave a comment

in Euro crisis, job search and matching, labour economics, macroeconomics, minimum wage, unemployment Tags: employment law, equilibrium unemployment rates, Eurosclerosis, expressive voting, labour market regulation, natural unemployment rate, offsetting behaviour, rational irrationality, unintended consequences

Greece’s GDP collapse is among the worst advanced economy falls since 1870

07 Aug 2015 Leave a comment

in currency unions, economic growth, economic history, Euro crisis, macroeconomics Tags: Eurosclerosis, Greece, prosperity and depression

Greece's GDP collapse is among the worst advanced economy falls since 1870. And most of those were war-related. http://t.co/QLp6fYN83u—

RBS Economics (@RBS_Economics) July 04, 2015

French unemployment incidence by duration since 1983

05 Aug 2015 Leave a comment

in economic history, Euro crisis, job search and matching, labour economics, labour supply, macroeconomics, unemployment Tags: employment law, equilibrium unemployment rate, France, labour market regulation, natural unemployment rate, unemployment duration

Nothing really changes in France recently unemployment duration. Italian labour market is notorious for having very low inflows and outflows from employment and unemployment.

Source: OECD StatExtract.

Swedosclerosis, Eurosclerosis and the British disease compared

05 Aug 2015 2 Comments

in currency unions, economic growth, economic history, economics of regulation, Euro crisis, fiscal policy Tags: British disease, British economy, Eurosclerosis, France, Germany, Italy, sick man of Europe, Sweden, Swedosclerosis

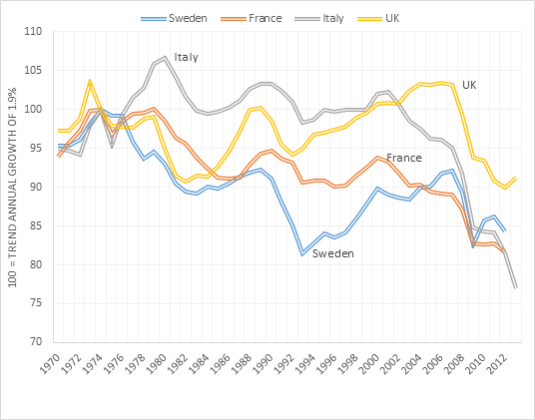

Figure 1 shows stark differences between Sweden, France, Italy and the UK since 1970 in departures from trend growth rates of 1.9% in real GDP per working age person, PPP. Italy did quite OK until 2000 growing at about the trend growth rate of 1.9% after which it fell into a hole so deep that it barely notice the onset of the global financial crisis. Sweden really had been the sick man of Europe until it turned its back on high taxing, welfare state socialism in the early 1990s. France has been in a long decline so much so that the global financial crisis is hard to pick up in the acceleration in its long decline in the mid-1990s. Figure 1 also shows Britain did very well, both under the neoliberal horrors of Thatcherism and the betrayals by Tony Blair of a true Labour Party platform. The UK grew at above the trend annual growth to 1.9% for most of the period from the early 1980s to 2007. The UK has done not so well since the onset of the global financial crisis.

Figure 1: Real GDP per Swede, French, British and Italian aged 15-64, 2014 US$ (converted to 2014 price level with updated 2011 PPPs), 1.9 per cent detrended, 1970-2013

Source: Computed from OECD StatExtract and The Conference Board. 2015. The Conference Board Total Economy Database™, May 2015, http://www.conference-board.org/data/economydatabase/

Note: When the line is flat, the economy is growing at its trend annual growth rate. A falling line means below trend annual growth; a rising line means of above trend annual growth. Detrended with values used by Edward Prescott.

German data was not in figure 1 because German unification threw all of its data into disarray for long-term comparison purposes.

Did fiscal austerity in 2010 have credible academic support?

05 Aug 2015 1 Comment

#Greece austerity gauge. Greek government spending has fallen 20% since 2008. In UK and Italy it's up. #GreekCrisis http://t.co/WMQBxxVFqq—

RBS Economics (@RBS_Economics) July 07, 2015

One measure of the scale of austerity in Greece…and other advanced economies. http://t.co/PxCLagdd3L—

RBS Economics (@RBS_Economics) July 06, 2015

The employment level in #Greece is back to where it was in 1985. It's the equivalent of the UK losing 6 million jobs. http://t.co/AAWHMEFwfK—

RBS Economics (@RBS_Economics) July 06, 2015

Did the GFC catch modern macroeconomists by surprise?

03 Aug 2015 Leave a comment

in budget deficits, business cycles, currency unions, economic growth, Euro crisis, fiscal policy, global financial crisis (GFC), great depression, great recession, history of economic thought, law and economics, macroeconomics, monetary economics Tags: bank panics, bank runs, banking crises, currency crises, Thomas Sargent

Recent Comments